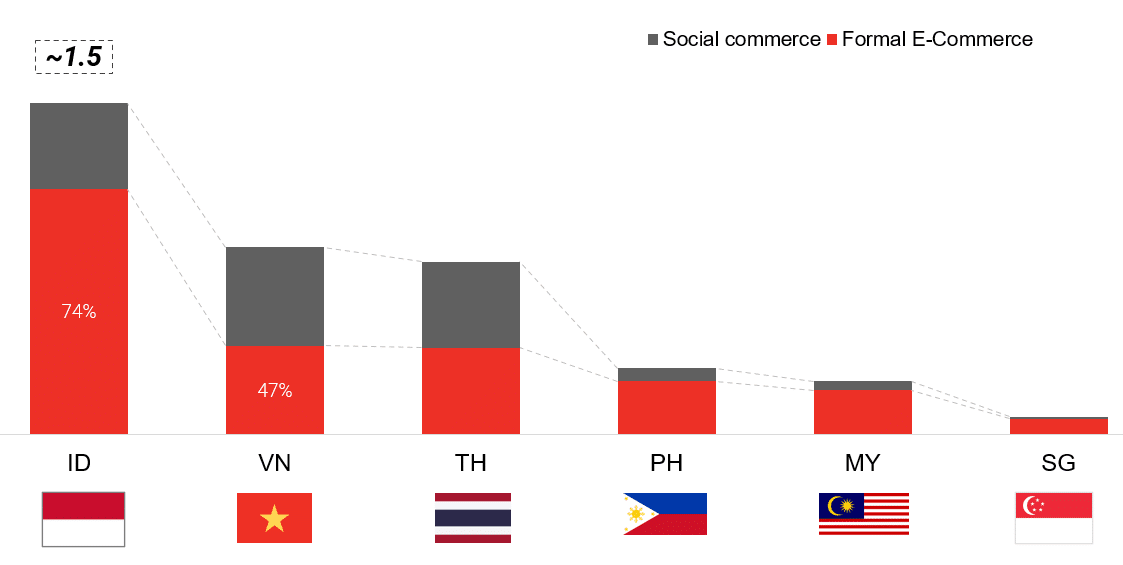

1. Social commerce is quite prominent across ASEAN – however, more mature e-commerce markets with higher GDP/Capita have a relatively lower share

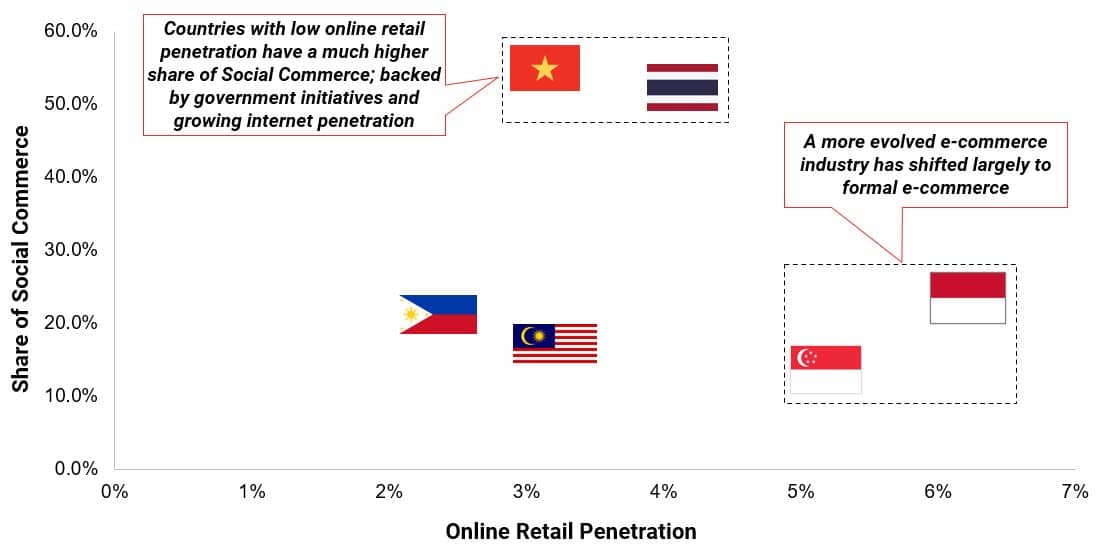

While social commerce share is relatively high across the ASEAN region, they exhibit varying trends based on 2 factors – a) income level of the country and b) maturity of online retail channel

- Indonesia & Singapore with a relatively more mature formal e-commerce sector see a lower share of social commerce in total shipments pie

- Vietnam & Thailand formal e-commerce markets are relatively nascent which is reflected in the higher share of social commerce. These market also have a strong demand for categories like Fashion & Beauty which are quite prevalent in the social commerce channel

- The relative socio-economic class of the consumer in these markets also is a factor in determining share of social commerce. The higher income groups typically prefer formal channels – which is evident from Singapore and Malaysia

Parcel share by end client- 2019

Billions Shipments, Annual

Online Retail penetration vs Social Commerce share

% penetration of retail market by Value, % Share of shipments

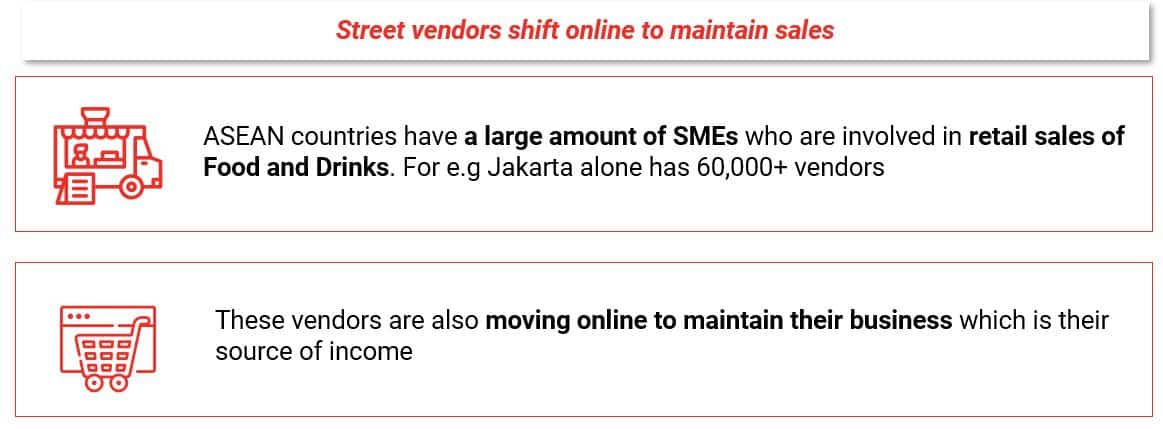

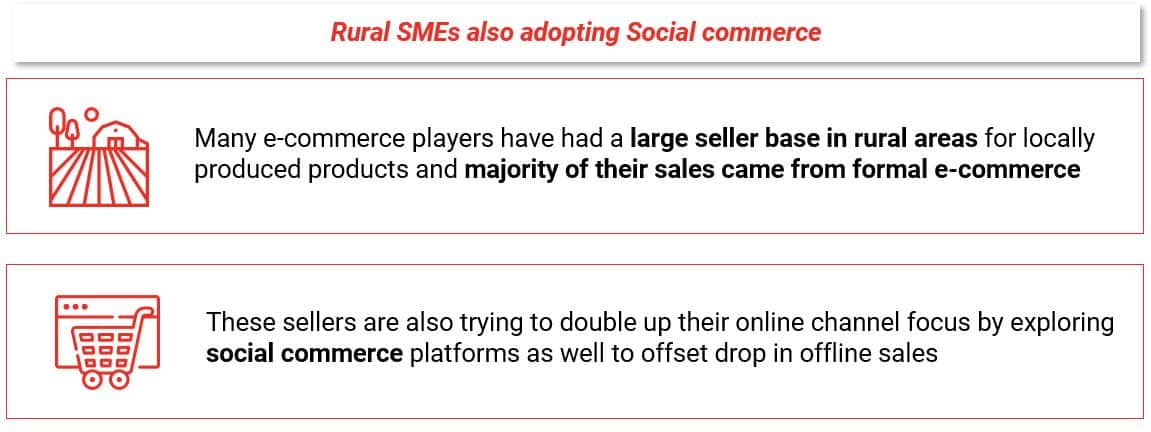

2. COVID has brought a lot of first-time sellers online – giving a new impetus to social commerce

Social commerce has seen an uptick in the recent months owing to Covid-19. Lockdown measures have resulted in decreased store time and extremely low footfall in offline stores. Many sellers have moved to the online channel to try and reach buyers and maintain their businesses.

People who have lost jobs during this period are also trying to leverage social commerce as a way to generate some quick income.

3. Innovative models have been coming up in the space recently and they are seeing a lot of investor interest as well

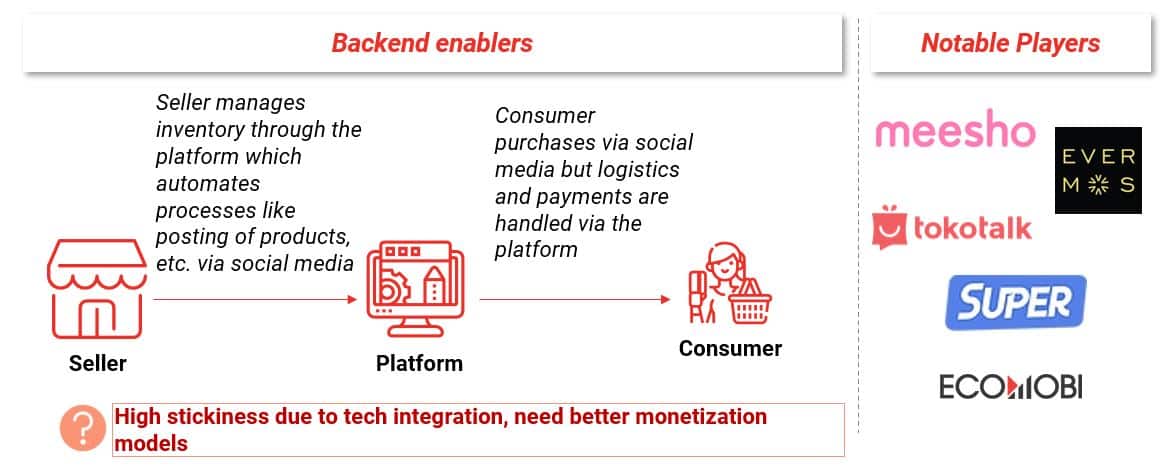

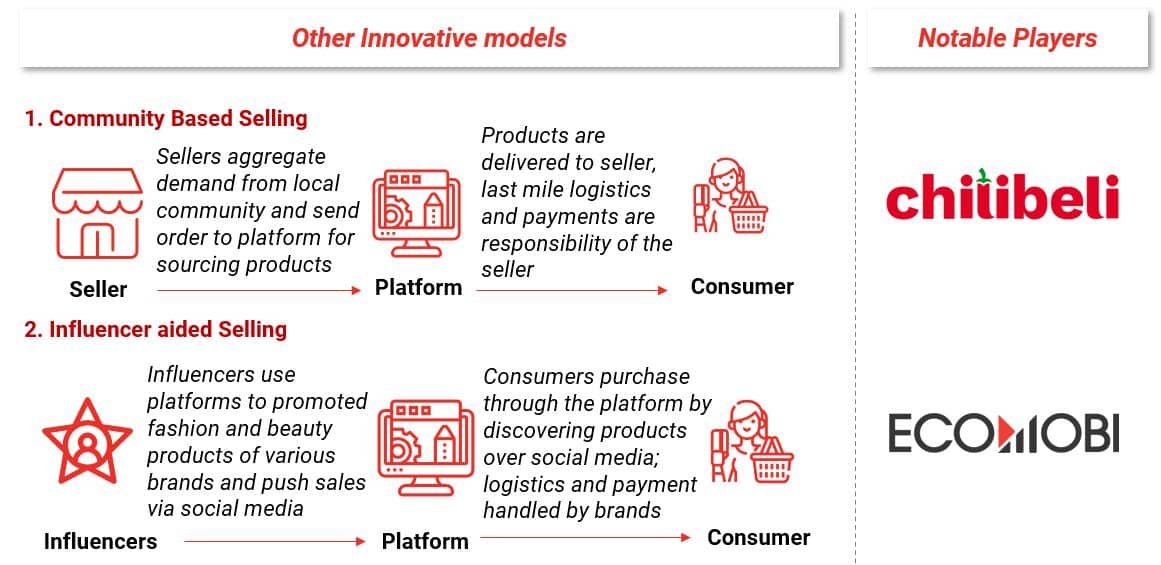

Social commerce has been seeing innovative models come up in the space ranging from solutions where there is direct selling where platforms help only in discovery to solutions where platforms take care of end to end logistics and also provide marketing/analytics insights to aid selling.

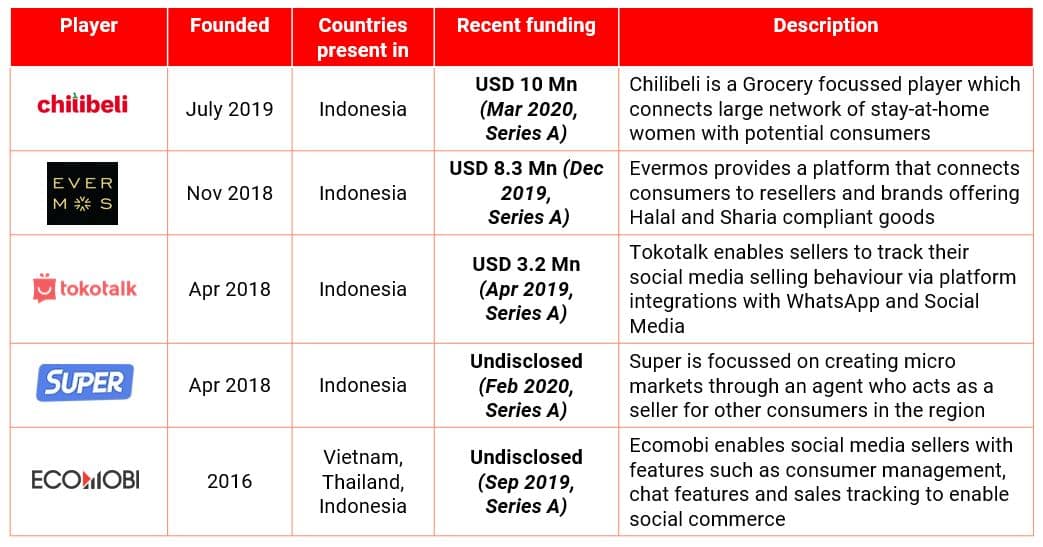

We have also been seeing increased investor interest in the area of late. Indonesia has been a leader here with multiple players having raised funding, accompanied with entry of players such as Meesho. Players like Chilibeli and Super (both having raised funds recently) have noticed more than 100% month on month growth in 2020.

The space is definitely heating up and one to watch out for in the future.

Different emerging business models in social commerce

While direct selling models offer few features, they are the most popular method due to ease of use for both sellers and consumers. Backend enabler models are providing a wide array of features to help sellers and buyers, however they need to look at ways to monetize & increase operational efficiency.

Feature comparison across different business models

List of players who have raised funding recently

The e-Logistics space has been seeing massive upsurge in demand on the back of the increasing online commerce. In our next few newsletters, we will take a peek into the e-Logistics space in ASEAN.