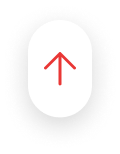

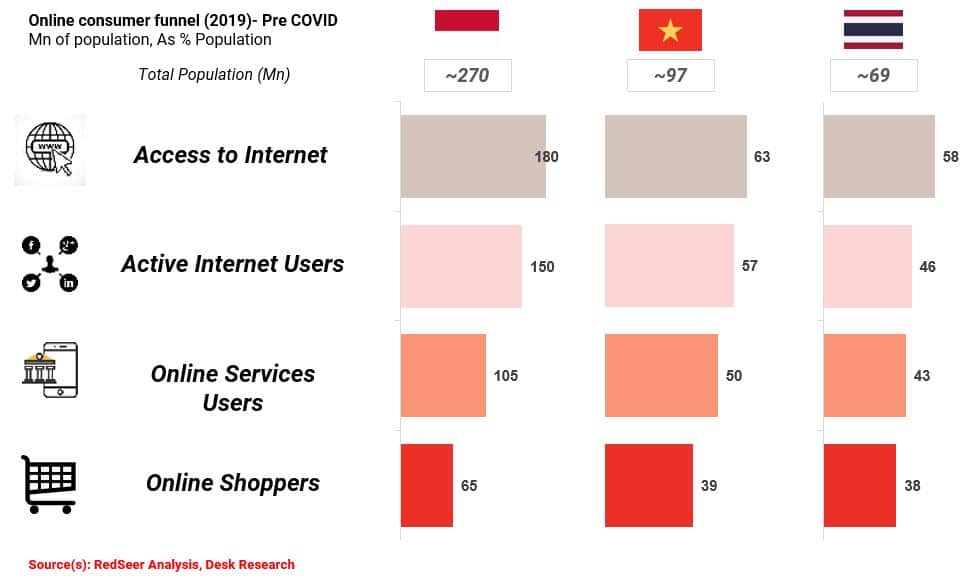

1. ASEAN countries have a healthy consumer digital funnel serving as a strong foundation for digital solutions to flourish

ASEAN has a huge online user base with more than 50% consumers being active users of internet. Online shopping has also taken off, with nearly 200 Mn active online shoppers annually.

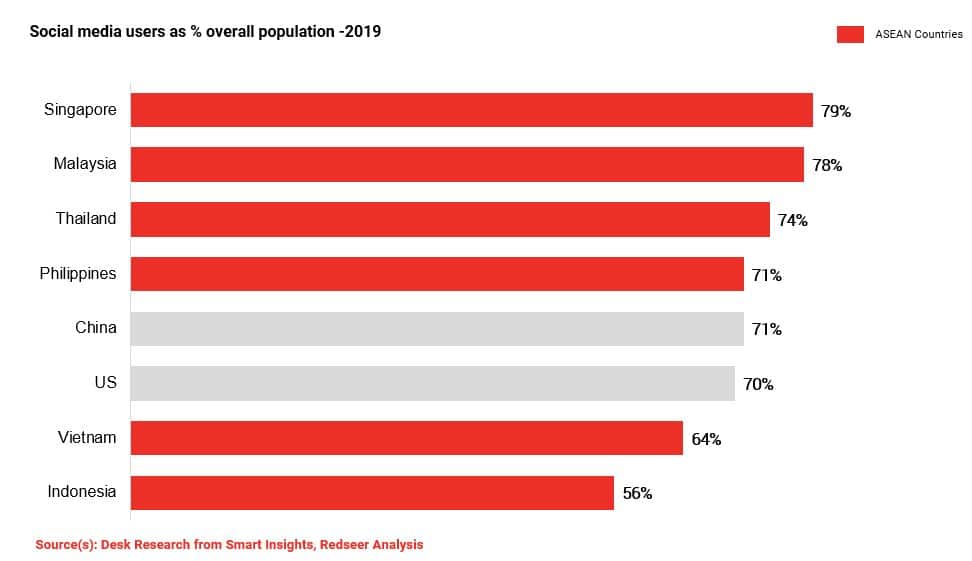

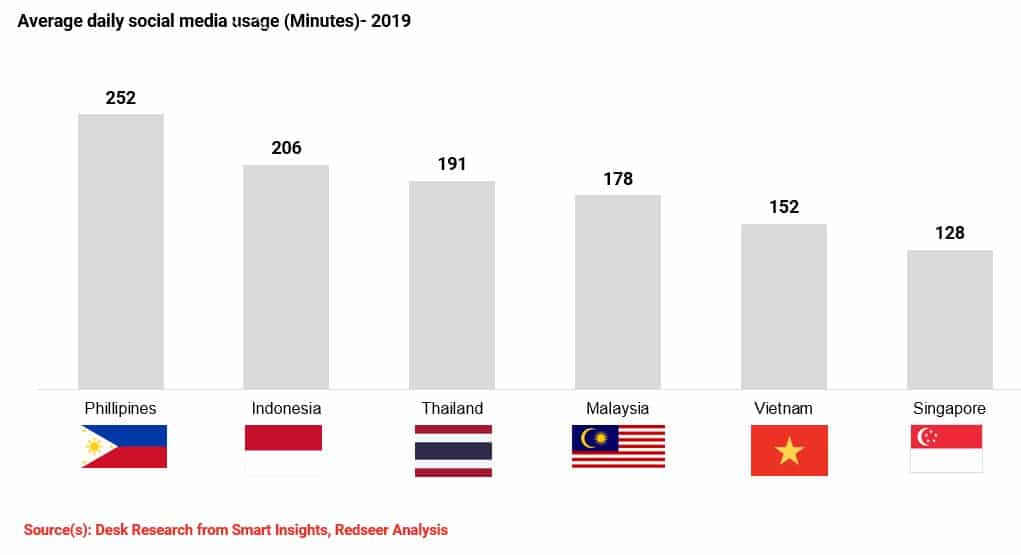

2. The average ASEAN consumer spends more than 3 hrs a day on social media platforms

Majority of the population are active users of social media and considerable amount of daily timeshare is spent on social media platforms, making the market ripe for digital solutions to flourish.

COVID truly proved to be a pivotal moment for digital adoption across categories. Per our surveys during COVID, major internet platforms have seen 100% + new customer acquisition, with the cost of acquiring customers having been reduced upto 1/4th for key platforms.

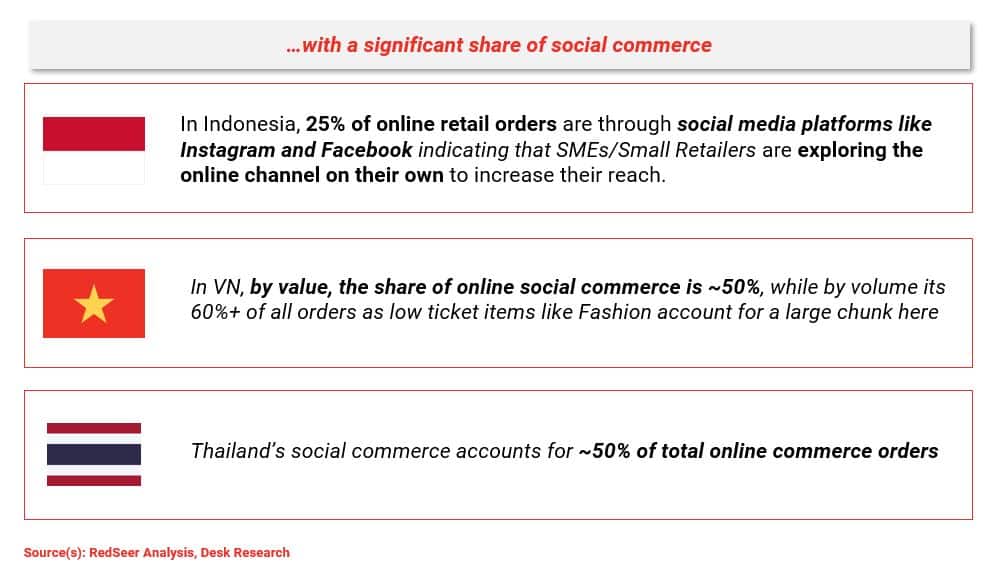

3. The Seller and SME eco-system is also highly digitized

The Seller & SME based in ASEAN countries are highly active on social media platforms. They have been quick to adapt to avenues like FB and Instagram to market and sell their products. This results in a high share of social commerce in most of these markets. Note: We will talk about social commerce in more detail in our subsequent newsletter.

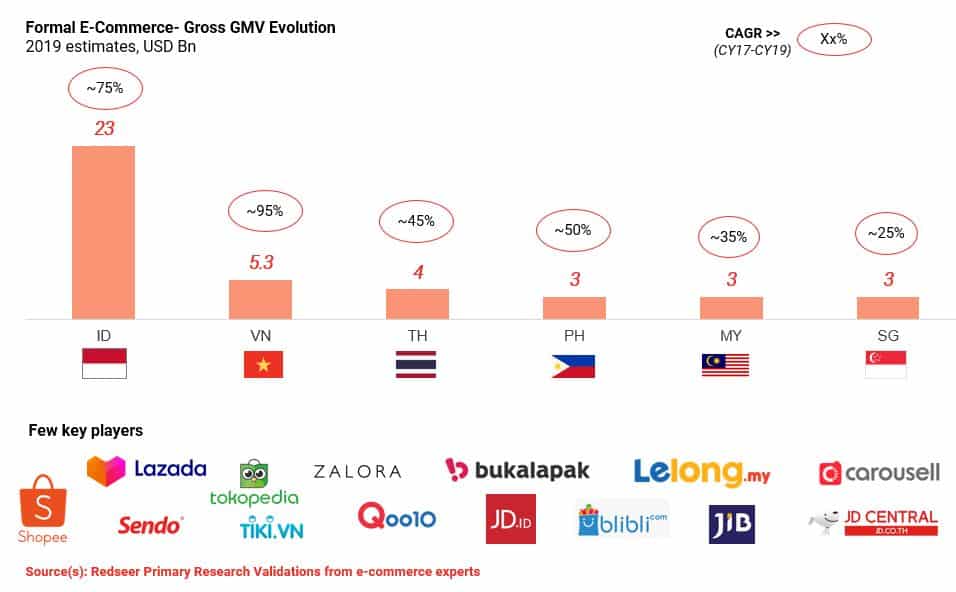

4. All these factors together, have catapulted the formal e-commerce markets in ASEAN

Indonesia is the largest market with USD 23 Bn GMV in 2019, while Singapore is the most advanced market with highest per capita spend on e-commerce. Shopee and Lazada are regional powerhouses with presence in all 6 countries and being among the top 3 platforms in all countries. While Shopee has followed a more C2C approach, Lazada has focussed on B2C model across countries.