The Indian Study Abroad market has witnessed a noticeable resurgence and understanding the pulse of market trends is crucial for maintaining a competitive edge. The recent study conducted by Redseer, spearheaded by Kushal Bhatnagar (Partner), sheds light on the rapidly growing Indian Study Abroad market. The study goes beyond exploring the nuanced needs and aspirations of Indian students and identifying emerging business models that are shaping and supporting this space.

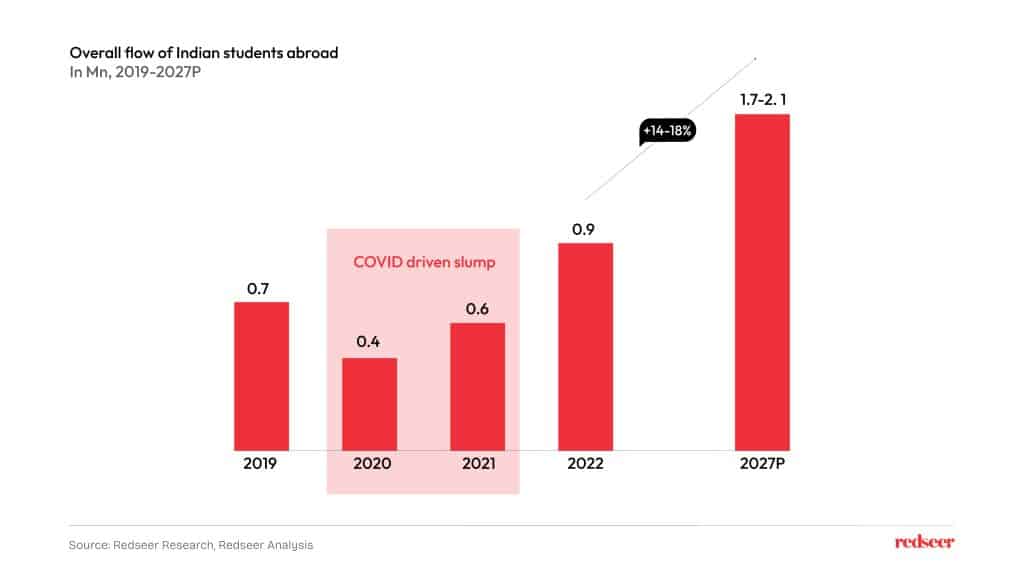

~2 Mn Indian students are projected to opt for overseas education by 2027

In 2022, a striking resurgence marked the narrative of Indian students pursuing higher studies abroad with figures soaring to an unprecedented ~900,000, surpassing the pre-COVID numbers of ~700,000 in 2019. Projections now point towards an ambitious trajectory with an estimated 2 million Indian students poised to pursue international education by 2027, reflecting a compelling 16% Compound Annual Growth Rate (CAGR). This has been driven by a growing awareness of the global academic landscape, slump in the Chinese student inflow to these universities, increased emphasis on specialized and advanced degrees, and an expanding middle-class demographic with the financial means to support such pursuits. While, postgraduate courses are anticipated to maintain dominance, constituting a substantial 62% share. STEM disciplines are expected to further increase their share from 58% to 61% by 2027.

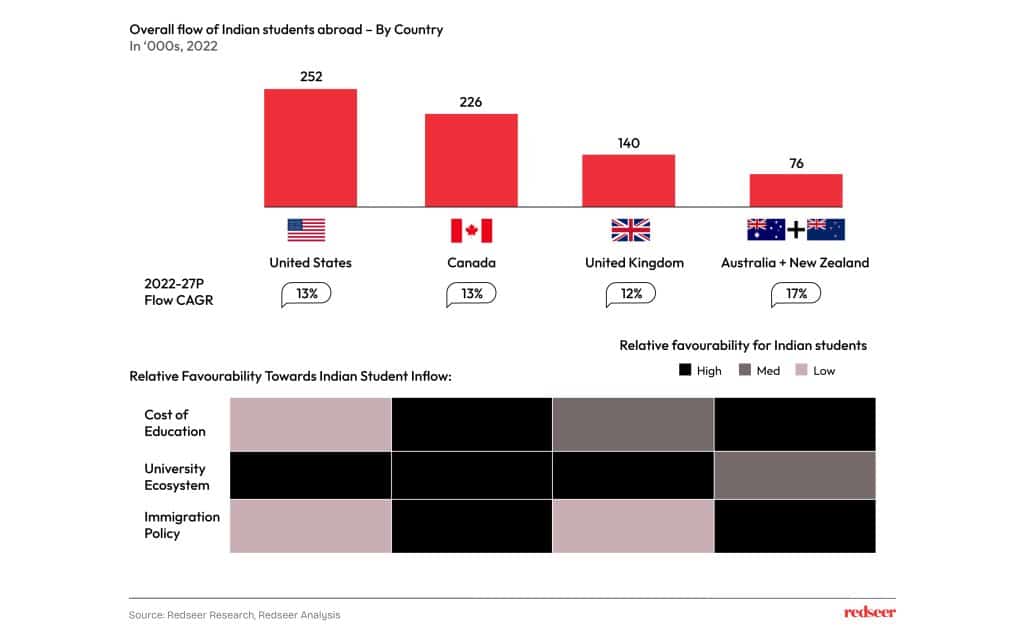

North America is likely to continue as the major hub with ANZ emerging fast

Geographically, North America, particularly the United States, retains its status as a steadfast hub while Australia and New Zealand (ANZ) emerge as dynamic regions. Despite the elevated cost of education in the USA, its appeal persists due to a robust reputation for STEM courses and well-funded research ecosystems. Canada presents itself as a compelling alternative, offering cost-effective education, although the impact of the recent deterioration in diplomatic relations is yet to be ascertained. ANZ is emerging through its focus on skilled migrants and a five-year post-study work visa in Australia, making it an increasingly attractive destination for Indian students. The shifting immigration landscape, characterized by increased stringency in the USA and the UK, prompts students to explore alternative destinations.

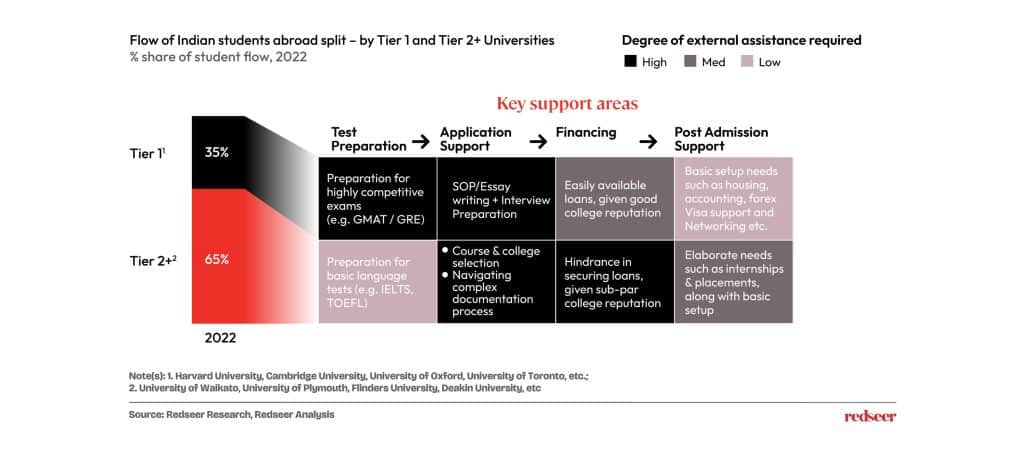

Tier 2+ universities account for ~2/3rd of Indian abroad student intake wherein students need support with application and financing

Both tier 1 and tier 2+ aspirants face distinctive challenges, demanding specialized support. Established players traditionally guide tier 1 aspirants, emphasizing rigorous test preparation and meticulous application assistance due to the competitive nature of admissions in top-tier institutions. In contrast, while there is lower competition for tier 2+ aspirants (leading to universities partnering with agencies for admission), they have to navigate a intricate documentation process and financial intricacies. Given the mediocre reputation of these universities, securing loans becomes a hassle for the aspirants. Additionally, they are reliant on external support for their documentation and visa processes.

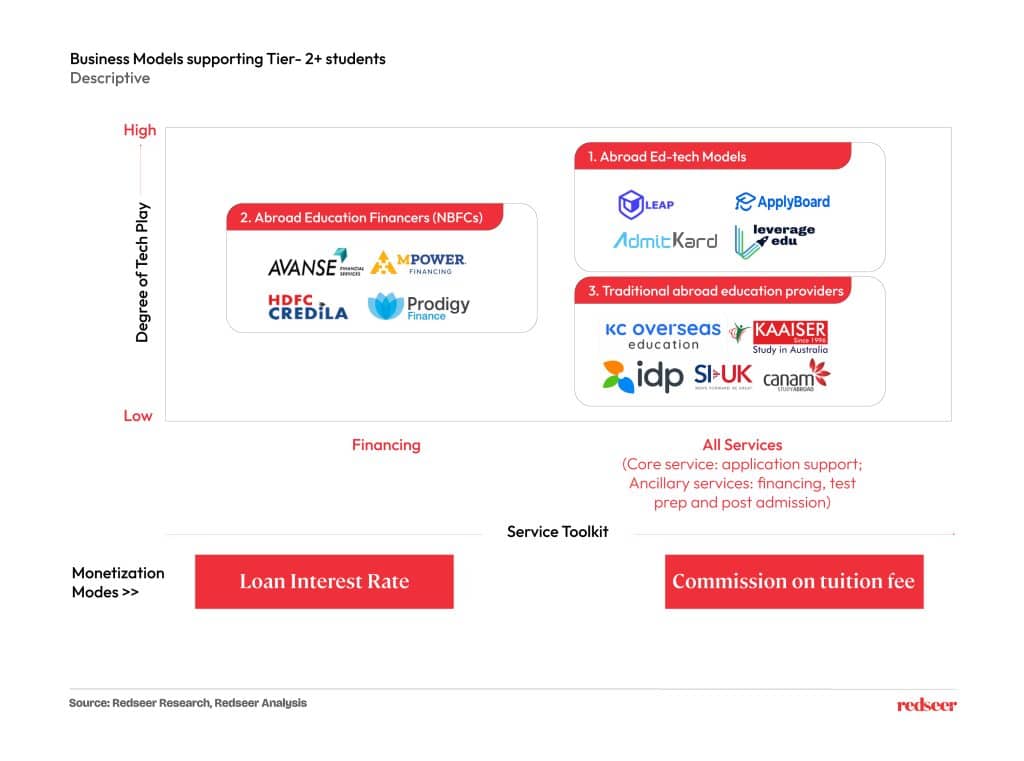

Multiple players provide the required support but differ in terms of service toolkit and tech play.

Two dominant business models attempt to solve the challenges faced by the Tier 2+ aspirants: financing-first and full-stack . Financing-first models, led by Non-Banking Financial Company (NBFC) players such as Avanse, Prodigy Finance, Mpower finance, and HDFC Credila, have built underwriting algorithms to support these aspirants and build university partnerships to generate demand. They primarily monetize through loan interest rates. Conversely, within the full-stack ecosystem, ed-tech models like Leap, Leverage Edu, ApplyBoard, and AdmitCard, have gained prominence in recent times. These players provide a tech-enabled experience, offering students easy access to course/university exploration tools, personalized and online guidance/counselling, and seamless online documentation process. The digital-first approach aligns with the evolving preferences of a tech-savvy student demographic. Most full stack players monetize via commissions on tuition fees from partner universities.

Thus, it becomes critical for CEOs and investors operating within the Ed-Tech sector to understand the nuances of this rapidly growing sector. This would help them better align their offerings with these trends and address the emerging needs of this market. Using this Ed-Tech companies can make more informed decisions and create a more meaningful impact for the sector.