What started-off as an online service to order books and get them delivered at the doorstep in a few days, India’s e-commerce landscape has seen significant evolution in terms of product categories, assortment spread, discovery approach, delivery speed, and logistics – all focused towards catering more effectively to the diverse needs & preferences of a large consumer base!

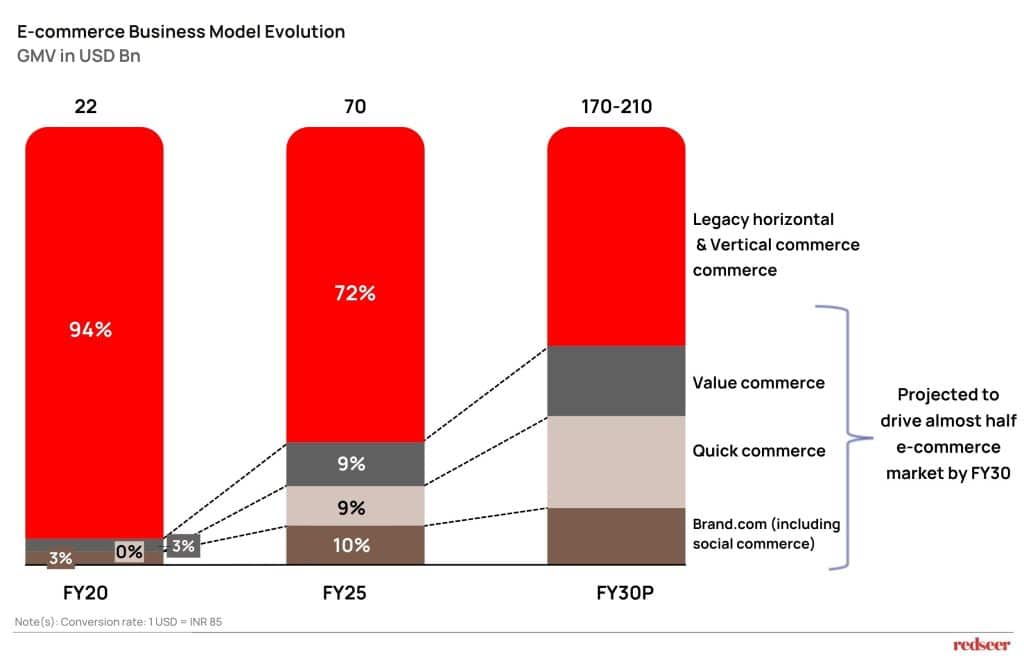

Multiple e-commerce business models have risen to the occasion to shape this evolution. At this point, there are 5 sizeable business models in the Indian e-commerce space:

- Legacy horizontal commerce: Multi-category play serving a wide range of purchase use-cases, with the help of a wide & balanced assortment entailing branded & unbranded products across price-points, strong integration with brands enabling affordability & competitive delivery speeds, and a mature logistics network to control the customer experience.

- Vertical commerce: Category-specific play typically catering to high-intent shoppers, through the provision of well-known, global, and new-age brands, curated in line with the latest trends.

- Value Commerce: Multi-category play built on large-scale participation typically from unbranded sellers and regional brands (enabling provision of an extensive, affordable assortment), discovery-led purchase journeys to support the exploratory shopping missions, and low-cost structures to support low-ticket servicing.

- Quick Commerce: Essential-first players are gradually becoming multi-category, enabling delivery of top-selling branded products at lightning-fast delivery speeds (<30 minutes), with the help of a dark store-led fulfilment network.

- Brand.com: Brand-specific e-commerce offering by traditional and digital-first brands, for stronger brand story communication, building consumer loyalty, direct customer data access, and high margins, leveraging the thriving new-age ecosystem of fulfilment & logistics solutions.

While the legacy horizontal commerce model kicked off the e-commerce journey in India and dominated it for over a decade, the specialised commerce models, whether solving for category depth (vertical commerce), affordability (value commerce), brand story & loyalty (brand.com), or convenience (quick commerce), have grown much faster. Further, as the Indian e-commerce market matures, the specialised commerce models are expected to continue to grow faster and drive more than 50% of the Indian e-commerce market by 2030. This trend is in line with mature e-commerce markets such as China, wherein leading players differentiate starkly in terms of value focus and convenience focus, shaping their assortment, pricing, and experience accordingly.

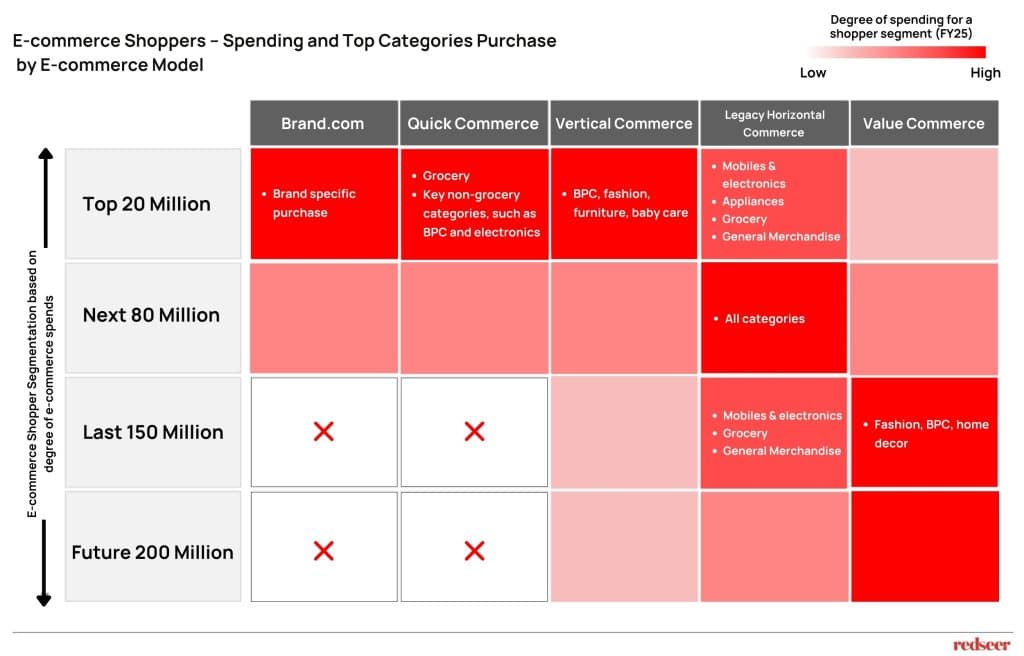

At the same time, it is important to note that all these models are bound to co-exist in India’s vast retail & e-commerce landscape, as they cater to distinct consumer segments and use-cases.

As illustrated below, quick commerce, vertical commerce, and brand.com are more prominent among the digitally mature consumers, given their ability to effectively serve the convenience-oriented, brand-conscious, and trend-first use cases. On the other hand, the value commerce model is widely used by the late e-commerce adopters, who are price sensitive, small-ticket transactors, brand agnostic, and exploratory. As a result, value commerce is also better placed (over other models) to enable e-commerce expansion to new users. Legacy horizontal commerce cuts across the different cohorts, depending on the category and use cases, owing to its multi-faceted play.

At Redseer, we solve for new and what’s next. From estimating the inflection point during e-commerce 1.0 to decoding tomorrow’s business models, we have consistently stayed ahead of the curve. With our deep data-led insights, our consultants predict the trends before they become business as usual, which enables them to provide the right strategic guidance.

The rising prominence of multiple e-commerce models leading to multi-model shopper interactions calls for brands to build a focused e-commerce strategy, which is optimised for different models and platforms. Brands should look to address the following questions while crafting their e-commerce strategy:

- How should you optimise your product portfolio (in terms of pack size, price-point, positioning, etc.) by e-commerce model and platforms?

- What should be your pricing & promotions approach, considering the difference in key purchase occasions/events, and shopper segments?

- How should you allocate the ad spends across different product categories, e-commerce models, and the different points in the e-commerce journey (home page, search-based ads, category listing, checkout, etc.)? Which marketing approaches (influencer partnerships, display vs listing ads, and push notifications) should you follow for which e-commerce model? What are the best practices to maximise your ROAS?

- What kind of logistics integration should be enabled to ensure competitive delivery speeds and stock-in’s?

- How should your internal processes, team, and capabilities be tailored to align with the evolving e-commerce models?

The answer to these questions is quite nuanced and requires a detailed understanding of the different platforms and the associated shopper journeys.

Looking to get ahead of e-commerce 2.0 and build a curated strategy to scale? Connect with our Associate Partner, Kushal Bhatnagar, for the right strategic guidance and to lead with confidence.