India’s ~USD 950 Bn retail market is largely unorganized, with general trade driving ~83% of the overall market. The share of general trade is even higher in the grocery market driving >90% of the market. The general trade market in India is highly fragmented and chaotic, wherein retailers face multiple challenges while procuring from traditional channels, owing to pricing opacity, frequent stockouts leading to low fill rates, no/slow delivery service, inconsistent and low product quality, and lack of credit, which makes procurement cumbersome, expensive, and untimely. eB2B platforms are solutioning for these retailers through superior procurement solutions enabled by strategic brand partnerships and by removing intermediaries from the retail value chain.

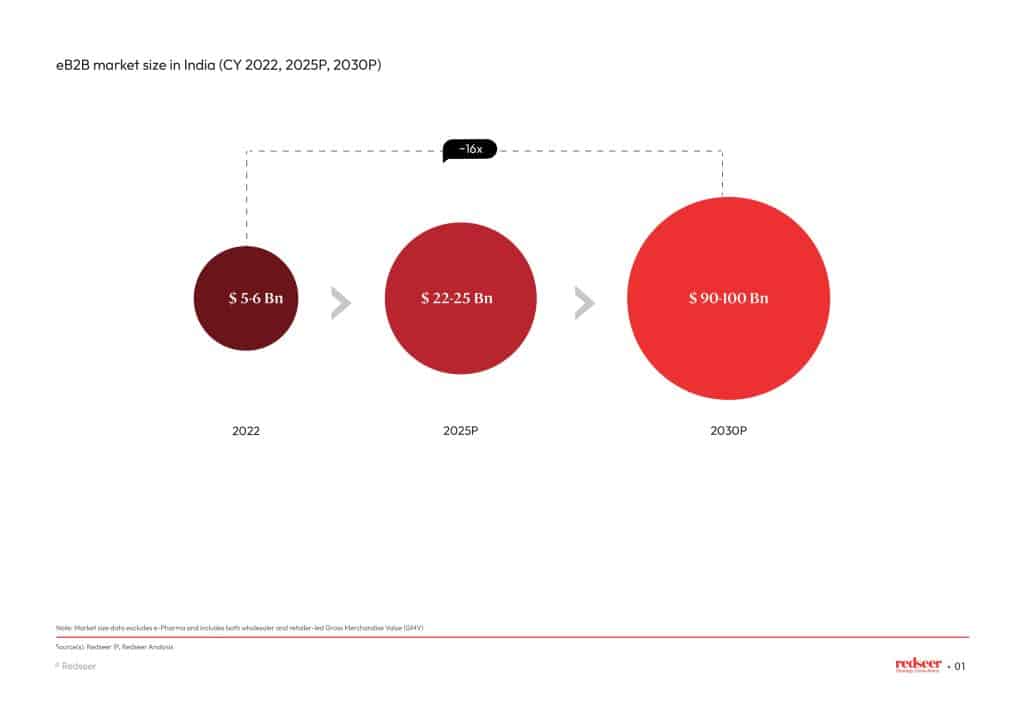

1. eB2B market in India is projected to be a $90-100 billion opportunity by 2030

The eB2B market in India is projected to witness a ~16x increase from USD 5-6 Bn in CY 2022 to USD 90-100 Bn by 2030, growing at a CAGR of 40-45%. 70-80% of the eB2B market is led by platforms catering to retailers, while 20-30% is led by platforms catering to wholesalers.

Growth in this market will be led by deepening penetration among retailers across categories and geographies and a higher wallet share for eB2B platforms as retailers get habituated and reap the benefits offered by these platforms – which enable cheaper procurement, faster deliveries, higher fill rates, and consistency in product quality.

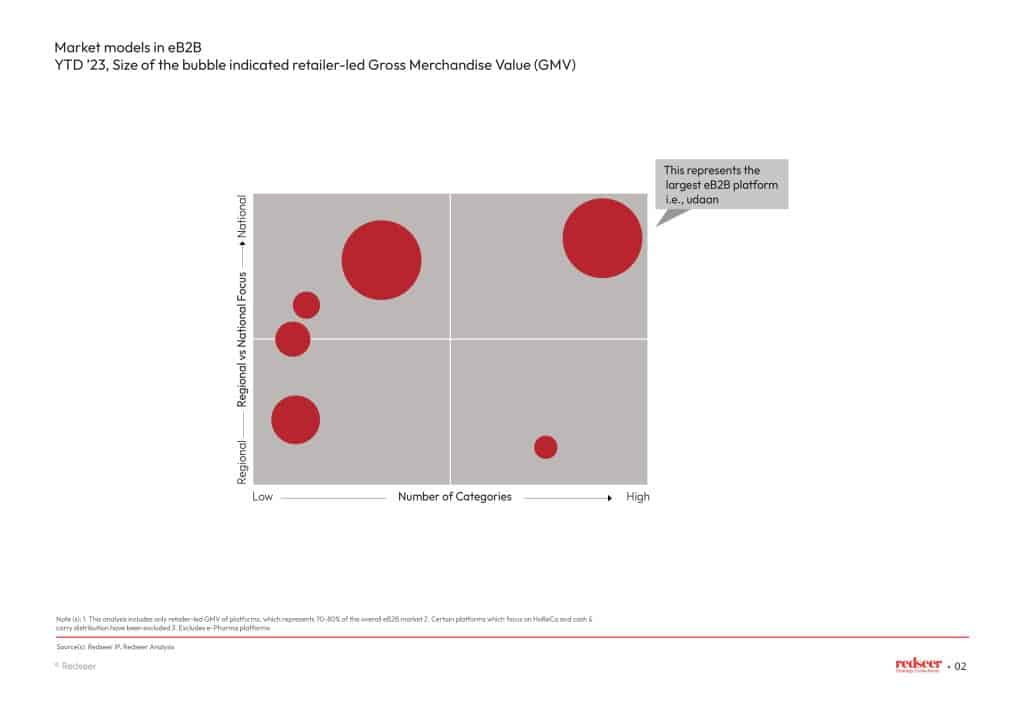

2. Multiple business models as platforms solace for ‘Growth + Profitability’; A multi-category first party based model seems to be the right answer

eB2B platforms in India can be segmented based on their regional vs national focus and the number of categories they operate in. There are limited multicategory national platforms (eg. udaan) with sizeable pan-India operations across categories which include grocery (staples & FMCG), electronics and accessories, fashion, general merchandise, and others. Multi-category platforms, especially those with an inventory-based model, have a distinct advantage of leveraging staples to drive low cost distribution penetration, increasing the frequency of service in any location, and then monetizing the distribution chain through other non-staples categories, thus creating the right gross margin to cost structure balance.

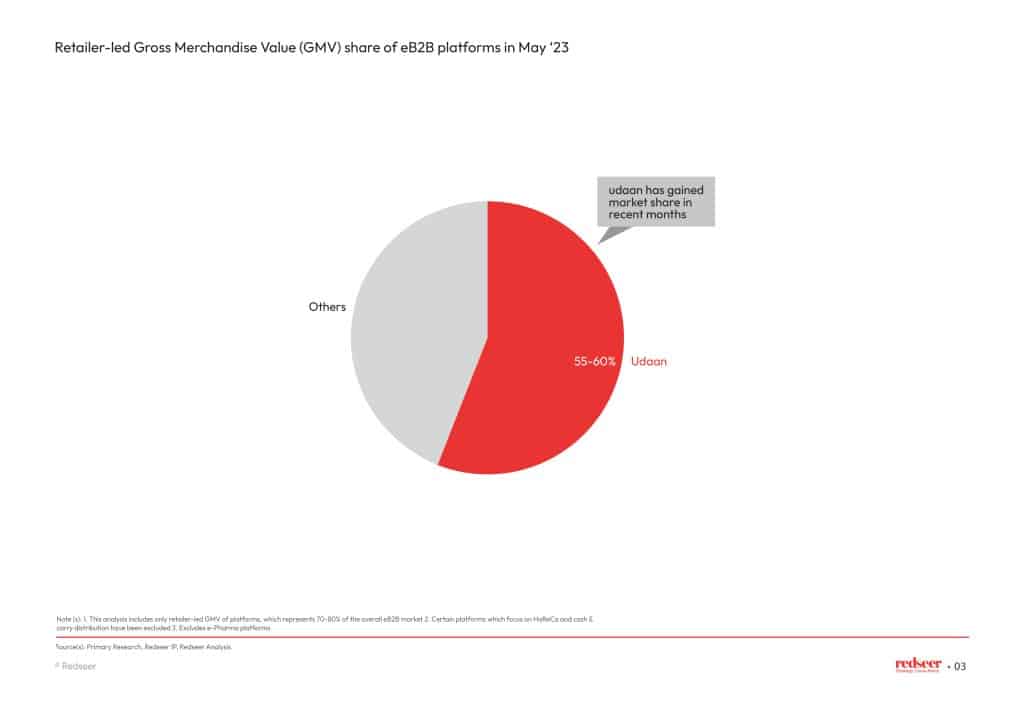

3. Market share of the platforms has been evolving with multicategory platforms gaining significant share and others falling behind

Over the last few months, many of these vertical platforms (for e.g., Bijnis, Dealshare, ElasticRun, Jumbotail etc.) have been struggling and across categories have shown limited growth/ been flat or declined due to challenging unit economics and prevailing macro-economic conditions, while multicategory platforms like udaan have gained market share to reach 55-60% of the retailer-led eB2B market, currently.

4. eB2B platforms focus on cross-leveraging assets and capabilities to drive profitability, unlike eB2C platforms which focus on cross-leveraging customers across categories

The high volumes and specialized needs of retailers across various categories and sub-categories require eB2B platforms to be highly competitive across all segments they operate in. For instance, a retailer who procures sugar from a particular eB2B platform, might not necessarily procure oil from the same platform, similarly a retailer buying detergents from a platform won’t necessarily purchase rice from the same platform, unless the platform is highly competitive in both sub-categories. To enable this competitiveness, cross leveraging capabilities and costs is critical, enabling eB2B platforms to serve retailers with consistent and high quality of products, right availability of products at competitive pricing and reliable service. Hence, the eB2B business model is distinct from eB2C (which focuses on cross leveraging customers across categories) creating a formidable business moat for eB2B platforms that is difficult to replicate. The key capabilities contributing to this moat are as follows:

1. Sourcing & Bulk Breaking: Backward integrated sourcing enabled by strategic partnerships with brands and manufacturers, coupled with bulk breaking capabilities remains a major moat for eB2B players.

2. Supply Chain: Warehousing fulfilment and delivery requirements of eB2B require nuanced category and subcategory level capabilities, due to bulk volumes and categories involved from transporting to handling of materials from various categories at the warehouse. eB2B platforms (1P models) have built specialized capabilities enabled by cost efficient warehouse and inventory management, distribution-led network architecture and data-driven last-mile routing.

3. Tech & Product: eB2B platforms, specifically 1P platforms, who enjoy structural advantages throughout the distribution value chain by virtue of being tech driven. Data analytics for demand predictability, inventory management through in-house warehouse management softwares (WMS), route optimization for GTM and deliveries, and credit underwriting on the back of high-quality transactional data, among others, helps eB2B platforms to enhance efficiency and competitiveness.

4. Go-to-Market (GTM): eB2B platforms have widespread retailer tie-ups and reach including those in Tier-2+ cities through their feet on street (FoS) network. These retailers, especially those that deal with grocery products, are highly sticky due to repeat purchases.

5. Lending: Lack of credit is a major pain point for retailers who either don’t have access to it through traditional channels or obtain it at higher interest rates through unstructured terms lacking paper trails. eB2B platforms provide organized credit at lower interest rates either through their captive credit arms or through Third Party (3P) tie ups with lending partners.

Furthermore, a multicategory approach enables higher competitiveness as platforms cross leverage these capabilities across categories and subcategories, driving significant cost efficiencies.

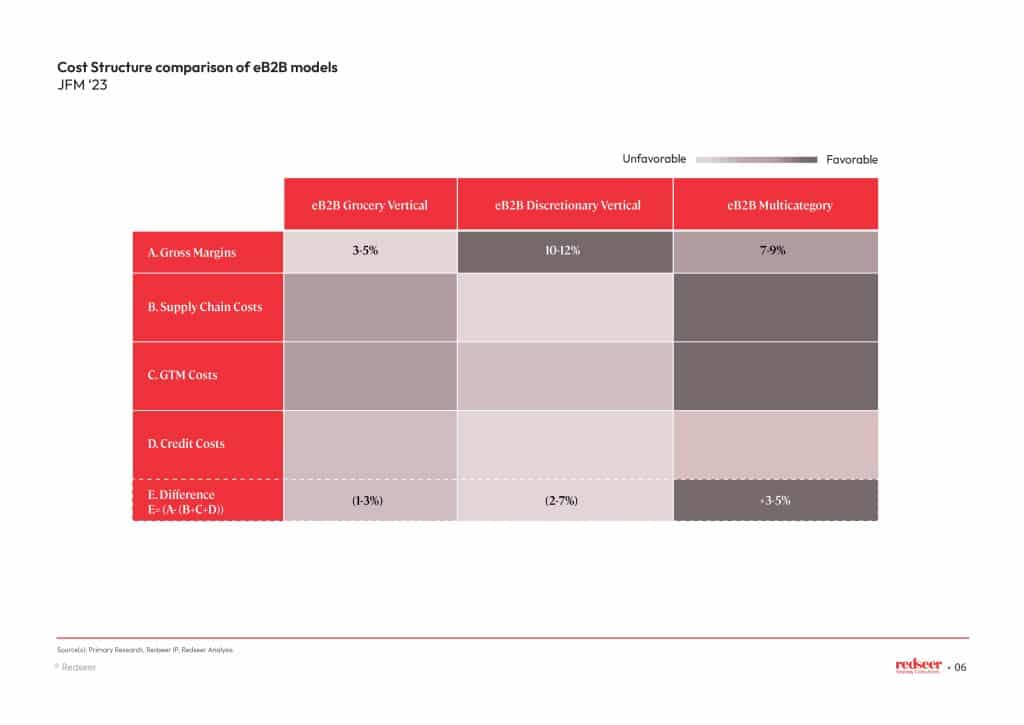

5. Reasons why a multicategory focus has done well and is essential to win in the long run – While staples grocery drives volumes and predictability for the right supply chain cost structure, discretionary segments (Clothing, Footwear, Home & Kitchen, Electricals & Hardware, Accessories), FMCG and, Fresh categories boosts margins / profitability.

Supply chain costs, go-to-market costs and credit costs are the three major cost heads in eB2B business. Inability to optimise cost structures has been the primary reason behind the challenging unit economics of vertical eB2B platforms leading them to scale down in recent months.

1. A multicategory approach helps optimise supply chain costs – Grocery drives higher utilisation of fleet (as supply chain cost is inversely proportional to weight / tonnage carried) and demand predictability, while discretionary categories enable better economics for multicategory platform.

Efficiently managing supply chain costs has long been the achilles’ heel of eB2B platforms as it contributes to a significant portion of operating expenses. When these costs surpass the range of 8-10% of Gross Merchandise Value (GMV), they become prohibitively high.

While grocery (especially staples) drives higher tonnage, more demand predictability enabled by higher frequency of orders, and a higher fleet utilisation, lower gross margins in the category leads to suboptimal profitability at a standalone level. In the case of discretionary products (especially footwear, home & kitchen, accessories, and general merchandise), while gross margins are higher, ASPs are low (e.g., t-shirts of Rs. 100), production is dispersed, and demand predictability is low, which leads to lower tonnage and low fleet utilisation, thereby increasing the supply chain costs. Third Party (3P) platforms, relying on Third-Party Logistics providers (3PL) for fulfilment, face heightened fulfilment costs due to outsourcing logistics, compared to First Party (1P) platforms handling it in-house through a captive arm.

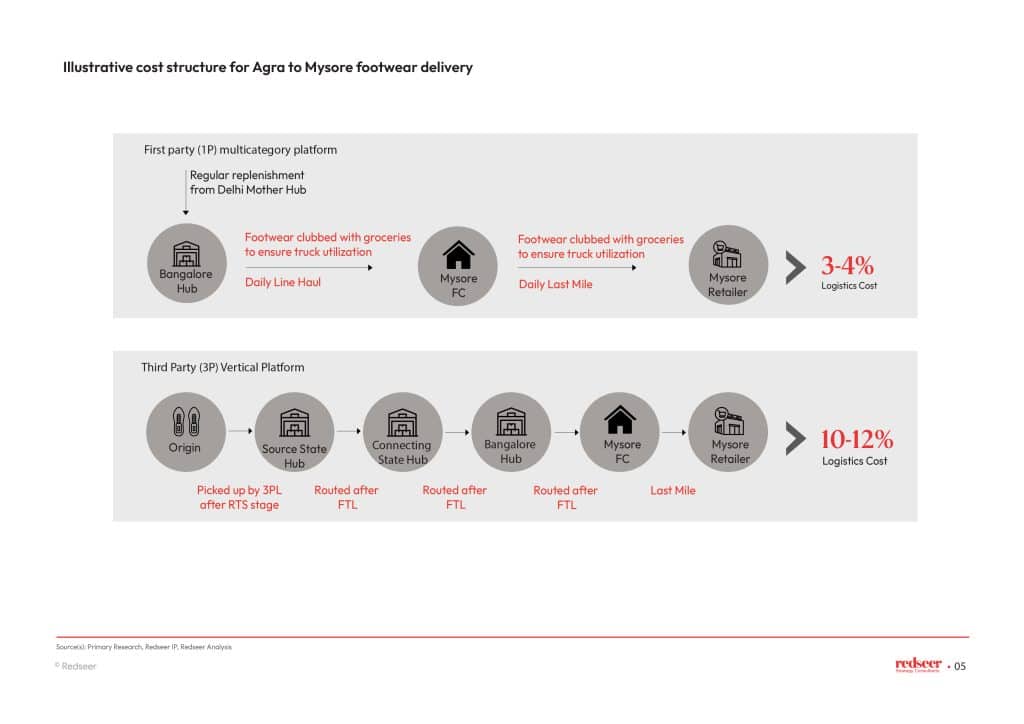

To illustrate this further, let’s consider the fulfilment journey of a footwear manufacturer in Agra to a retailer in Mysore.

1P multicategory platforms (eg. udaan) have regular procurement from the footwear seller ensuring that it is either kept at the Delhi Mother Warehouse or transported to the Bangalore Fulfilment Center at periodic intervals for replenishment depending on inventory management levels. The mid-mile journey from Delhi to Bangalore occurs on a set frequency, allowing for the consolidation of footwear products with other categories, thus minimizing logistics costs. Subsequently, the daily line haul from Bangalore to Mysore optimizes fleet utilization by transporting footwear products alongside grocery, effectively spreading costs across multiple products and categories. Finally, from the Mysore hub), a daily milk run consolidates footwear products with other grocery items, providing for high route level density and LM efficiency.

By implementing optimization strategies, the overall logistics cost for the 1P multicategory platform amounts to approximately 3-4% of GMV, which is amongst one of the lowest eCommerce supply chain costs in the country. On the other hand, 3PL providers would charge 3P platforms between 10-12% based on origin pin code and destination pin code distance and weight of the goods to be shipped.

2. A multicategory approach has other benefits too – helps optimise go-to-market (GTM) and credit costs

Vertical platforms who are only focussed on either grocery or discretionary categories struggle to manage go-to-market (GTM) costs because of low retailer density, which results in lower throughput per feet-on-street (FoS), and because of low demand predictability.

However, for multicategory-focussed platforms, GTM cost optimization happens through leveraging the same tech (used to implement beat plans/route optimization) and customer service across all categories/portfolios, and further through aggregation of sub-categories within portfolios. Aggregation, in this context, plays out with a single FoS resource being allocated multiple sub-categories. For instance, a single FoS resource handles staples, FMCG, select fruits & vegetables, and select general merchandise for a kirana store. Similarly, a single FoS resource working with lifestyle stores will handle both clothing and footwear, while another FoS resource working with general stores will handle metals, plastic, and appliances.

When it comes to credit costs, lower ticket sizes and higher frequency of purchase increase the frequency of collection, affecting collection efficiency. A multicategory, First-Party (1P) model leads to higher collection efficiency enabled by better underwriting efficacy and lower collection costs as delivery agent helps with collection. Further, cost optimization is enabled by cross leveraging the same collection infrastructure across all categories and sub-categories.