Easing macro headwinds are poised to revive interest in Southeast Asian private markets in 2024. As macro drivers take a backseat, the intense focus on profitability will progressively ease. Startups responding well to the emerging demand-supply trends will regain traction. Sectors that could see higher startup activity levels in 2024 include AgriTech, Artificial Intelligence, HealthTech, and Travel. In today’s update, we cover the above points. We also share a list of our most-read reports from 2023. Details follow.

01.Southeast Asia is attractively positioned, as 2024 could shape up to be less about macro and more about micro…

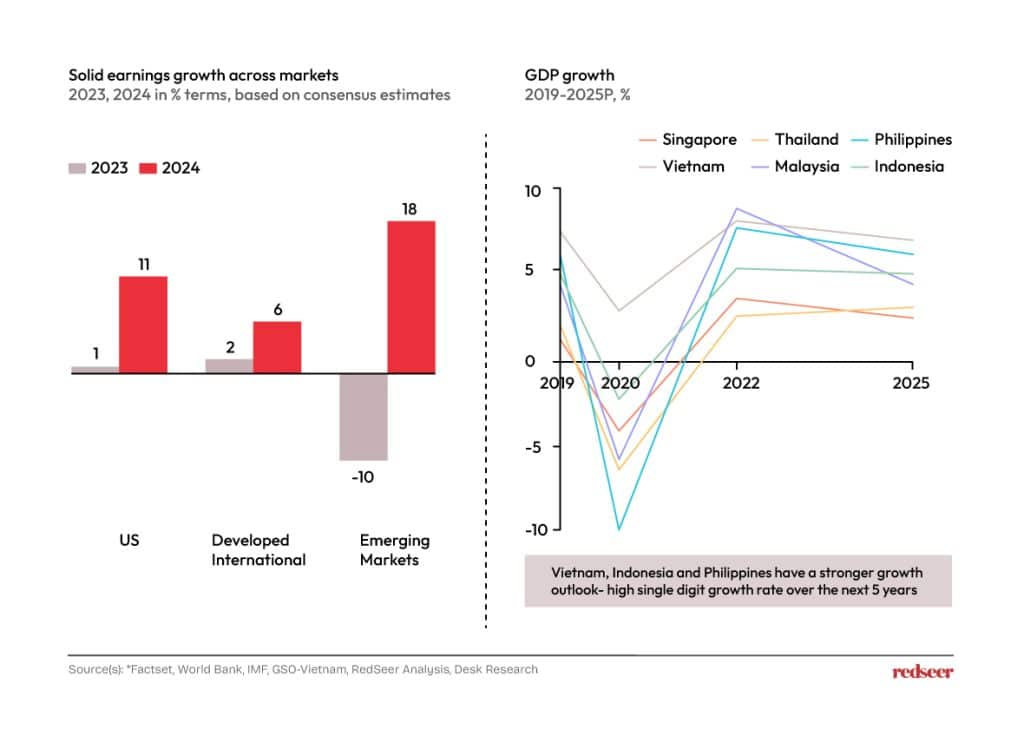

Media reports (Federal Reserve triggers market rally as it signals interest rate cuts in 2024, 14 December, Financial Times) suggest likely interest rate cuts next year. Secondly, consensus earnings estimates for public markets imply a strong YoY revival for emerging markets*. Thirdly, developing South and Southeast Asian economies are coming out of China’s shadow as alternative investment destinations. Collectively, these factors should help South and Southeast Asian public markets and drive positive spillover effects for the private markets. Private companies tapping into the emerging demand gaps will gain rapid traction.

02.While specific sectors dominated past private investments, a shift could be underway. However, country-wise allocations may not change soon

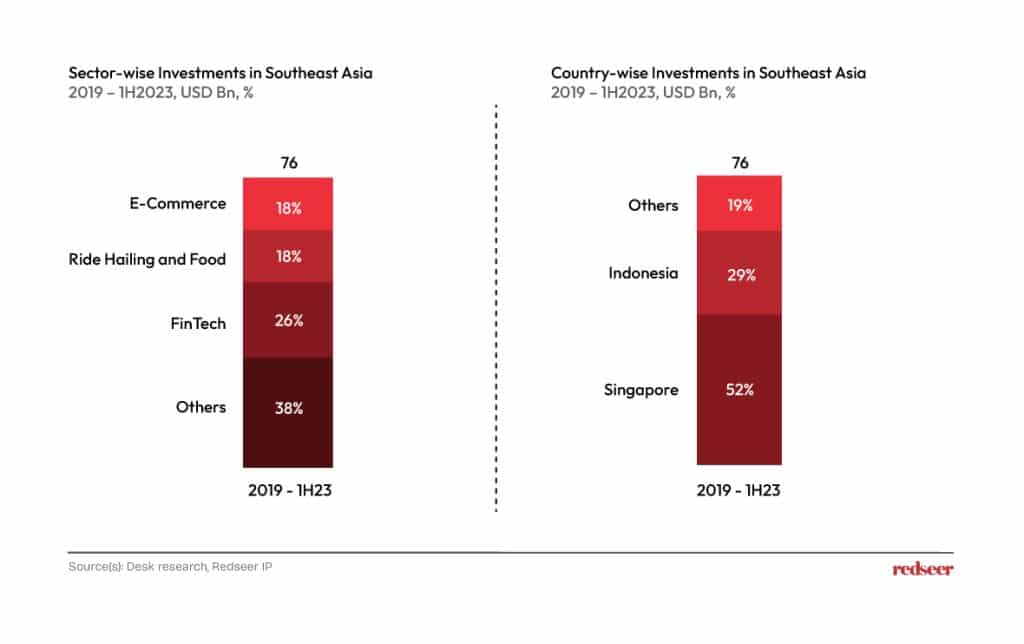

E-Commerce, FinTech, and On-Demand Ride Hailing and Food Delivery services accounted for more than 60% of total Private investments in Southeast Asia till 2021. However, starting in 2022, sectors like HealthTech, EdTech, and Deeptech/AI began gaining more attention and attracting more than 40% of the share, signaling the emergence of the next wave of digital sectors.

In contrast to private investments diverging into new sectors, country-level allocation remains largely clustered around Singapore and Indonesia. The two countries have cornered more than 70% of investments since 2019. Vietnam gains interest on an on-and-off basis, while the other countries have seen limited investments. This trend could persist for the next two to three years unless there are material improvements in government policies and supportive startup ecosystems in the lagging countries.

03. Sectors where the next wave of investment opportunities could be emerging in 2024

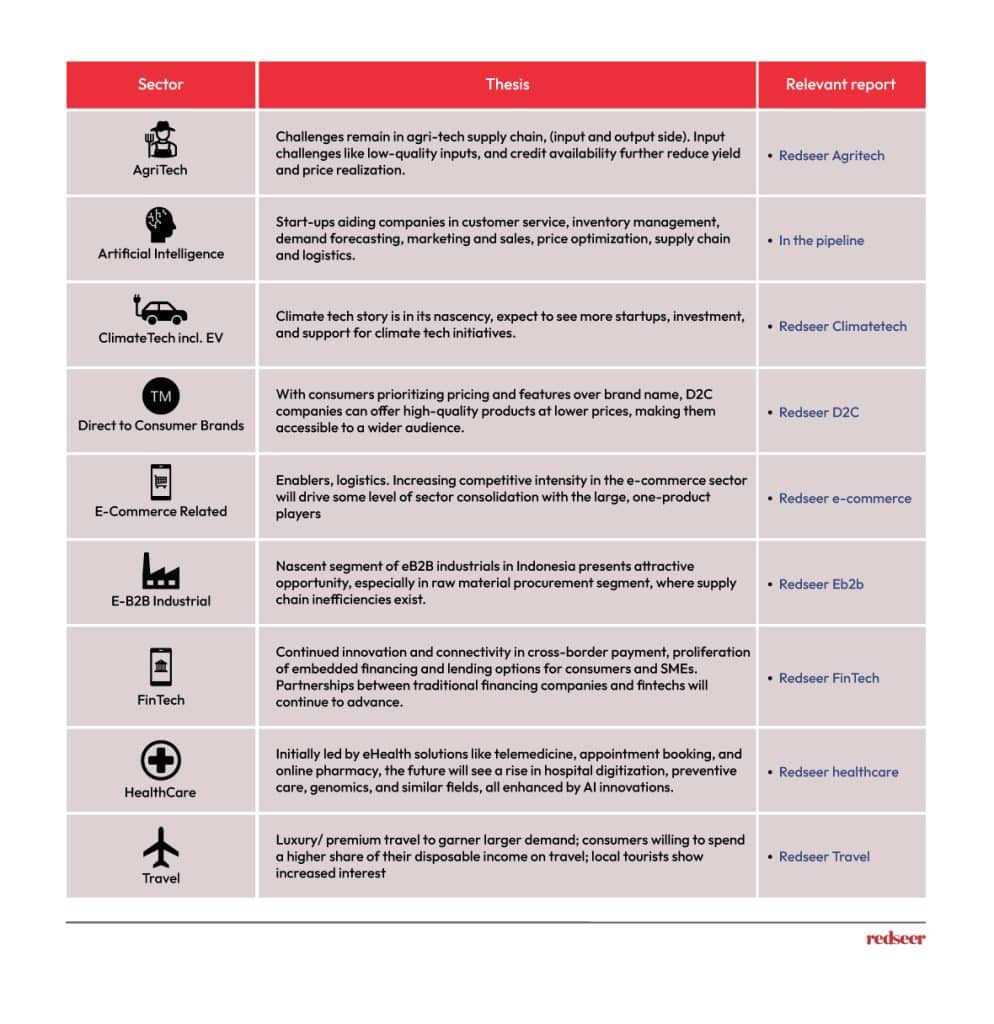

Improving macro-outlook is poised to benefit investment activities in sectors like AgriTech, ClimateTech / ElectricVehicle. Companies in traditional sectors like E-Commerce, FinTech, Healthcare, and Travel will sustain momentum, while there will be a breakout of local Artificial Intelligence (AI) focused startups in 2024.

04.Our most-read reports of 2023

These three reports had the highest readership in the last twelve months. While we have been highlighting emerging themes on our own, inputs from our readers have helped us a lot. Drop us a line if you have specific themes or trends worth highlighting.