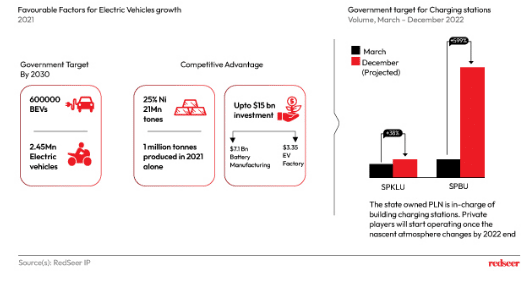

1. Indonesia possesses the macro tailwinds needed to stimulate the growth of the Electric Vehicles sector

Indonesian government wants to invest for a green economy, hence has launched a roadmap to convert fuel engine vehicles to BEVs (Battery Electric Vehicle) and hybrid electric vehicles (HEVs).

It possesses the largest nickel (an important component of Li-ion battery) reserves in the world at a whopping 25% of total Ni on earth. Additionally, the electric vehicle projects have been brimming with fundings from LG energy solutions, Hyundai, CATL, Toyota among others.

The government is enroute to expand its EV charging station infrastructure from its current expanse of 38 cities.

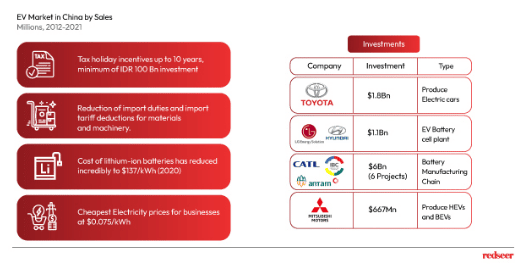

2. The government has been actively involved in subsidies to encourage the population to switch to electric vehicles. There have also been substantial investments to promote EV production and manufacturing in Indonesia

The government has introduced a plethora of incentives to encourage EV adoption that include Tax holiday incentives for EV manufacturers, reduction of import duties on unassembled and semi-assembled vehicles and import tariff deductions for materials and machinery utilized in EV production. Battery is the most expensive component of any electric vehicle, and the cost of lithium-ion batteries has been on a steady decrease. It reached a value below USD 137/KWh in December 2020, from around USD 900/KWh in 2011.The investments have also been steadily increasing showcasing the good market potential of the EV sector.

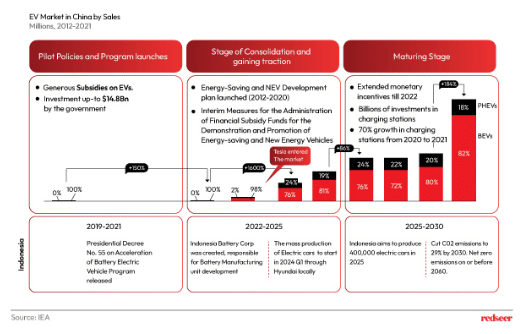

3. China’s stages of EV development can be incorporated in Indonesia to achieve its target of 25% EVs on road by 2030

Chinese government introduced a number of Monetary incentives, EV quotas for vehicle manufacturers and importers, manufacturing subsidies and procurement. Indonesia is on track now in introducing subsidies to encourage its populations to switch to EVs.

The extensive battery chain in China (80% of world’s Li-ion batteries) boosted its sales from 2020 to 2021. Indonesia with large reserves of Ni is investing in battery manufacturing units to produce locally manufactured EVs.

The mass production of EVs is expected to start in Indonesia by the first quarter of 2024 through Hyundai with locally produced batteries kickstarting the EV volume growth.

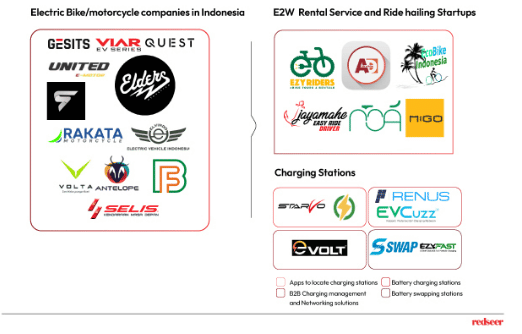

4. Indonesia has one of the largest two-wheeler markets in the world and a lot of new companies are tapping into the electric two-wheeler sector complying to Indonesia’s E2W target for 2030

Indonesia has one of the largest two-wheeler markets in the world. And it hopes to achieve 13 million motorbikes (including converted ones) by 2030.

While the electric car segment has been nascent, the electric bike and moped manufacturers in Indonesia have been quite on the rise with GESITS, Viar and United Motor being on the forefront competing with global companies. Gesits, Selis and Viar hold the largest market share in the E2W sector.

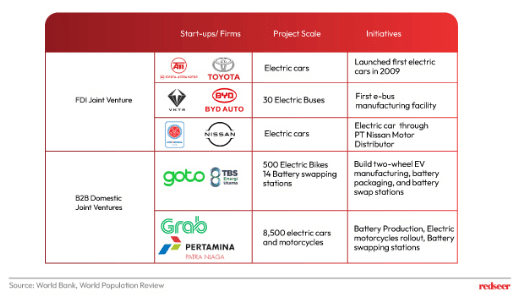

5. Indonesia aims to cut emissions to 29% by the year 2030. To support the cause, there have been joint ventures between local and foreign companies to roll out electric buses and electric bikes

Indonesia aims to cut C02 emissions by 29% by the year 2030. Transportation emissions are third biggest cause of worldwide CO2 emissions, and several companies are already onboard to reduce the carbon footprint.

These firms/companies have begun rolling out electric vehicles and electric buses in their services for starters encouraging electric vehicle adoption and infrastructure development.

6. Indonesia contains an attractive ratio of millennials in its population of 265 million that value sustainability and will potentially switch to EVs in the near future

At present >50%3 of the GenZ consumers like to ensure that the platforms/ brands/ essentials they are using are aligned with their values – Sustainable.

By 2025, Gen Z will make up for ~30% of the total workforce. By then, they will be financially stable enough to buy their own electric vehicles.