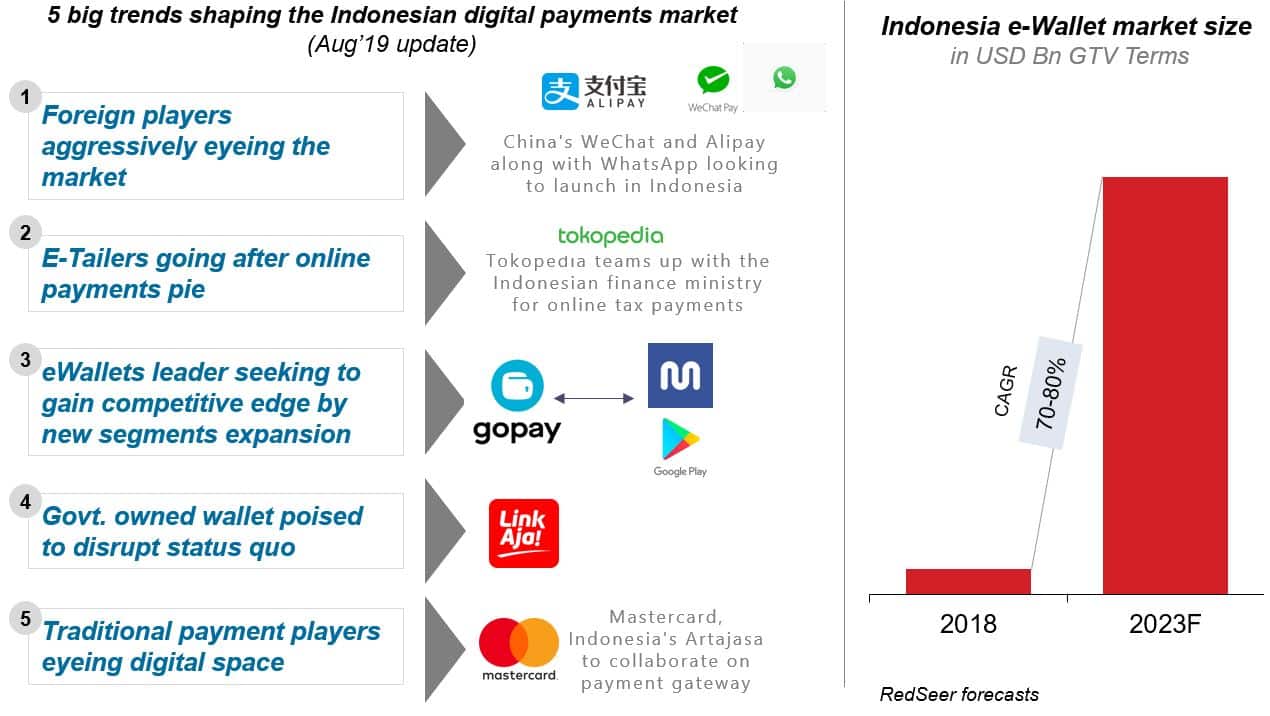

1. Fast-growing Indonesian eWallets and digital payments space seeing massive supply-side activity

Published on: Aug 2019

Summary takeaways

- Continued rapid growth (70-80% CAGR) in Indonesia e-wallets space is attracting the attention of major global players even as local players expand into new segments

- Given the expected intense competition, the market may be heading for consolidation

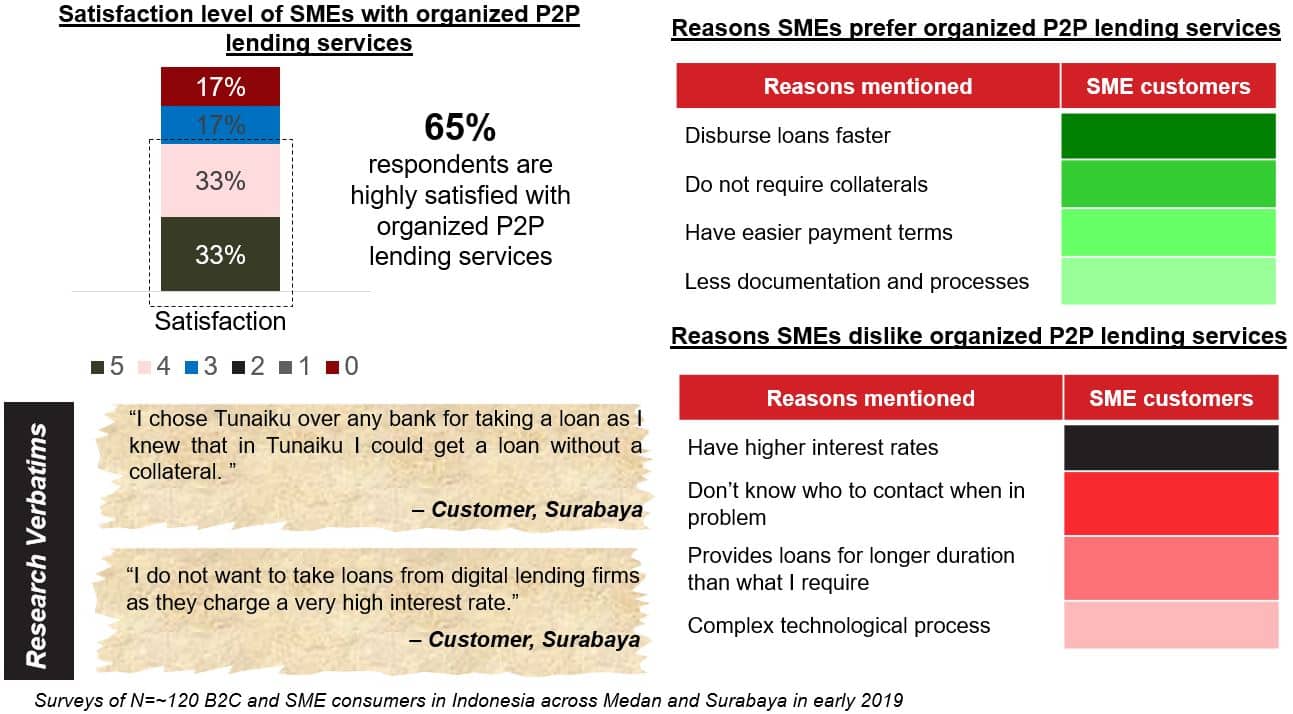

2. Indonesian P2P lenders have driven high satisfaction in SMEs users in smaller cities- owing to fast and collateral-free disbursement

Summary takeaways

- Research with SMEs outside Jakarta indicates the strong positive impact of P2P lenders

- While there are concerns with the high rate of interest, in general, SMEs report high satisfaction with collateral-free loans that are quickly disbursed

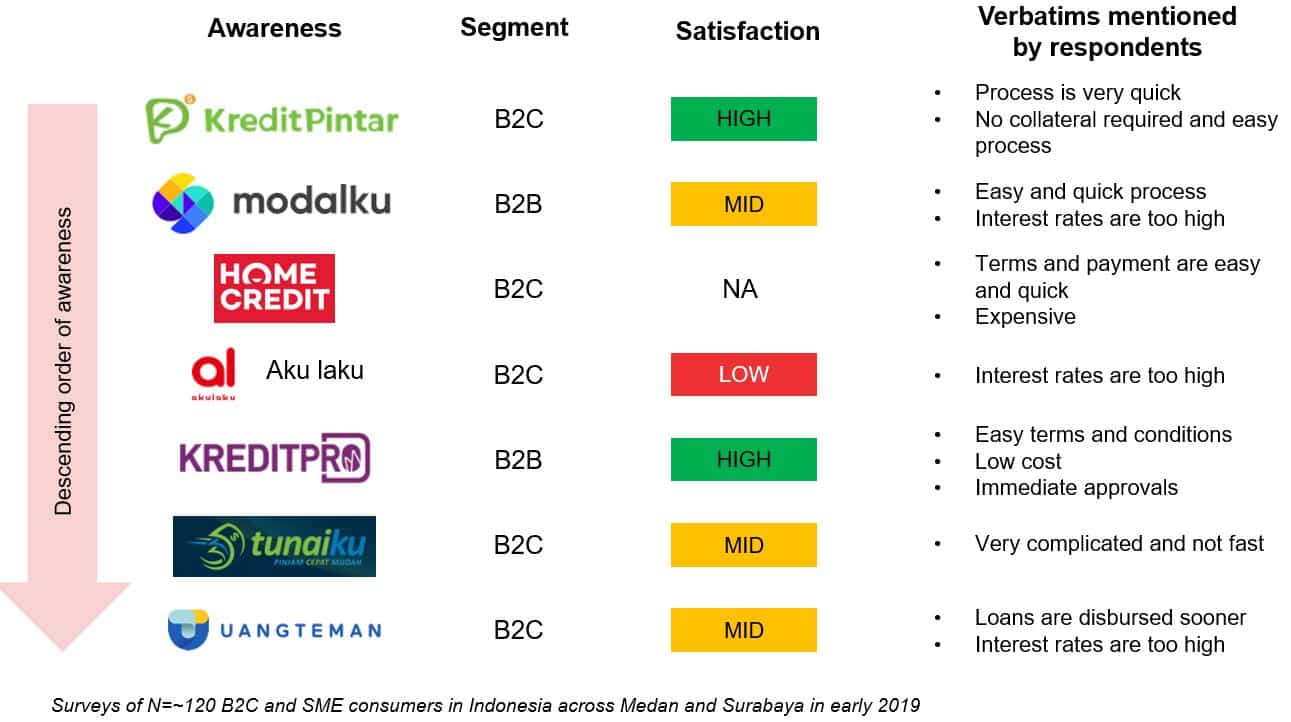

3. Satisfaction varies for P2P lenders; KreditPintar has high satisfaction and together with Modalku, also has the highest customer awareness in smaller Indonesian markets

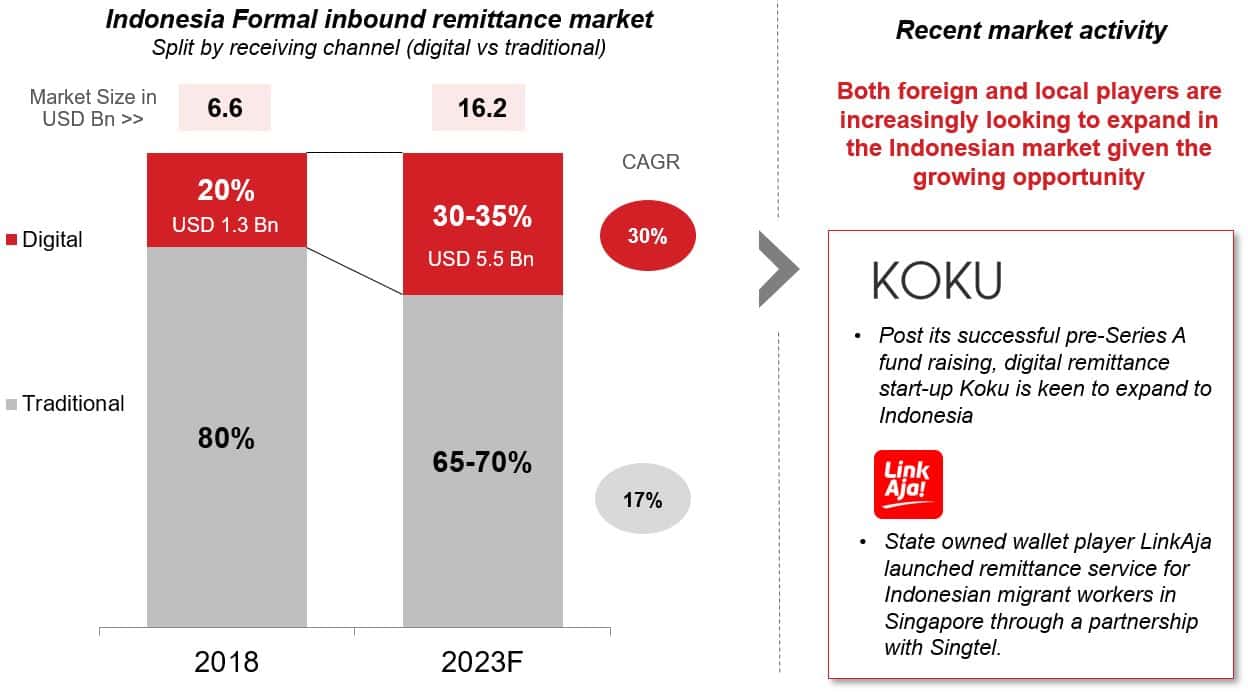

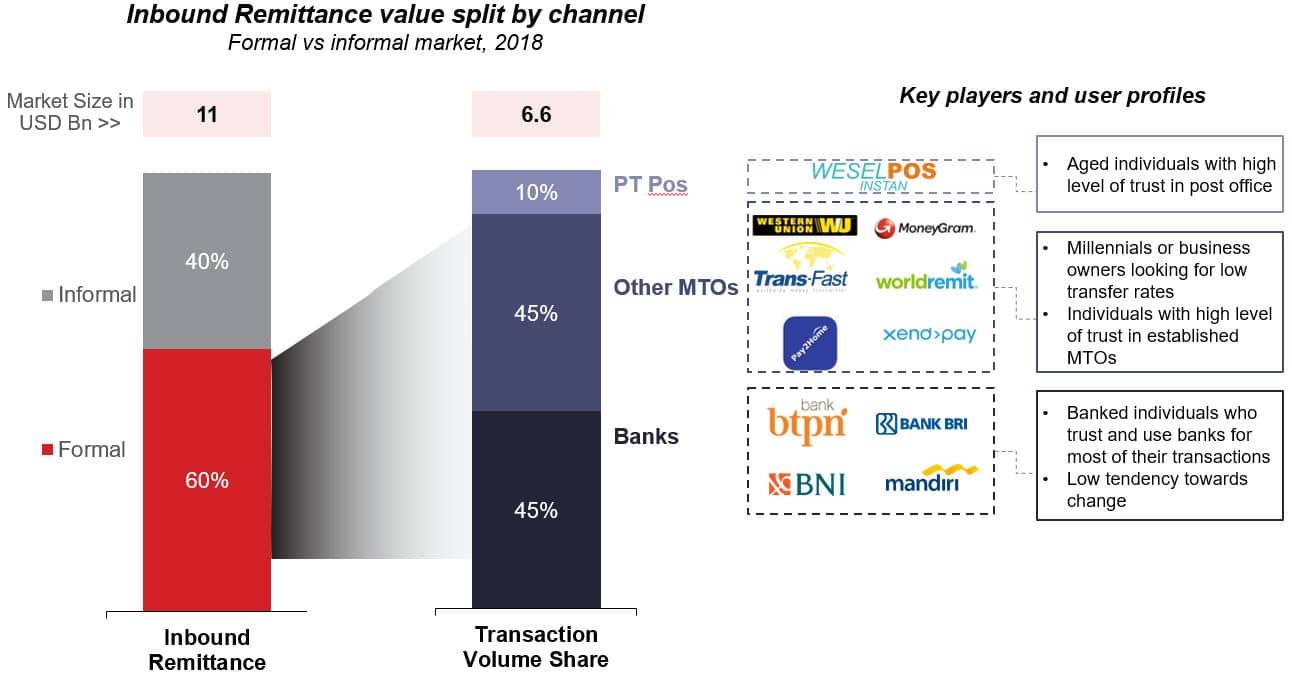

4. Indonesia’s international inbound remittance market has traditionally been highly informal and dominated by large banks and money transfer operators

5. With growing digitization, the structure of Indonesia’s international inbound remittance market is changing- attracting many new players