Internet proliferation in the last few years has led to India having the second-largest internet user base in the world. By 2030, it will be ubiquitous as India expects to have more than a billion internet users across the nation. With the humble beginnings of selling books, the online marketplace has come a long way to penetrate every market category and even dominate some for both goods and services. Digitally native brands – businesses born out of the internet constitute ~40% of all consumer sales today.

In the next 5 years, online shopping will constitute a minimum of 25% of sales across all major categories, such as Fashion, Home & Living, BPC, and others; an exception to this would be – Groceries. Online portals will continue their streak of being the dominant channel for sales of Electronic goods and Large/Small Appliances. According to our estimates, by 2030, Indian Tech/New-age companies will clock a gross merchandise value (GMV) of USD 1 trillion and have a valuation of USD 5 trillion.

So what will the IPO landscape look like in the near future? Let’s take a look.

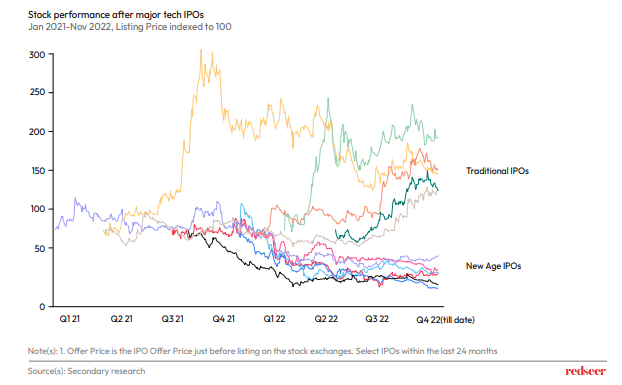

“Tech/New-age IPOs correcting sharply in contrast to traditional companies have been the recent trend”

Indian consumer internet companies grew in popularity through rapid innovations. Some of the matured companies listed on public markets were well-received. However, most of these companies have experienced a sharp correction lately. Macroeconomic trends with lower interest rates fueled the growth of these companies when capital availability was high. Profitability took a backseat to focus more on growth and the need for habit-building among consumers.

The recent global macroeconomic headwinds with higher interest rates dealt a blow to their growth-first approach. It even called into question the ability of Indian new-age startups to be value-creating public market companies. However, the narrative jumps the gun without taking two key factors into account.

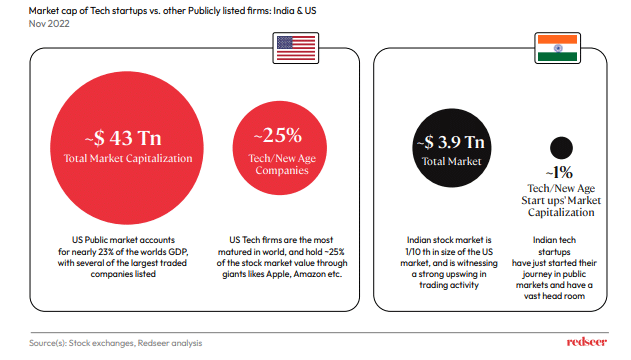

Indian Tech/New-age companies have substantial growth headroom for public market capitalization

With economic growth, there’s plenty of room for expansion in the public markets, especially for Tech/New-age companies. India’s market capitalization to GDP ratio is much lower compared to large economies such as the US, China, and the UK, indicating a lot of opportunities for innovative companies to generate tremendous value. The under-penetration of the public market is much starker for the Tech/New-age companies. For instance, India’s NSE – National Stock Exchange only has about 2000 listed stocks, while The Big Board – NYSE – New York Stock Exchange has listed more than 7000 companies. Here’s where it gets interesting – in the USA, the Tech/New-age stocks represent 25% of all public market capitalization compared to India, which stands at 1%. With the consumption and supply trends resembling larger economies, it’s only a matter of time before new-age companies in India rise to prominence. IPOs following suite would also increase, although they are less frequent at the moment.

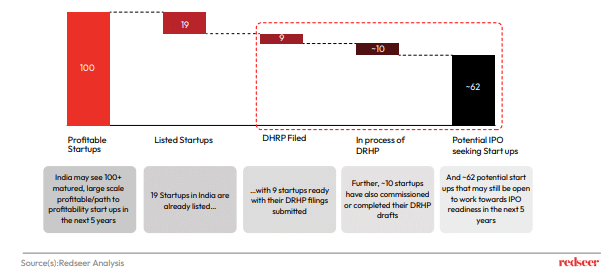

“There are 80 potential Tech/New-age IPOs in the pipeline over the next five years”

India has about 100 new-age companies that are either profitable or on their path to it. The ones that are on the path to profitability are expected to get there in about 5 years. Out of the total, 60 companies already have a unicorn status, while 40 of them are on their way to fortune as ‘soonicorns’. These new-age companies are characterized by their innovative approach and being highly internet-oriented. They are managed by experienced operators, mentored by seasoned VCs, and supported by a maturing ecosystem of enablers. Out of these 100 companies, 80 are still unlisted, and a majority of them are in their prime, 8 years of operation, and ready to take the next big leap in their journey.

In the US, Tech/New-age companies go public within 10-12 years of incorporation. With so many Indian startups at a critical juncture in their journey, the ongoing macroeconomic factors only facilitate their next move. Having their focus re-shifted on profitability, the companies are on a fast lane toward IPOs.

Companies must have deliberate & goal-based approach to be IPO ready

With fast internet adoption combined with economic tailwinds in the foreseeable future, there’s no reason to think Indian Tech/New-age companies wouldn’t make it big in the public equity markets.

While the economic forces at a macro level stay unambiguous for now, each company has its own challenge when it comes to gaining the trust of the investors and the public and staying ready to fulfill its fiduciary duties. Most of the 80 companies mentioned earlier have about a year or two to go to their IPO, and preparation starts now. Their approach needs to be deliberate, goal-based, and process-oriented for IPO preparation. The first key aspect is to identify the right metrics that communicate the strength and value of the company to the investors and to top the metrics to gain their confidence. Although organizations across different industries have specific metrics that communicate their value, most companies need to strive to win in areas such as market leadership, consumer love, clearly visible TAM, predictable revenues, moats/multiple use cases, and a clear path to profitability. It is necessary to set clear goals, track the metrics, recognize gaps, and improve consistently to hit the metrics.

The second key aspect of a deliberate approach that often goes underappreciated is investor relationships and trust. In the public market, reputation and transparency are critical to IPO success, and companies need to establish a good rapport with investors at least a few years before the IPO.

Accomplishing this starts with a CFO highly regarded by the investor community who is competent and can handle the job. Further, winning the trust of the investor community begins with regular communication about industry developments and business performance, being upfront about challenges while also demonstrating the ability to solve them. Through maintaining continuous communication, it also becomes helpful to avoid/pre-empt corporate governance lapses or regulatory risks.

The Indian market is massive and unorganized, with growth opportunities for companies with innovative approaches. It also has a large total addressable market across various consumer categories, making growth unlikely to be a problem. By focusing on profitability and revamping their methods with a deliberate and goal-based approach to be IPO-ready, Indian Tech/New-age companies have a great potential to become valuable large-scale assets.