There is a revolution afoot in the Indian insurance sector. We’re talking about InsurTech. While insurtech has been around the block for some time, regulatory innovations have allowed further newer business models to evolve that improve customer & agent experience and lower cost of servicing. In this week’s edition of our newsletter, Kanishka Mohan and his team bring to us an exciting new sub-segment of Insurance. Read on!

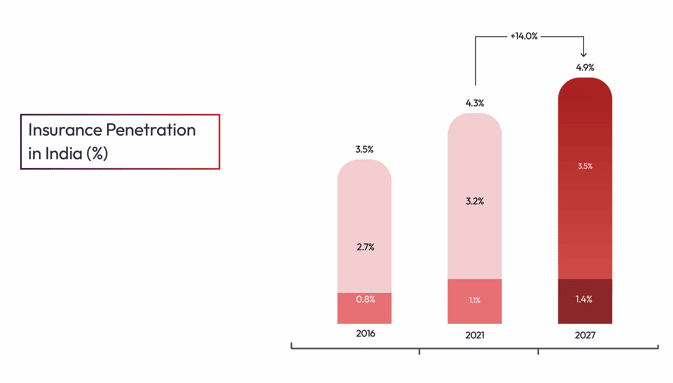

1. Digital insurance in India is a story that is just getting started. Currently, India’s insurance penetration stands at 4.3% – leaving significant headroom for growth compared to global standards

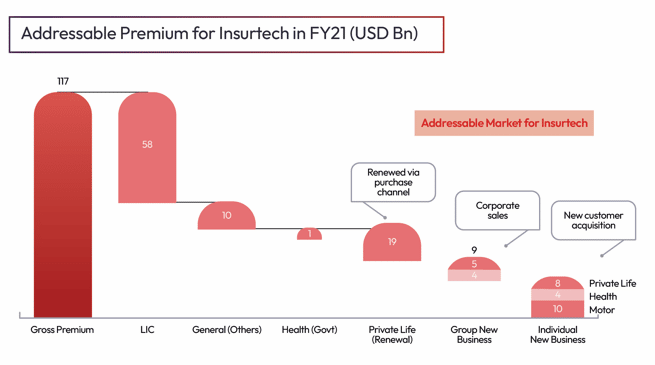

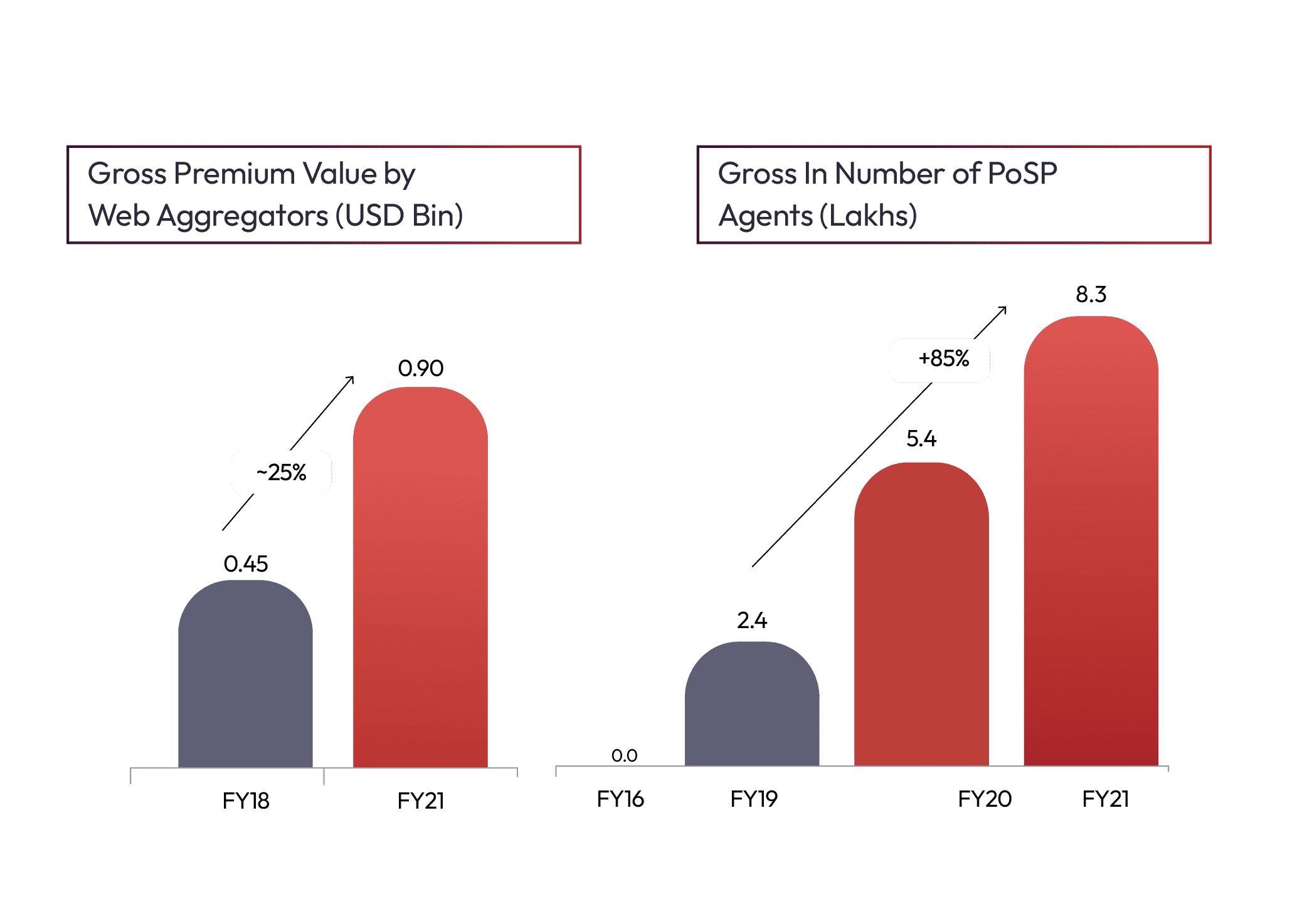

By FY27, we expect the overall insurance market to reach $250 Bn. Of the $117 billion of premium underwritten in FY21, ~$50 billion is addressable for insurtech. Technology has already transformed the way insurance is bought and sold in India.

2. Tech interventions such as artificial intelligence, machine learning, chatbots and IoT are enabling transformation

Technology innovation is transforming the experience of insurance purchase. The application of artificial intelligence and machine learning will enhance our experience of InsurTech. Soon enough, India will be looking at wearables and smartphones which can generate data about individuals: to incentivize better preventive healthcare and consequently lower claims & premiums.

3. Insurers and Insurtech have to work in tandem to drive this sector forward. One of the key changes is the PoSP agent license announced by IRDA in 2015 with more relaxed qualification criteria, increasing the accessibility of the insurance agent careers

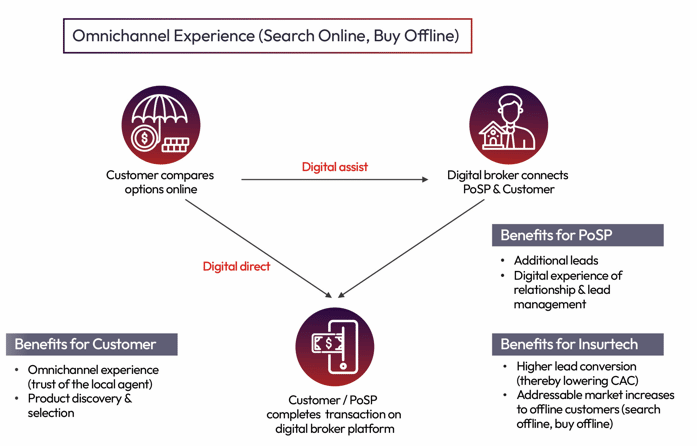

4. Omnichannel in insurance is a key innovation for future growth

Omnichannel in insurance is a key innovation that has yet to emerge in India, which will enable consumers to find insurance across all touchpoints. Digital models have the potential to evolve into an omnichannel experience for the customer, while creating a winning proposition for the agent & broker. Already, the willingness of consumers to search online and buy offline is evident.

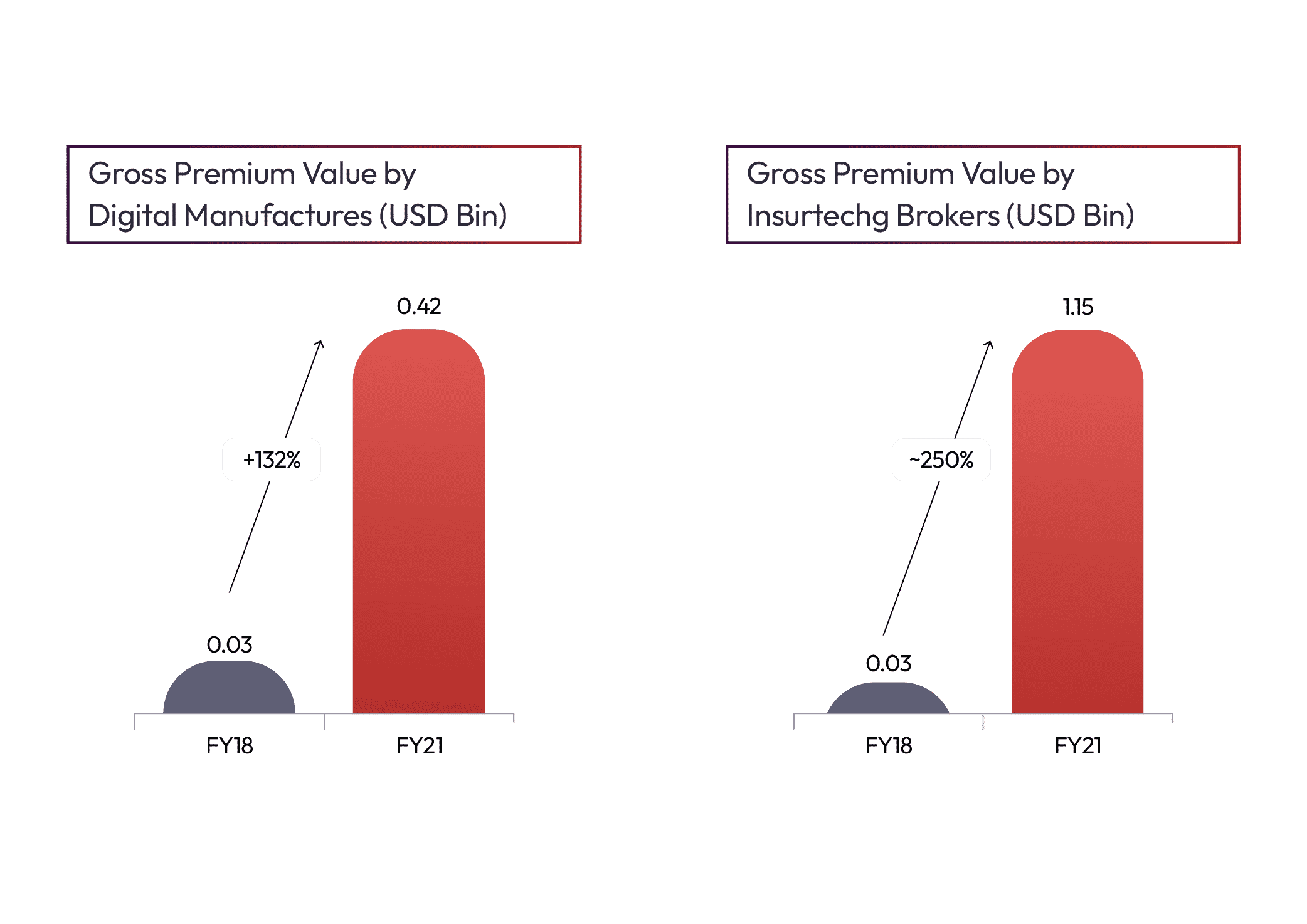

Over the last decade, there are three broad digital insurance purchase models that have emerged: Digital Manufacturers, Digital Brokers, and Web Aggregators. Through the use of these digital models, insurers can expand their reach and better serve their customers. This will create a fluid and seamless experience, which in turn will increase the likelihood that consumers will buy insurance online. Further, fueling the size of the online market and, as a result, the size of the overall insurance market.