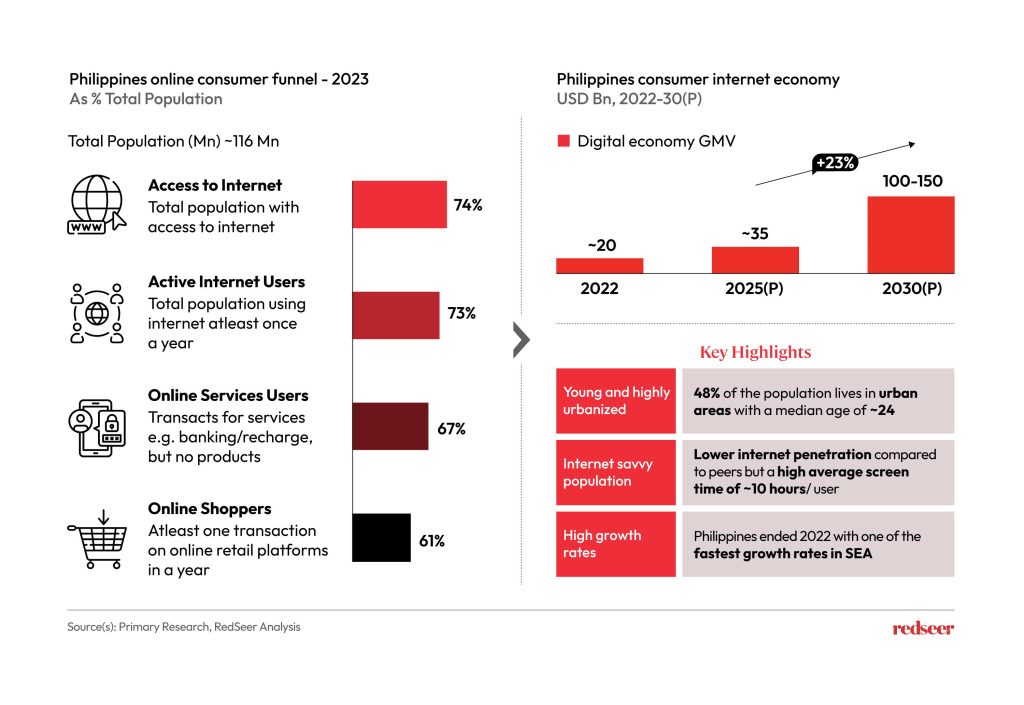

The Philippines’s has the second largest population in Southeast Asia with ~USD 400 Bn GDP that is expected to grow at high-single-digit levels in the next few years. Its digital economy is small, but is poised to grow with sustained urbanization, rising internet accessibility, widespread smartphone usage, and a largely English-speaking population. In this newsletter, we shine a spotlight on Healthcare, Digital Insurance and Direct-to-Consumer retail in the Philippines. We believe more sectors will emerge in the coming years as founders and funding grow over time.

01. Strong underlying consumer sentiments towards online shopping presents a robust opportunity for the digital ecosystem

With a population of ~116 Mn, the Philippines is the second most populous country in SEA. Highly urbanized, with ~48% of the population residing in urban areas, the country has a youthful demographic, with a median age of ~26 years, which is among the lowest in Southeast Asia. Although digital penetration is lower compared to other Southeast Asian countries, the country displays a higher online shopping usage. The Philippines boasts high internet usage, with individuals who have access spending an ~10 hours per day online. This strong digital consumption, along with a young population and projected high single-digit GDP growth, provides favourable conditions for the consumer internet sector, with a CAGR of ~23% in gross GMV from 2021 to 2025.

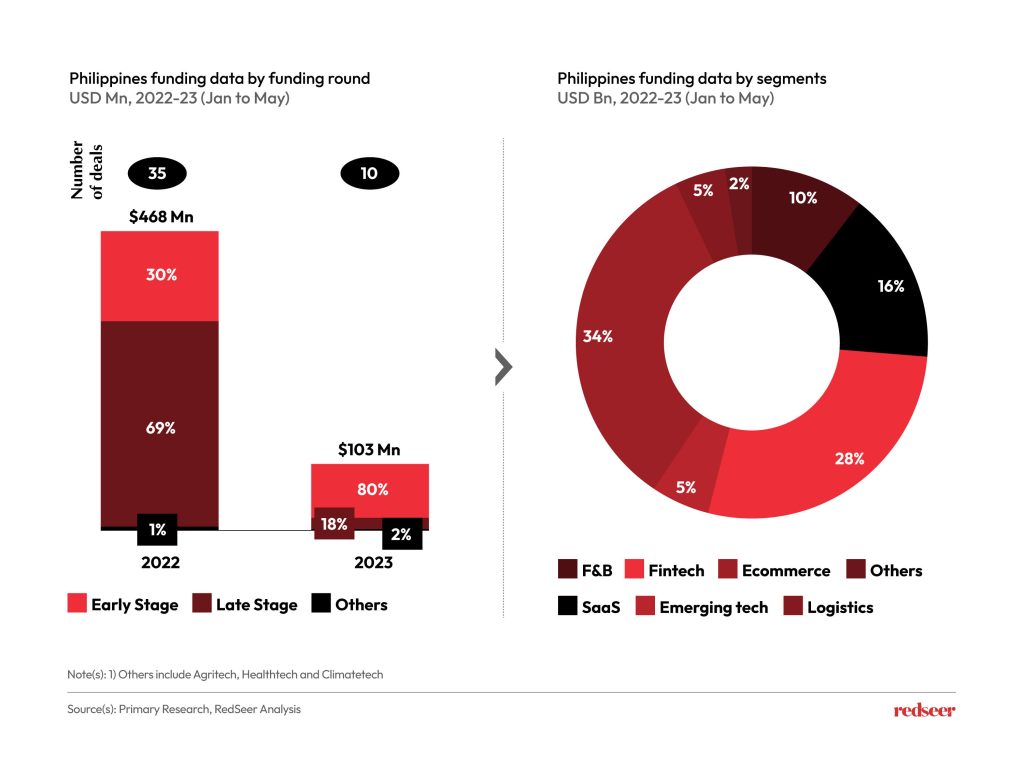

02.Ecommerce, Fintech and F&B are some of the leading sectors that have attracted maximum funding in the country

A major chunk of 2023 investments have been in the early-stage segment. This is a function of ongoing macro headwinds and selective investments in late-stage companies. The reasonable early-stage investments create pipeline for sturdier companies over the medium term. E-commerce and fintech remain the largest sectors, with emerging opportunities within healthtech, Insurtech and D2C spaces which would be covered in the newsletter.

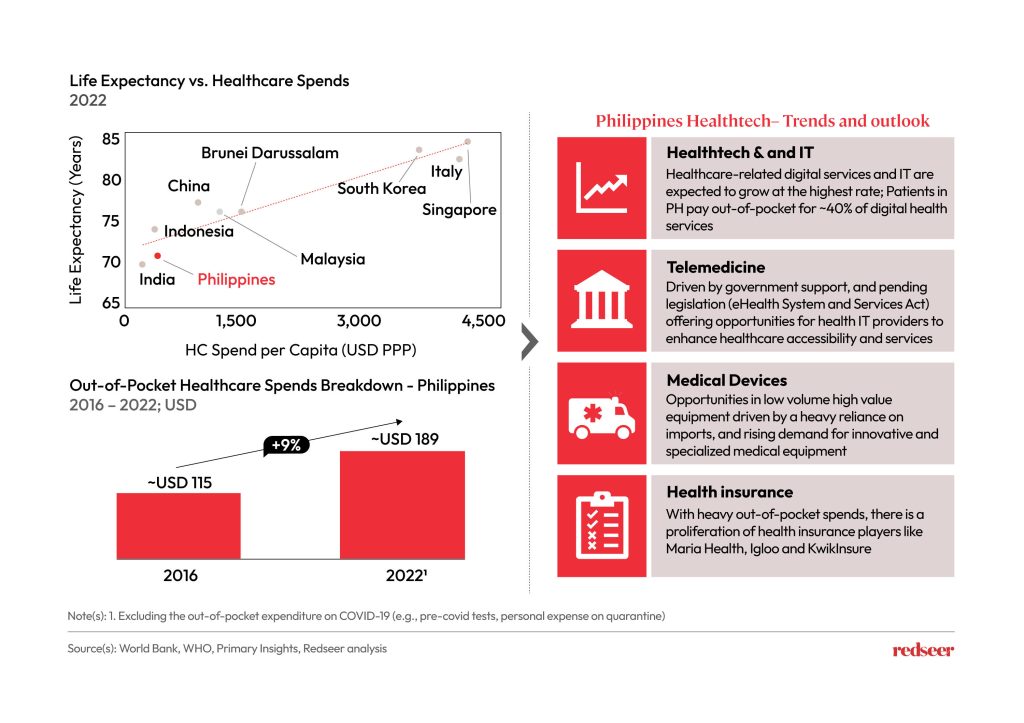

03. Rising healthcare expenditure creates room for new-age healthcare to provide affordable and accessible solutions in the country

The Philippines’ healthtech sector is rapidly advancing, driven by the growth of healthcare-related digital services and IT. Government support and impending legislation offer opportunities for improved accessibility, while the rise of health insurance players like Maria Health and Igloo addresses the heavy out-of-pocket expenses, signalling a shift towards innovative solutions and increased recognition of HealthTech’s importance.

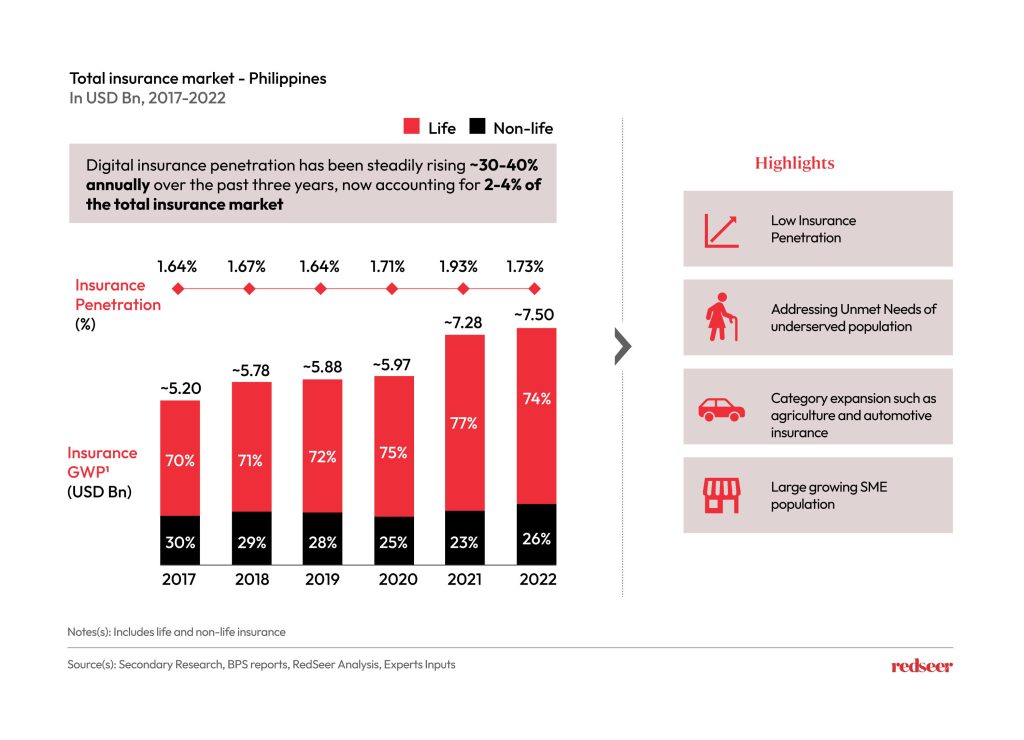

04. Digital insurance has been growing strongly at 30-40% per annum while the overall market is steadily increasing at 7% growth per annum

The Philippines’ insurance sector has significant growth potential due to its low, sub-2% penetration rate. The overall market is undergoing digital transformation, with a growing emphasis on streamlining traditionally offline processes. The market is moving towards automation and tighter integrations to enhance the customer experience and scalability.

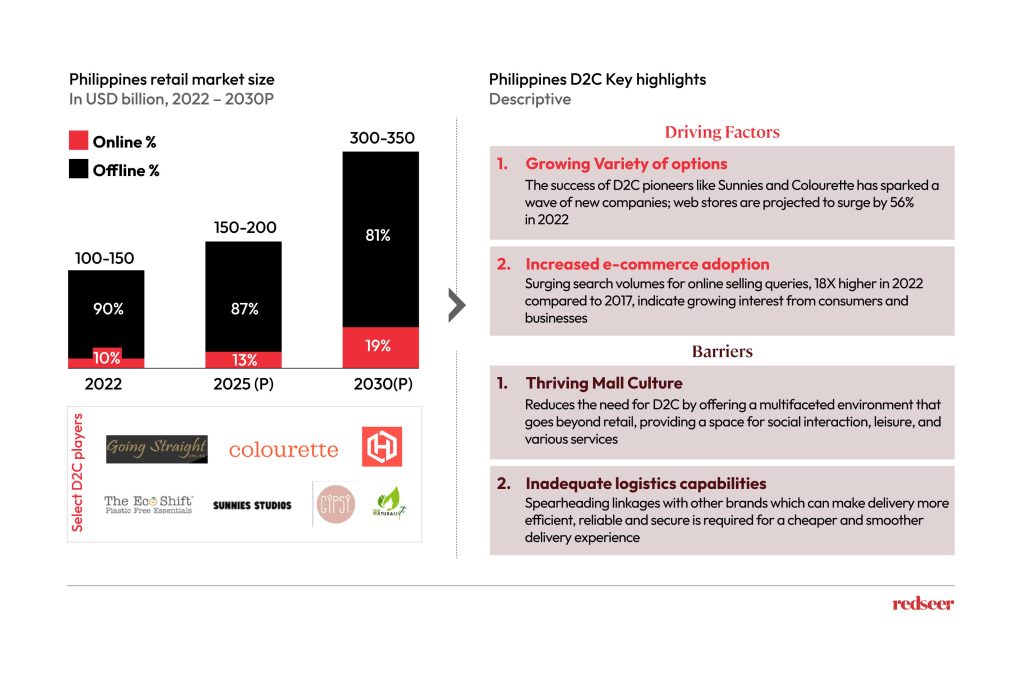

05. Direct-to-Consumer companies adopting an omnichannel approach are finding traction in Fashion, Beauty and Personal Care categories

Direct-to-consumer pioneers like Sunnies and Colourette are driving the emergence of new companies. They are adopting an omnichannel approach to reach customers across multiple channels. This approach is increasing customer trust and helping them scale up in an evolving consumer retail landscape.