Fashion’s booming! New brands are popping up everywhere – just in 2022 fashion startups had raised USD 6 billion + globally But here’s the thing: while chatting with a colleague recently, she was surprised she couldn’t find stylish modest clothes that fit her taste. We did some digging, and guess what? There just aren’t many funded modest fashion startups out there, especially in Indonesia. Seems strange, considering the demand!

So, we hit the ground and found a whole untapped market buzzing with potential. There are even some successful bootstrapped companies already doing great.

1. Modest Fashion – an overlooked opportunity?

The Gap in Modest Fashion

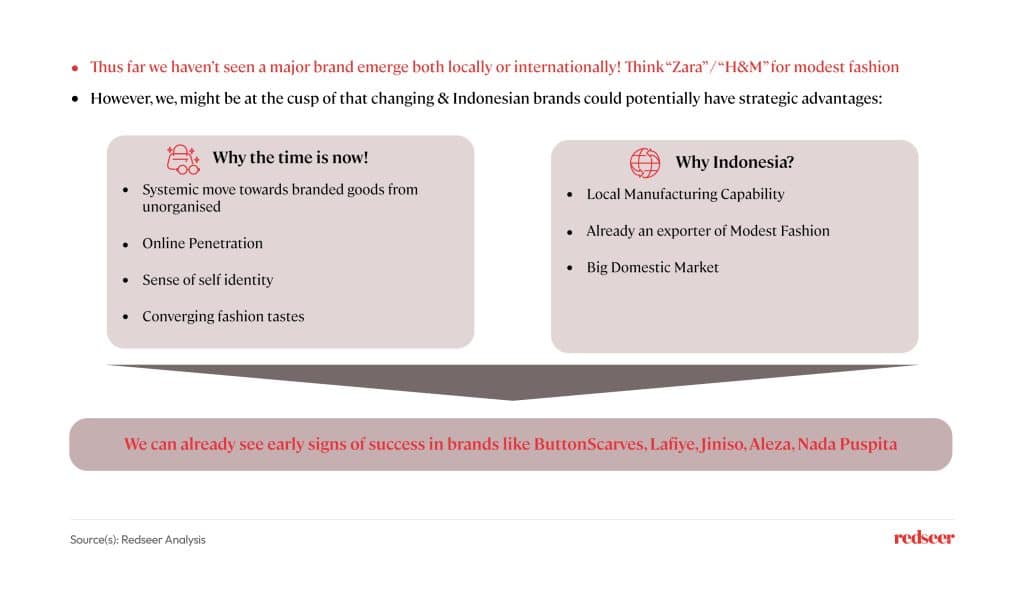

The global modest fashion market is estimated to be worth over $200 billion, yet there’s a surprising lack of established, standalone brands catering to this segment. While larger fashion houses have launched modest lines in recent years, these offerings often fall short – consumers find them either uninspired or not culturally appropriate.

A Prime Opportunity for New Brands

This presents a significant opportunity for dedicated modest fashion brands that understand the specific needs and preferences of this demographic. Here’s why now is the perfect time to enter this market:

- Shift Towards Brands: Consumers are increasingly drawn to branded goods over generic alternatives.

- E-commerce Boom: The rise of online shopping allows digital brands to effectively target niche markets like modest fashion.

- Demand for Trendier Options: Today’s consumers crave stylish and modern modest clothing that reflects their personalities, moving beyond traditional styles.

- Global Convergence: Younger demographics worldwide are embracing similar definitions of modest fashion, creating a more unified global market.

Indonesia’s Advantage

Indonesia is uniquely positioned to become a hub for modest fashion brands. With a large domestic market and strong manufacturing capabilities, the country fosters a thriving ecosystem for modest clothing. We’re already witnessing the emergence of successful Indonesian modest fashion brands.

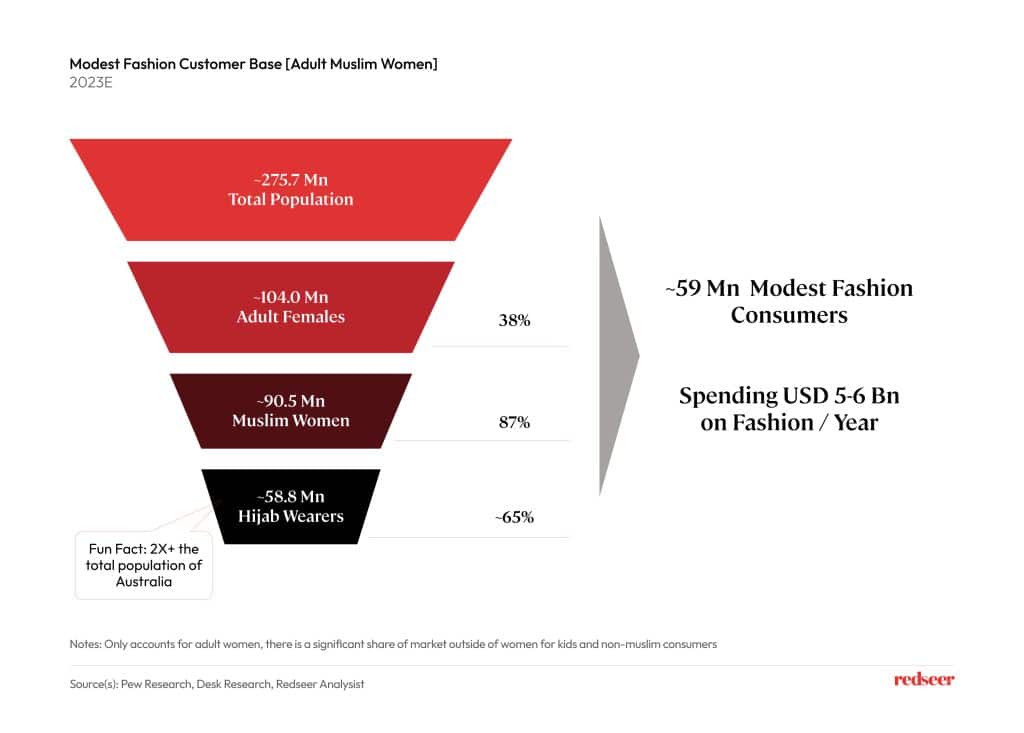

2. Modest fashion is a USD 6Bn+ opportunity in Indonesia with more than 58 Mn takers; Globally 500-800 Mn women wear Hijabs

While the market is not only limited to Muslim Women. They form one of the biggest consumer cohorts are directionally give a very good sense of how big the market is. Across the world, it’s estimated there are 500-800 Mn women that wear Hijabs. In Indonesia alone, there are ~59 Mn Adult Women. Almost double the size of the entire country of Australia! This translates to USD 5-6 Bn worth of modest fashion opportunities just for adult women while the market extends beyond this as well.

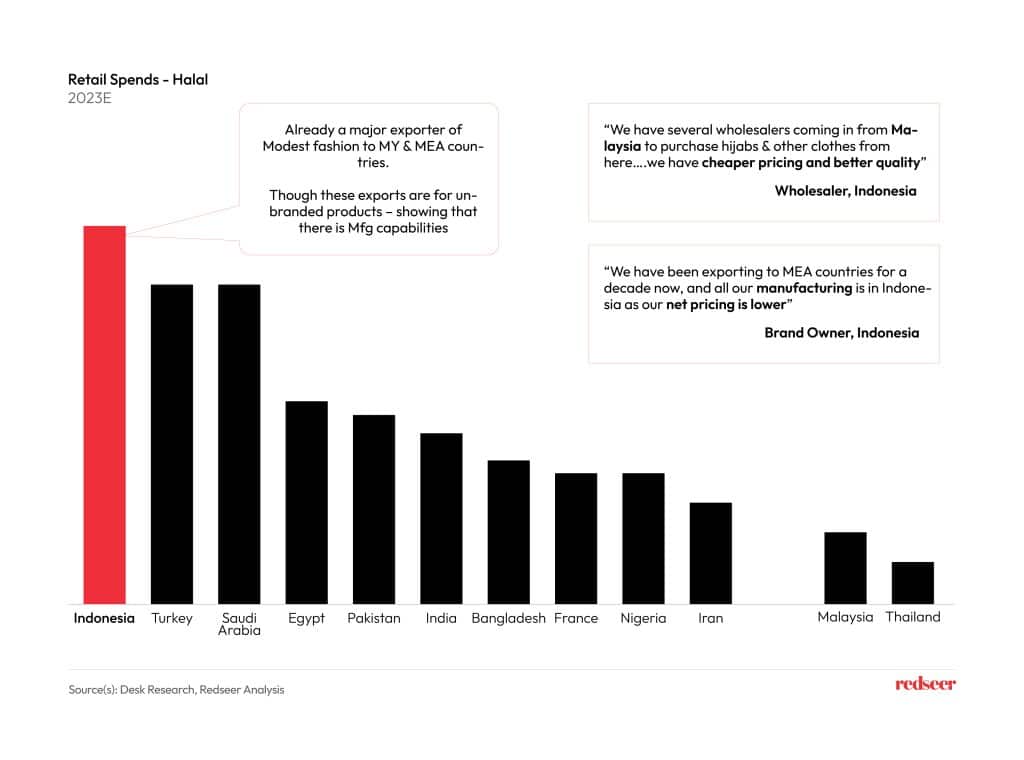

3. Indonesia is the biggest Halal retail market in the world & is already a leading exporter of Modest Fashion to KL & MEA countries

Indonesia has a unique position in the global market. It’s not only one of the biggest domestic markets for Halal products, including modest fashion, but it also boasts strong manufacturing capabilities. This combination makes Indonesia a major exporter to Malaysia and many Middle Eastern countries, offering both competitive prices and high quality. However, a large portion of these exports are currently unbranded, presenting a significant opportunity for Indonesian companies to develop their brands.

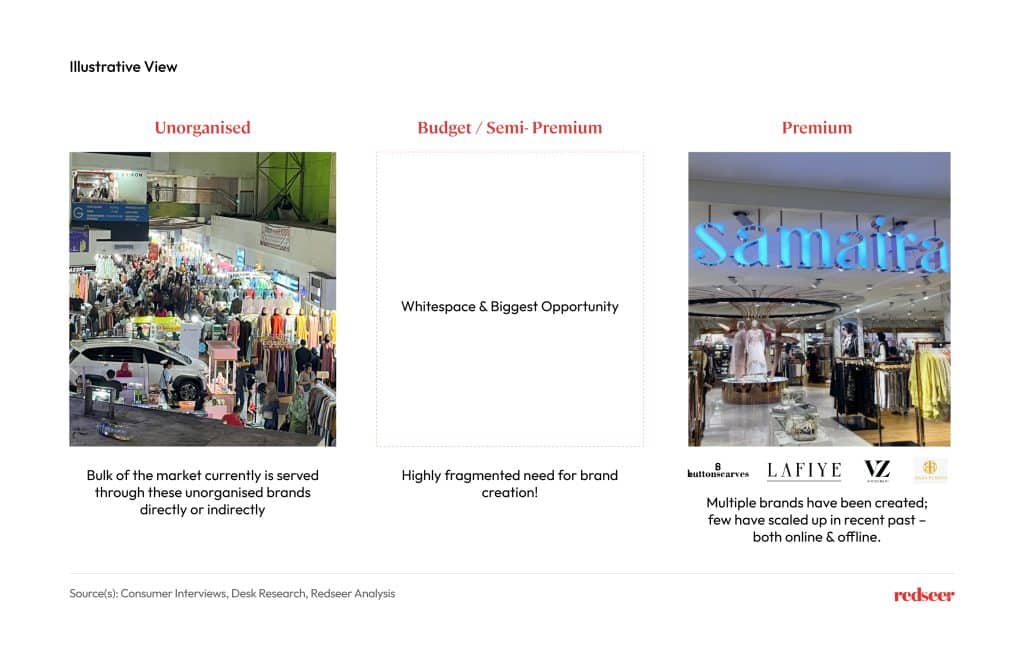

4. Lay of the land: 1. Highly fragmented, 2. Few brands have scaled recently (limited to premium); 3. The bulk of the market is budget & semi-premium – the need for brand creation

Locally, shopping habits are changing.

For a long time, Indonesians frequented unorganized markets called “Pasars.” Here, numerous unbranded products were sold directly to consumers or resellers who then distributed them locally. These markets served as hubs, particularly in major cities like Jakarta. However, consumer preferences are gradually shifting towards branded products. The new generation of shoppers is increasingly turning to online platforms. While a few local brands have emerged in recent years, most cater to the premium segment. Some have achieved rapid growth, reflecting a strong consumer desire for trendy branded products.

The gap in the market:

A significant portion of the market remains budget-conscious, seeking products at semi-premium price points. This segment currently lacks established scalable brands.

Post-pandemic opportunity:

Interestingly, the opportunity to serve this price-sensitive market has become even more lucrative in tier 2+ cities (cities outside major metropolitan areas) following the pandemic. These areas have witnessed significant consolidation among resellers. The survivors have adapted to face online competition.

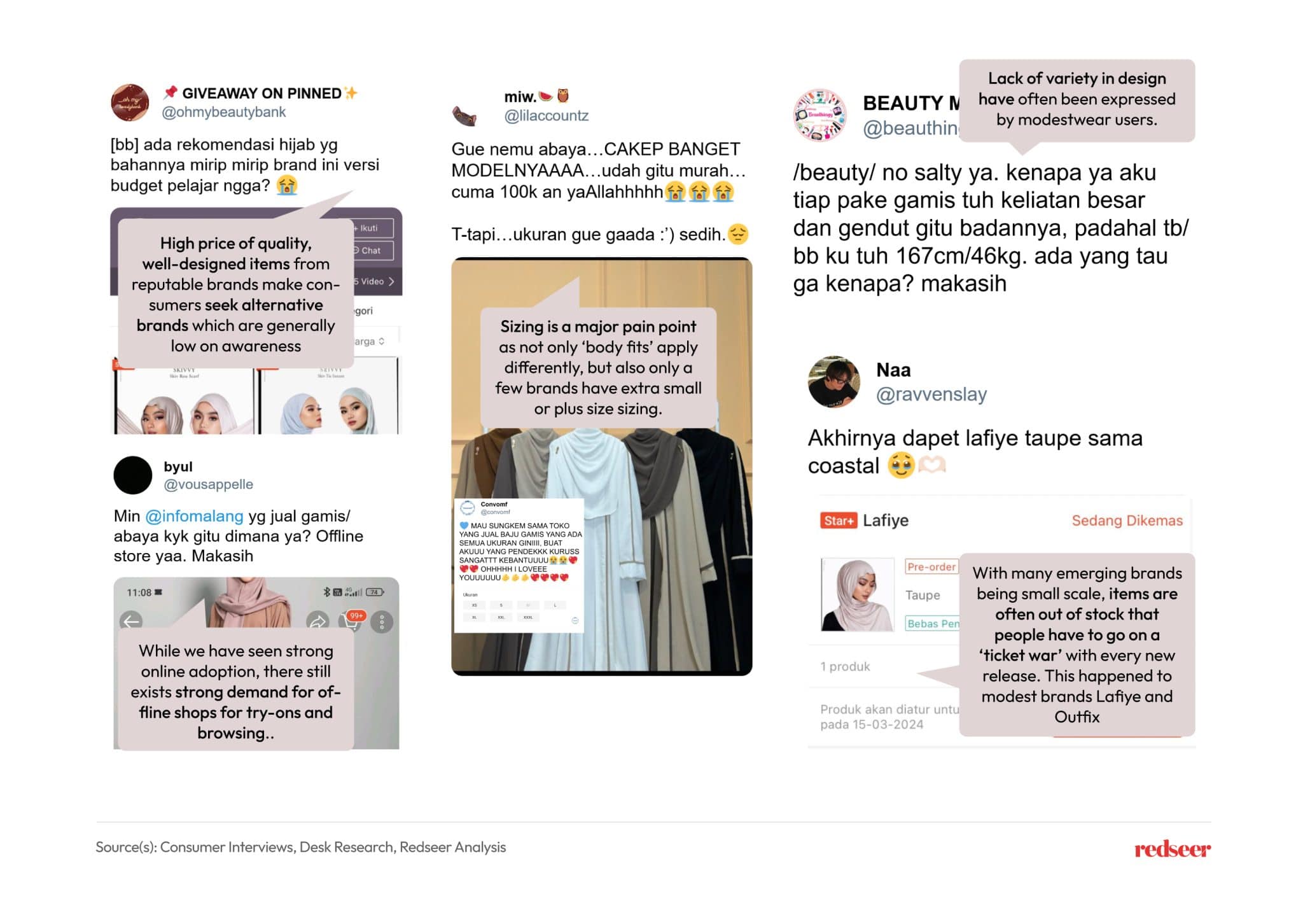

5. Younger & Budget Shoppers – unsatisfied with current market offerings; complaints around pricing, designs & lack of offline options

Understanding Customer Needs:

- Budget Conscious: Consumers prioritize affordability across online and offline channels.

- Personalized Style: Customers seek clothes that reflect their individuality. Explore options like customizable pieces, curated collections based on style preferences, global design trends, and pop culture.

- Offline Presence: There’s a desire for more physical stores or brands. Consumers want to elevate their shopping experience from “Pasars” and want a more mall-like convenience. Offline trials is key for brands as consumers want trials.

Fun fact: “Let’s go shopping” is a common pastime in Indonesia. And having an offline footprint in the mall can be helpful for brand visibility.

Potential Opportunities:

- Budget Fast Fashion: Identify a gap in tier 1+ cities for trendy styles at accessible prices. Develop a brand or retail format that fills this void, focusing on high-quality materials and ethical production within a budget.

- Curated Online Marketplaces: Address online shopping challenges by creating a platform that aggregates reputable budget-friendly brands. Implement robust quality control measures and clear sizing guides to build trust with consumers.

- Niche Markets: Capitalize on specific consumer segments like athleisure, kids’ clothing, or accessories. Develop targeted brands or product lines to cater to these growing markets.

6. Showcasing the top 10 brands in the Indonesian modest fashion space online

We looked at the landscape and highlighted the top 10 brands that stand out