Southeast Asia’s pet care market is barking up the right tree, with its value already hovering around USD 9 billion. As pet ownership transforms into pet parenting to pawrents, the region is witnessing a surge in premium products, health-focused services, and tech-driven solutions tailored for furry companions. In this edition, we explore the exciting trends, untapped opportunities, and the movers and shakers shaping a sector that’s proving to be a pet lover’s paradise. We also throw a spotlight on some global giants that can be seen as an inspiration by our own local startups on how to scale up and go beyond.

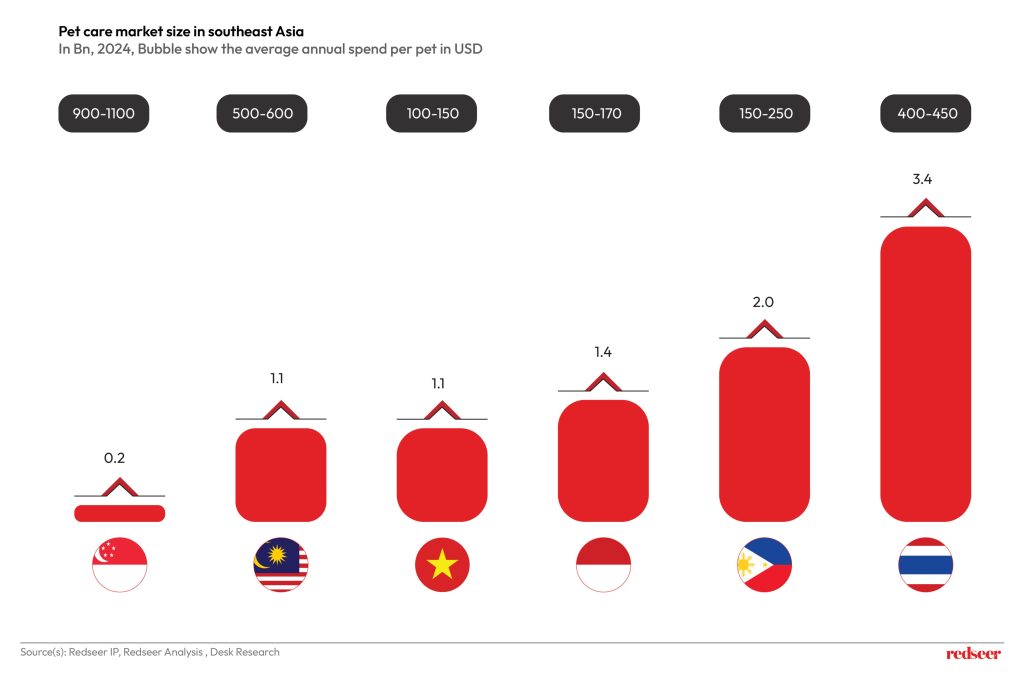

Pet care market size in Southeast Asia stands upwards of 9 Bn and is expected to grow at a CAGR of ~12%

The total opportunity in the pet care market that is up for grabs in southeast Asia is upwards of USD 9 Bn. Within the region, Singapore is the highest paying market with people spending ~900-1100 dollars per year on their pets (equivalent to spending levels seen in the US) however in terms of the overall size of the opportunity in terms of dollar value, Thailand has the largest potential.

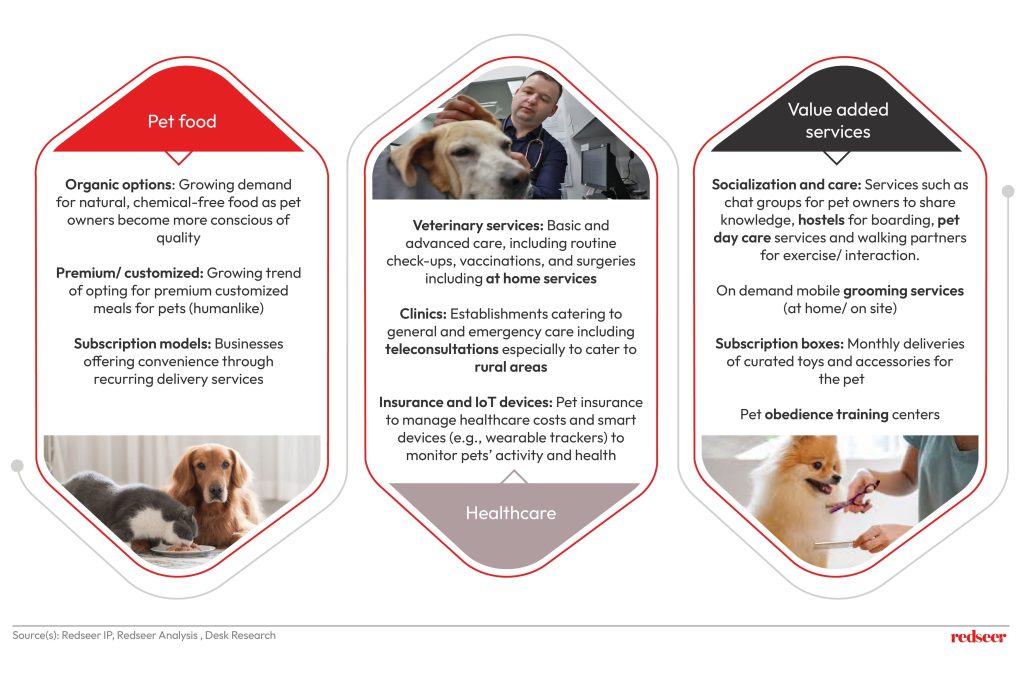

So, what are the areas of opportunities for pet care players in the region?

We spoke to pet care players in the region, and they remarked that SEA pet care landscape opportunities need to be looked at from a geographical and demographic lens as well: Within the urban middle- and high-income cohorts – organic food, premium toys, pet insurance, and grooming services are popular. For the urban lower-income cohorts, cost-effective healthcare is the priority. Meanwhile for senior citizens, and rural folks it is tele consultations, at-home visits for vaccination,s and health checkups that are popular.

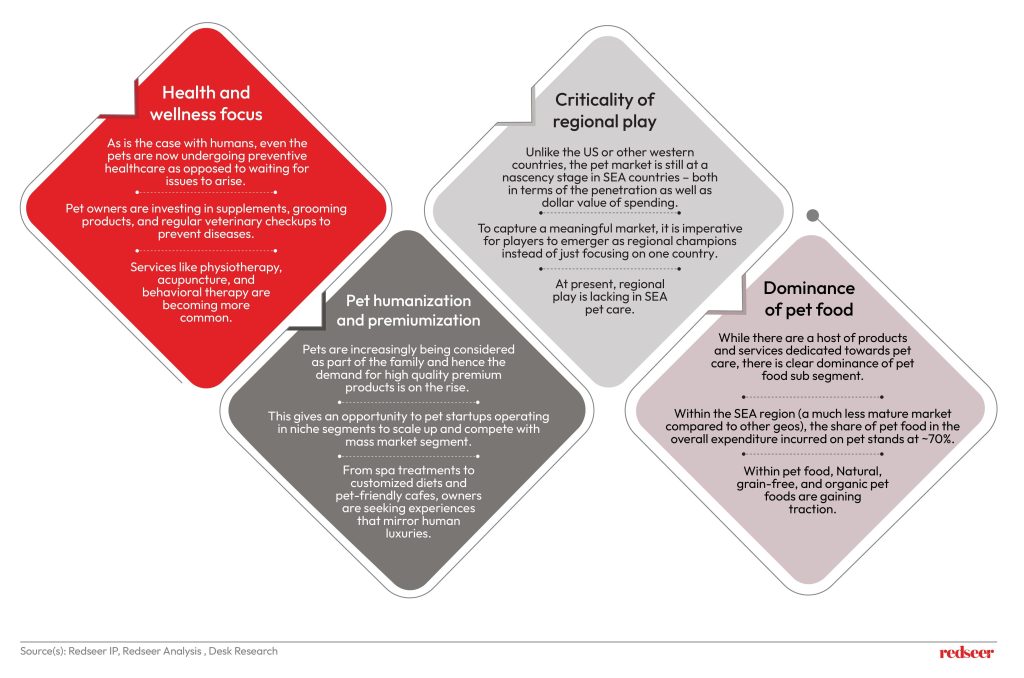

Further building upon the basics, there is a clear trend of pet humanization leading to growing demand for human-grade products and services for pets

The habits within the pet care segment are evolving just as pet owners transform into pawrents.

Old practices

- Feeding pets home food.

- Taking care of pet’s health based on word of mouth or neighbors/ friends’ guidance

Evolving practices

- Customized/ healthy/ organic pet food

- Routine immunization and checkups for pets And this leads to plenty of opportunities for the pet care players in the region

This leads to plenty of opportunities for the pet care players in the region.

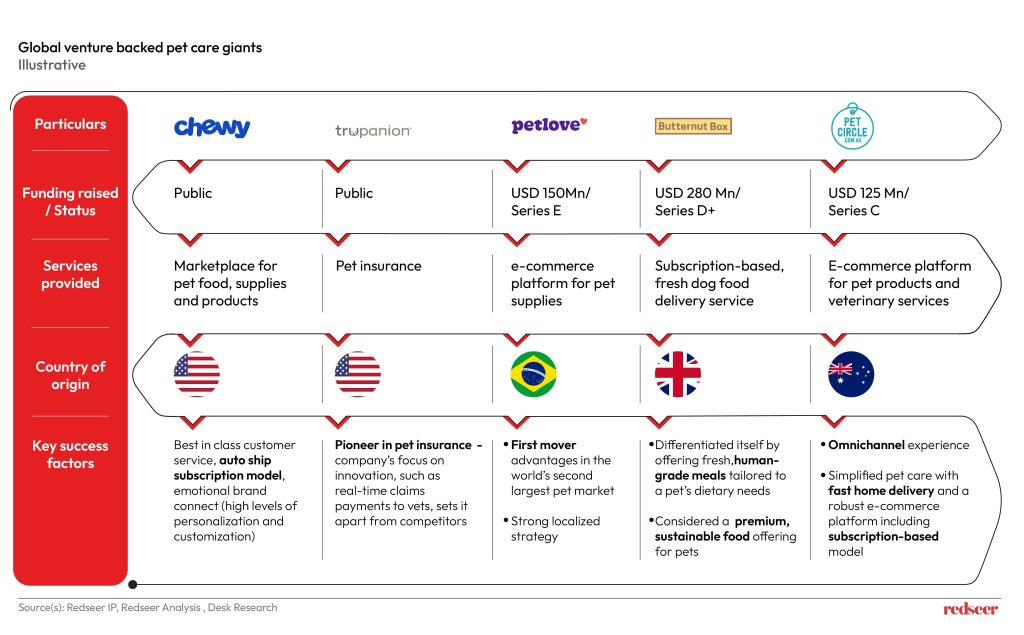

Globally we have many prominent examples of VC-backed pet care startups that have scaled enormously

From the above chart, we can draw the following commonalities that have enabled success for these global giants:

Customer Convenience: Subscription models, auto-ship services, and fast deliveries reduced friction for pet owners.

Personalization: Tailored nutrition and product recommendations built strong customer loyalty.

Premiumization: Offering premium, health-focused products allowed these startups to cater to higher-spending, quality-conscious consumers.

Tech and Data Integration

Investor Backing: Support from major VCs like SoftBank, General Atlantic, and L Catterton provided capital for scaling and expansion.

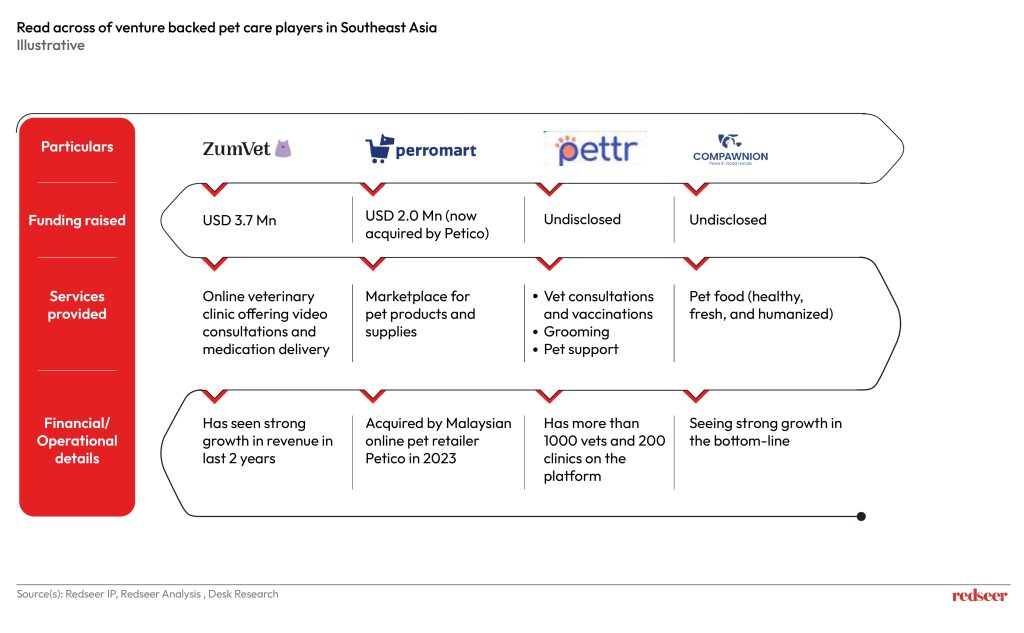

But the SEA landscape is still in nascency. While the pet care players in the region are showing promise, they need to cover considerable ground to achieve scale

The players in SEA are not regional and at present confined to respective home countries only – this limits the TAM. Further, across geos, the requirements are more aligned basis urban vs rural, high income vs low income as compared to individual country characteristics.