Retail’s next alpha may not lie in what’s new but in what’s been around for centuries. India’s $12 billion saree market is a vibrant, culturally rooted category that remains vastly fragmented and underserved, despite its high purchase frequency and deep emotional relevance. With 100+ million SKUs spanning fabrics, motifs, and regional identities, sarees represent a uniquely Indian opportunity, one that the modern retail ecosystem has yet to fully unlock. With the right strategy, this heritage segment can evolve into a scalable, tech-powered retail success. Redseer’s latest deep dive unpacks why the saree market deserves a playbook of its own, and how brands and investors can tap into its full potential.

The estimated US $1.2 trillion opportunity in the retail sector speaks a lot about opportunities available in India. However, whenever we say retail, high-growth categories such as fashion, electronics, or grocery come to our minds. Smaller categories like sarees, spices, toys, or even home decor, which have good potential to outgrow the former, remain overlooked.

In our last article, we went deep into the potential of the toys market from our report, India’s Got Retail Report, a US$ 2-3 billion opportunity today. In this article, we will explore the saree market in India to understand how we can leverage the country’s rich cultural heritage into commerce.

These smaller segments have huge demand in our daily life but are often very fragmented, with the distribution process being manual, lacking consistency in merchandising and unoptimised logistics.

Owing to these, retailers face high wastage, stockouts and SKU duplication, leading to a dissatisfied consumer experience and falling short of the rising expectations on a global scale. Inconsistent quality, limited availability and lack of product trust make them lose interest. And, that’s exactly where you can bet.

While larger organisations have often attempted to address these challenges, however, their reach has been very limited. It’s in this value gap that organised retail players are trying to carve out a competitive advantage.

Sarees: India’s $12B Fashion Giant

Sarees are deeply woven into India’s culturally rich heritage. It is one of India’s most regionally rooted yet commercially underestimated categories. But why do we want to double click on this market and why does the saree market look intriguing now?

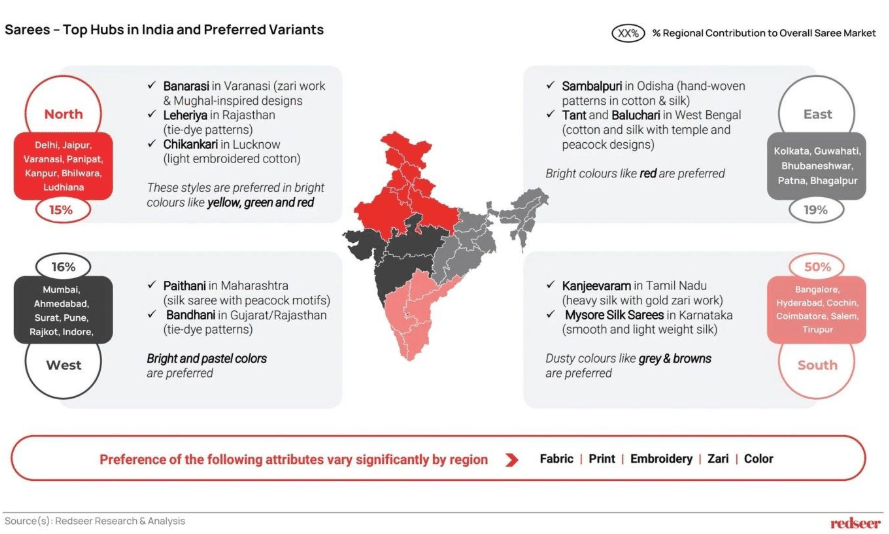

First of all, the Indian saree market is diverse. It had an estimated value of US $12 billion in CY24, and it boasts over 100 million SKUs, and this involves more than 75 fabrics, 70 different print types and myriad of regional variations in colours, embroidery, patterns, materials or even the zari work. This complexity of so many variables at a time has kept national players at bay, with 60-65% of the market remaining unbranded and another 25-30% dominated by regional saree brands.

Can we consider this category as retail’s ‘alpha edge’?

- Deep Cultural Roots: Sarees are a heritage! They cannot be considered as mere clothing. They represent special occasions, cherished heirlooms, regional pride and also everyday wear. There is a sense of emotion that acts behind this category whether we wear it occasionally or daily.

- Fragmented, Underserved, Untapped: Since the market is mostly unbranded, there are opportunities to digitise, organise and improve discovery.

- High Purchase Frequency + Low Brand Loyalty: This combination makes it a perfect landscape for D2C brands that are ready with innovative ideas to launch their product in the market and can disrupt the normal and bring innovation.

The regional complexity or the variations that once was treated as a challenge to growth and scale can now be seen as competitive moat. From Banarasi silks in Varanasi, Paithanis in Maharashtra, Kanjeevarams in Tamil Nadu to Bandhanis in Gujarat, every geographical location has distinct preferences across fabric, print, colour, and price points. For example:

- North India prefers bright shades (yellow, red, green) for their festivals.

- South India loves dusty browns, heavy zari and ofcourse silk for weddings or occasions.

- East India sees strong demand for bright red colours during Durga Puja, especially in Bengal and Odisha.

- West of India values lightweight pastel fabrics like Kota and Bagru because of their warm climates.

While sarees are sold online also, the experience is not the same. Poor categorization, lack of regional filters, inconsistent quality and minimal trust make the discovery a frustrating process. Availability of a particular piece is also very challenging. The saree market needs online saree shopping platform that understands our rich regional culture throughout all the region and state and then embed commerce with it.

It also needs to focus on localised catalogues, regional curation, vernacular content, influencer-led storytelling and quality assurance. The saree market would not fit into the conventional retail playbook. It deserves a model that celebrates the regional tapestry of India. With a well-researched strategy on a large scale, there is good potential to take this category global, positioning India as the “Saree Capital of the World”.

And, this is where you need us. At Redseer, we Solve for New and What’s Next. Once the strategy driven by data is in the right place, this market has the power to celebrate India’s artisans, along with regional pride and timeless beauties or heirlooms. Nowhere do we see such sheer diversity of history and stories embedded together behind each type-be it the pattern or fabrics or even celebrating the craftsmanship shaped by regions carried on for centuries.

Dive deep into our Retail expert, Kushal Bhatnagar’s, insights and perspective in India’s Got Retail Report.