Are you longing to buy your favourite phone or laptop? Well, today, a number of lending options are available which allow you to make an instant purchase of your desired product, and you can repay the amount within a stipulated period. This type of short-term financing has grown increasingly popular in recent years. As the Indian consumer increasingly adopts these credit-driven options, saving-based purchase options are also starting to emerge.

Here’s my colleague Kanishka Mohan decoding the new trend of shopping behaviour in India.

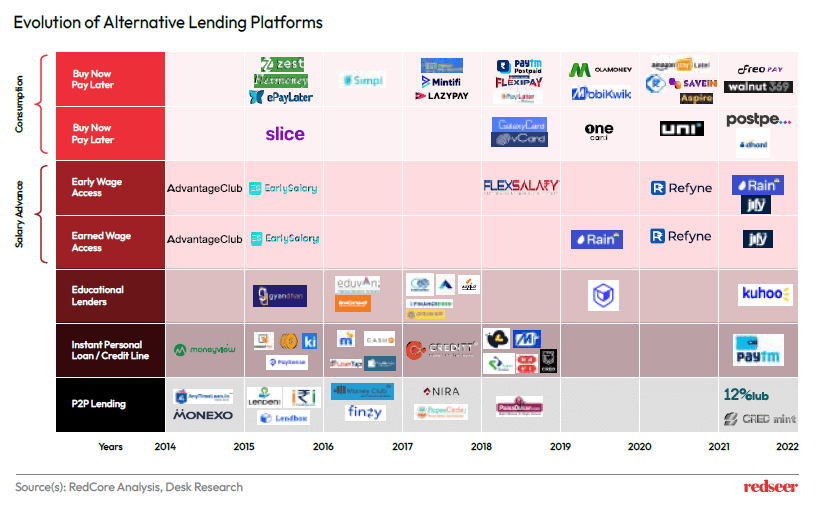

1. The last decade has seen the emergence of multiple alternative lending options that have brought customers closer to their dream purchase

When you shop online for gadgets, appliances, clothes or fashion products, you’ve seen the option at checkout to break the cost into smaller instalments over time.

A BNPL (Buy Now Pay Later) plan gives credit for instant purchase of your favourite products. It is offered even for those without good credit scores or credit card eligibility. Couple of clicks on the phone is all that it takes to get credit under BNPL.

In the past decade, this option for instant gratification has gained popularity, especially among young and low-income consumers.

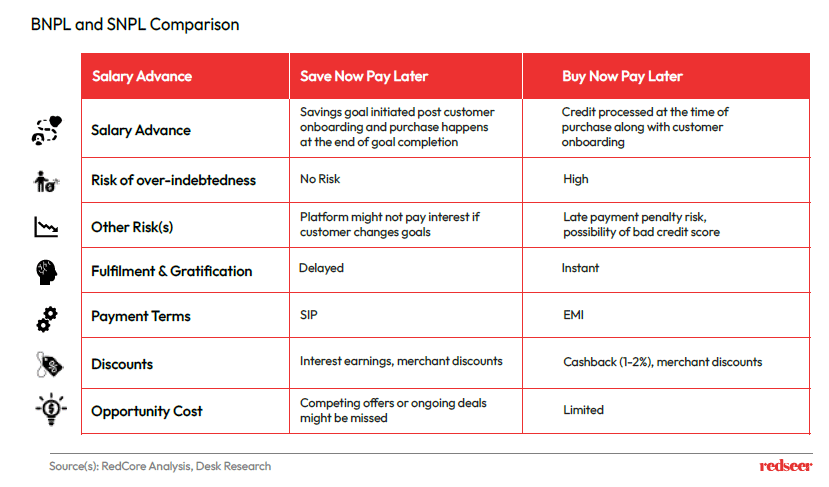

2. Startup with a new proposition – Save Now Pay Later (SNPL), are now taking Indians back to their savings DNA.

The market has recently been flooded with lending options, and customers have become accustomed to the buy now and pay later concept. However, India has always been a savings-first country and hesitant to take credit. The new concept of Save Now and Pay Later looks to leverage India’s traditional, financially conservative DNA. SNPL platforms enable customers to make planned, goal-based savings over time. Once the target amount is reached, they can get the desired product. This is part of the trend of returning to sustainable and mindful spending.

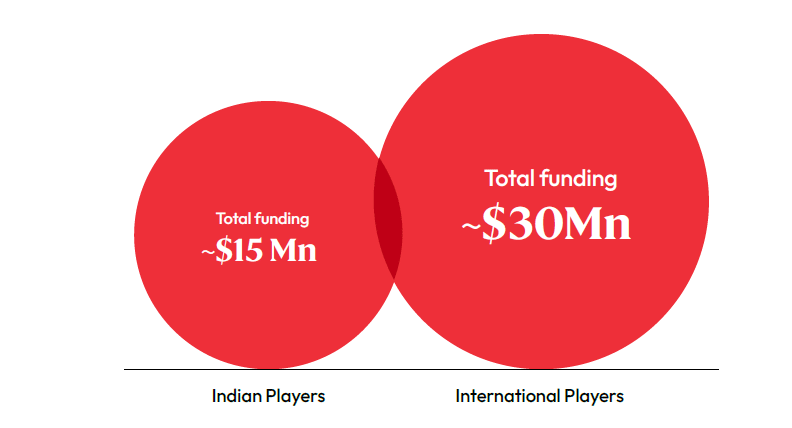

3. Though at a nascent stage, SNPL has captured the attention of investors both in India and globally

Save Now, Pay Later, or SNPL model, which has brought saving and spending on the same platform, is still a nascent theme globally. Since there has been little innovation in savings accounts as a financial product in decades, start-ups are now using the power of the India stack to give customers a more rewarding savings experience. To date, Indian firms have raised <$15M collectively.

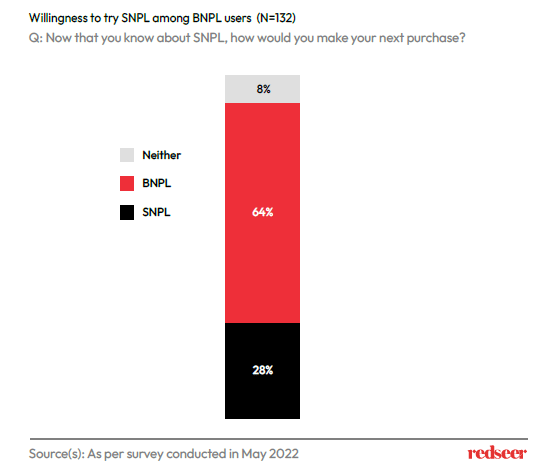

4. Moreover, ~30% of customers who have used lending options before, are open to SNPL as a conscious behavioural response, validating the use case that SNPL promises

Our data suggest that ~30% of customers are willing to try SNPL. Despite the BNPL wave, with proper awareness of SNPL, customers are looking forward to opting for a strategy to invest their savings for planned expenses. This scheme, combined with the discounts offered by the brands, ensures that users are not caught in a debt cycle and can spend on things they require rather than impulse buys that could result in buyer’s remorse.

So, there are a number of reasons to why consumers would choose saving scheme. To start with, simplicity, flexibility and, above all, living within one’s means, not on borrowed funds. The savings scheme itself is simple. All you must do is deposit a fixed amount for a few months. Once the duration is over, the accumulated money can be used to purchase the desired purchase. This offers a more convenient and debt-free shopping experience.

The emphasis on obtaining credit and receiving satisfaction is no longer the go-to option. Without a savings plan, people fall into a debt trap, hurt credit scores and lower savings, which does not leave much for emergencies. In comparison, SNPL offers a debt-free alternative to making high-value purchases. It does not require or impact the customer’s credit score and liabilities. Moreover, with the right awareness about the concept and resolving app issues related to login, account creation, KYC, and app interface, SNPL will transform the shopping experience.