In this note, we look at Singapore’s vibrant fashion market landscape and its growth drivers. We share factors that are critical for brands to scale locally and in the broader SEA region. Brands that effectively tap into local tastes, leverage online platforms, and foster meaningful connections with the Singaporean audience are poised for triumph in this vibrant fashion ecosystem.

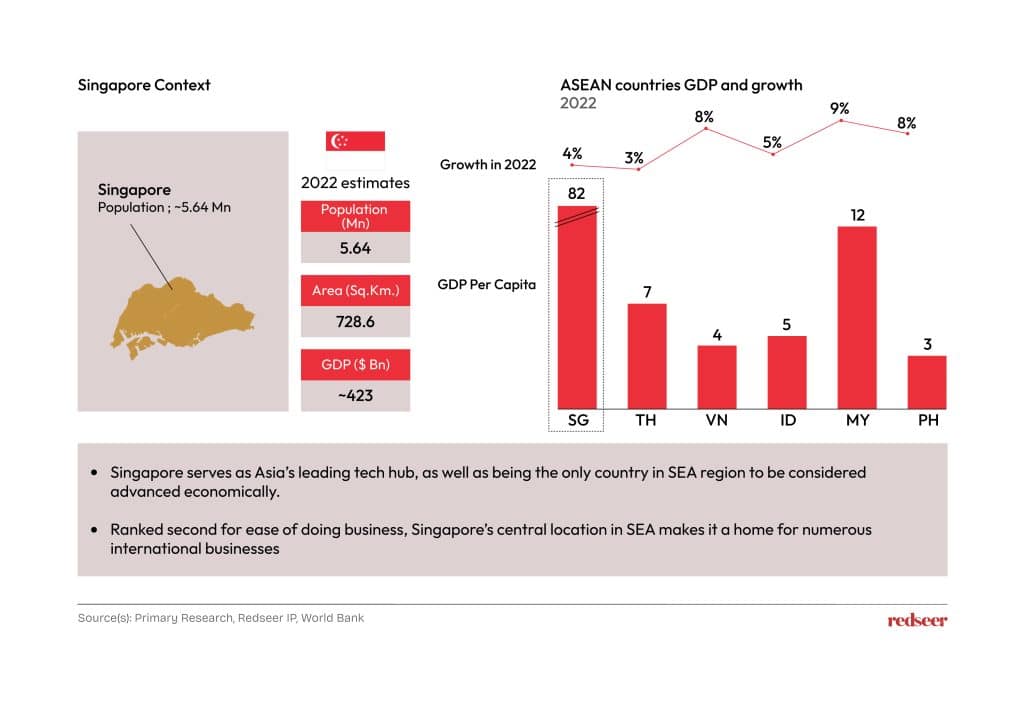

01.Singapore’s high GPD per capita and advanced infrastructure make it an ideal business hub, fostering innovation and local opportunities in its robust

Singapore’s high GDP per capita and advanced infrastructure make it an attractive hub for fashion retail in Southeast Asia. The region’s highest GDP per capita in Singapore signals a strong propensity to spend, while its status as Asia’s leading tech hub enhances the integration of innovative solutions in the fashion industry. With a second-place ranking for ease of doing business and its central location in SEA, Singapore offers an advantageous environment for international fashion businesses, fostering growth and accessibility to a diverse and affluent consumer base.

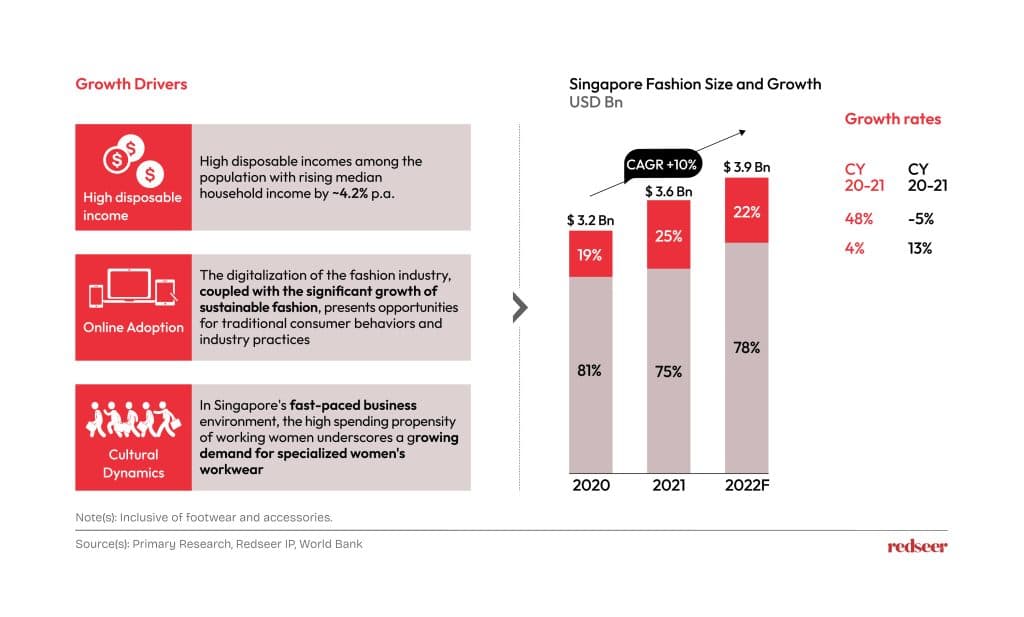

02.Singapore’s strong macro-economics– drives ~USD 4 Bn and steadily growing apparel market

The ongoing digitalization of the fashion industry, coupled with a notable surge in sustainable fashion, brings forth opportunities that challenge traditional consumer behaviors and industry practices in Singapore. The fast-paced business environment, coupled with the growing sustainability wave, create a demand for both trendy and sustainable fashion choices in the dynamic and culturally rich fashion landscape of Singapore.

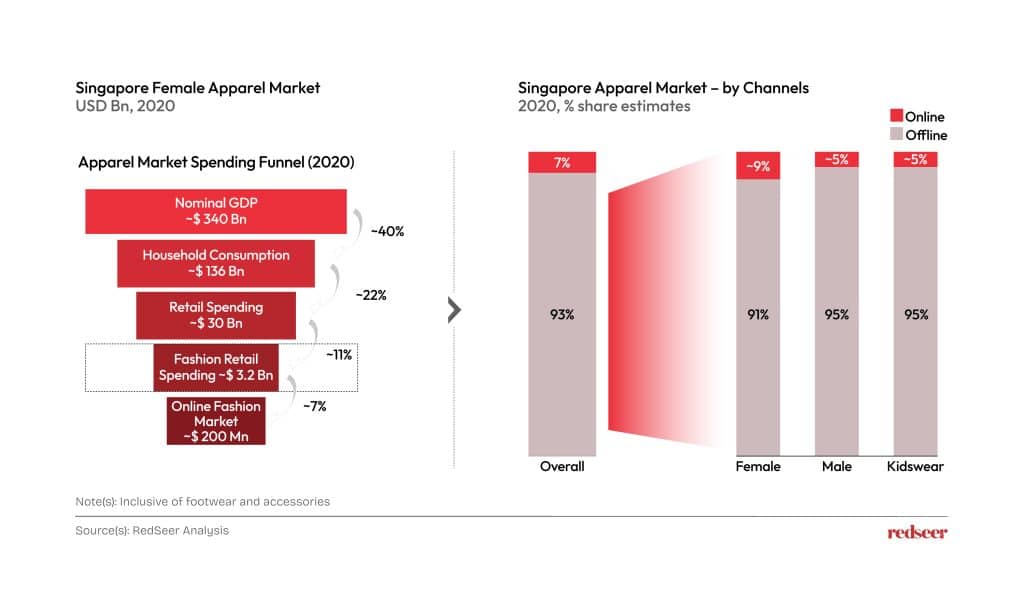

03.Female Apparels enjoy a greater online penetration compared to overall online market penetration for fashion retail in Singapore

With 10% of retail spending allocated to fashion, there’s a significant online opportunity, particularly for women’s apparel, boasting a 9% online penetration compared to the overall market’s 7%. Women’s online brands are poised for growth by enhancing e-commerce strategies, leveraging digital marketing, prioritizing customer experience, and embracing sustainability. International expansion and innovative collaborations further contribute to tapping into this thriving market.

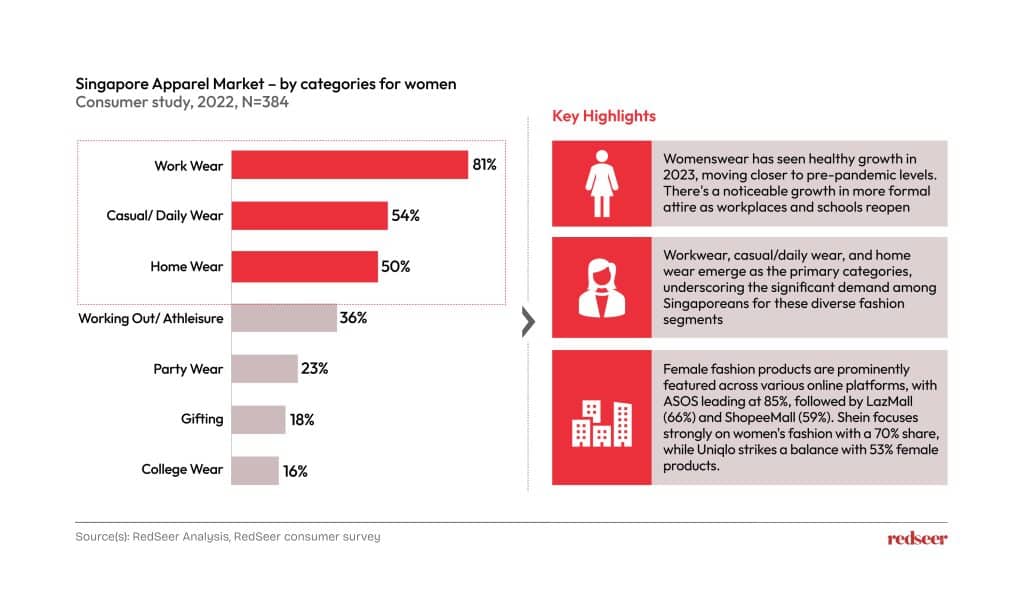

04.Workwear, casual/daily wear, and home wear emerge as the primary categories among Singaporean women

In the realm of Singaporean women’s fashion, workwear, casual/daily wear, and home wear stand out as the top categories, reflecting a robust demand in these diverse fashion segments. The women’s apparel sector has demonstrated healthy growth in 2023, approaching pre-pandemic levels, with a noticeable uptick in formal attire as workplaces and schools reopen. Across various online platforms, ASOS takes the lead with an 85% focus on female fashion, followed by LazMall at 66% and ShopeeMall at 59%. Notably, Shein places a strong emphasis on women’s fashion with a 70% share, while Uniqlo strikes a balanced approach with 53% of its products catering to female consumers.

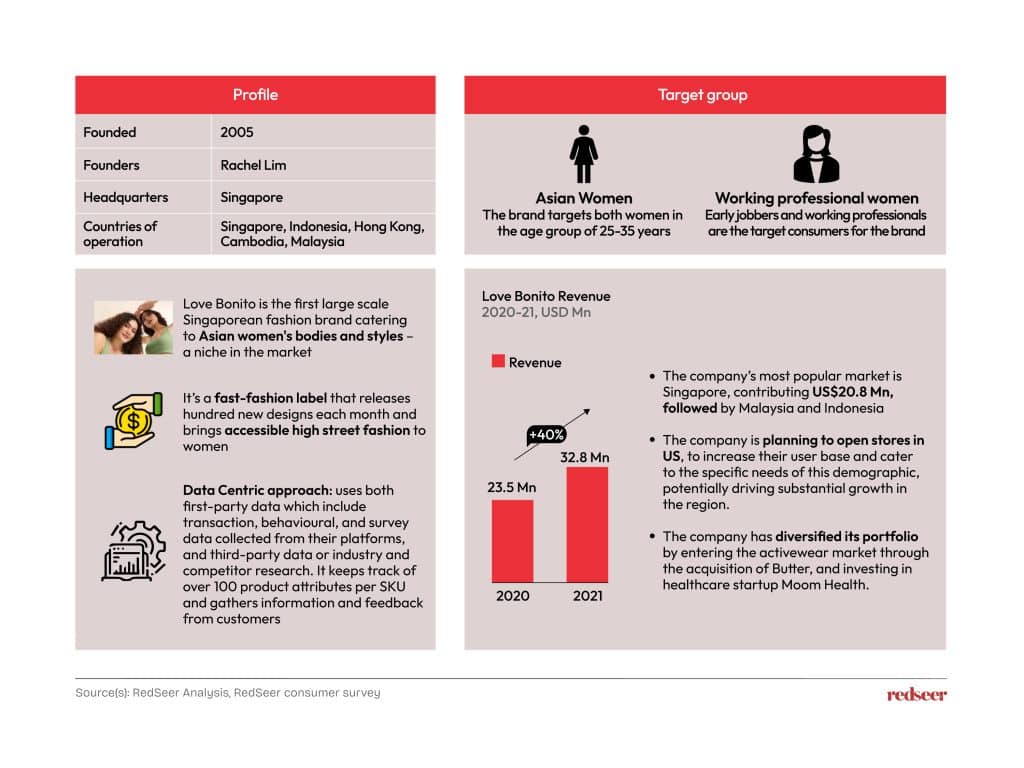

05.Love, Bonito has strategically expanded its global footprint in Southeast Asia and Hong Kong, with imminent plans for further growth in the United States and the Philippines, signalling a preparedness for scaling operations

Originating in Singapore, Love, Bonito Holdings has strategically diversified from Asian work wear to a full-scale fashion house by entering the activewear market through the acquisition of Butter (now Cheak) and investing in healthcare startup Moom Health, bolstering its portfolio for future growth in the local and regional markets. With significant funding from notable investors like Primavera Capital and Openspace Ventures, the company, led by CEO Dione Song, demonstrates investor confidence. Emphasizing the U.S. market and planning a midterm IPO, Love, Bonito focuses on sustained expansion, showcasing their success in cultivating investor trust and positioning themselves strategically for global growth within the competitive fashion industry.