The online grocery market in Saudi Arabia is on the cusp of significant expansion, with the market expected to reach SAR 10 Bn by 2028. The market already generates 100K daily touchpoints with consumers, supported by over 20K drivers.

Increased demand, developing supplier ecosystem, and government initiatives drive this growth. As consumer behavior shifts towards convenience and speed, with 80% expecting delivery within two hours, quick delivery models associated with advanced tech are set to dominate.

Read on to find out more about the specifics of the dynamic industry.

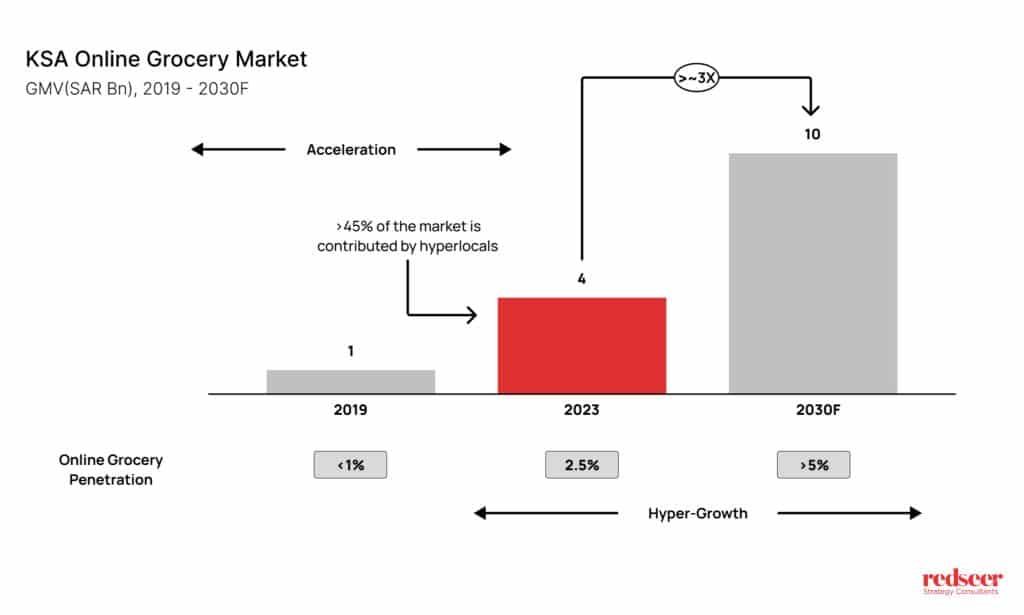

1. Online grocery sales in KSA are set to reach SAR 10 billion, marking a 3x increase

The online Grocery market currently constitutes just $1 billion of the $46 billion total grocery retail market. Factors such as low adoption in non-central regions, the elderly population, and low-income groups had previously discouraged consumers from ordering online. However, ongoing investments from the supply side and an increasing preference for convenience are expected to drive market growth. The market is expected to almost triple to reach a 5% penetration rate by 2030.

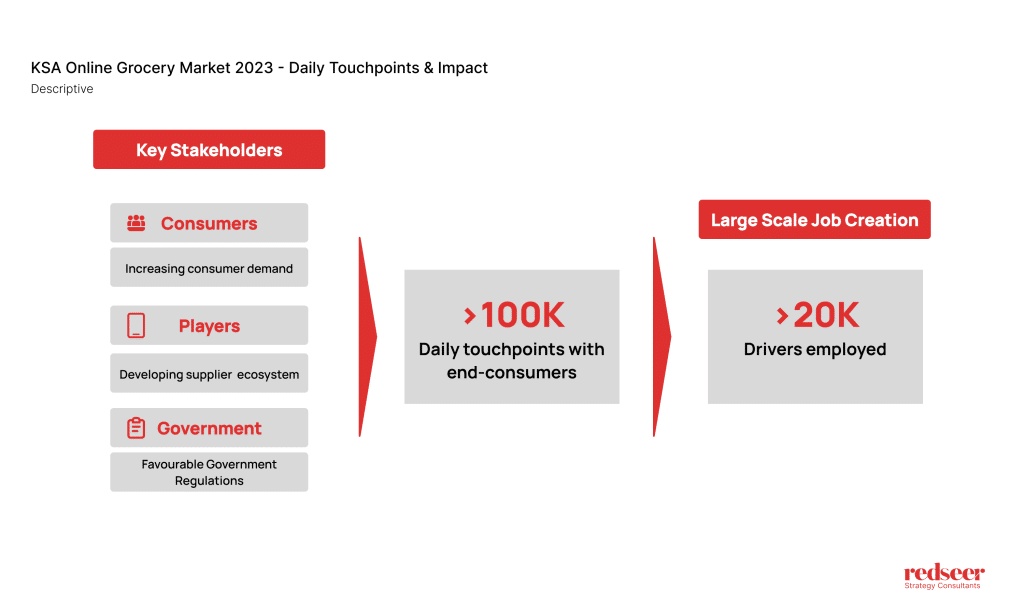

2. This market is already generating approximately 100K daily touchpoints with end consumers served by more than 20K drivers

Driven by increased demand, developing supplier & enabler ecosystems, and government initiatives to support players, the market is already generating 100k daily touchpoints with end consumers. This directly translates to large-scale job creation and supports economic growth within the region.

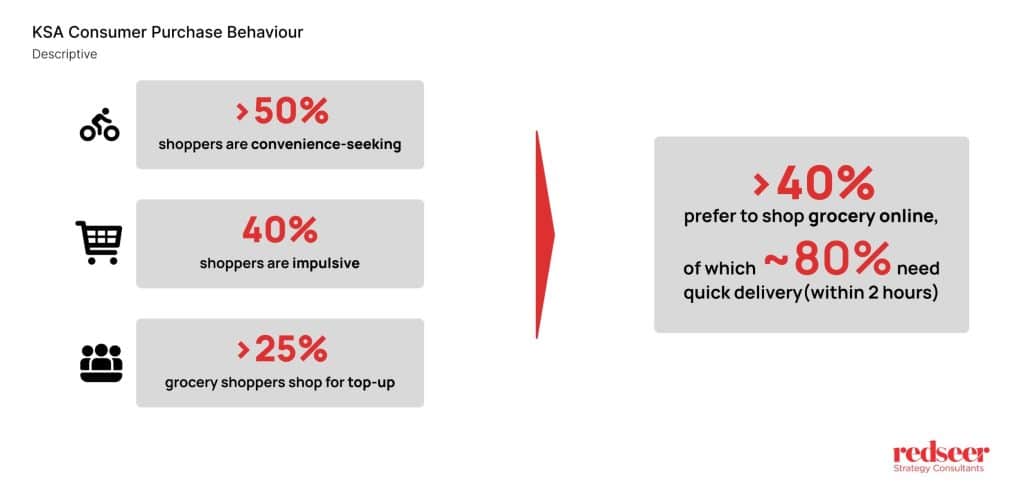

3. Quick delivery in this market is crucial for impulsive online grocery shoppers who need quick delivery for their top-up orders

Grocery shoppers in Saudi Arabia now prioritize online grocery shopping, especially express delivery options. The increasing working population, including more working women, has driven up the demand for online grocery services. Additionally, the impulsive and top-up culture is growing, with 40% of shoppers making spontaneous purchases and 25% buying items as they run out.

These shifts in consumer behavior, driven by urbanization and rising incomes, are creating significant tailwinds for the overall hyperlocal grocery market.

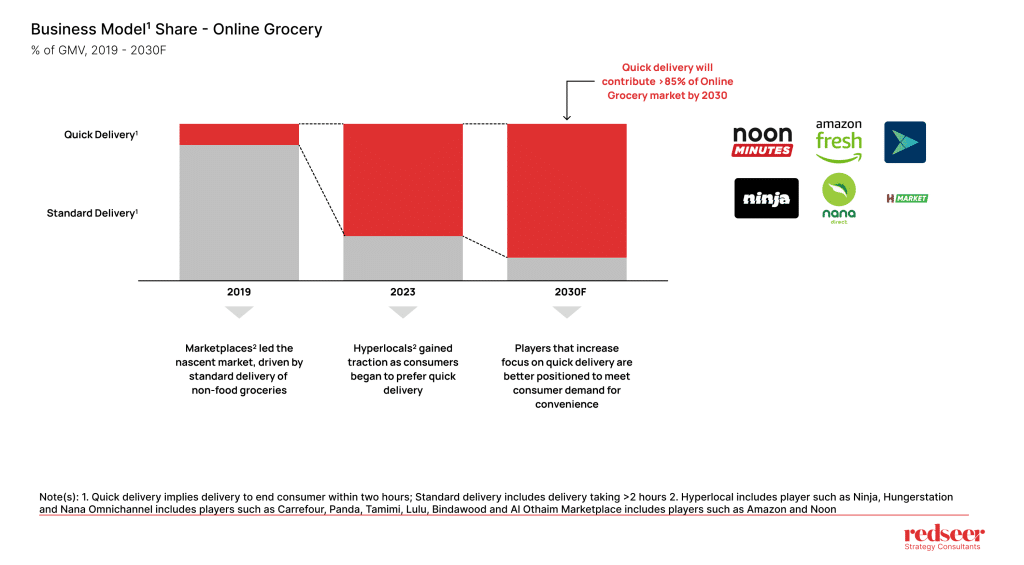

4. In terms of business models, quick delivery is likely to account for over 85% of the online grocery market by 2030

Initially driven by standard delivery models, the market saw rapid growth during the pandemic, which acted as a springboard for hyperlocal players like Ninja and Nana. Leveraging their network of dark stores for quick delivery, these players have transitioned the market from marketplace-driven to now to hyperlocal-driven.

Hyperlocals such as Ninja, Hungerstation, and Nana have captured a significant market share due to their quick delivery and superior tech infrastructure compared to other competitors.

KSA’s online grocery market is poised for exponential growth, driven by consumer demand for convenience and quick delivery. Businesses that adapt to these trends and enhance their delivery capabilities will be well-positioned to thrive in the future.