The Food Services Landscape in KSA is witnessing significant growth powered by a thriving food delivery segment. This comes at a time when the kingdom is investing significantly into leisure and entertainment infrastructure to attract tourism, both international and domestic.

The intersection of food services and L&E offers attractive opportunities for brands catering to these segments. We’ll take a look into this niche segment in our newsletter today.

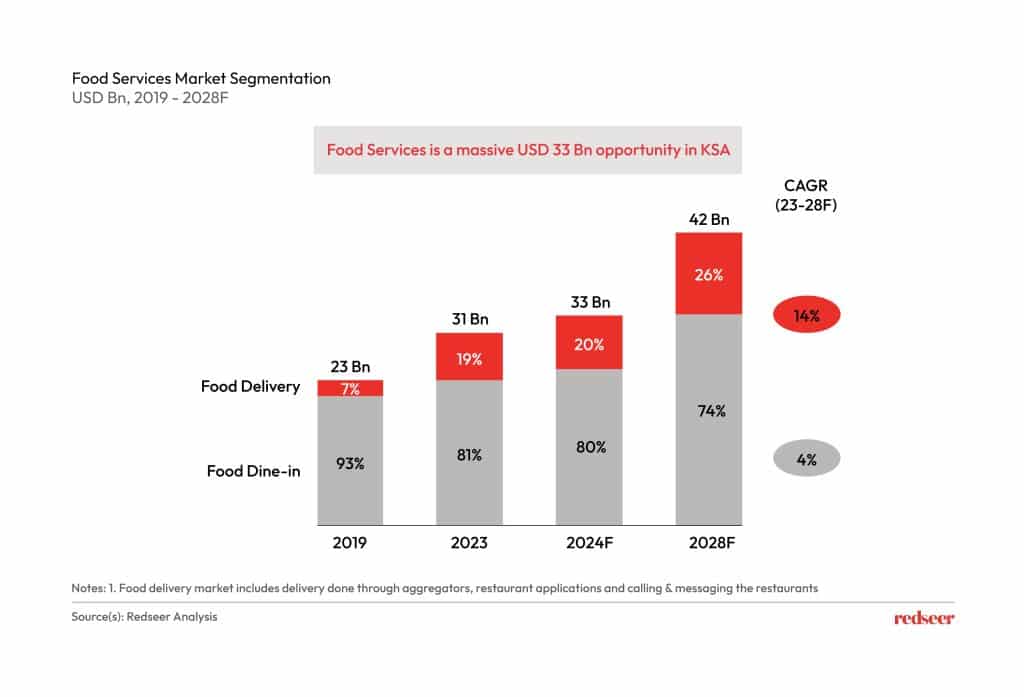

1.Food Services is a massive USD 31 Bn opportunity in KSA of which Dine-in represents >80%

KSA has a strong eating out culture which has contributed to a thriving food services market. The sector is seeing strong tailwinds driving a CAGR of 6% by 2028, reaching USD 42 Bn by 2028. The growth is driven by strong demand and robust supply in the market with the food delivery segment being a key catalyst over the last 2-3 years.

The core demand drivers include an urban population that is digitally savvy and mature. Close to 50% of the population lives in the top 10 cities.

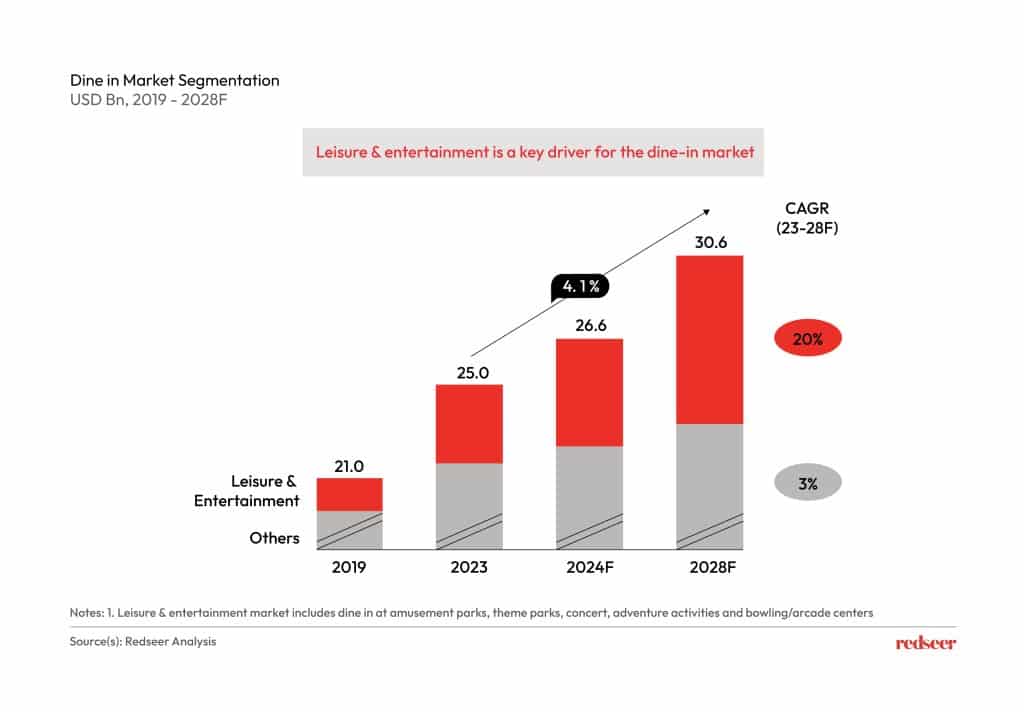

2.Within Dine-in, L&E is a niche segment that will multiply 2.5x over the next 5 years – driven by the transformational initiatives towards making KSA a top leisure destination

Leisure & entertainment is a key driver for the dine-in market. This segment is expected to see a CAGR of 21% and 2.5X growth, driven by the increasing number of tourists and the aggressive development of mega L&E projects in KSA. The kingdom today is seeing an increased cultural acceptance towards diverse entertainment formats like movies, musical shows, etc. Strong government initiatives towards developing a culture of Leisure & Entertainment in the country have greatly aided this ongoing shift.

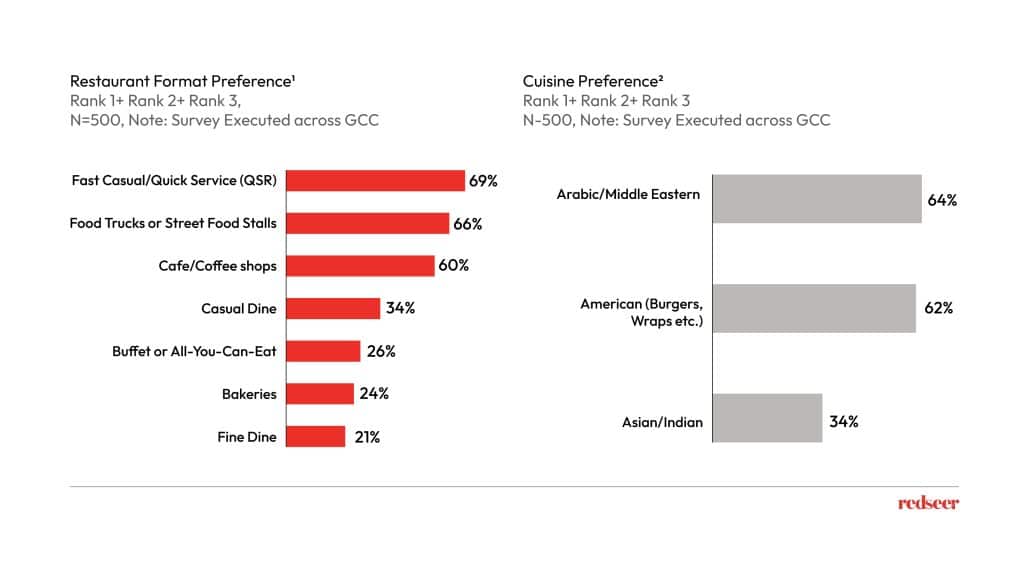

3. Consumers at L&E locations showcase a distinct preference towards QSR or casual food formats

When at key L&E destinations like amusement parks, animal and bird parks, and other landmarks, the consumers in the region showed an increased preference for QSR or casual food formats, with an inclination to choose Arabian or Middle Eastern Cuisine. This was closely followed by food trucks and street food stalls, for American cuisine.

However, for short stay locations like Landmarks, there is a higher consumer intent to eat at cafes and Bakeries.

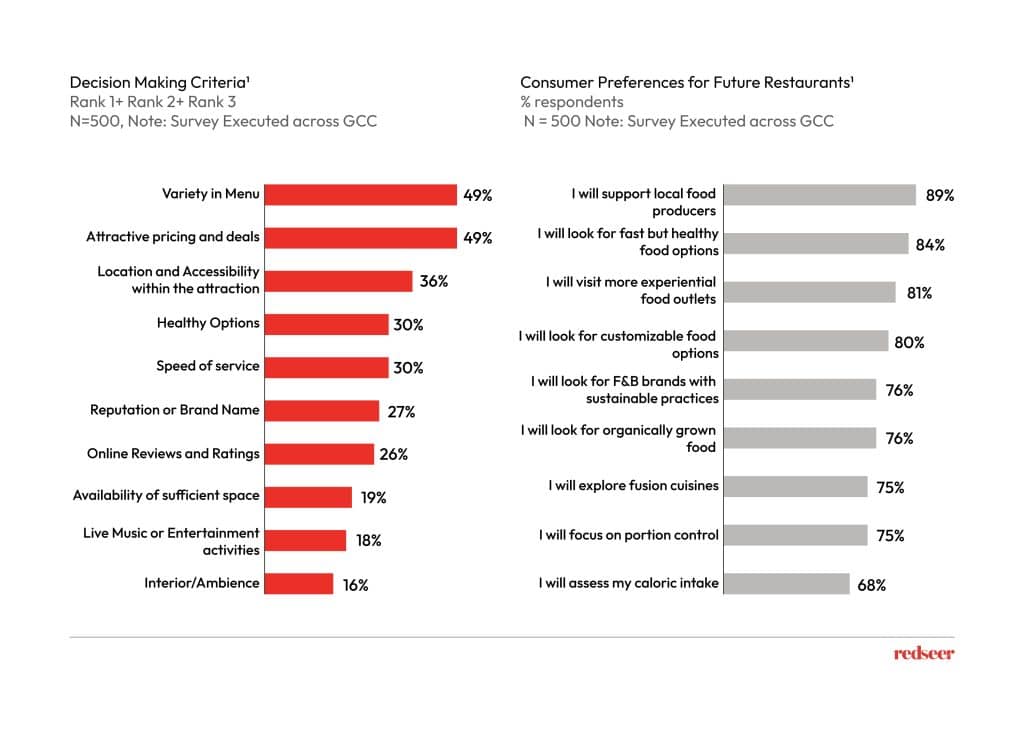

4. While variety, price remain top decision drivers, there are other intrinsic needs that brands need to build their story around

Price and variety tied are the top decision drivers for consumers while choosing an outlet at an L&E location. This was followed by location and accessibility at 36%. Other factors which contributed towards decision-making were healthy options, speed of service, reputation and brand name, and online review and ratings. On the flip side, long wait times acted as the strongest deterrent for consumers to pick a dine-in location.

However, below these peripheral needs are some more intrinsic consumer needs. Today’s consumers care about sustainability and want to support local food producers. They are looking for healthy, customizable options with portions control. Brands need to curate their messaging around such intrinsic needs to drive more resonance with the consumers.