In the dynamic landscape of retail and ecommerce, one trend has emerged as a game changer: the meteoric rise of quick commerce (q-commerce) in India. Q-commerce, with a $2.8 Bn current market size, is set to become a disruptive force, poised to reshape the retail industry as we know it.

With India’s burgeoning urban population and rising disposable incomes, the demand for convenient, on-demand shopping solutions has never been greater. Q-commerce platforms have harped on this trend and relentlessly executed instant product deliveries (8-20 minute timeframe), striking a certain chord with their target users: the GenZs and millennials residing in metros.

Q-commerce success in India has surprised many industry experts, primarily because of multiple failure stories of similar models globally. With q-commerce market leaders also reporting forward movement on the path to profitability, India is poised to emerge as the pioneer of q-commerce success around the world.

Investors and platforms keen on tapping into this lucrative market can capitalize on the convergence of technology, logistics, and consumer behavior driving the q-commerce revolution in India.

Analysing this hyper growth trend in the Q-commerce industry, Kushal Bhatnagar, Redseer’s resident industry expert, shared his insights. Helping us delve into the factors driving the explosive growth of q-commerce in India and explore the myriad opportunities it presents.

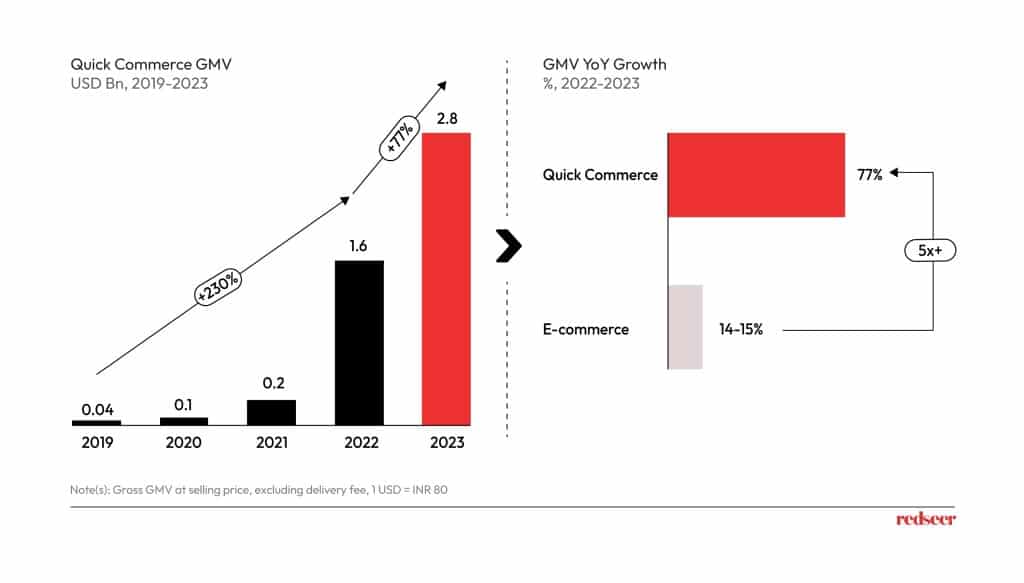

1. Q-Commerce GMV skyrockets, surging at an unprecedented 77% year-on-year growth rate

Q-commerce has been able to sustain the COVID-led momentum it received between 2019 to 2022, by registering 77% growth in its GMV last year. This is despite 2023 being a slow consumption year, which led to nominal growth of the overall e-commerce market. This further strengthens the K-shaped recovery story for 2023, wherein while India’s A-led consumption grew extremely well, India’s B/C consumption remained flattish or declined.

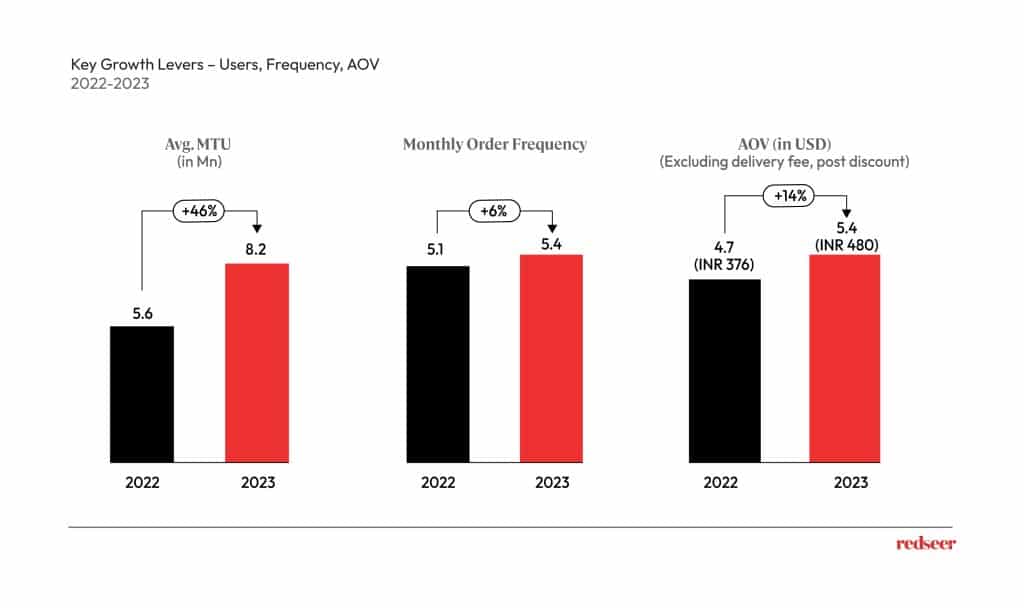

2. New user adoption drove this remarkable growth…

With q-commerce continuing to deliver on its promise with minimal lapses in the consumer experience, more consumers shifted their planned e-commerce spending to q-commerce. GenZs and millennials residing in cities like Bangalore, Delhi NCR, and Mumbai continued to be the flag bearers of this category. Further, instant purchase habits became stronger among the existing users, who further increased their spending on the platforms.

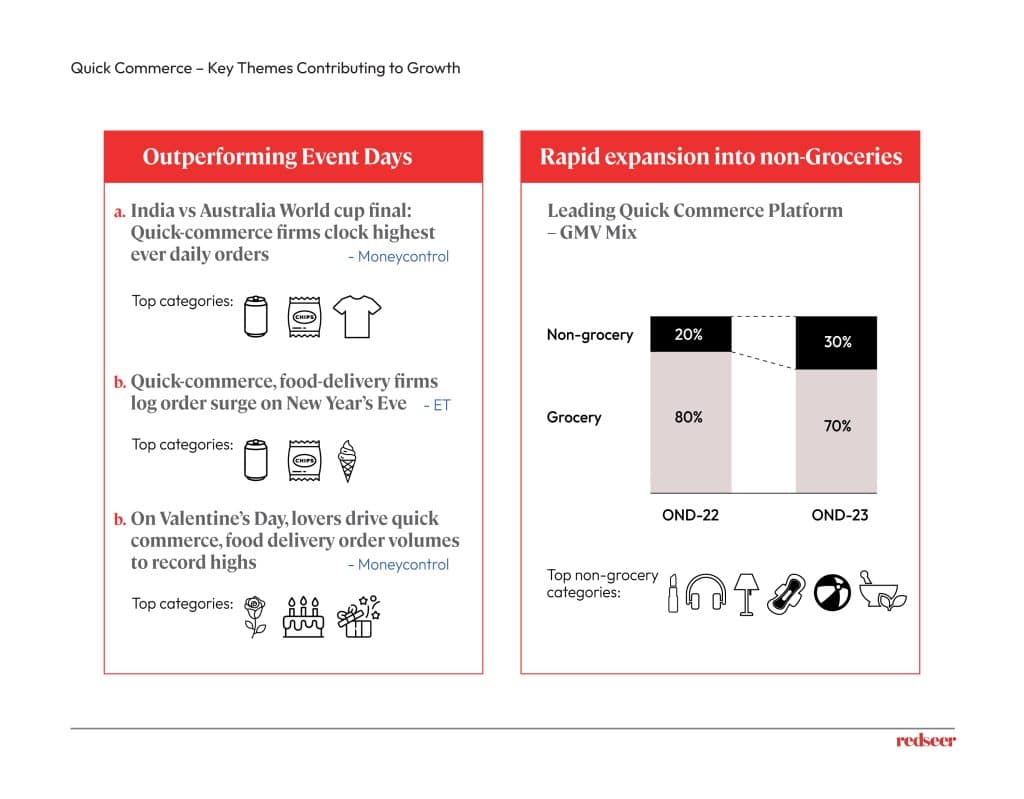

3. Winning event days and category diversification have emerged as exciting pages in the q-commerce playbook.

Q-commerce platforms have mastered understanding their target customers’ purchase patterns and accordingly customizing the selection & experience. Event Days in the last 6 months is one of the best examples of this effort. Almost all leading platforms reported record sales on days like the Cricket World Cup (CWC) Final, New Year’s Eve, and Valentine’s Day. Along with running event promotions, platforms ensured availability of the apt selection on these days (e.g. India team jerseys on CWC final, rose & bouquet on Valentine’s Day, etc.).

Further, platforms are not confined to typical grocery selections such as fruits, vegetables, meat, staples, FMCG, etc., but have already ventured into the broader retail pie of beauty, electronics, home decor, wellness, and other general merchandise. D2C brands, particularly, are harping upon this trend and starting to look at q-commerce as a lucrative channel partner.

This will put q-commerce platforms up against the legacy e-commerce giants, which would eventually lead to better convenience for customers across categories.

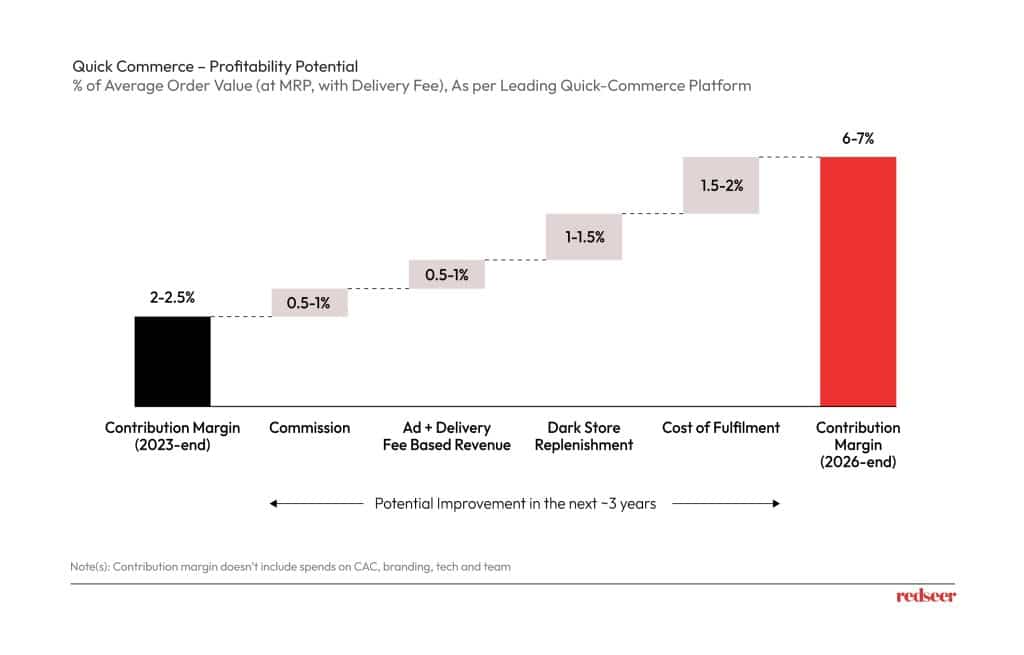

4. Q-commerce is here to stay with a realizable path to profitability.

In addition to the explosive growth, q-commerce platforms also inched closer to profitability last year and have a practical path to improve their profits further. This is constituted by multiple levers such as an increase in AOV enabled by non-grocery expansion & push towards high ASP SKUs (to bring down the relative cost of fulfillment), improvement in dark store utilization, growth in ad revenues (with q-commerce providing an effective platform to reach the highest spending consumers in the country) and rise in commissions (with scale, as a factor of platforms’ buying power). As a result, we expect q-commerce contribution margins to reach +6-7% by the end of 2026.

5. Going ahead, q-commerce is likely to sustain 40-45% growth over the next ~3 years, riding on promising user growth potential.

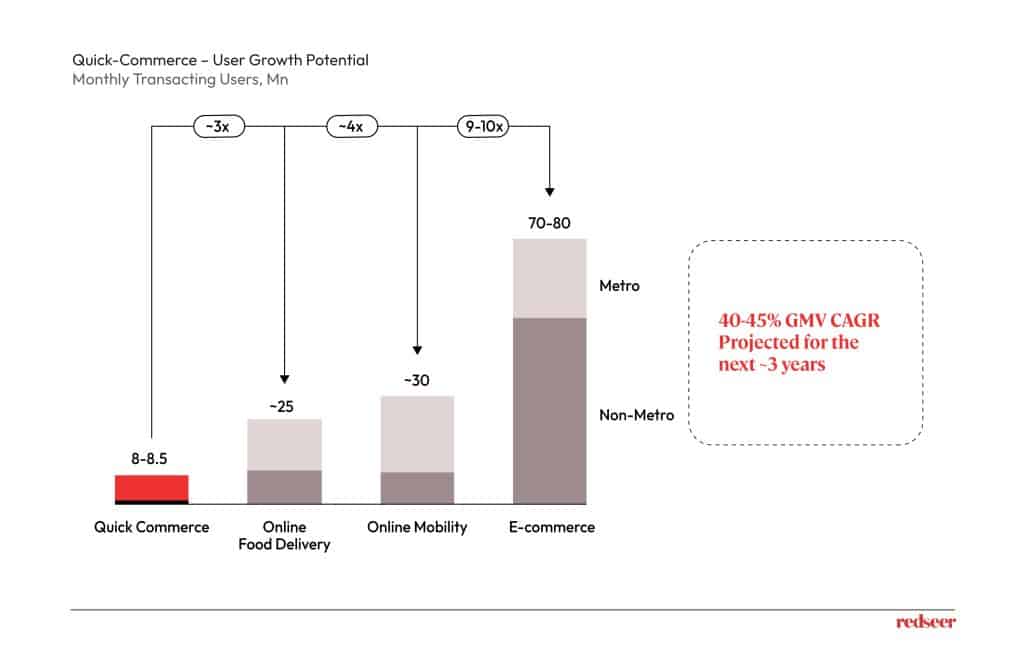

The Average monthly transacting users of quick commerce still stand at 1/3rd of online food delivery and 1/4th of online mobility, thereby leaving headroom for growth, given the high consumer overlap with these sectors. Like online food delivery and mobility, q-commerce is expected to be a metro-first phenomenon (top 8 cities), with gradual adoption in the tier 1 markets (next ~50 cities).

Redseer predicts a 40-45% GMV CAGR for q-commerce in the next 3 years.

In conclusion, the rise of quick commerce in India represents a paradigm shift in the retail industry, driven by changing consumer behaviors, technological advancements, and a conducive business environment. With its ability to offer instant gratification and unparalleled convenience, q-commerce is set to redefine the way Indians shop and provide immense investment and growth opportunities for industry players.

While the outlook is promising, it will be interesting to observe the consistency in q-commerce performance in the upcoming quarters. Further, while we are yet to observe the scale of response from legacy e-commerce platforms, it is clear that the q-commerce space will heat up in the next few months.

Need more insights into the Q-commerce industry’s growth? Talk to our Industry Expert – Kushal Bhatnagar today. And for more such insights, subscribe to our newsletter to stay ahead of all industry trends.