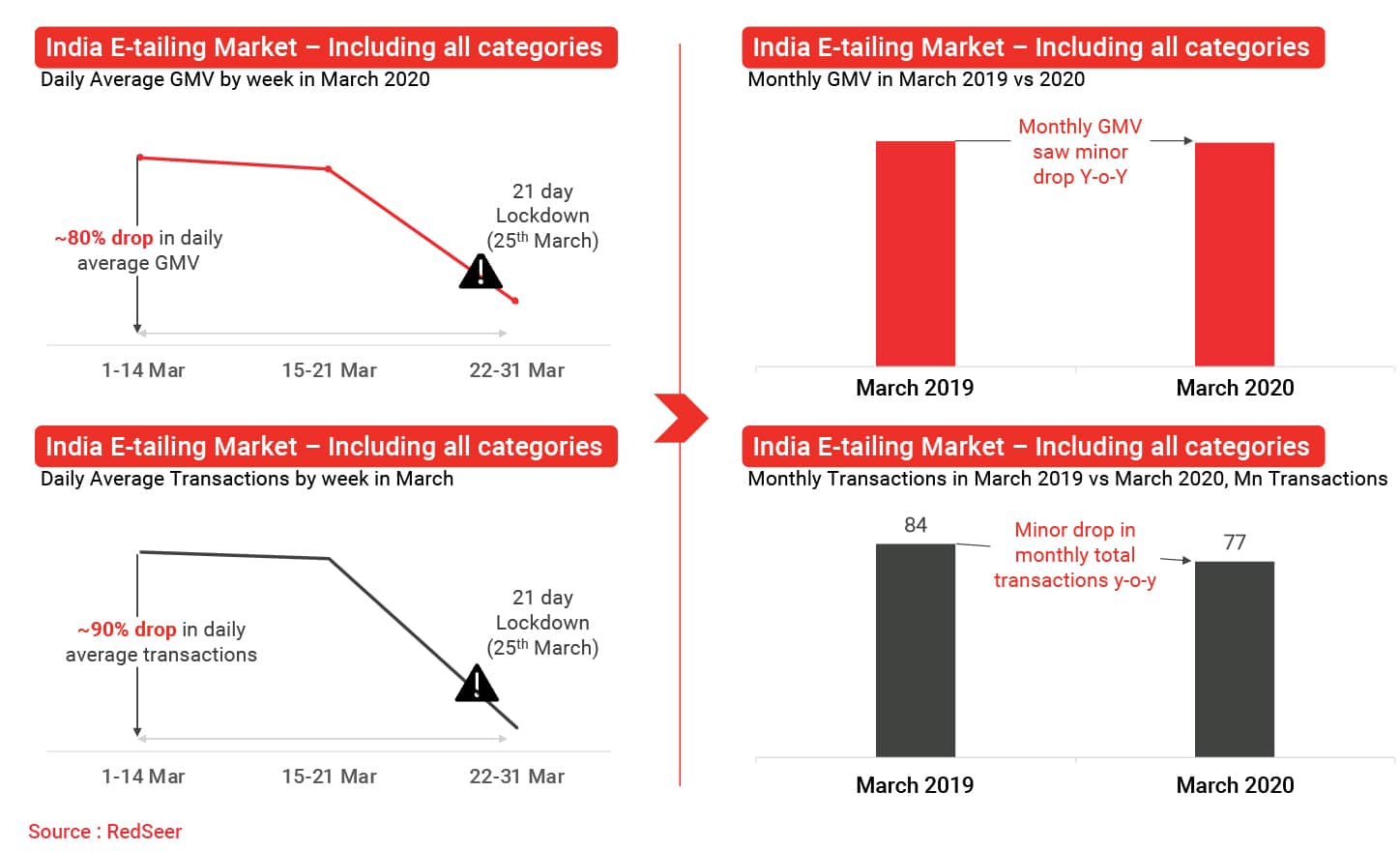

1. For E-tailers, extremely steep order drop in last week of March 2020 led to GMV/trx for whole month falling vs March 2019

India’s USD ~29 Bn E-tailing market (2019 annual GMV) was significantly impacted by the lockdown in March last week, as seen by a precipitous drop in GMV/transactions for the platforms vs 1st week of March.

Which eventually led to the sector GMV and transactions dropping slightly y-o-y in March 2020, one of rare such instances in last few years.

What’s in store for the sector for rest of 2020? Can it hit the USD 40+ Bn GMV mark in 2020 as forecasted by us in Jan 20?

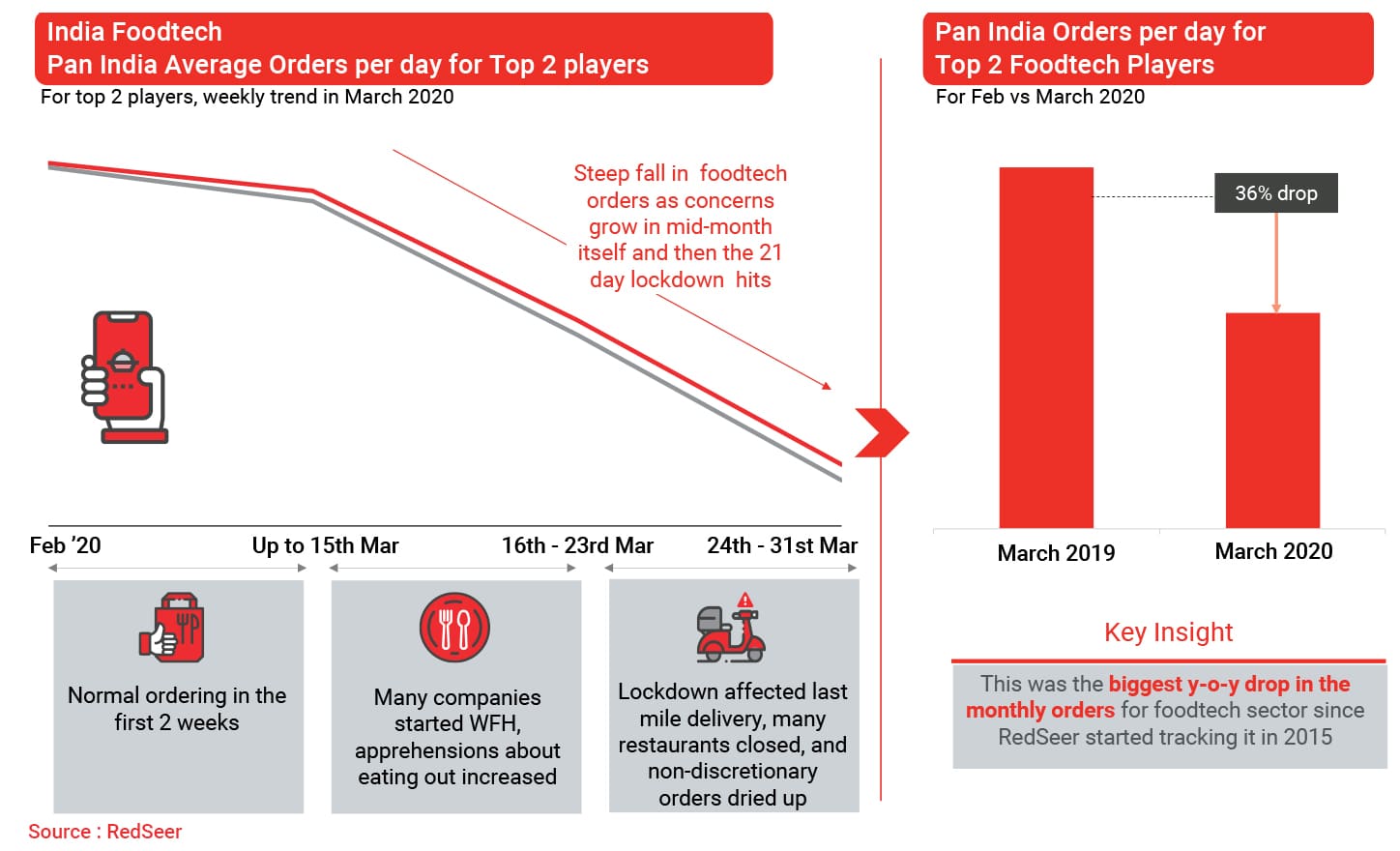

2. India’s Foodtech sector suffered a significant y-o-y drop in orders in March 2020

India’s fast growing Foodtech market saw a significant dip in the last two weeks of March 2020, driven by both supply and demand side factors. As consumers responded to Covid-19 thread much earlier (15th March) by reducing online consumption, compared to e-commerce where online orders only really dropped in last week.

This trend resulted in one of the largest y-o-y drops in orders for the Foodtech sector in last 5 years.

However, can Foodtech deliver again in rest of the year? What do the consumers say? And what is the voice delivery executives, the backbone of the industry?

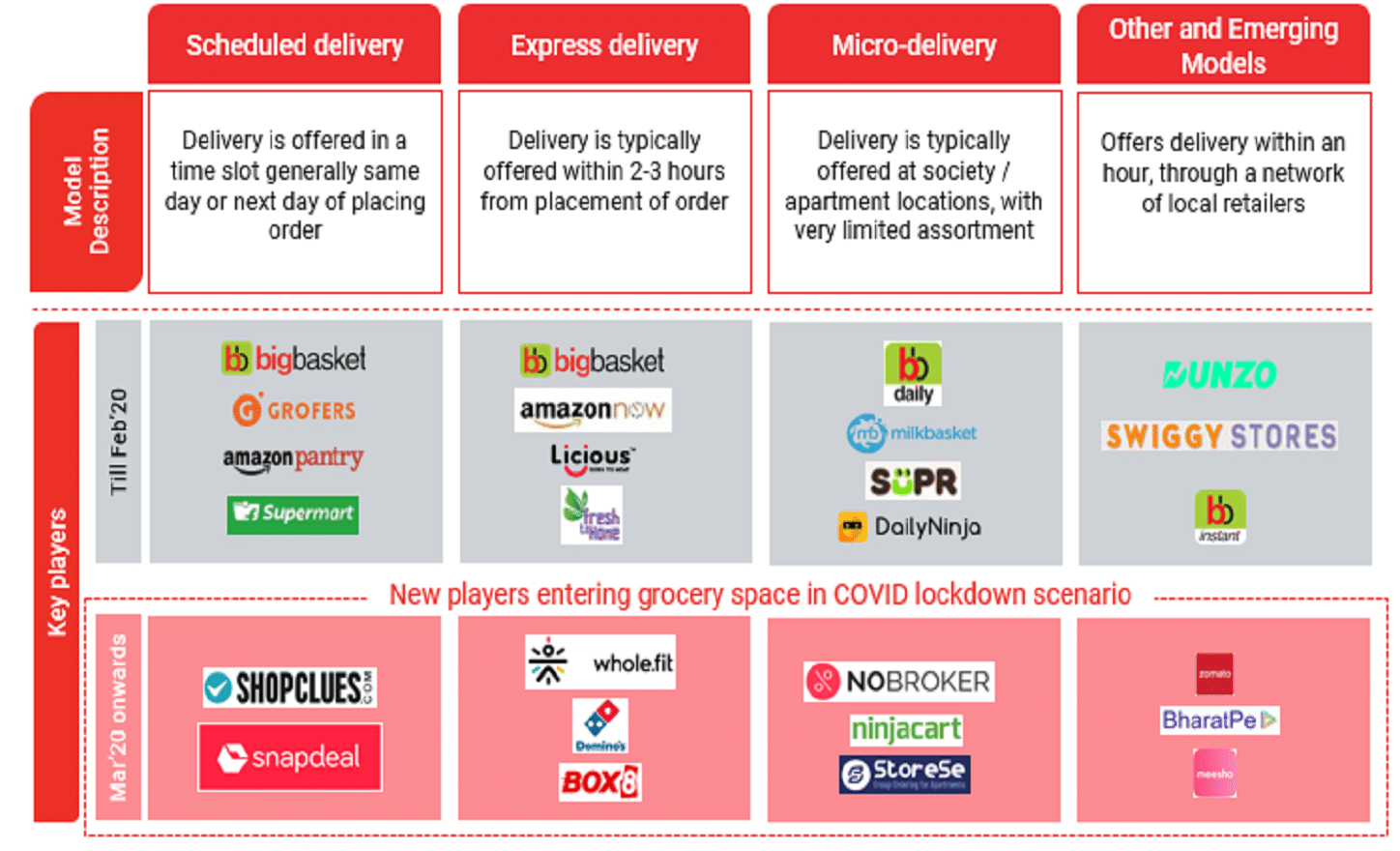

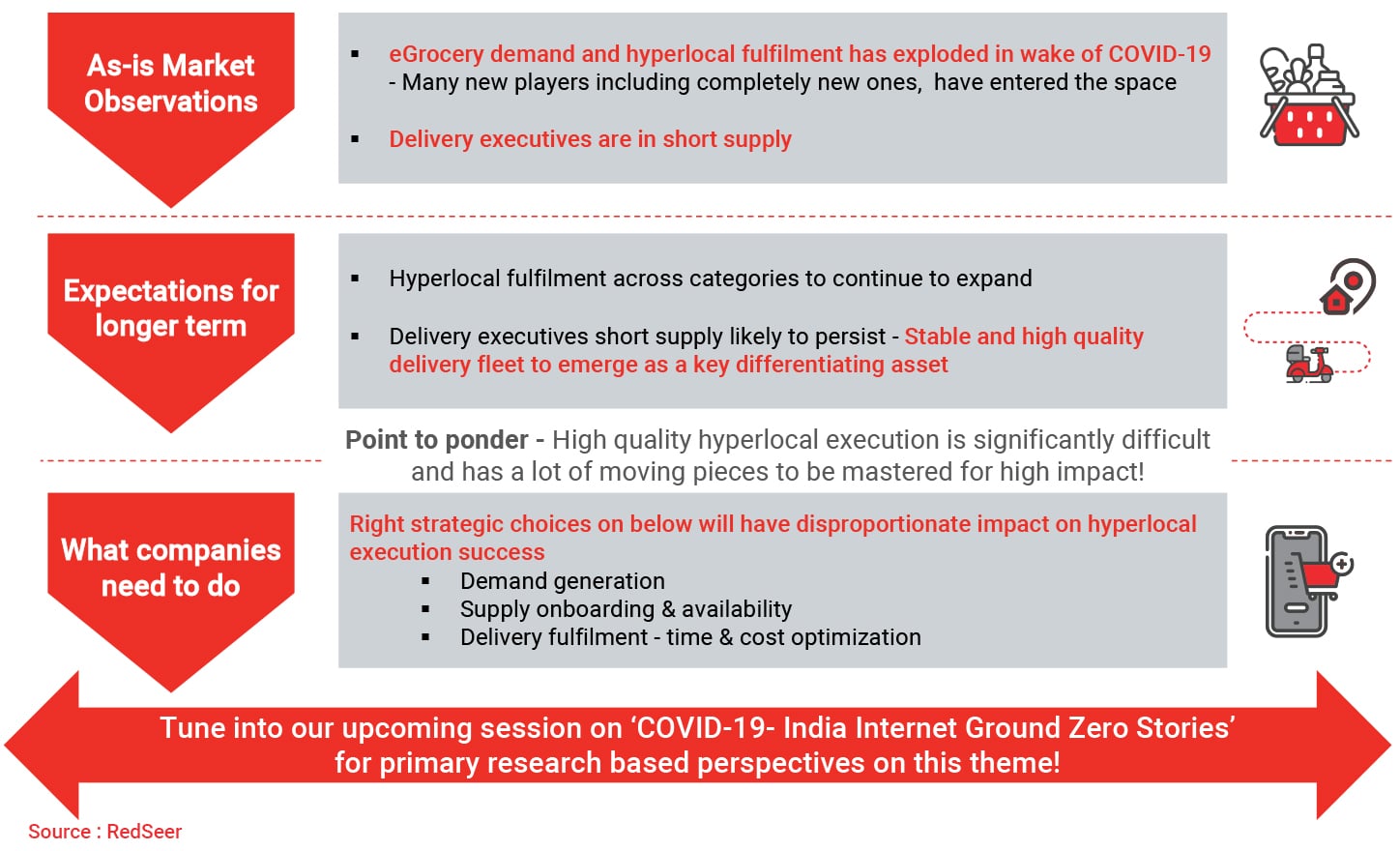

3. Even as other sectors suffered, eGrocery exploded and saw entry of multiple new players in lockdown scenario in March 2020

The COVID-19 crisis has led to a pressing need for at-home access to groceries, which has led to an influx of new players into India’s nascent (<$2 Bn GMV in 2019) eGrocery market.

Profile of the new entrants varies- some have already been associated with allied fields (Snapdeal, whole.fit), while others like Nobroker and BharatPe are completely new into this space.

Can the one-time spike in eGrocery sustain in rest of 2020 and beyond?

4. Explosive growth in eGrocery will demand both new entrants and mature players to significantly deepen their Hyperlocal capabilities

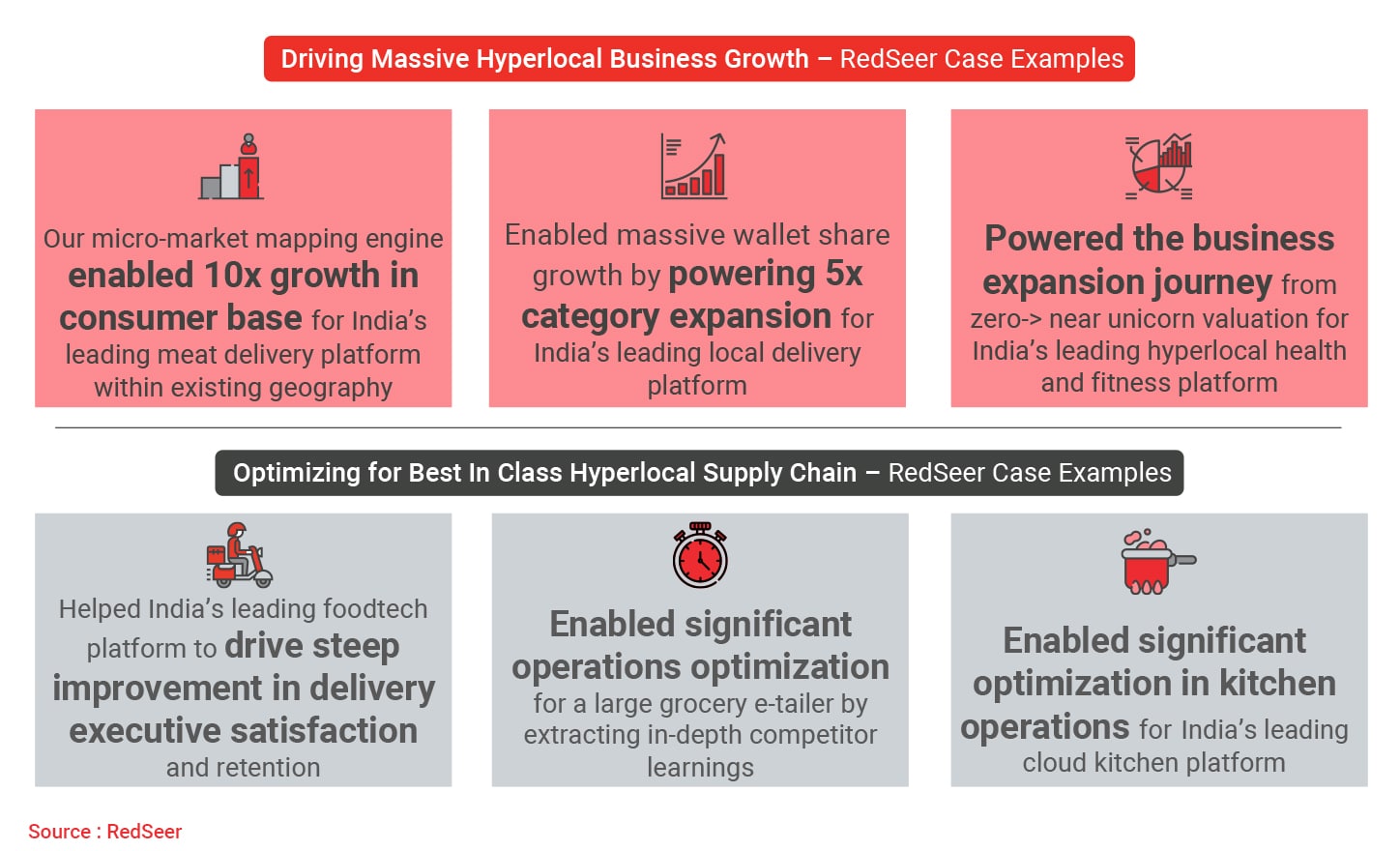

5. Our Hyperlocal Growth and optimization Engine (HuGE) has enabled multiple clients to master this fast expanding model