The Indian food services market is witnessing a transformative trend in the outside food eating habits of the consumers especially in metro and tier 1 cities. Leading this paradigm shift is the House of Brands (HoBs) model, poised to revolutionize brand scalability and revenue generation. Redseer’s latest report, “Winning Recipe for Food Brands in India,” delves deep into this transformative trend and the role of HoB model in shaping the future trajectory of Indian food services market.

With that said, what are some of the insights and actions that food service brands can take to stay ahead of the curve? Rohan Agarwal, Partner at Redseer and author of the study, offers a glimpse into the India’s diverse food services sector in this story while recommending measures that will accelerate the sector’s progress towards surpassing $100 billion in revenue by 2028.

1. Evolving outside eating habit of Indians is fuelling a $100 Billion Opportunity

Outside eating behavior is now more habitual for Metro and Tier 1 consumers rather than being a luxury, which can be seen by the frequency of outside eating going up by 30% and 20% for students & young adults and mid-lifers respectively compared to 2018. They are increasingly looking for more variety and are also vary of quality driving the need for brands in the ecosystem.

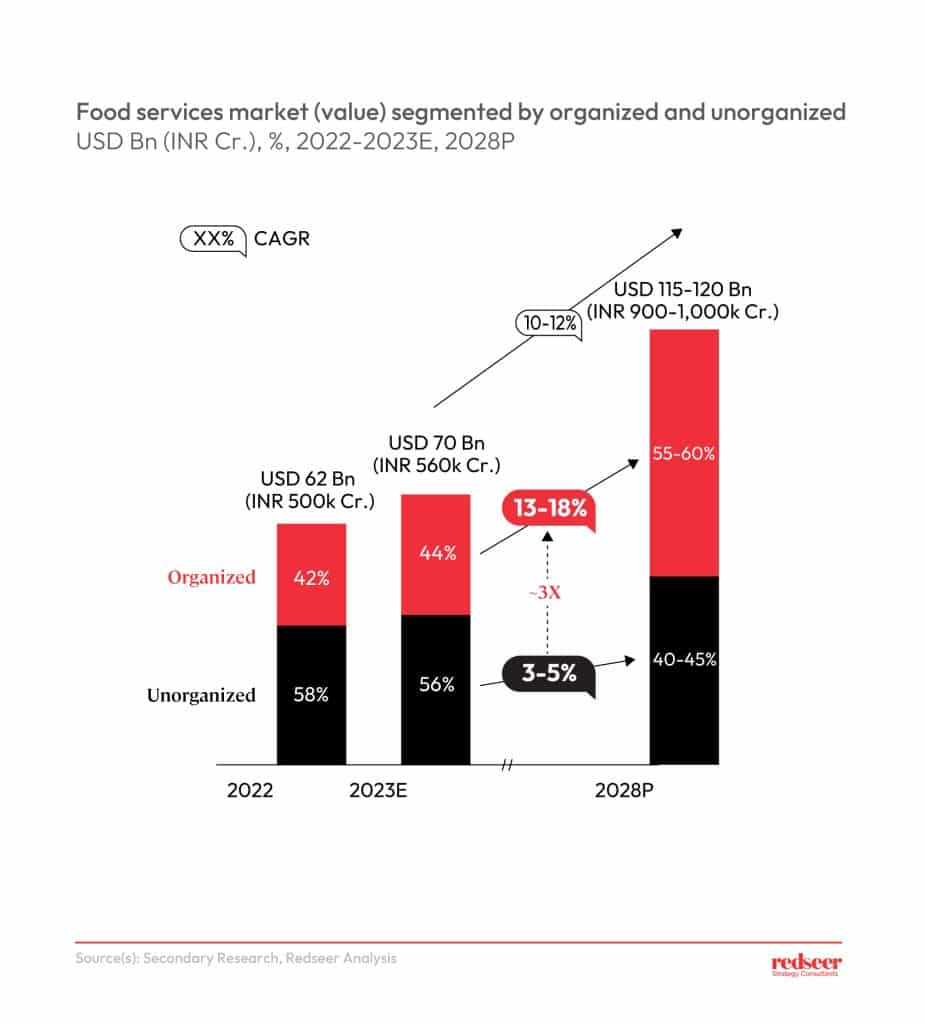

This habit formation coupled with consumer’s focus on quality is boosting the growth of the Indian food services market, which is on track to surpass the monumental $100 billion mark by 2028. The organized food services market is expected to be the key beneficiary of this trend and become 2X from USD 30 billion to USD 60 billion in the same period. Brands are also leveraging this opportunity and are scaling their presence especially across metro and tier 1 cities, for example Dominos has more than 1,700 outlets and continues to expand its presence further.

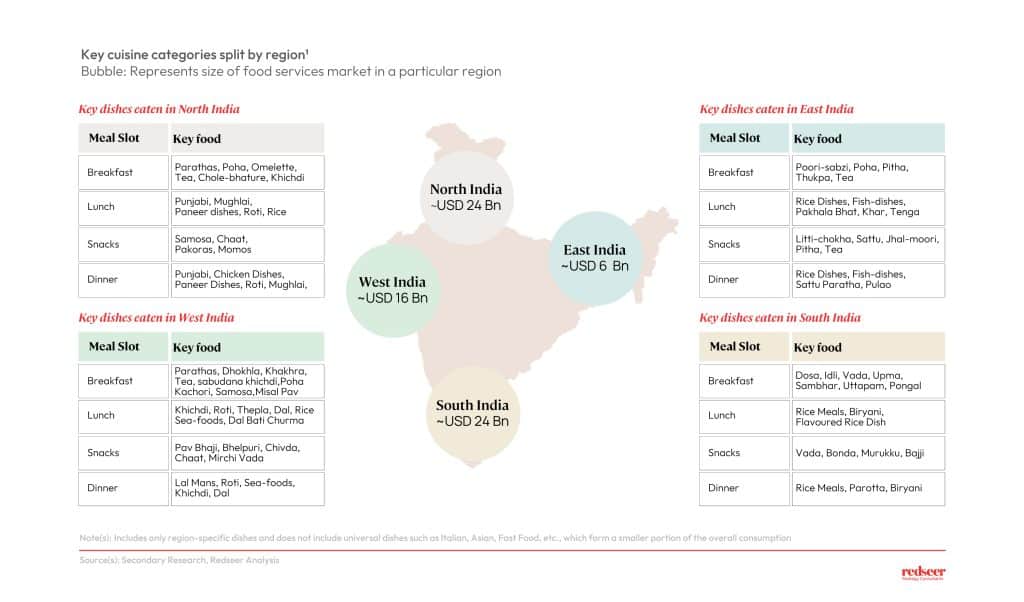

2. The diverse palette of the Indian consumers calls for brands to tap into multiple cuisines.

Indian palette is extremely heterogeneous, with varied tastes for cuisines across regions. For example, in Biryani category we see diverse regional variations such as Lucknowi, Kolkata, Ambur, and Hyderabadi, reflecting the rich culinary landscape of India. This diversity restricts the Total Addressable Market (TAM) and makes scaling beyond INR 100 crore a challenge for most standalone brands with presence in a single city or a single cuisine. For instance, in the INR 20,000-30,000 crore biryani category, a typical metro city may only have an organized market size of INR 800-1,200 crore. Thus, achieving a revenue target of INR 100 crore by operating solely in a single metro city within the organized biryani cuisine necessitates capturing 10-15% market share, posing a significant challenge for a standalone brand to overcome.

3. House of Brands model is a natural choice for the diverse Indian food services market.

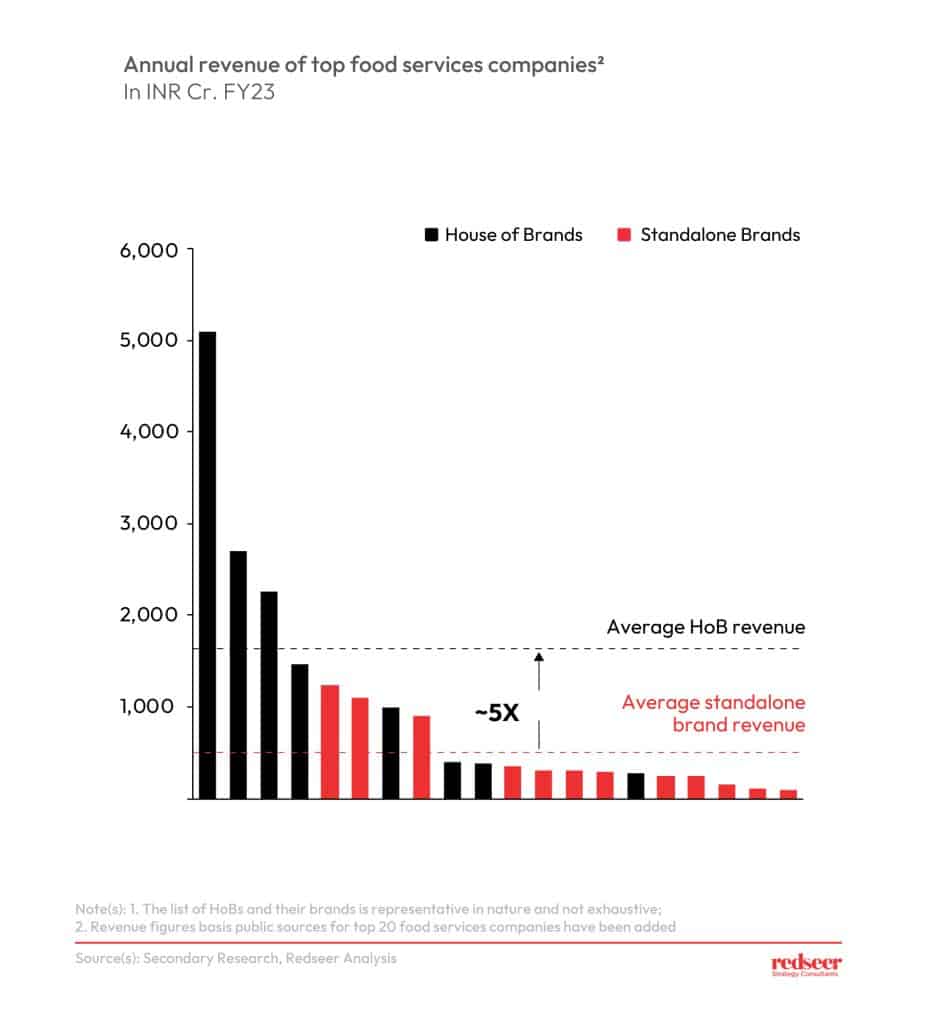

House of Brands (HoBs), which own multiple brands across various cuisines under a single umbrella, demonstrate an average revenue at least 5 times higher than standalone brands. This is partly due to their ability to target a larger Total Addressable Market (TAM) across cuisines and meal slots. The sharing of resources within the HoB strategy also facilitates increased kitchen utilization and enables better operating leverage such as lower COGS, further solidifying their competitive advantage in the market.

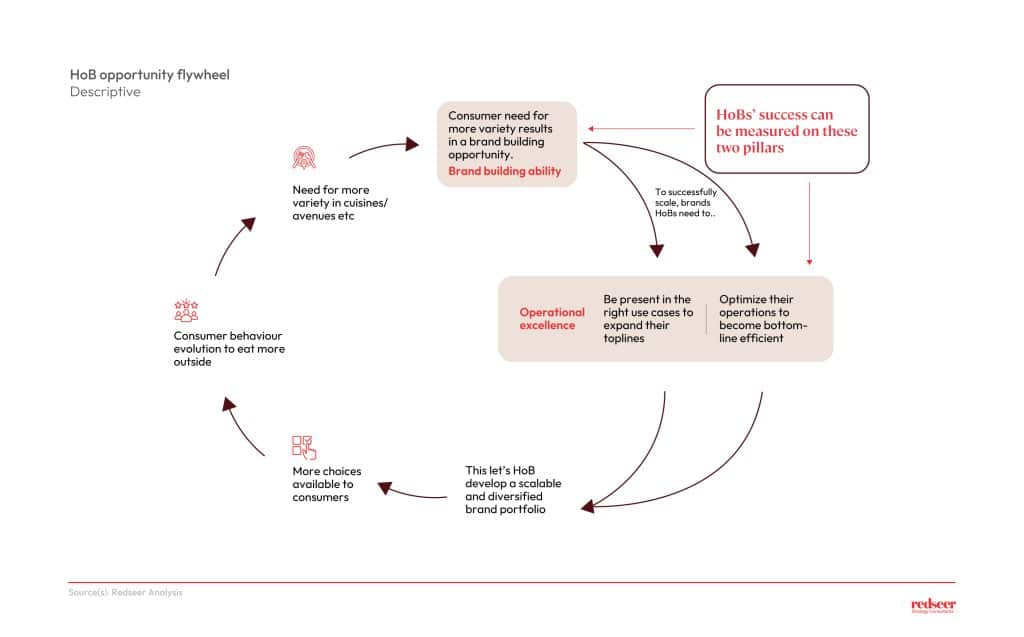

4. Successful House of Brands ace in building brands continuously while being focused on operational excellence.

The performance of House of Brands (HoB) players can vary significantly. For instance, in H1FY24, Same Store Sales Growth (SSSG) for HoBs ranged between 15-20% to a negative 5-7%. There are two critical aspects that the successful House of Brands excel at. Firstly, their ability to build and scale multiple brands across diverse cuisines, thereby capturing higher revenue potential rather than being dependent on their anchor brand. Secondly, driving operational excellence through measured geographic expansion, targeted micro market strategy, strong consumer funnel and optimized capital & operational expenditures. New-age house of brands have successfully performed with this model and have scaled 3-4 brands above the INR 50 crore mark and their cloud-kitchen led model has enabled them to expand quickly given their significantly lower setup costs and time.

As we witness the remarkable journey of these new-age HoBs scaling new heights within a remarkably short timeframe, it becomes evident that the HoBs model holds the key to unlocking the boundless opportunities that lie ahead in India’s thriving food services industry.

To read the full report, click here