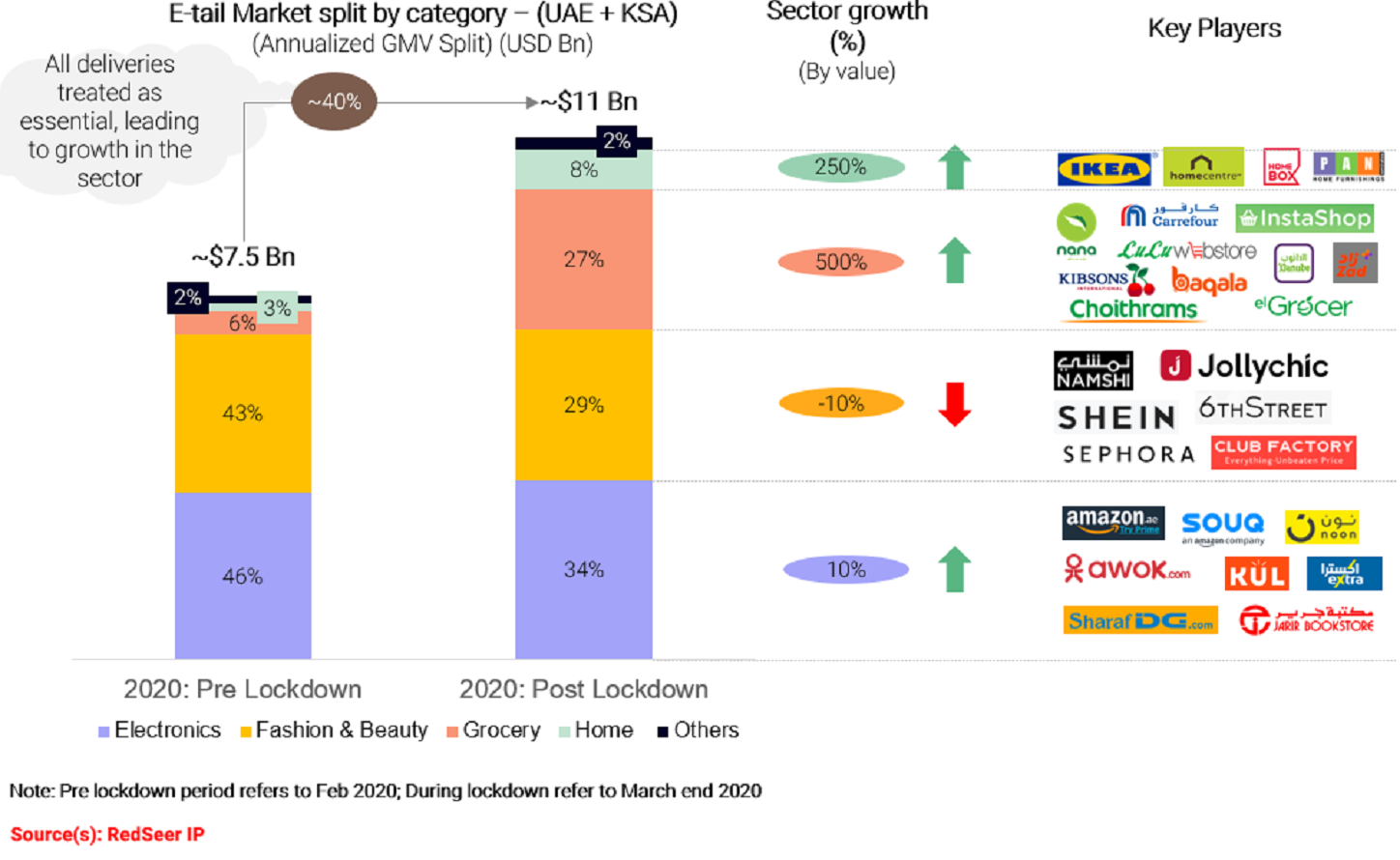

1. Overall the e-tail market has grown by ~40% by value with eGrocery being the biggest gainer

Lockdown measures have led to growth for e-tail. The growth rate during the lockdown has been ~20% by order volume and ~40% by value resulting in annualized GMV of $11 Bn.

• eGrocery has been the biggest benefiter with a spike of 500%+ due to panic buying and increased cooking at home. The category share in e-tail GMV pie jumped from 6% to 25%+ in this time period.

• Home segment grew ~250% due to work/study/gymming from home, increased cooking demanding for more kitchen utensils while increased time spending with kids demanding for more toys.

• Electronics also grew by ~10%, driven by work/study from home.

• Fashion and Beauty went down ~10% due to lack of occasions. A lot of players also operating in this category are Chinese CBT players who have lost ground in last few months, ultimately negatively impacting the category.

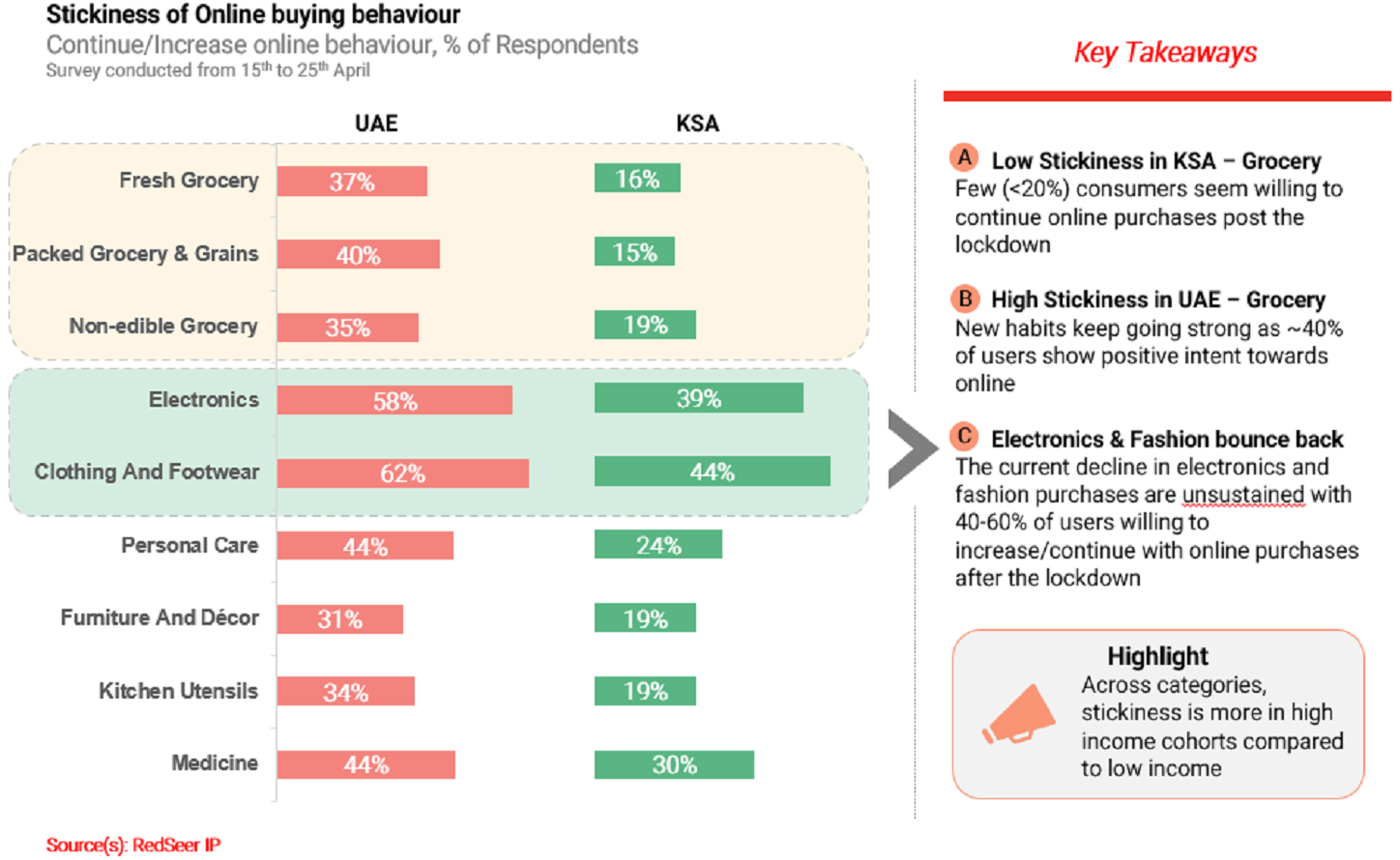

2. Online is the new go-to

Consumers in both, UAE and KSA have shifted towards online channel post lockdown, more so in KSA than UAE. This has been propelled by a large number of first-time users especially for purchase of essential products. The question remains as to whether this habit of online buying will “stick”.

• We see that in UAE this behavior will continue – ~40% of consumers are willing to continue/increase their online purchases of grocery.

• However, the number is lower for KSA at <20% – showing us that consumers are using online only as a stop gap till the situation normalizes. Categories of electronics and fashion are expected to bounce back.

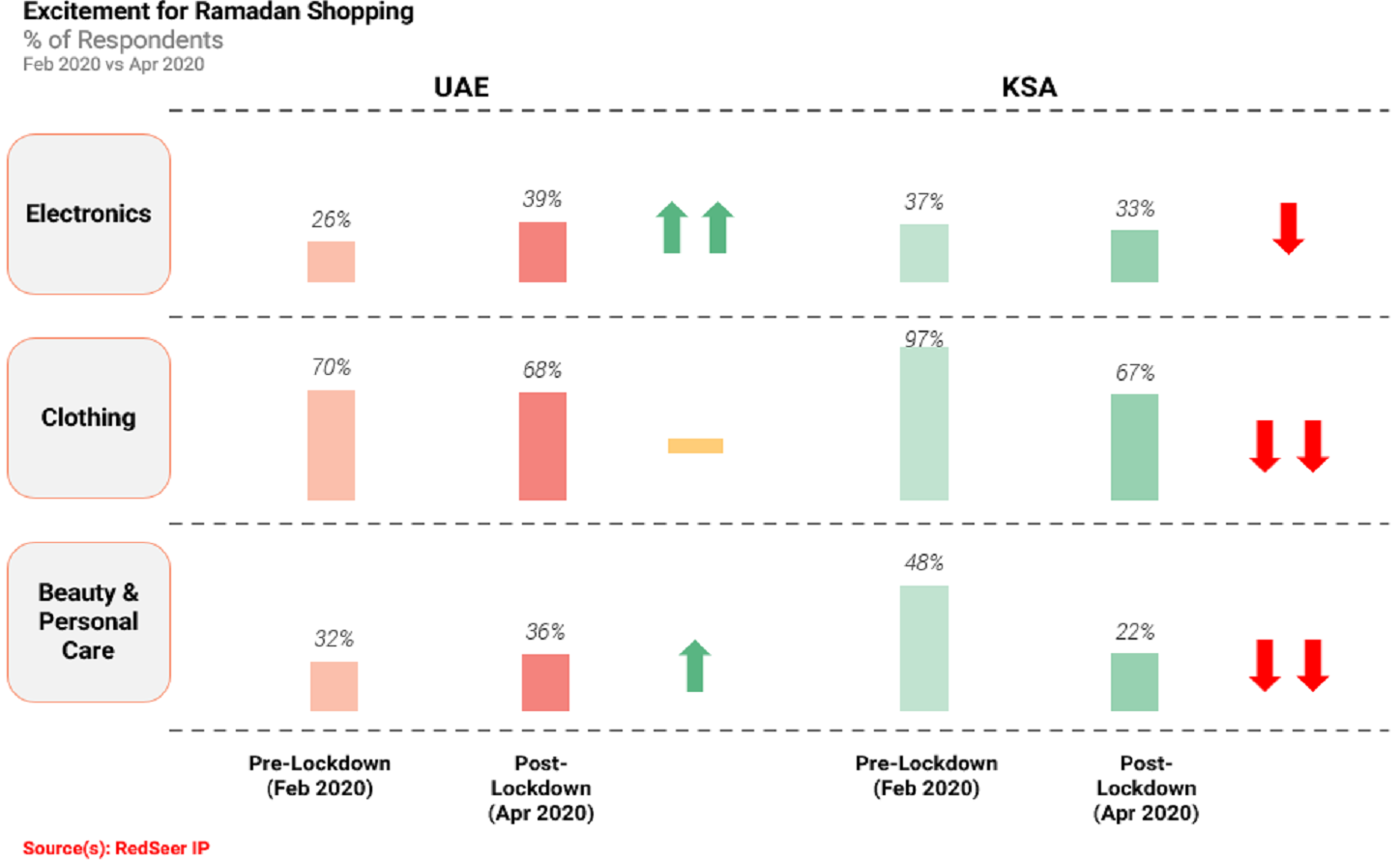

3. Ramadan excitement revised upwards in UAE and downwards in KSA

Consumers in both regions have revised their expectations about Ramadan shopping. More consumers in UAE plan to make purchases in key categories of electronics and BPC. In KSA by contrast, lesser consumers are planning to make purchases compared to what they had planned a few months ago before the lockdown. This is possible due to the high amount of pessimism in KSA about the pandemic lasting more than 4 months as well as a widespread perception of negative financial impact.

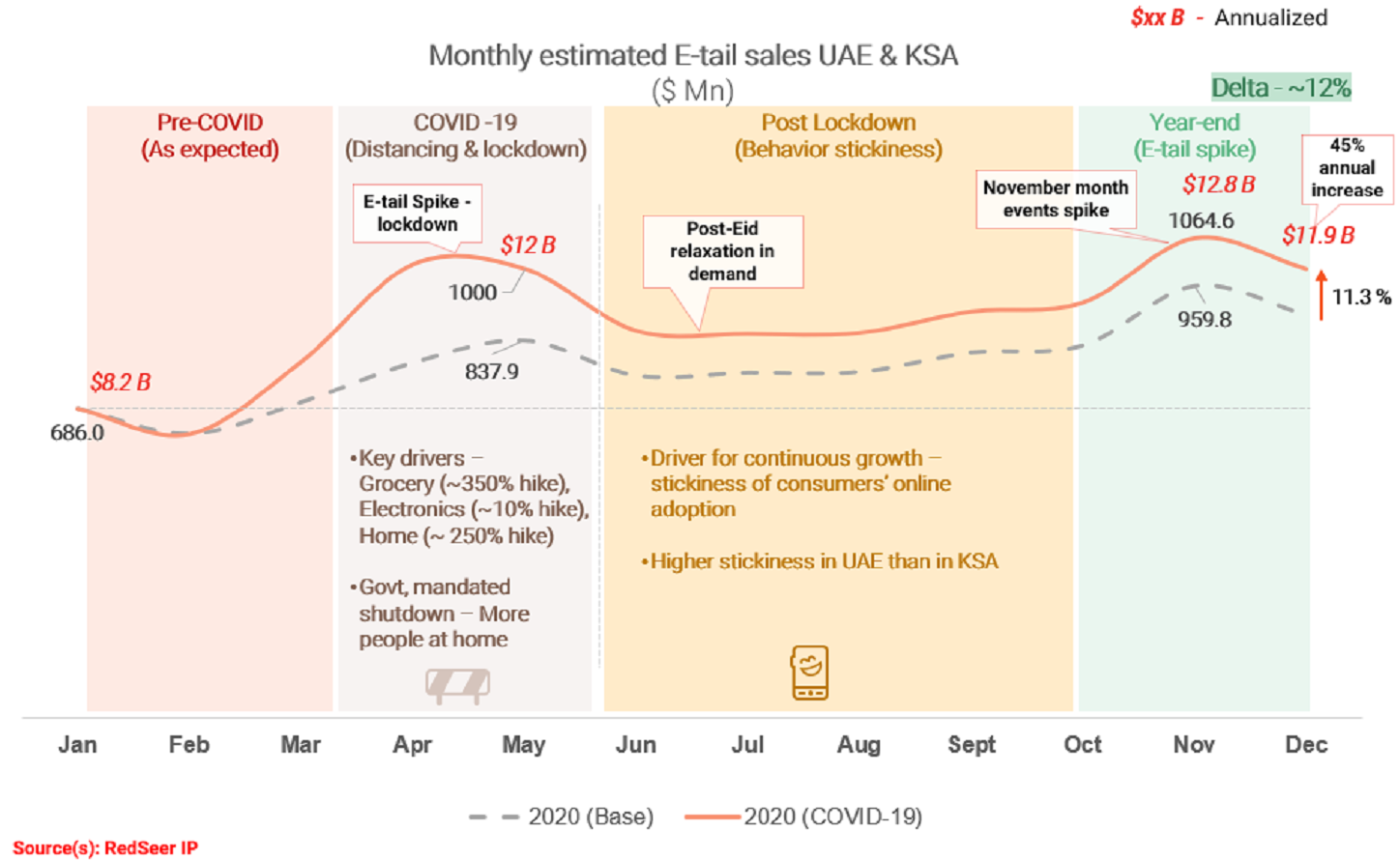

4. E-tailing GMV projected to be 11% higher than previous expectations

When we extrapolated this behaviour to understand the value impact on E-tail, we estimate the etail in region will grow much faster ~45% compared to earlier estimate of ~35%, all categories displaying a positive shift. Again, grocery is expected to gain the most where this shift is much bigger followed by home, fashion and electronics.

Read More: