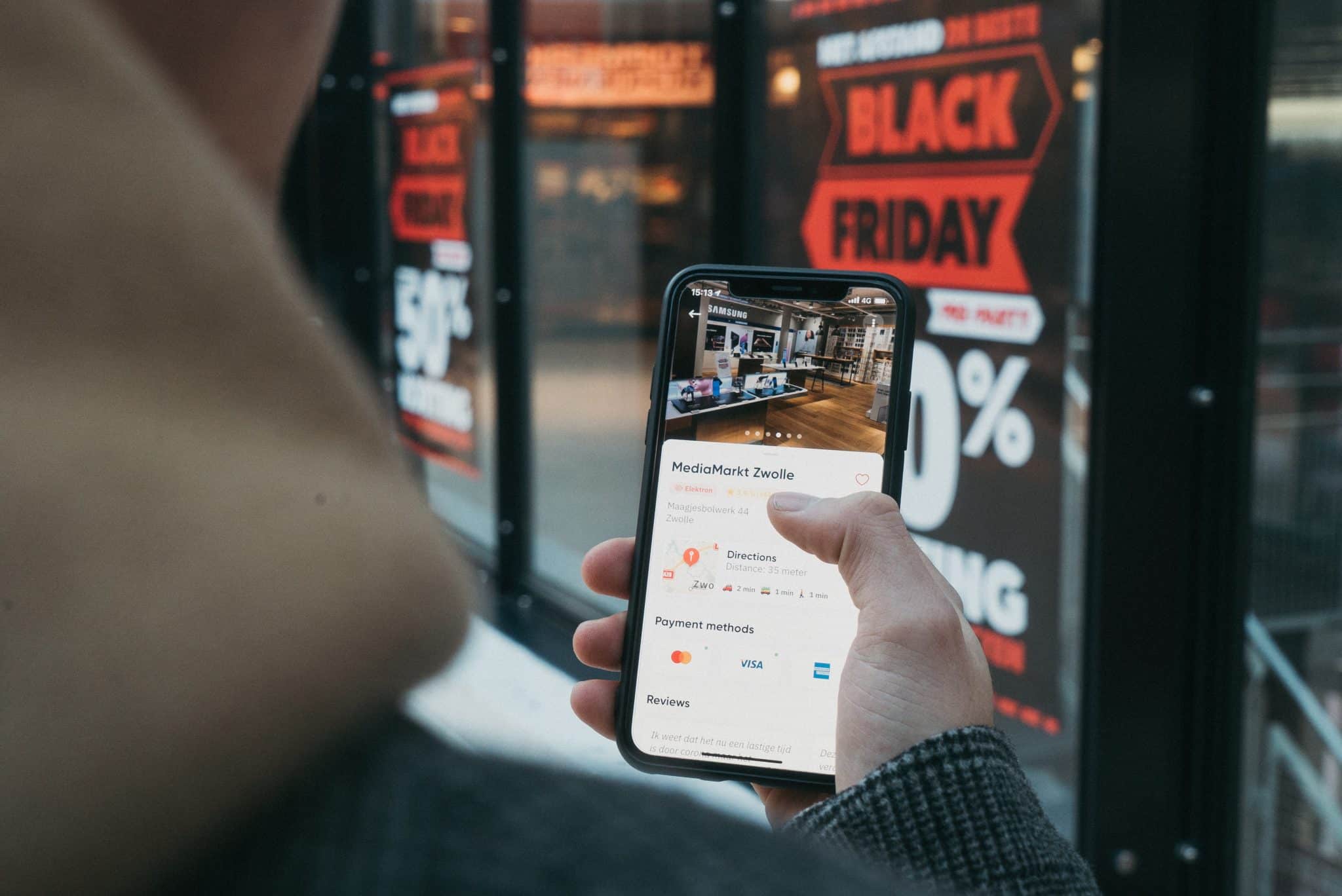

The e-tail market in India has also experienced significant growth in recent years, with the rise of e-commerce platforms and the increasing adoption of online shopping. The growth of the e-tail market in India has been driven by several factors, including the increasing use of smartphones and the internet, the availability of affordable data plans, and the rise of e-commerce platforms like Amazon, Flipkart, and Snapdeal. These platforms have made it easier for consumers to shop online, and have also helped to create a more competitive and transparent marketplace.

Here’s a report offering an in-depth insight into how the overall trend is positive, and the e-tail market in India is expected to continue to grow in the coming years.