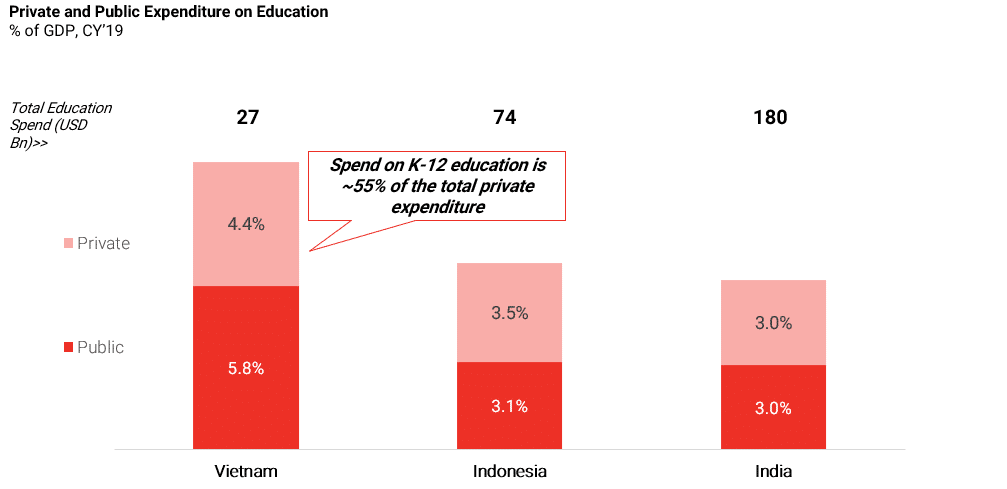

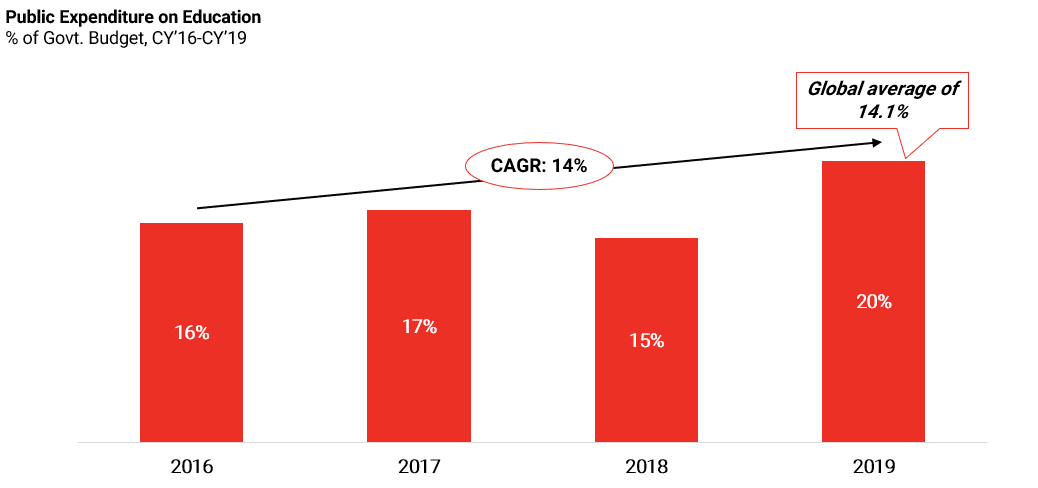

1. Education spend has traditionally been high in Vietnam with public spending increasing even further over the years

Education spend in Vietnam (both public and private) is high when compared to other developing countries such as India and Indonesia. Government spends almost 20% of its budget on education.

There is a disparity between focus on K-12 and post K-12 education with ~55% of private expenditure directed towards the K-12 segment (as opposed to global average of 40% on K-12 education) in addition to 45-50% of public spending.

Such high spend makes Vietnam one of the most lucrative education markets in the region.

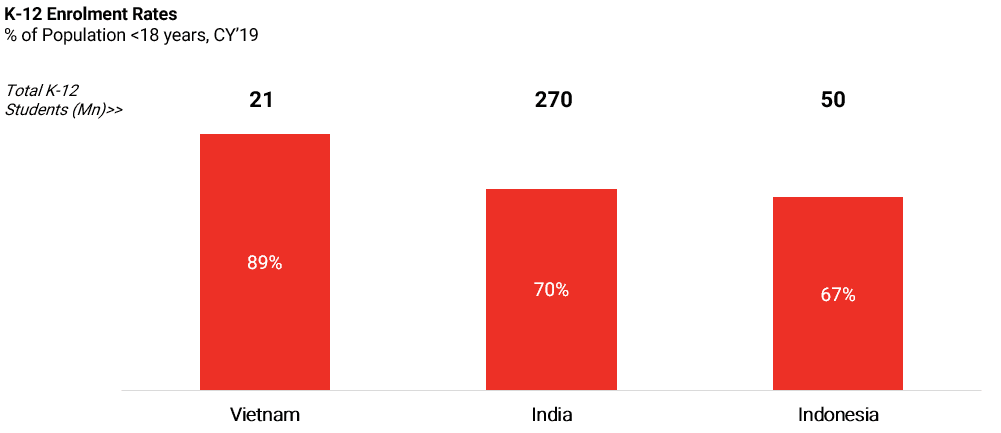

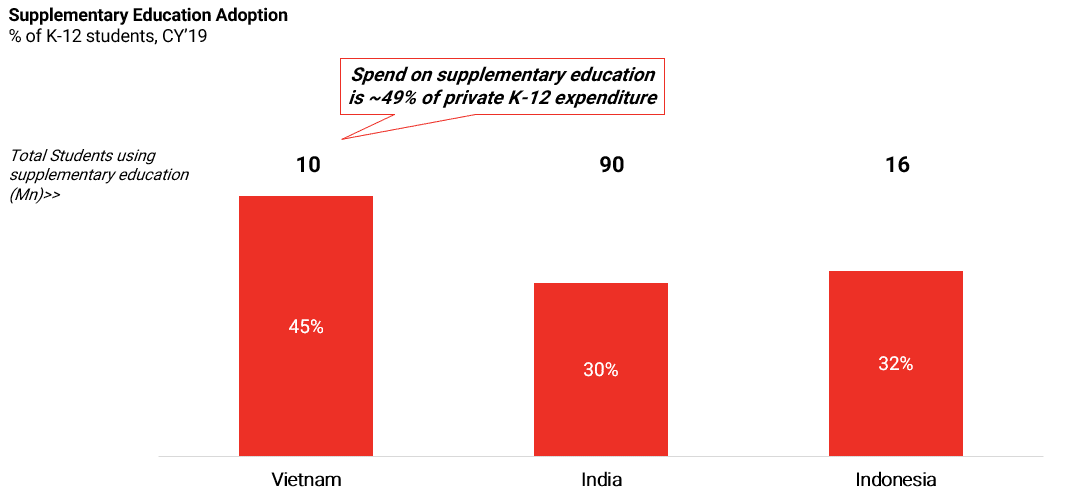

2. The high spend is reflected in the K-12 education landscape – high enrolment rates and high adoption of supplementary education

High enrollment rate in Vietnam reflects the high spend on K-12 education. Enrollment rates are similar for primary and secondary education in Vietnam as opposed to other developing countries where there are high drop-out rates after primary education.

Additionally, ~45% of the K-12 students in Vietnam avail supplementary education, primarily focused on English, Maths and Test Prep. At an overall level, ~49% of the private K-12 expenditure (USD ~3 Bn) was spent on supplementary education in 2019 which is 2x what is spent in India at a per capita level.

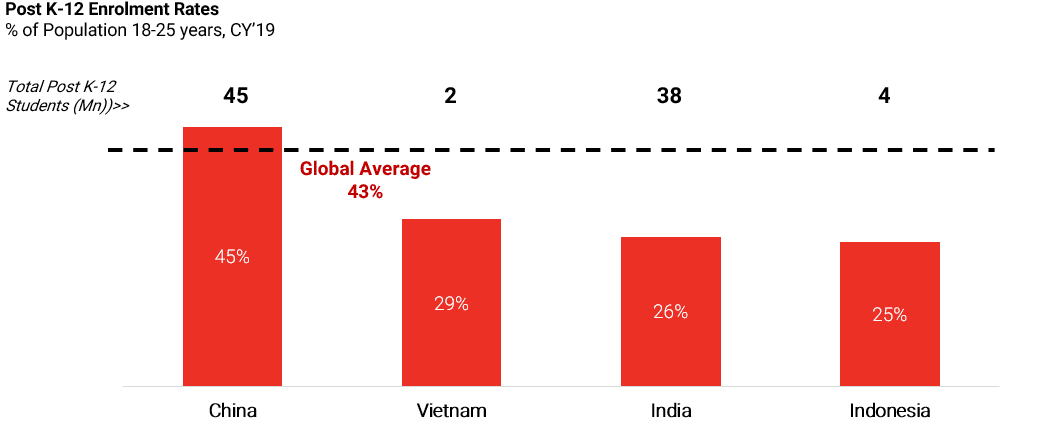

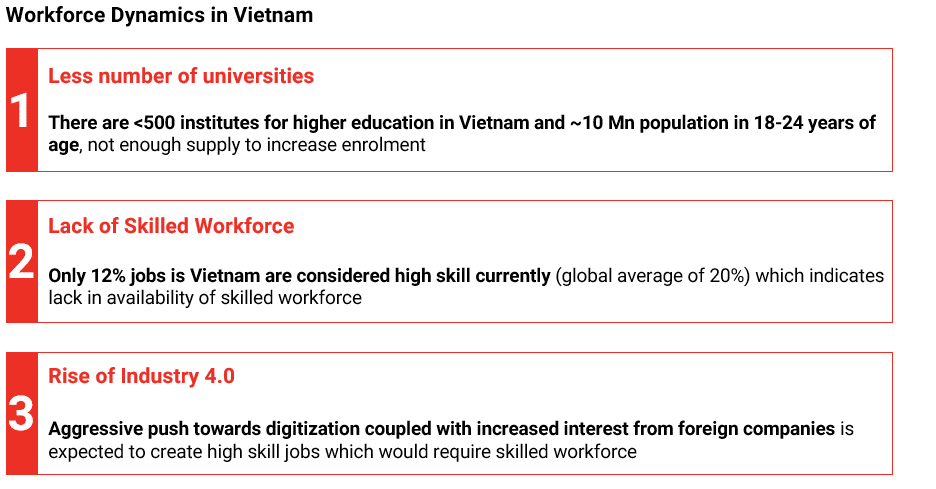

3. Post K-12 segment is characterized by low enrolment rates and unskilled workforce due to supply gaps – presenting a lucrative opportunity for EdTech

Post K-12 segment has been underserved in Vietnam with enrolment rates comparable to other developing countries. This can be attributed to low spending on university infrastructure and only 45% of private spend directed towards post K-12 (as opposed to global average of 60%).

This has also led to gap in skilled workforce which is not sustainable considering the manufacturing boom and push towards digitization taking place currently.

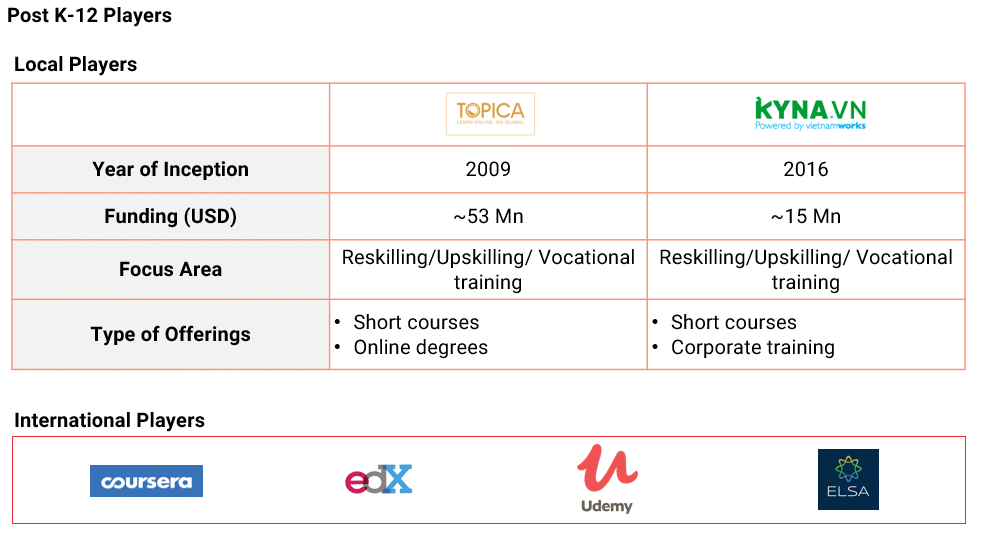

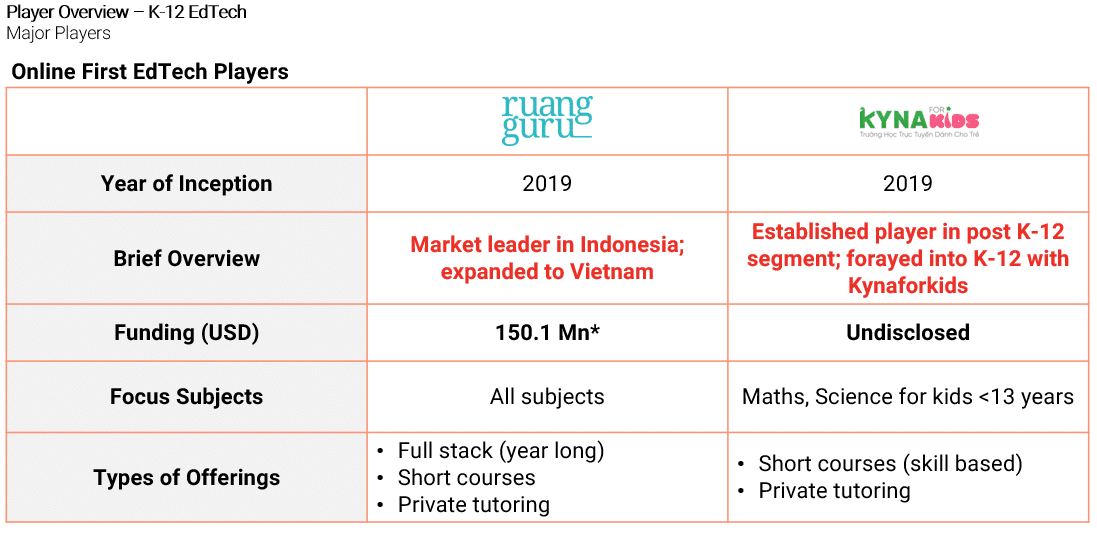

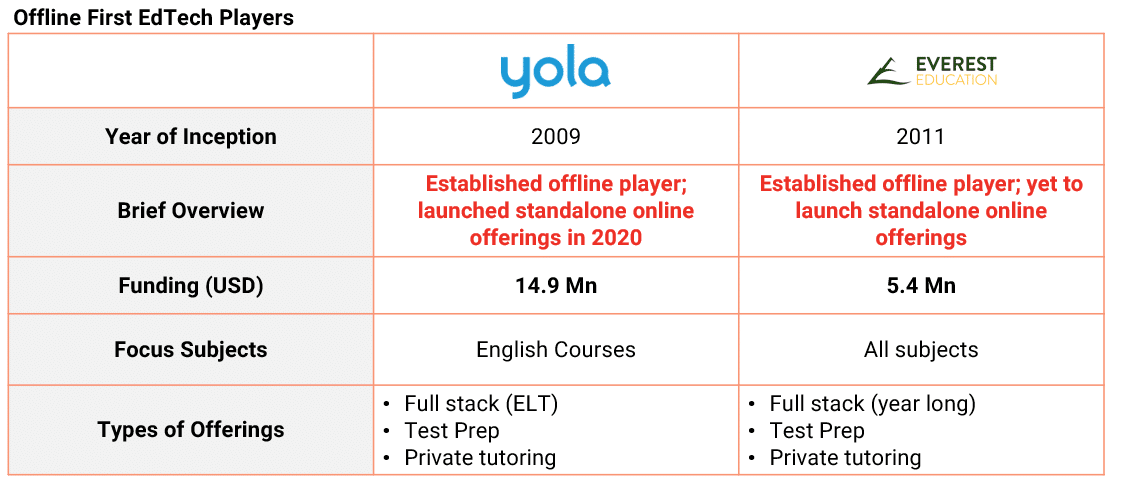

4. Hence, EdTech players have traditionally been focussed on Post K-12 segment (although there is a marked shift towards more lucrative K-12 segment of late)

Topica and Kyna are among the most popular EdTech platforms in Vietnam and have focused on post K-12 segment. Furthermore, adoption of global EdTech platforms focussing on post K-12 has been high.

There has been an entry of players in K-12 segment from other regions (Ruangguru from Indonesia). Additionally, traditionally offline focused players (Everest Education and YOLA) and also players focused on post K-12 segment have ventured into the more lucrative K-12 segment recently (Eg: Kyna for kids).

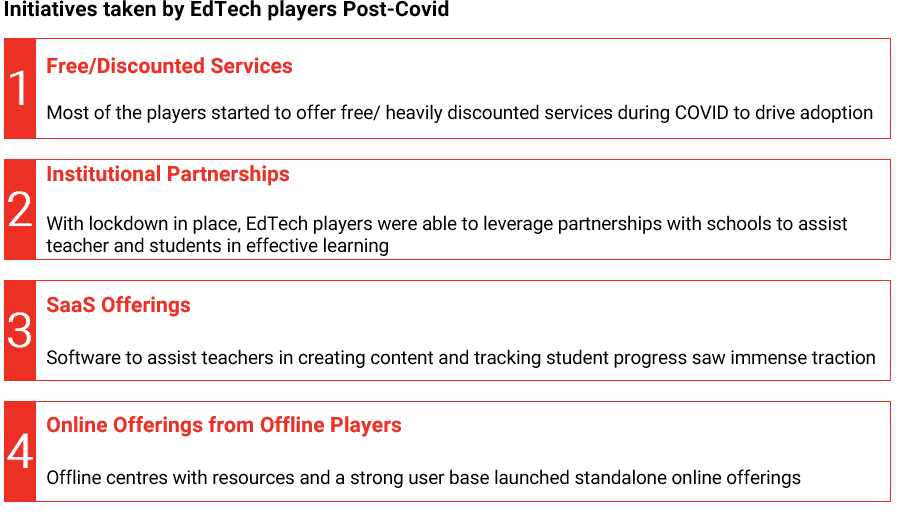

5. COVID has provided further impetus to EdTech, players are coming up with new initiatives to cater to this demand upsurge

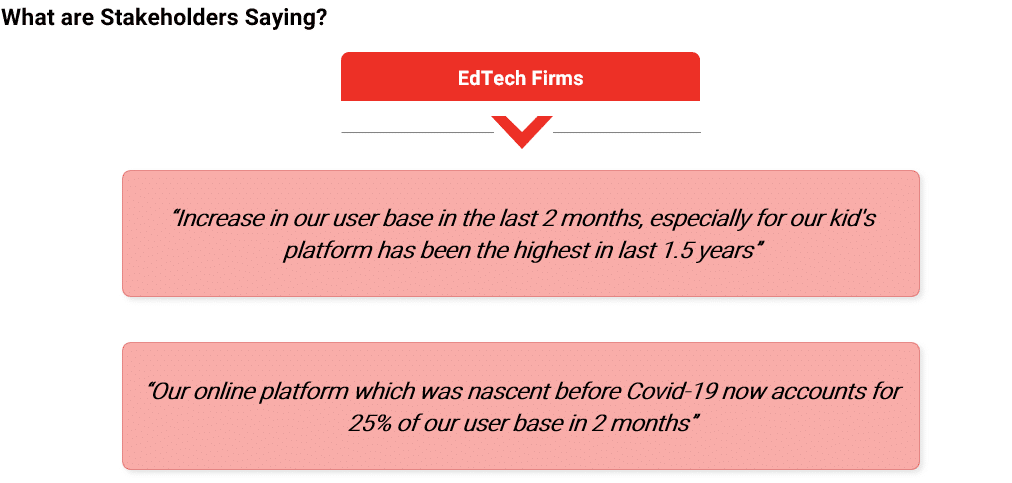

COVID has created a demand upsurge for online learning and EdTech players have adapted quickly to cater to this demand.

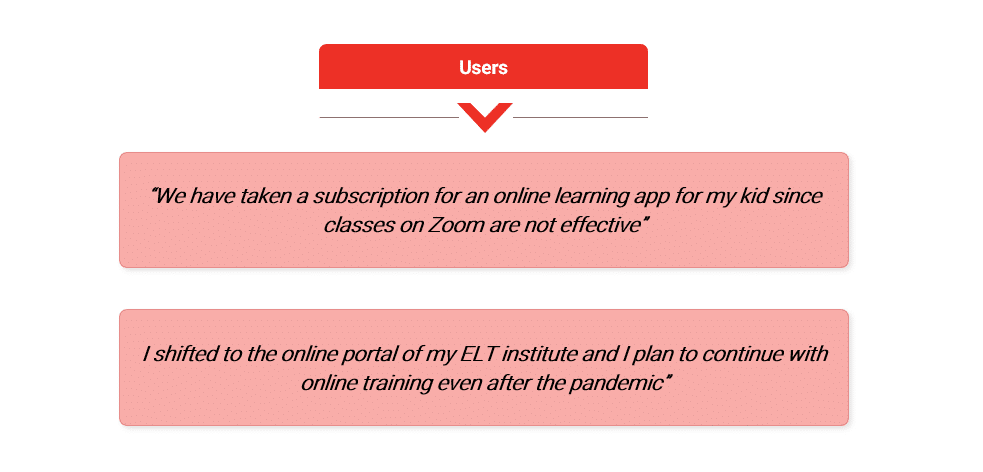

While both K-12 and post K-12 segments have reported exponential growth, K-12 has clearly outpaced the growth of post K-12. Users also report increased comfort with EdTech platforms.

It remains to be seen how this new normal in consumption of online learning can be sustained post COVID, given strong competition from offline players.