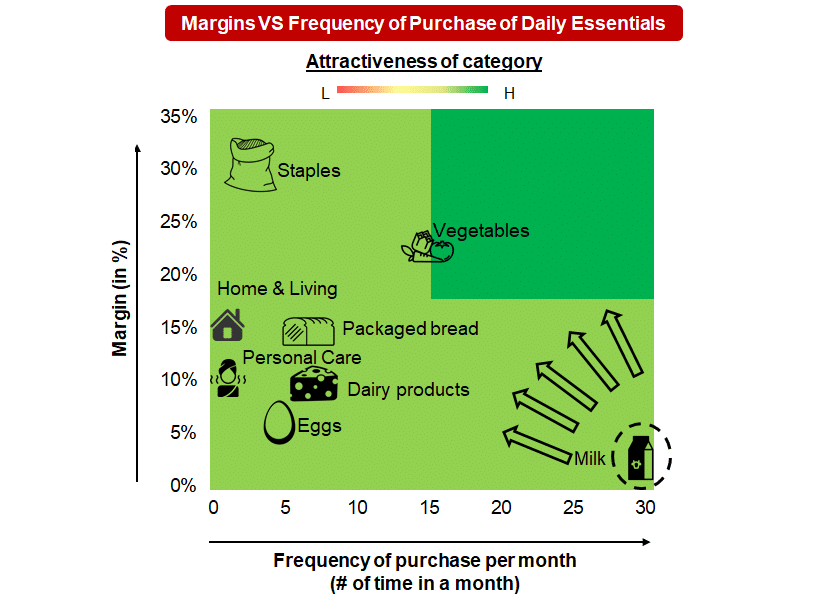

1. Milk has the highest frequency and the lowest margins in the daily essentials category

The online milk delivery business is growing fast in India. The players have focussed on milk category to make consumers habituated with their services as the frequency of milk purchase is high. But since the margins are low in milk, the players are all set to add more and more daily essential categories to increase revenues.

Want to get strategic guidance?

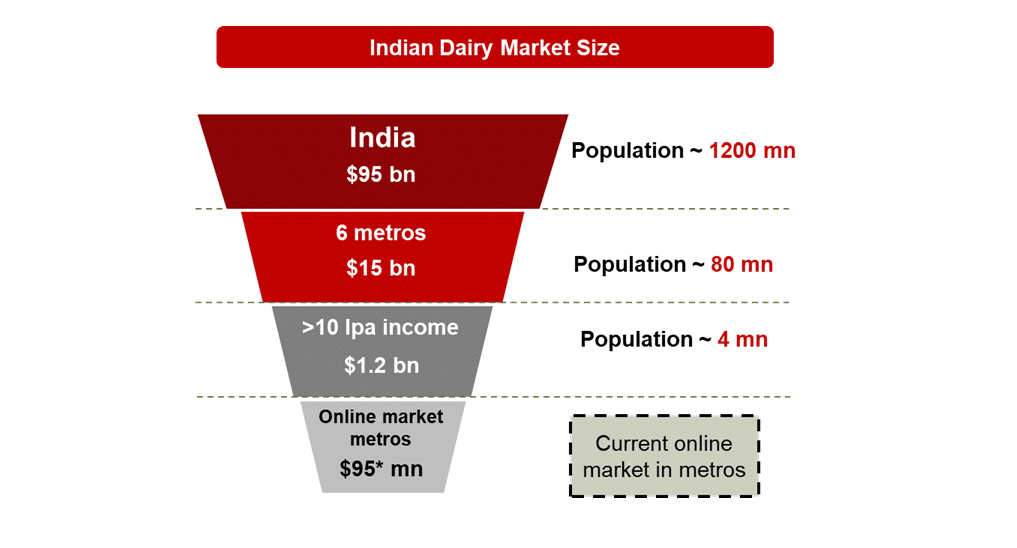

2. The online milk delivery has an addressable market of $1.2 bn of which 8% is online

The Indian dairy market is ~ $95 bn of which ~ $15 bn is in the top 6 metros. A large portion of target customers of online dairy products falls into the > INR 10 lpa income bracket within the top metros. With the population of top 6 metros being ~ 80 mn of which 5% earn more than INR 10 lpa, we have a 4 mn target consumer base. Assuming an average yearly spend of $ 300 for the > INR 10 lpa income bracket, we estimate an addressable market of $ 1.2 bn of which 8% is currently online.

3. The online milk delivery players are relying on the frequency of milk purchase to get consumers habituated with their services

The online milk delivery business is growing fast in India. The Indian consumers spend more than Rs. 1000 per month on milk and purchase it almost daily. The margins earned on milk are low, online milk delivery players are hence planning to push other high margin categories once the consumer gets habituated with them.

Explore related articles.