Both online and offline retail in India started gaining momentum from Q1FY24 with offline retail growing faster than ecommerce in Q2FY24. As per seasonal trends and captured in our ECCI of 131 for Jul’23 this led to a strong festive season of Oct-Nov ‘23.

Have a question?

Our experts are just a click away.

Not surprisingly in the post-festive period, the sentiment for future 4-months e-commerce spending in Nov ’23 shows a modest decline with an ECCI of 127, however retains an optimistic outlook.

While this is in line with annual trends, we see some headwinds emerging for ecommerce platforms. These include a slowdown in new consumer addition, consumers stickiness to existing categories and some customer dissonance with the measures taken by platforms to drive profitability. Outlined below are key insights derived from our eCommerce Consumer Confidence Index, shedding light on discernible patterns in consumer spending across various categories and offering implications for platforms and brands.

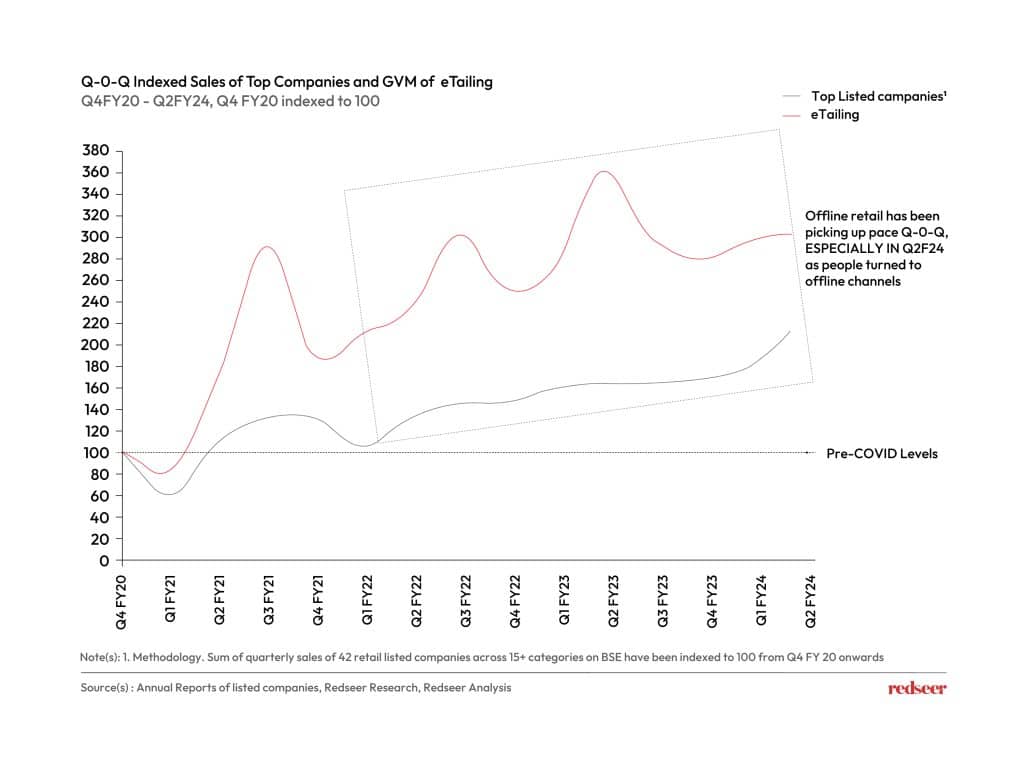

Retail sales have shown an uptick from Q1FY24, with offline channel outpacing eTailing

Though eTailing continues to grow quarter-on-quarter, offline retail consumption can be seen closing the gap with a considerable uptick in Q2FY24 as people turned to the traditional channels.

Future eCommerce spending sentiment dips since July’23 (ECCI 131), but remains in the optimistic zone with a ECCI of 127

After a robust ECCI in July ’23, indicated an anticipated upswing in eCommerce sales during the festive season, the post-festive cool-off period still maintains a positive sentiment, albeit slightly subdued with an ECCI of 127. Some of this moderation is also attributed to emerging headwinds, including a decline in eCommerce Net Promoter Score (NPS), the nearing saturation of various categories, and a gradual deceleration in the adoption of new users.

The future eCommerce spending sentiment declines, with Fashion, Food delivery, and Grocery modestly driving growth for the next 4 months

Benefiting from the unmatched convenience of home delivery for food and groceries, it comes as no surprise that these categories take the lead in shaping the landscape of future eCommerce spending. Next level analysis of data threw up a noteworthy observation that the middle-income consumer cohort, earning between 5-10 LPA, exhibits the highest inclination towards increasing eCommerce spends in the coming months.

New category adoption remains muted and unchanged since July’23, with only a few consumers willing to explore new categories

As eCommerce continues to mature, a discernible trend emerges wherein most consumers display persistent preference to purchase only specific categories through online channels while opting for offline purchases in others. In this, Beauty and Personal Care, Home and Furniture, and Electronics emerge as the leading categories consumers are keen on trying.

eCommerce NPS declined compared to July’23 as consumers faced the impact of profitability initiative by key players

Ecommerce players are strategically shifting their focus to pursue a path to profitability, as evidenced by the introduction of platform fees, an uptick in delivery fees, dynamic commissions charged to sellers, and a reduction in festive discounts and offers. This shift has notably impacted the lower-income consumer cohort, resulting in a modest decline in the overall Net Promoter Score (NPS).

While most consumers lean towards aggregator platforms, D2C is gaining ground, particularly in Health, Home, and BPC categories

As brands continue to innovate their services and product offerings through the D2C channel, a discernible shift in consumer preference towards brand.com is underway. Notably, in the Home and Furniture category, features such as free installation by Ikea and a 100-day trial by Wakefit appear to be influential factors driving this trend.