General trade currently drives >90% of the ~USD 950 Bn Indian Retail market and it is largely fragmented in nature. The challenges of slow delivery service, inconsistent product quality, pricing opacity, lack of credit, and even frequent stockouts continue to affect procurement through traditional channels, rendering the process both expensive and cumbersome. The influx of eB2B platforms into the bustling ecosystem has enabled the bridging of many of these critical gaps through strategic brand partnerships, improved procurement processes, and the removal of intermediaries in the overall retail value chain.

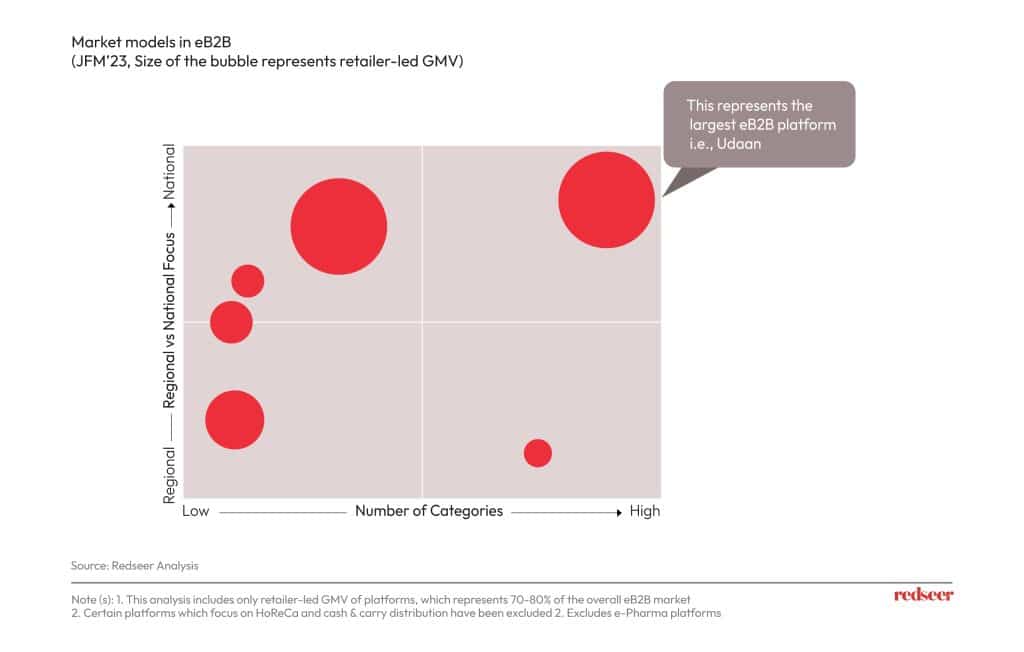

EB2B platforms can be broadly divided along the lines of geographical focus (regional vs national) and the number of categories they have a presence in. India currently has a few multicategory platforms with a national presence in segments like General Merchandise, Groceries (staples & FMCG), Accessories, and Electronics among others. The inventory model followed by these platforms effectively enables them to leverage staples to drive low-cost distribution penetration, increase the frequency of service in any location, and subsequently monetize the distribution chain through other non-staple categories. This invariably helps create the right gross margin to cost structure balance.

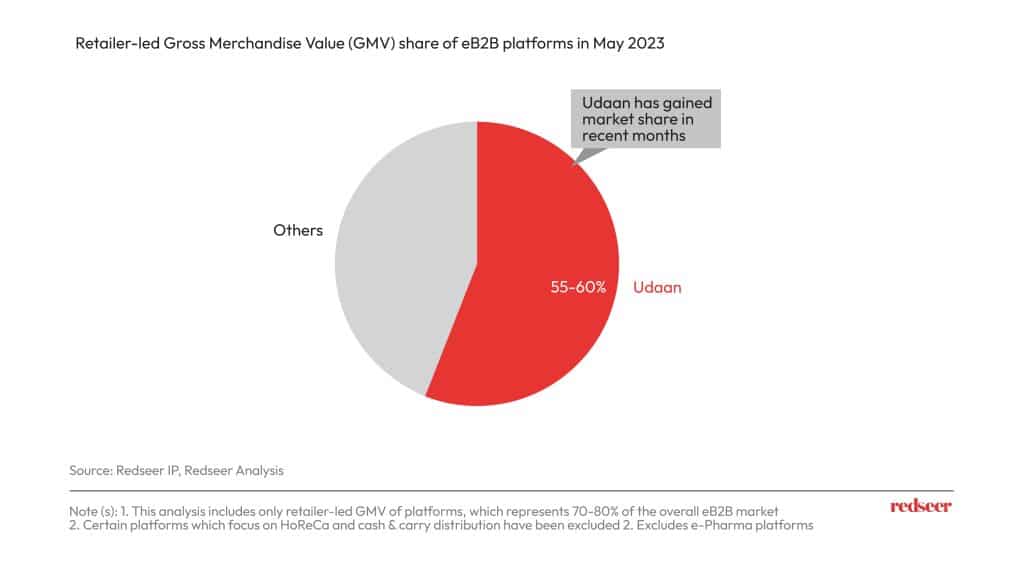

Multicategory eB2B’s increased their retail market share to 55-60% while vertical platforms tackled unit economics and macroeconomic challenges in 2023

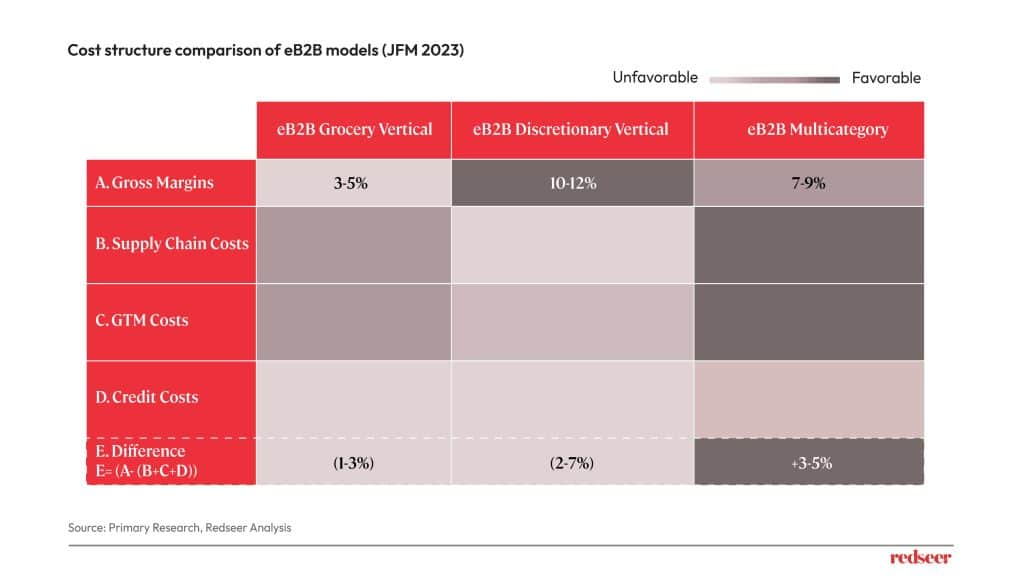

Over H1 2023, vertical platforms showed limited growth across categories as they navigated prevailing macroeconomic conditions and unit economics-related challenges. Multicategory eB2Bs, on the other hand, saw their share in the retail market increase substantially. Challenges in optimizing cost structures comprising of supply chain costs, go-to-market costs, and credit costs compelled many vertical eB2B platforms to scale down.

The multicategory approach enables supply chain, go-to-market (GTM) and credit cost optimization

Want to get strategic guidance?

Supply chain costs in the eB2B space are seen to exceed 8-10% of Gross Merchandise Value (GMV) and in turn contribute significantly to operating expenses. The multicategory approach can imbue the value chain with higher demand predictability and better utilization of the delivery fleet among other aspects. This is particularly beneficial for the grocery segment wherein higher order frequencies, lower gross margins, and higher fleet utilization often lead to suboptimal profitability. Discretionary products including Footwear and General Merchandise see lower tonnage and fleet utilization hike up supply chain costs.

Multicategory platforms allow for the optimization of GTM costs through the aggregation of Feet-on-Street (F0S) across multiple sub-categories in addition to leveraging the same technology and customer service. A multicategory First-Party (1P) model leads to higher collection efficiency enabled by better underwriting efficacy and lower collection costs as delivery agents help with collection.

EB2B offers the advantage of cross-leveraging staples over the eB2C model that focuses on cross-leveraging customers

Retailers across multiple categories face high volumes and often have specialized requirements that call for sophisticated multicategory eB2B platforms that help them maintain their competitive edge. Designing eB2Bs to cross-leverage capabilities and costs can usher in consistency in product quality, competitive pricing, product availability, and superior service.

Five components are required to create a stronger eB2B ecosystem such that capabilities can be effectively cross-leveraged:

- Strategic brand partnerships enabling Sourcing & Bulk Breaking.

- Efficient supply chain management built on cost-efficient warehouse and inventory management, distribution-led network architecture, and data-driven last-mile routing.

- Tech & Product capabilities specifically data-driven 1P platforms, Warehouse Management Software, and credit underwriting driven by high-quality transactional data.

- A Go-to-Market (GTM) comprising retailer partners with strong F0S networks.

- An ecosystem-wide mechanism for organized credit at lower interest rates.

The eB2B market in India is expected to grow to 100 bn by 2030, registering a 40-45% CAGR. Deepening retail penetration among retailers across categories and geographies and carving out a higher wallet share for eB2B platforms to reap the benefits of the multicategory approach will shape the growth of the sector as we look ahead.