As we step into 2025, the MENA region stands at the threshold of a digital transformation that promises to reshape its economic landscape. The convergence of technology, changing consumer behaviors, and robust digital infrastructure has set the stage for unprecedented growth in the digital sector.

We predict five major shifts that will characterize MENA’s digital transformation in 2025:

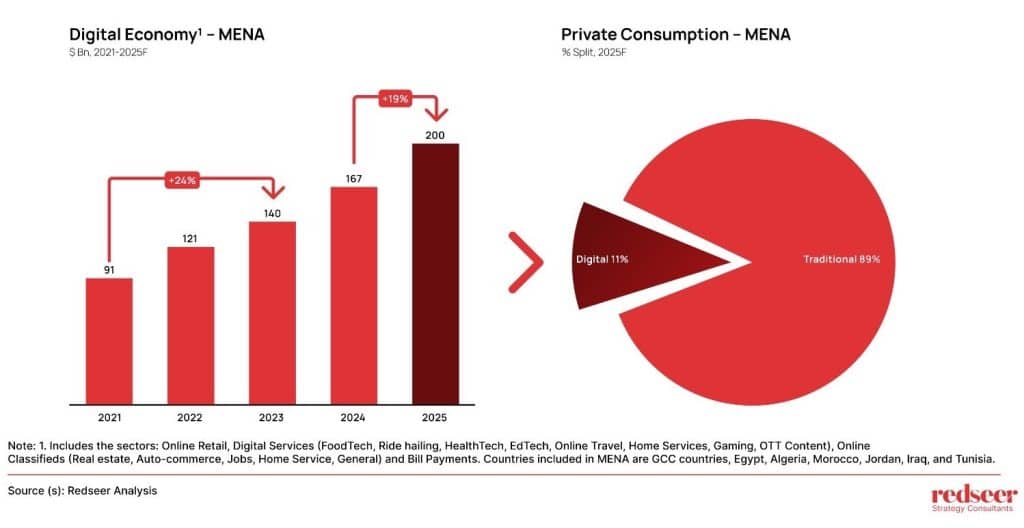

- The digital economy will achieve new scale, reaching $200 Bn and driving over 10% of private consumption

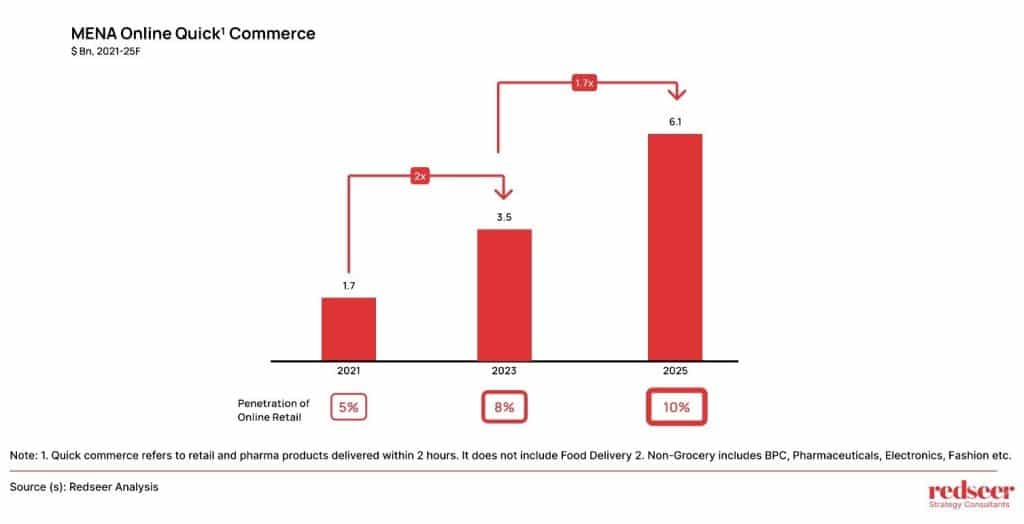

- Quick commerce will emerge as a $6 Bn market force, commanding more than 10% of online retail

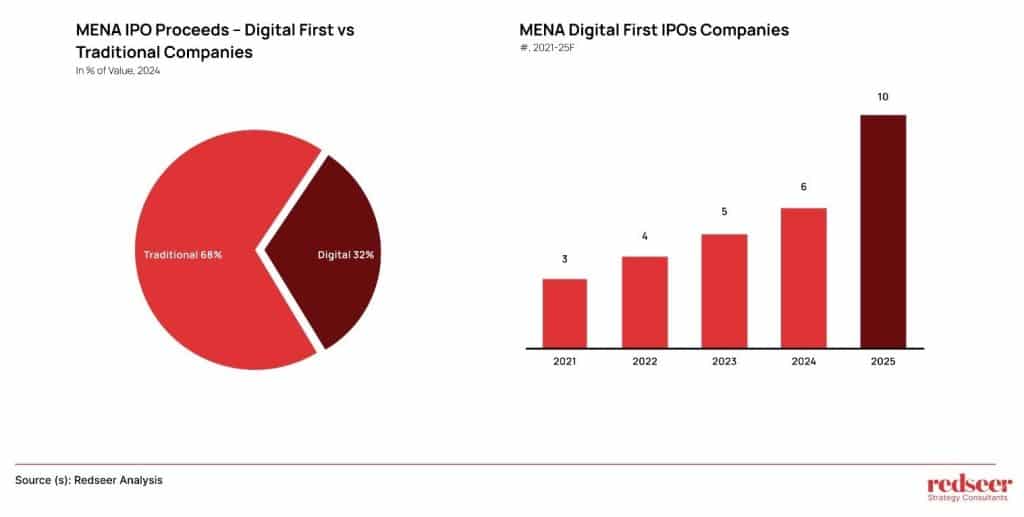

- Technology companies will drive record capital market activity, with 10 anticipated IPOs marking an all-time high

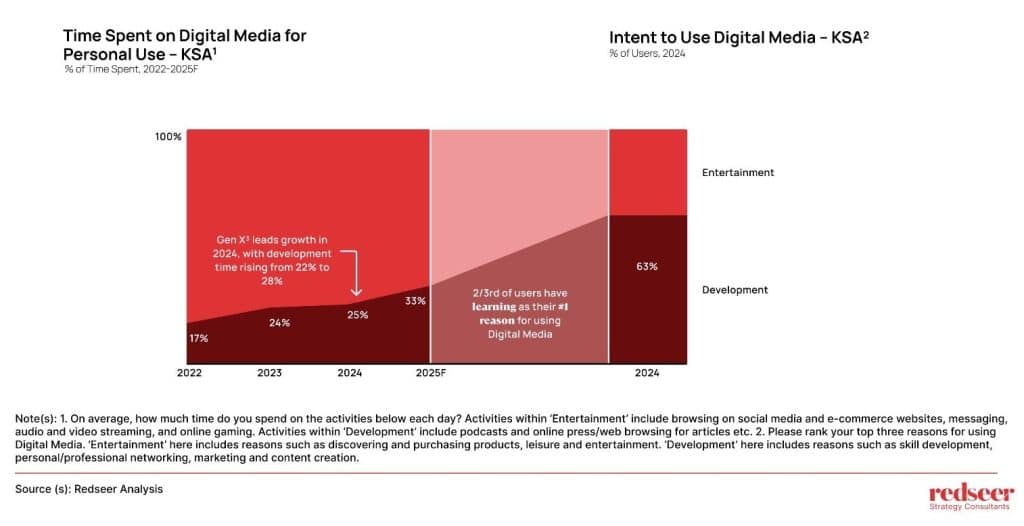

- Digital media consumption will pivot toward learning, moving beyond entertainment

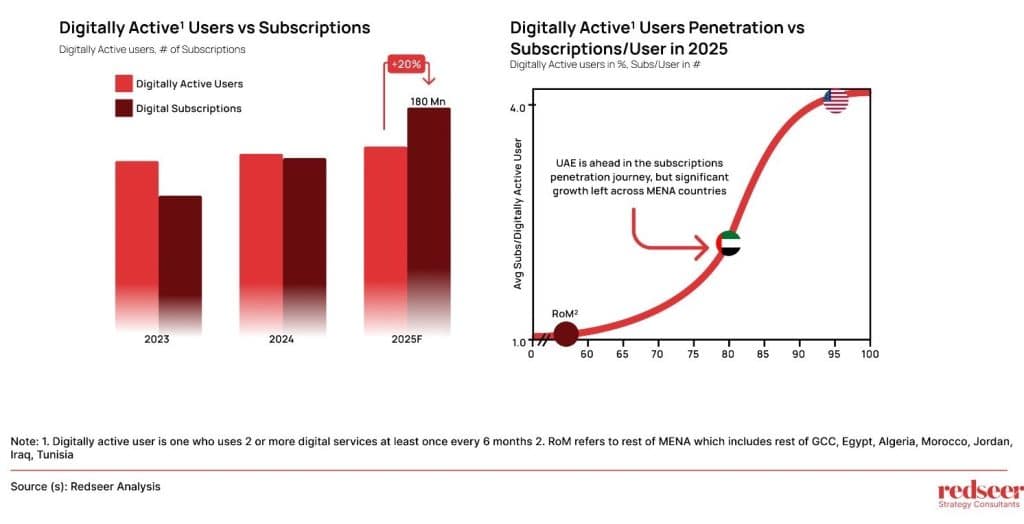

- Digital subscriptions will outpace active users, signaling deeper digital engagement across the region

Digital Economy to reach $200 Bn in 2025, driving >10% of private consumption

Want to evaluate new investment and M&A opportunities?

The MENA region’s digital economy has demonstrated remarkable resilience and growth, expanding steadily from $91 Bn in 2021. Our analysis indicates this momentum will accelerate, pushing the digital economy to $200 Bn by 2025—a compelling 19% increase from 2024. This expansion reflects a deeper transformation in consumer behavior, with digital channels set to drive more than 11% of private consumption across the region.

The impact of this digital transformation extends far beyond traditional e-commerce, across multiple sectors, including online retail, digital services, foodtech, ridehailing, healthtech, edtech, online travel, home services, gaming, OTT content, online classifieds, and various digital payment solutions.

Quick commerce to represent a $6 Bn opportunity in 2025, surpassing 10% of Online Retail

The Quick Commerce landscape in MENA has undergone a significant transformation. We estimate that this sector will represent a $6.1 Bn opportunity by 2025, with its share of online retail reaching 10%—up from 8% in 2023. This shift signals Quick Commerce’s evolution from a niche offering to a mainstream shopping channel.

Particularly noteworthy is the sector’s expansion beyond groceries. Categories such as Beauty and Personal Care, Pharma, Electronics, and Fashion will emerge as key battlegrounds, with rapid delivery becoming a crucial competitive advantage.

Tech to see increased deal activity – 10 IPOs expected an all-time high

Over the past three years, MENA has witnessed a significant surge in IPO activity, with 2022 and 2023 marking the peak, each hosting ~50 IPOs. A closer examination of the 2024 figures reveals a compelling shift: digital-first companies now account for 32% of IPO proceeds in MENA, buoyed by an increase in deal volume to six and several landmark listings.

Our IPO Readiness Index, which evaluates the preparedness of companies in the region for their public market debut, currently identifies over 25 digital-first companies on the cusp of listing. Of these, we anticipate that ~10 will go public in 2025, positioning the year as a breakthrough moment for tech IPOs in MENA.

Consumers to use digital media primarily for learning

The digital media landscape, particularly in KSA, reveals a fascinating evolution in consumer preferences. Our study shows users will dedicate 33% of their digital media time to learning by 2025—a dramatic increase from 17% in 2022. Gen X users lead this transformation, with 63% citing development as their primary motivation for engaging with digital media, compared to 37% who prioritize entertainment.

This shift reflects a broader cultural transformation in KSA, where digital media increasingly serves as a catalyst for personal and professional growth rather than mere entertainment.

- Subscriptions to surpass number of active digital users in MENA

MENA’s digital market is undergoing a structural shift, with platforms transitioning from rapid user acquisition to maximizing customer wallet share through subscriptions. With 200 million internet-connected individuals aged 13+, and 150 million actively using digital services, the region is poised for a subscription-driven growth era. Multi-vertical platforms like Careem and Noon lead the charge, leveraging diverse service portfolios to boost adoption. By 2025, digital subscriptions are projected to outnumber active users, marking a loyalty-focused growth phase.

The UAE leads this transformation, with digital penetration rates rivaling mature markets like the United States. Both markets demonstrate sophisticated consumption patterns, averaging 4 subscriptions per user. Meanwhile, the rest of MENA presents substantial growth potential, with digital active user penetration around 60% and lower subscription-to-user ratios. While free trials help onboard users, the real challenge lies in delivering sustained value to ensure retention, shaping the future digital champions of MENA.

As we approach 2025, MENA’s digital economy stands at an inflection point. The convergence of increasing digital adoption, maturing business models, and evolving consumer preferences creates fertile ground for transformative growth. This evolution represents more than a shift in consumption patterns—it signals a fundamental transformation in how people live, work, and engage with digital services. The MENA region is positioning itself as a significant digital economy, with implications that will resonate well beyond its geographical boundaries.