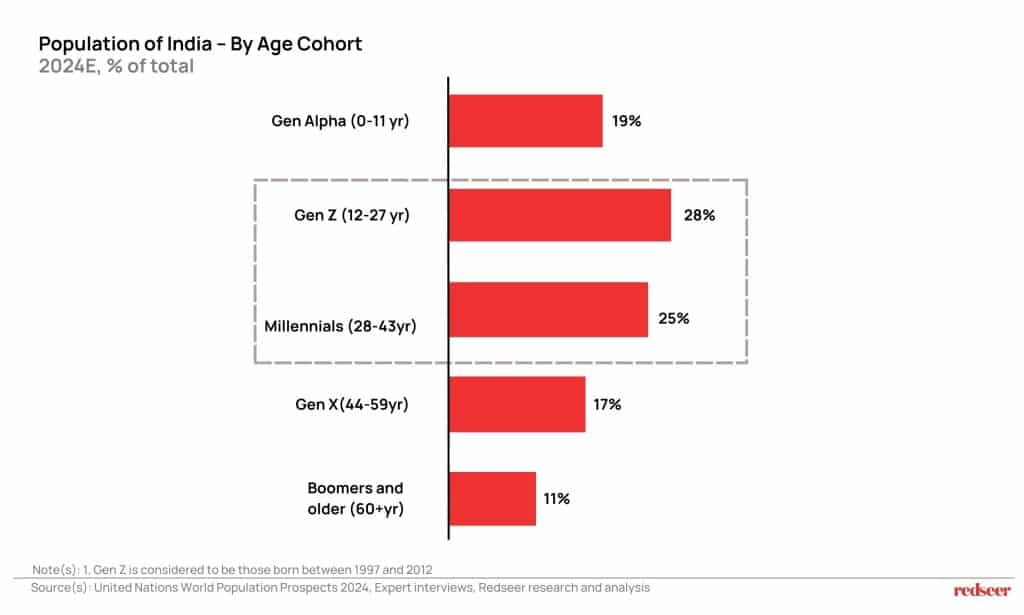

Still betting only on metros and celebrity endorsements? India’s next wave of beauty growth is elsewhere already. Two distinct but powerful segments are leading this change: Gen Z and the young millennials, and the non-metro consumer base. The way they discover products, what they value, how they make purchasing decisions, and where they shop is different from other cohorts. They are not only expanding the beauty pie but also redefining what beauty means in India.

Inside the Vanity Kits of Gen Z & Young Millennials

Have a question?

Our experts are just a click away.

Now, a swipe of tinted blush or a spritz of a lavender-infused mist isn’t just cosmetic for today’s Gen Z and millennial consumers. Beauty is a ritual—it has become a form of self-expression, a badge of identity, and for many, a source of joy. They are not just buying products—they’re buying the stories, values, and identities. And they’re doing it with both discernment and delight.

- Fast-paced, trend-first consumption: Virality and novelty drive decisions. They are drawn to brands with “instagrammable” packaging, limited-edition drops, bold product innovation, aesthetic campaigns, or experiential marketing. It’s not just about what is working, but the “wow” factor. Consider pop-up shops during campus fests or spring breaks. It’s about being seen, both online and offline.

- Peer recommendations trump celebrity endorsements: Micro-influencers, skincare YouTubers, and peers have a much higher influence compared to big celebs. Authenticity, relatability, and grassroots trust are the new currency.

- Beauty as status and self-care: Unlike generations before, young consumers today see beauty more as their wellness and personal care journey and a statement of their identity. Young consumers might skip a ₹200 kajal but willingly spend ₹3,000+ on a night cream that aligns with their personal goals.

- Value-first buying: This generation also connects with brands that stand for something bigger. Whether it’s vegan formulas, cruelty-free practices, sustainability commitments, or a clear social cause, the vision behind the brand is something that acts as a key purchase driver.

- Fragrances– Fragrances are worn not just to smell good, but to feel good—to uplift, to express, to stand out. Gen Z prefers kits and minis that allow layering and experimentation—think “summer-coolers in a bottle.”

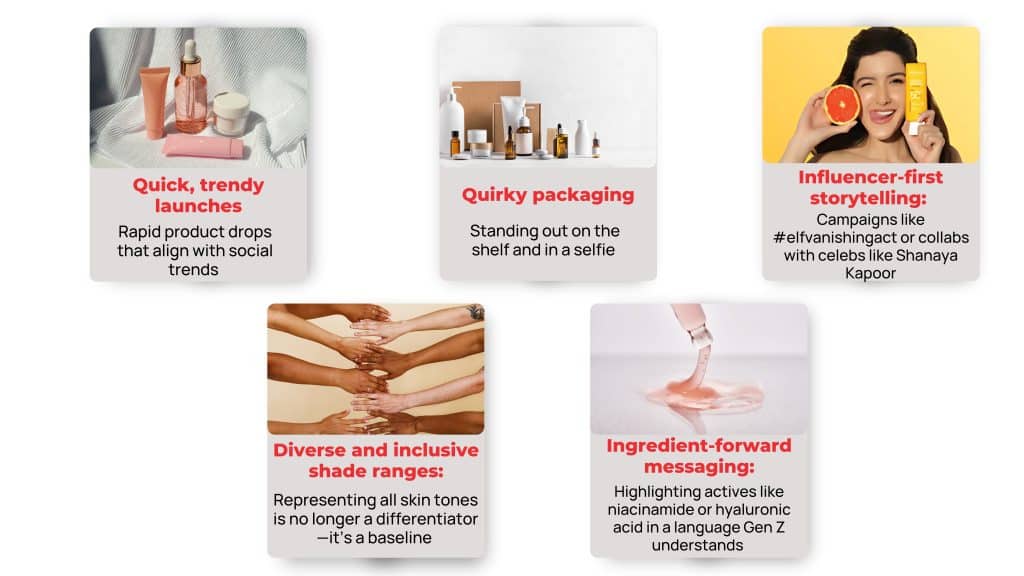

Brands are evolving to meet these expectations through:

Even legacy brands are evolving. They’re moving away from traditional, top-down messaging and embracing ingredient-forward, Gen Z-centric narratives. They’re swapping top-down ads for ingredient-led narratives, embracing Gen Z’s values around inclusivity, sustainability, and authenticity. Examples include Lakmé’s Xtraordin-Airy Lip-Eye-Cheek Tint, or Kiehl’s shift from apothecary roots to modern sustainability.

Beyond the Metros: The Next Beauty Boom

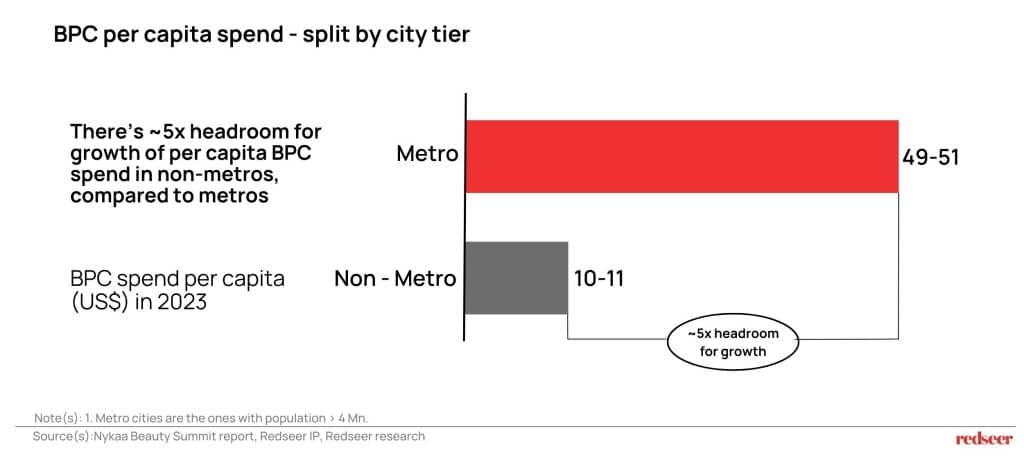

Cities beyond metros are setting a new pace in beauty. Rising incomes, digital access, and aspirational lifestyles are fuelling this shift and closing the gap with metros in preferences, awareness, and spending power becoming more aligned. A consumer sitting in Indore or Kochi is now as trend-aware and aspirational as her counterpart in Mumbai or Delhi. With influencers, makeup artists, dermatologists, and global trends now just a scroll away, the digital revolution has made beauty inspiration accessible to everyone. Global trends, K-beauty routines, ingredient education, and viral formats are now available across the country. Here’s what’s driving the non-metro beauty boom:

- 5x headroom for growth: Nearly 80% of the growth in middle and high-income households over the next 5 years is expected to come from non-metro cities. This surge in affluence is driving up discretionary spending, yet beauty spend per capita still remains 5x lower in non-metros vis-à-vis metros, indicating massive untapped potential for brands that can crack the right product-market fit.

- Omnichannel Access: Leading brands’ revenue share from non-metros is rising as the customers are both ready and willing to engage. Offline access is also expanding here through general stores, supermarkets, malls, and a growing store footprint.

- Localized, Entry-Level Innovation: Entry-level SKUs—minis, kajals, hydration sticks—are helping first-time users explore beauty in relatable formats. Regional influencers play a big role in making these aspirational yet accessible.

- Aspirations are converging: Affordable data and global content access like K-beauty routines, ingredient education, and viral formats have made non-metro consumers just as trend-driven and experimental as their metro counterparts.

Winning in this landscape requires going beyond national campaigns and one-size-fits-all playbooks—brands need regional insight, tailored formats, and hyperlocal relevance.

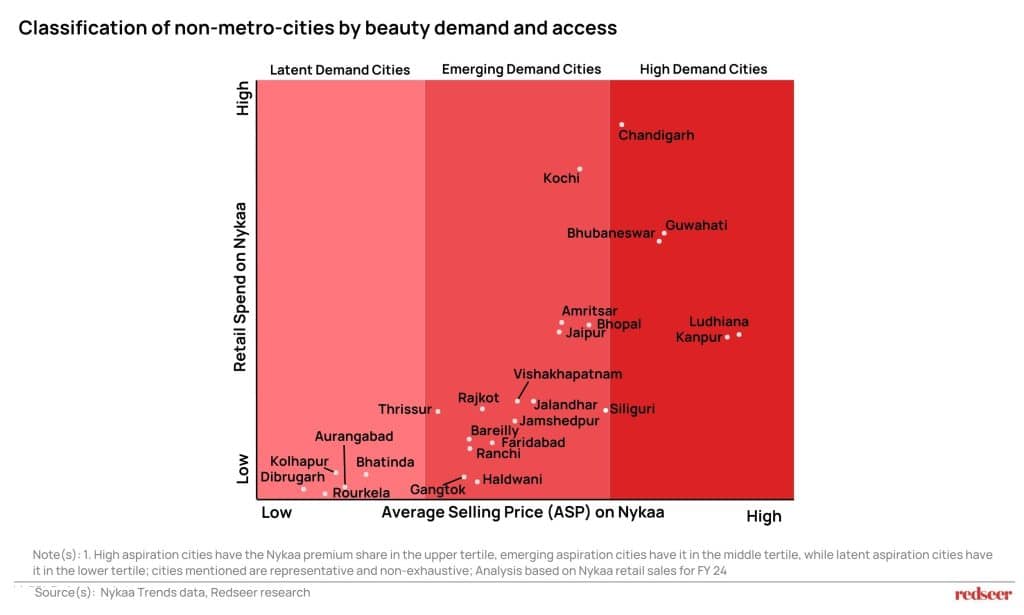

This non-metro beauty landscape is far more nuanced than a simple “Tier 2+” classification. A closer look reveals a three-tiered aspiration pyramid, each with distinct consumer behaviour and retail dynamics.

High Aspiration Cities: Commercial hubs like Surat, Ludhiana, and Bhubaneswar have thriving industries like textiles, trading, and manufacturing, creating high discretionary income pockets. As consumers show a spending propensity on par with metros. These cities behave like metro extensions—ripe for premium products, influencer activations, and omnichannel distribution.

Emerging Aspiration Cities: As new business hubs and urbanization is driving growth in non-metros, they are nurturing a mid-level to upper-mid-level income groups with increasing beauty and personal care needs and adoption. While the overall retail base may be smaller, their spending propensity mirrors metro trends, signalling readiness for aspirational offerings and entry-level premium brands. Cities like Ranchi, Faridabad, and Rajkot are a few examples of this category.

Latent Aspiration Cities: Cities like Rourkela, Gangtok, Bhatind,a Dibrugarh may currently see moderate economic activity and early-stage beauty adoption. However, these represent the next growth frontier. With increasing digital access and content consumption, there is potential for future scale.

Redseer Perspective

Beauty brands that will remain relevant among the new evolving audiences are those that will keep the following points when building future strategies

- Spot Trends Early, Launch Fast: Keep product pipelines agile and aligned with fast-moving beauty trends.

- Beauty Aspirations Are Borderless: Win hearts in high-aspiration Tier 2 and 3 cities where beauty dreams are booming.

- Influence with authenticity: Build influencer squads that reflect real users, real voices, real impact.

- Make beauty for everybody: Bake inclusivity into every formula, price point, and shelf space.

- People Don’t Just Buy Products—They Buy Beliefs: Share your purpose boldly—because today’s consumers buy into brands that stand for something.

To understand more about the BPC market and our insights, check out our detailed report