India’s Once-in-a-Generation Growth Window

We solve the strategy behind scale!

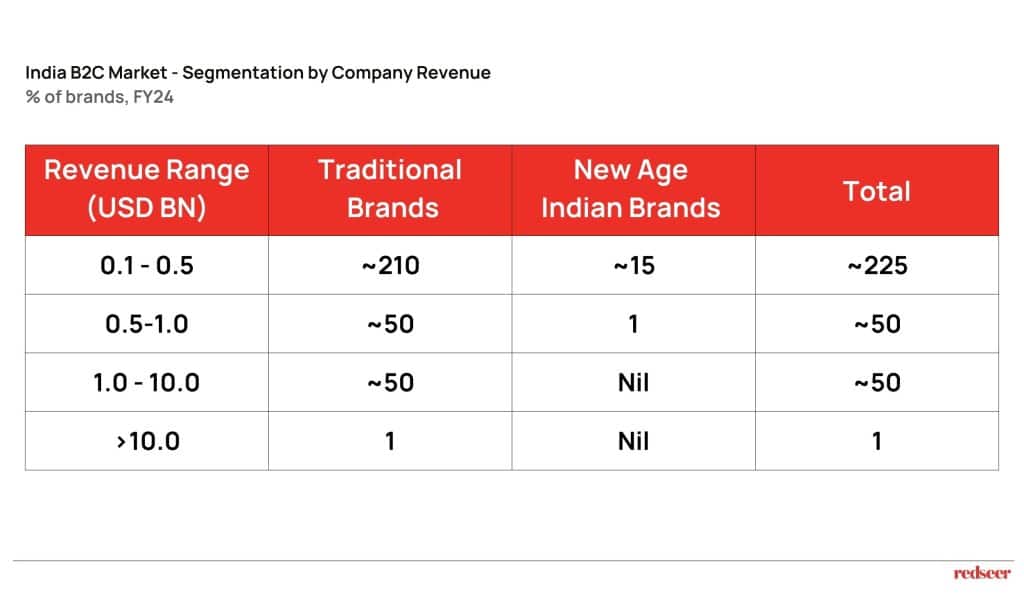

India, despite being one of the world’s largest and most dynamic markets, is home to just ~350 consumer brands – both traditional and new-age – with revenues over $100 Mn. In contrast, China boasts ~2,800 such brands (8x more), while US consumer spend per capita is 23x higher. The gap isn’t just stark; it signals a massive whitespace in India’s B2C brand ecosystem.

But this is changing.

This disparity is poised to narrow as India’s economic indicators signal a shift. The nation’s GDP per capita has recently surpassed the $2,000 threshold, a critical inflection point historically associated with accelerated discretionary spending. For instance, when China crossed this benchmark in 2006, it experienced a substantial surge in consumption growth in the subsequent years.

India’s trajectory suggests a similar pattern. With a burgeoning middle class and increasing disposable incomes, the demand for diverse and premium consumer products is expected to rise. In a landscape where over 200 traditional brands operate below the $0.5 Bn mark, and new-age Indian players are just beginning to emerge, the runway for breakout success stories is vast — and wide open.

Opportunity Areas of National Brand Creation

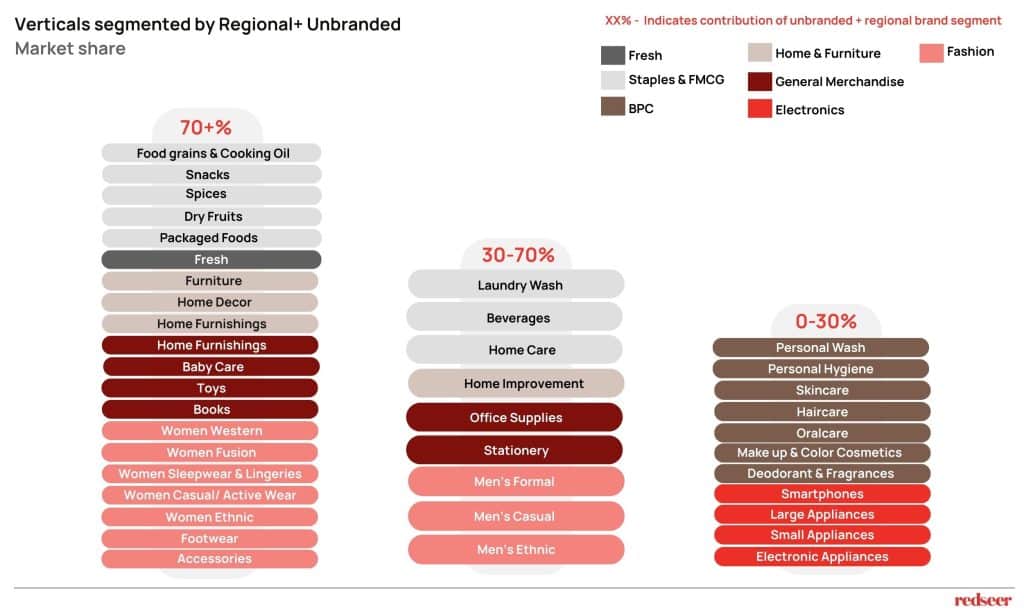

India presents multiple opportunities for creating national brands, particularly in categories with high unbranded market share. Sectors such as fresh, staples, FMCG, jewellery, fashion, home & furniture remain dominated by regional and unbranded products, accounting for over 70% of the market share.

Organised channels are rapidly growing across these categories, creating significant opportunities for national brands to scale and capture market demand, especially as consumer aspirations rise and preferences shift towards branded offerings.

Organised Channels Are Redefining Market Access for High-Aspiration Categories

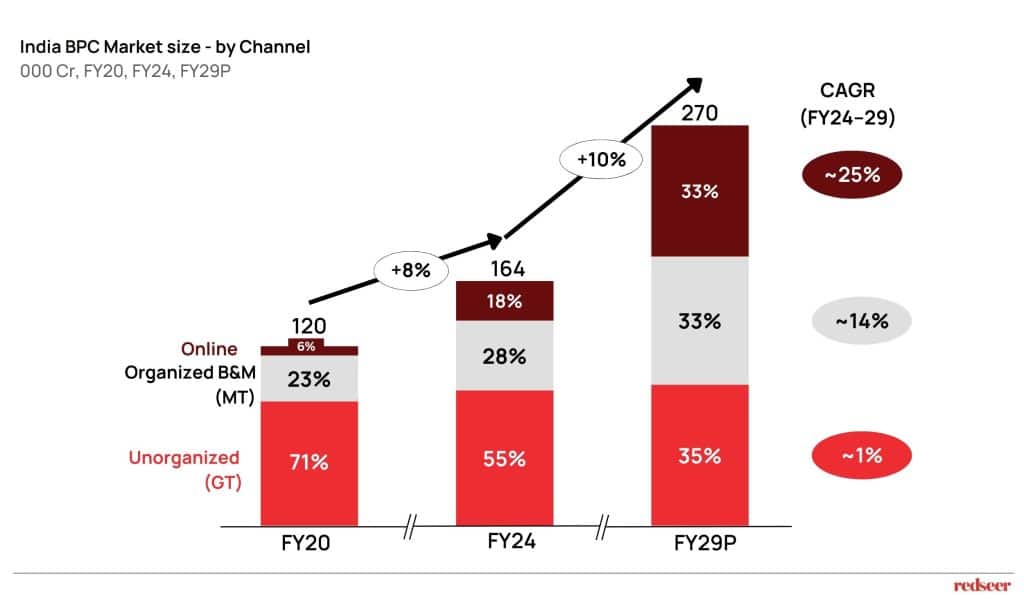

The growing share of organised channels across categories is expanding opportunities for national-level brand creation and rapid scaling. We can observe this trend in the Beauty & Personal Care (BPC) segment, where only ~30% of revenue was generated from organised channels in FY20. This has since increased to ~45% in FY24 and is expected to further increase to ~65% by FY29P. The increasing penetration of online shopping, further augmented by the growth of quick commerce, has accelerated this change.

Additionally, the rise of multibrand B&M giants such as Shoppers Stop, Lifestyle, and Smart Bazaar, along with the expansion of single-brand store networks, has provided customers with more options, especially those who prefer to touch, feel, and see products before buying.

Driven by this rapid upscale of organised channels, the BPC sector has seen the emergence of multiple national brands scaling to millions of dollars of revenue in a relatively short period of time.

Cracking the Code: How New-Age Brands Are Winning in White Spaces

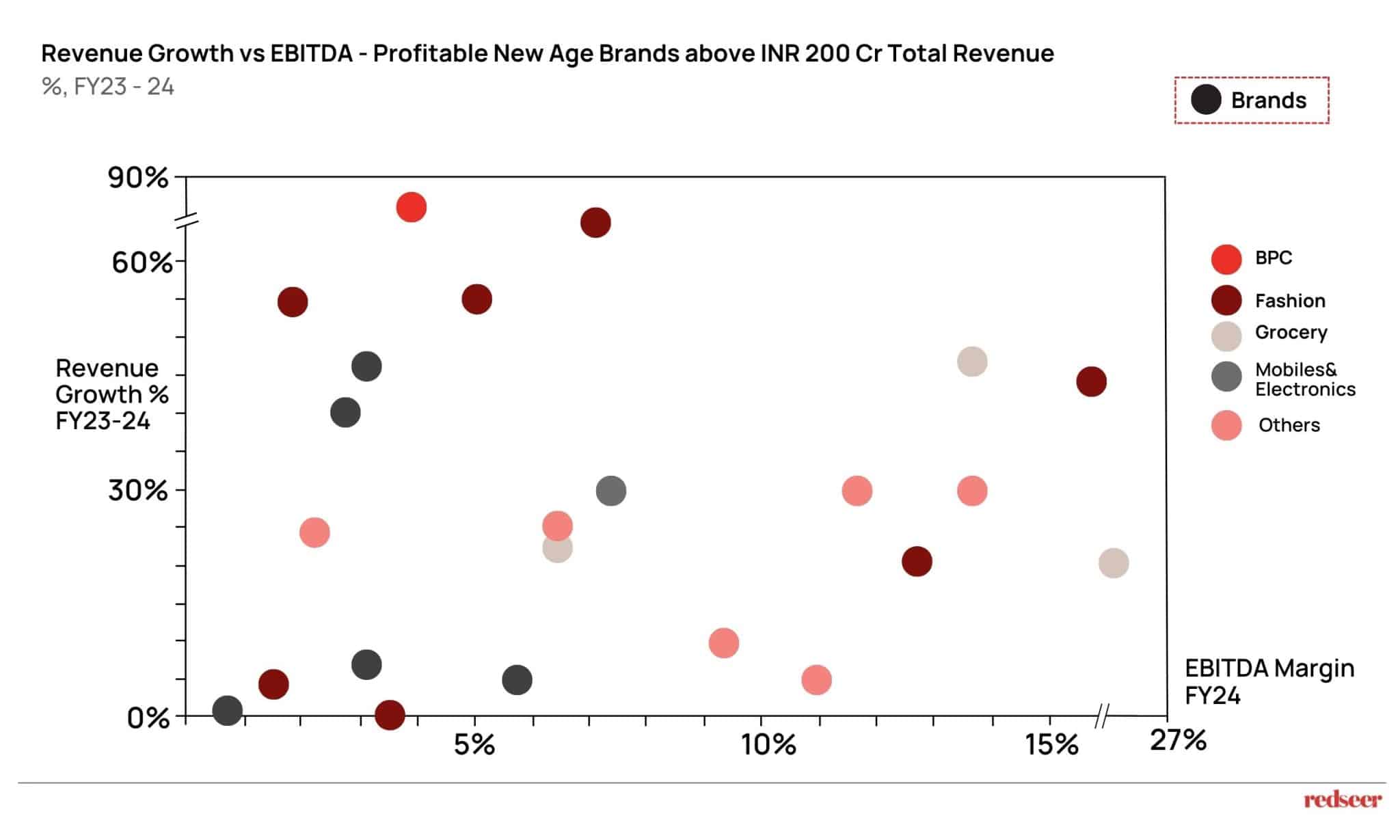

New age brands are solving for the market whitespaces and building the playbook around how to serve India’s growing brand needs. Already, 23 new age brands have crossed INR 200 Cr (>$24 Mn) revenue mark, all while being EBITDA profitable and maintaining strong year-on-year growth. Their edge? The ability to anticipate shifts, quickly adapt to the rapidly transforming consumer needs, and harness tech to scale with precision has led to this trend.

This trend shows that the right mix of ingredients to scale the next wave of new age brands is already in place. Given their sustainable scaling journey so far, many of these brands are well positioned to grow much large and exceed the coveted $100 Mn revenue market in the near future, creating large national and even international brands in the process.

What will define the new consumer brand playbook for India?

- Where do the biggest whitespace opportunities lie — across categories, markets, and consumer segments?

- Which scale and monetisation models will be adopted by new-age consumer brands?

- How will brands unlock their next $ 100 Bn – $ Trillion growth opportunity?

- What role will organised retail and the digital-first model play?

- How will innovation-led brands shape the future of India’s consumer landscape?

All this and more will be revealed in our upcoming report – “3M (Macro, Model, Market)”, releasing in May.

Be the first to access these breakthrough insights.

Whether you’re looking to accelerate ahead of your competition or maximize returns on your investments, connect with our expert, Mrigank, today.