Quick delivery may have started as a niche, but it’s quickly becoming the norm.

Food was the first category to go quickly, and it worked. UAE consumers embraced the ease of ordering meals from home, fueling the rise of unicorns like Talabat and strong, fast-scaling players like Noon and Careem (the region’s “Rhinos”). Then came groceries. Now, retail—from pharmacy to fashion—is being delivered within minutes, all through the same ecosystem.

We solve the strategy behind scale!

What does this shift mean?

- The market opportunity has increased multifold.

- Quick Retail is no longer just an add-on—it’s expected to surpass the food aggregator market in the UAE by 2030.

By building existing infrastructure and adding innovative service extensions, Q-commerce platforms are evolving fast, meeting changing consumer expectations while unlocking new revenue streams.

Read on to see how this shift is playing out.

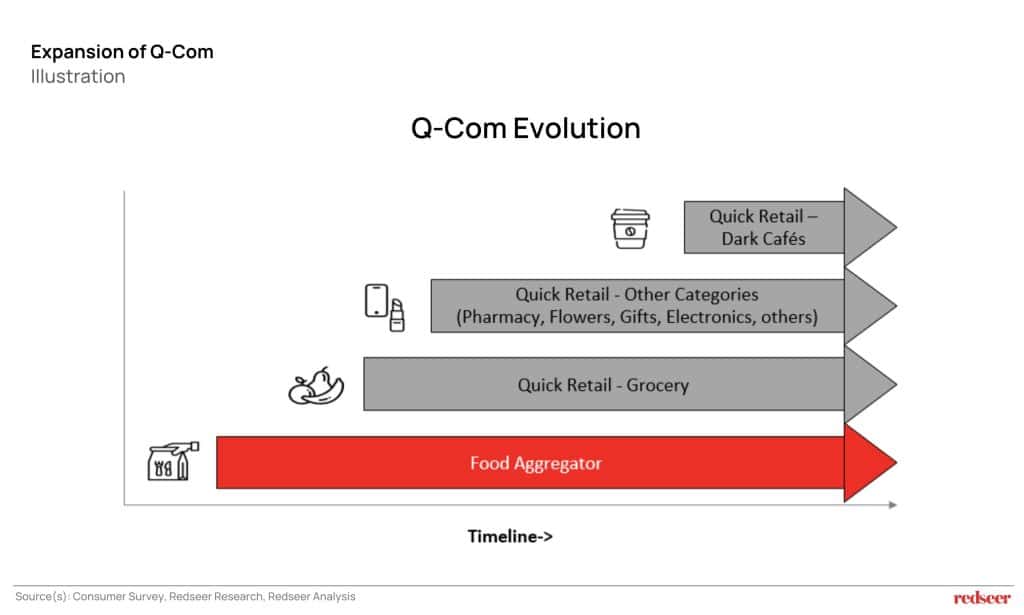

Q-commerce market is evolving beyond food delivery into quick groceries and quick retail

Q-commerce in the region began with food delivery. As platforms developed dense delivery networks and micro-fulfillment infrastructure, quick grocery delivery came as the next logical evolution, driving increased adoption and deeper consumer engagement. This was followed by a move into other retail categories like pharmacy, flowers, electronics, beauty, and personal care. More recently, the emergence of hybrid models like dark cafés, which blend fast food and grocery offerings, exemplifies the evolving landscape.

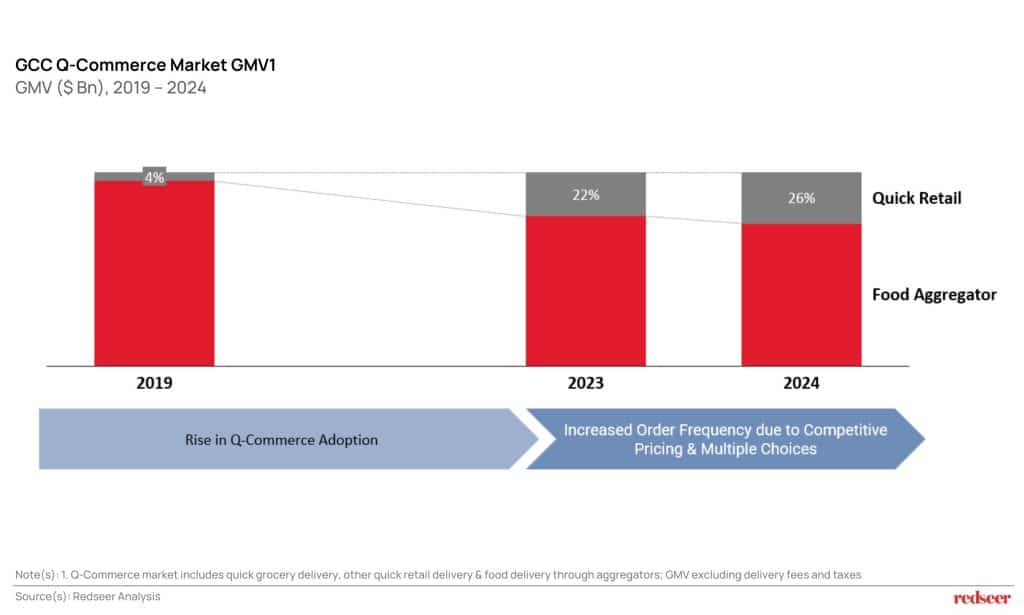

Quick Retail share has increased significantly from <5% in 2019 to 40-45% of the total market in 2024

In 2019, Quick Retail contributed <10% of the GMV of the UAE Q-commerce market. Today, it accounts for approximately 40–45% of the total Q-commerce market. This shift has been driven by an evolution in consumer behavior, closely intertwined with platform-led innovations. As players expanded their SKU offerings across categories such as pharmacy, beauty, electronics, and fashion, consumers responded with increased order frequency and broader cross-category engagement. This had increased the market opportunity multifold.

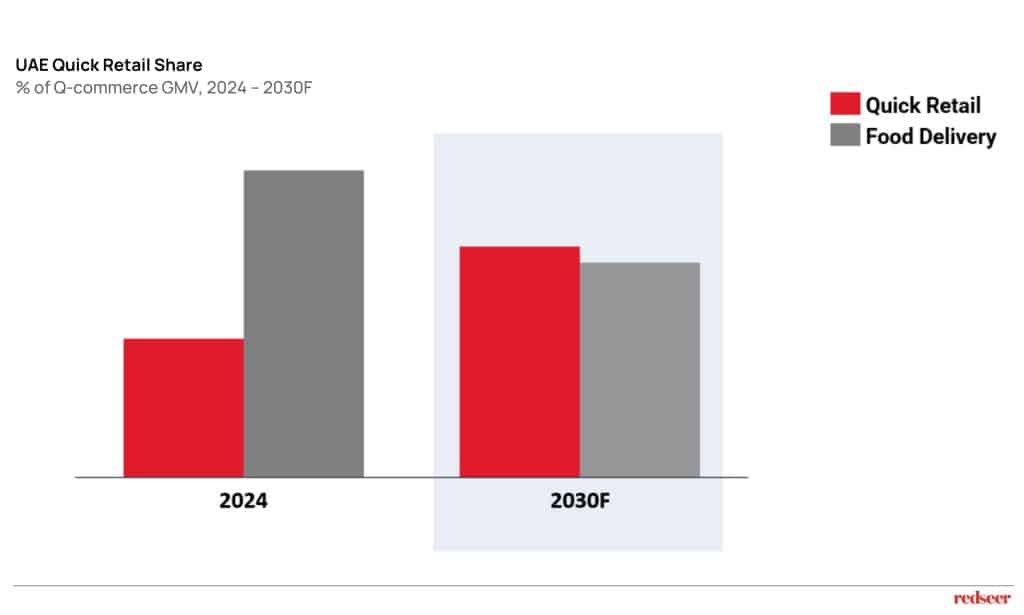

In UAE, Quick Retail is expected to surpass food aggregators by 2030F

The shift is already underway. By 2030, Quick Retail is expected to surpass food aggregators in the UAE. Global examples like Zepto Cafes in India and Meituan’s 30-minute retail delivery in China show what’s possible. Locally, platforms are following suit, blending categories to increase retention and building all-in-one ecosystems.

The rapid evolution of Q-commerce in the UAE signals a profound shift in consumer expectations and market dynamics. What began with food delivery is now an expansive ecosystem that includes groceries, retail, and beyond. Quick Retail is poised to surpass food aggregators by 2030, driven by a convergence of infrastructure advancements and consumer demand. As platforms continue to innovate and diversify their offerings, the Q-commerce landscape will only grow more integrated, meeting the needs of consumers and unlocking new revenue streams in the process.

“Quick” is no longer just about food—it’s about fulfilling any need, instantly.