Saudi Arabia’s financial sector is undergoing a transformation, with digital lending emerging as a key enabler of growth. Fintech-driven solutions are bridging the credit gap by offering faster, more accessible financing tailored to SME needs. With increasing regulatory support and continued fintech innovation, digital lending is empowering SMEs, fostering entrepreneurship, and driving economic expansion.

In this article, we explore four key aspects of KSA’s SME Digital lending market and its potential to unlock economic growth.

- Saudi Arabia’s credit need is underserved

- This is more pronounced for SMEs

- Multiple digital players have emerged to solve this need

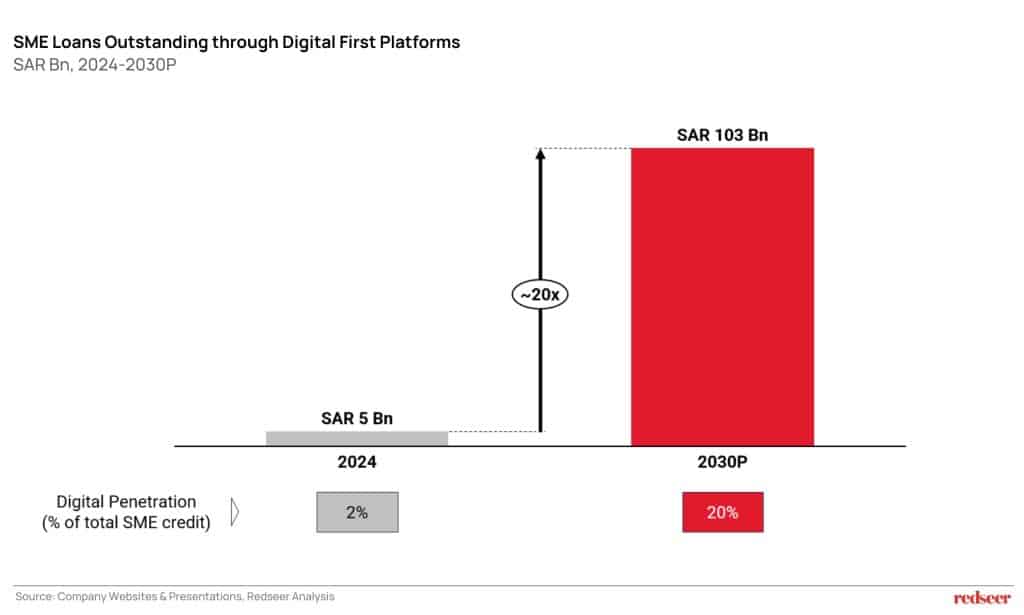

- Digital Lending could reach SAR 103 Bn in 2030, representing 20% of total SME credit outstanding

Want to evaluate new investment and M&A opportunities?

Read on to see how this shift is playing out.

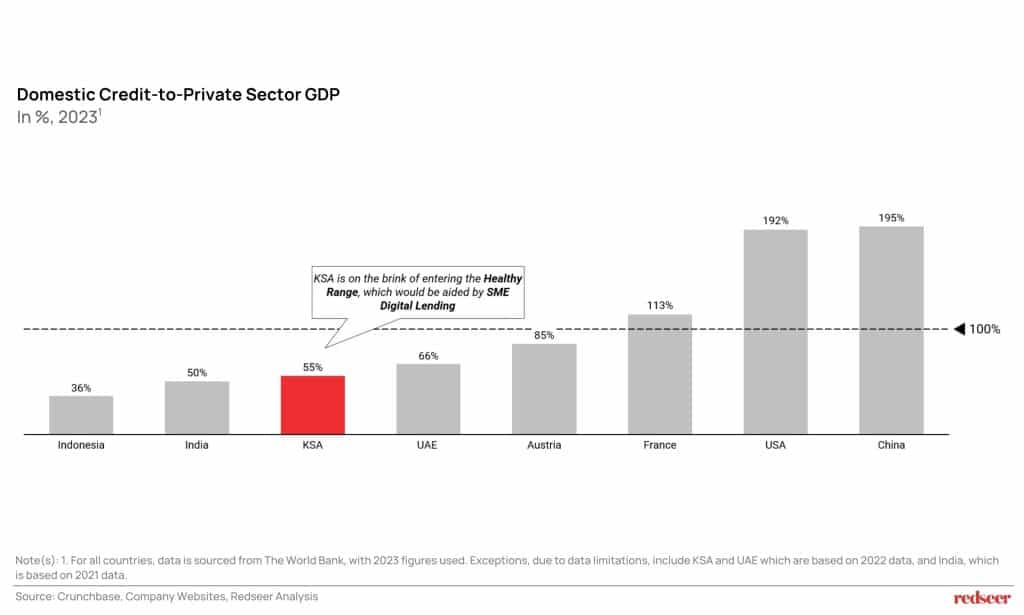

Saudi Arabia’s credit need is underserved

Saudi Arabia’s credit market has historically been underdeveloped, with limited access to financing, particularly for SMEs. In contrast, more mature credit markets benefit from higher private sector lending, which drives business expansion and economic growth. While excessive borrowing can pose risks in some economies, a well-balanced credit environment fosters entrepreneurship and investment.

Over the years, credit access in Saudi Arabia has been steadily improving, driven by ongoing financial sector reforms and the rise of digital lending. Fintech solutions are playing a pivotal role in bridging the credit gap by expanding financing opportunities for SMEs, startups, and individuals.

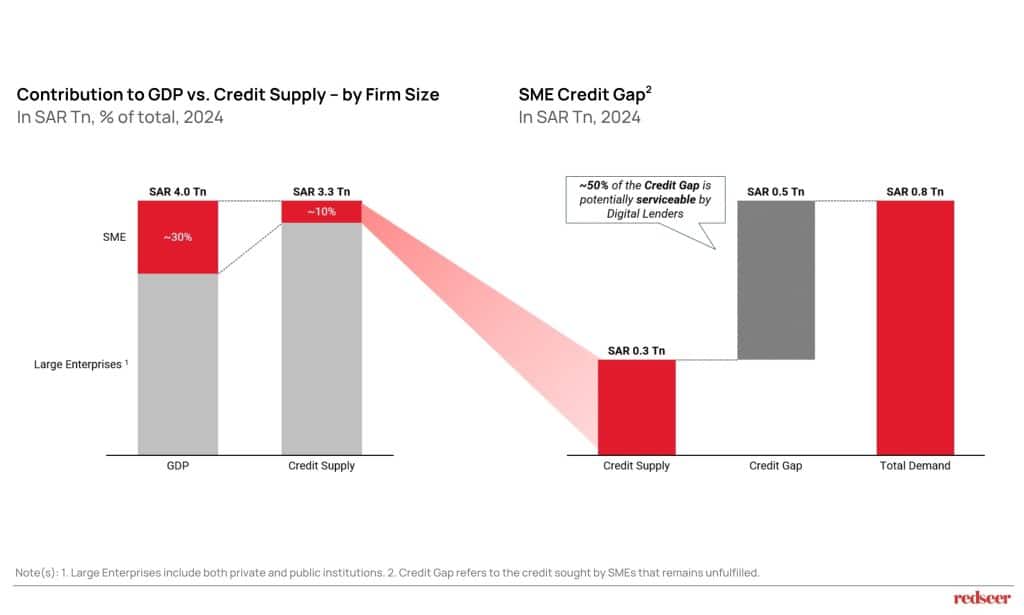

This is more pronounced for SMEs

Small and medium enterprises (SMEs) play a crucial role in Saudi Arabia’s economy, contributing ~30% of GDP. However, they face severe credit constraints, receiving only ~10% of total credit supply. This financing gap, estimated at SAR 0.5 trillion, limits their ability to expand, invest, and create jobs, ultimately slowing economic growth. Traditional banks tend to favour large enterprises, leaving SMEs struggling to secure the funding they need for working capital and long-term investment.

Multiple digital players have emerged who are solutioning for this need

To address the SME financing gap, digital-first lenders in Saudi Arabia are expanding rapidly, leveraging diverse funding models to enhance credit accessibility. By integrating technology-driven solutions, these platforms provide tailored financing options that support business growth and economic development.

With innovative approaches to credit assessment and alternative lending, these companies are reshaping the financial landscape, offering businesses greater flexibility and access to capital.

SME Digital Lending could reach SAR 103 Bn in 2030, representing 20% of total SME credit outstanding

Saudi Arabia’s Vision 2030 has created a thriving fintech ecosystem, with progressive regulations and strong government support driving growth. Fintech lenders are transforming SME financing through data-driven risk assessment, alternative credit scoring, and seamless integrations with e-commerce and POS systems.

Backed by bank and investor partnerships, these lenders are scaling rapidly to meet the rising demand for faster, more flexible financing. By 2030, digitally enabled alternative lending has the potential to power over 20% of SME credit, fuelling growth and economic diversification.