While global IPO markets collapsed by 75% in value since 2021’s peak, the MENA region has emerged as a notable outlier, maintaining momentum and actually increasing its market share during a period of widespread decline. This resilience tells a story of strategic market positioning, regulatory innovation, and the power of mega-deals in volatile times.

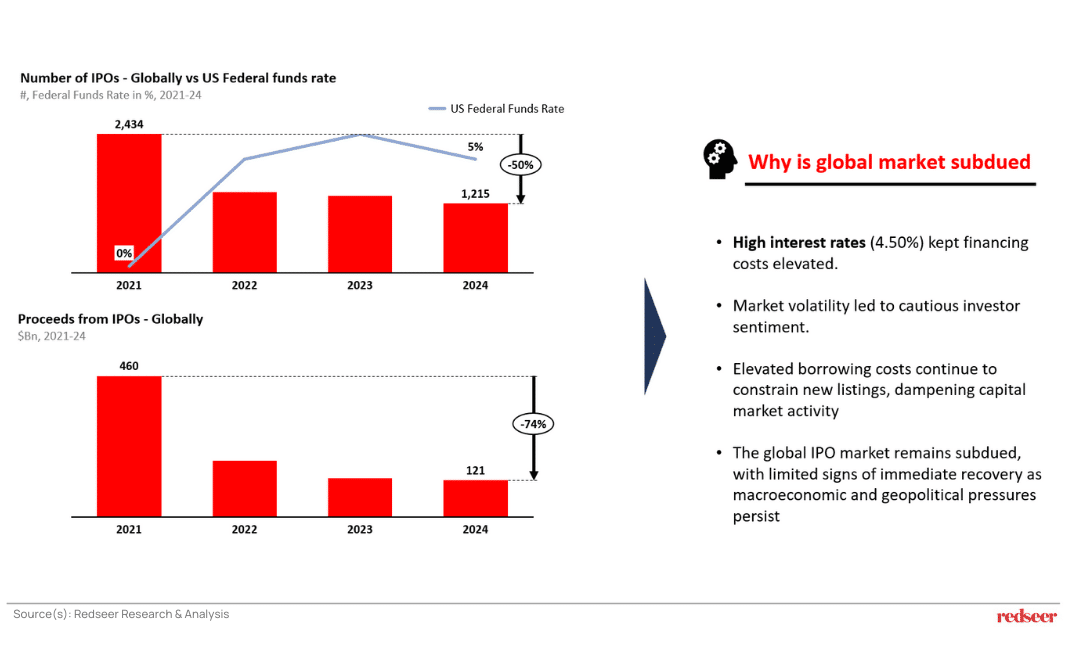

1. While the global IPO market remained subdued in 2024…

Global IPO activity has halved in volume and dropped nearly 75% in value proceeds plummeting from $460 billion since 2021 to $121 billion in 2024. This decline wasn’t random. High interest rates at 4.50% fundamentally altered the risk-return calculus for public markets, making debt financing expensive and equity markets less attractive. Market volatility created cautious investor sentiment, while elevated borrowing costs constrained new listings and dampened overall capital market activity. The result was a subdued IPO environment with limited signs of immediate recovery as macroeconomic and geopolitical pressures persisted. Equity markets have grown more selective, with fewer growth-stage companies attempting to go public and institutional investors seeking profitability over promise.

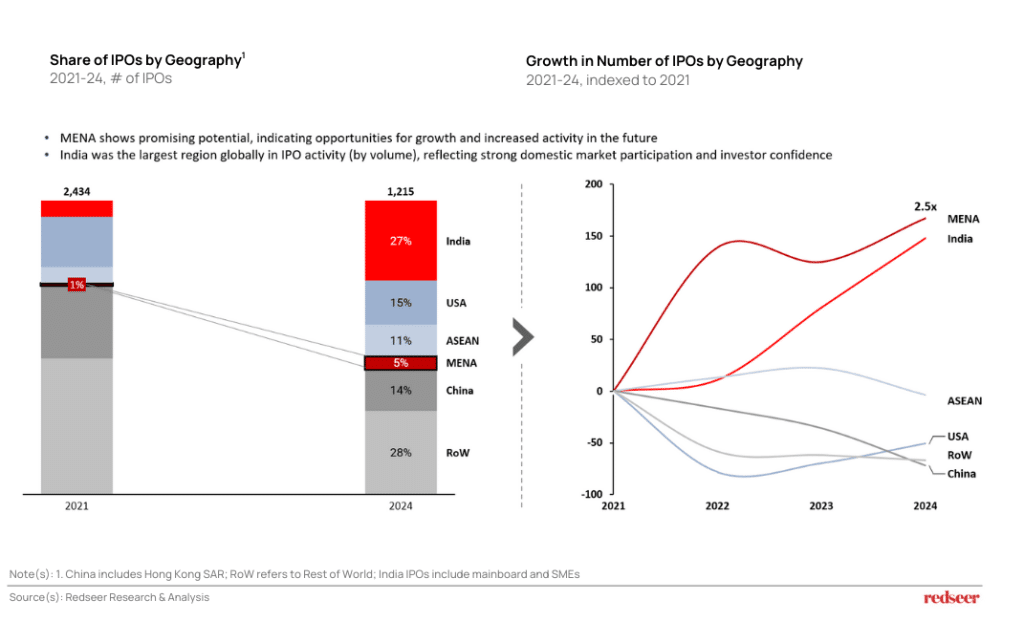

2. …MENA maintained momentum, now contributing 5% to Global IPO volumes…

In stark contrast to global trends, the MENA region has maintained strong IPO momentum. The region showed a 2.5x increase in IPO activity from 2021 to 2024, even as traditionally dominant markets like the USA, China, and ASEAN experienced significant declines. While representing just 5% of global IPO volume in 2024, MENA actually grew its relative importance in the market, demonstrating sustained growth through multiple market cycles rather than temporary resilience.

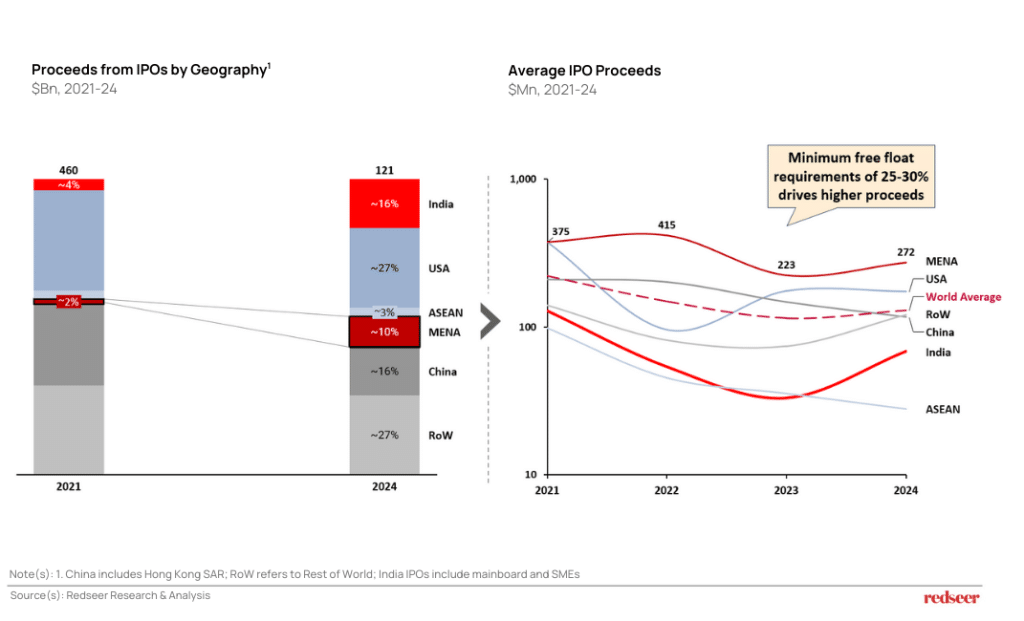

3. …and an outsized 10% to value, owing to higher average proceeds

MENA’s real differentiation becomes clear when examining deal economics. While accounting for approximately 5% of global IPO volume, the region captures roughly 10% of global IPO proceeds due to significantly higher average deal sizes. MENA’s average IPO proceeds reached $272 million in 2024, substantially higher than the global average, driven by mega-deals and minimum free float requirements of 25-30%. These regulatory requirements have become competitive advantages, forcing companies to go public at scale and creating more substantial, liquid markets.

The MENA IPO story from 2021-2024 ultimately demonstrates how well-structured markets with appropriate regulatory frameworks can thrive even during periods of global financial stress. The region’s ability to grow market share while global volumes contracted positions it as an emerging capital markets hub with sustainable competitive advantages built on quality over quantity.