Quick-commerce’s sustained, explosive rise in India is well established. The sector continues to grow at ~150% year-on-year during the first 5 months of this calendar year, driven by dark store footprint expansion, selection growth, category diversification, and fierce competition – all contributing to the provision of an affordable & wide product assortment to consumers at lightning-fast speed.

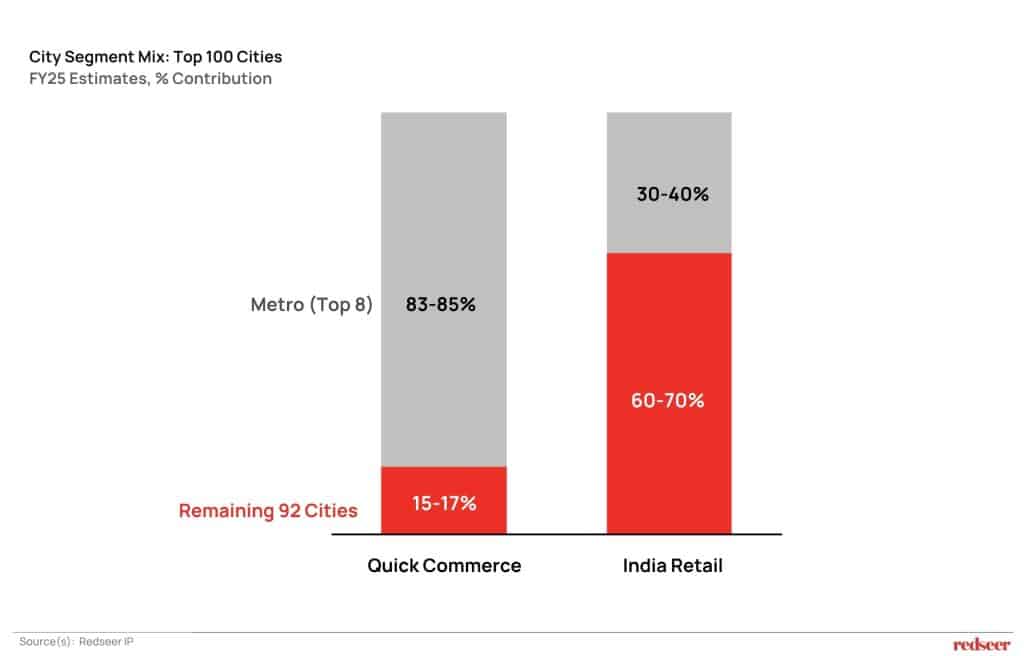

Despite this unprecedented growth and expansion of leading platforms to more than 100 cities, non-metro representatives of 90+ cities (excluding 8 metros from 100+ QC cities) contribute just over 20% of quick-commerce GMV.

Have a question?

Our experts are just a click away.

While this indicates a large growth headroom for quick commerce when compared to their 60-70% contribution to the overall retail market in the top 100 cities, it also raises a few questions:

- Is there enough demand for quick commerce in the current set of ~100 cities?

- At what scale of demand will quick commerce be able to create a profitable play in the long-tail cities?

- How can quick commerce platforms effectively solve these challenges while scaling sustainably in the smaller cities?

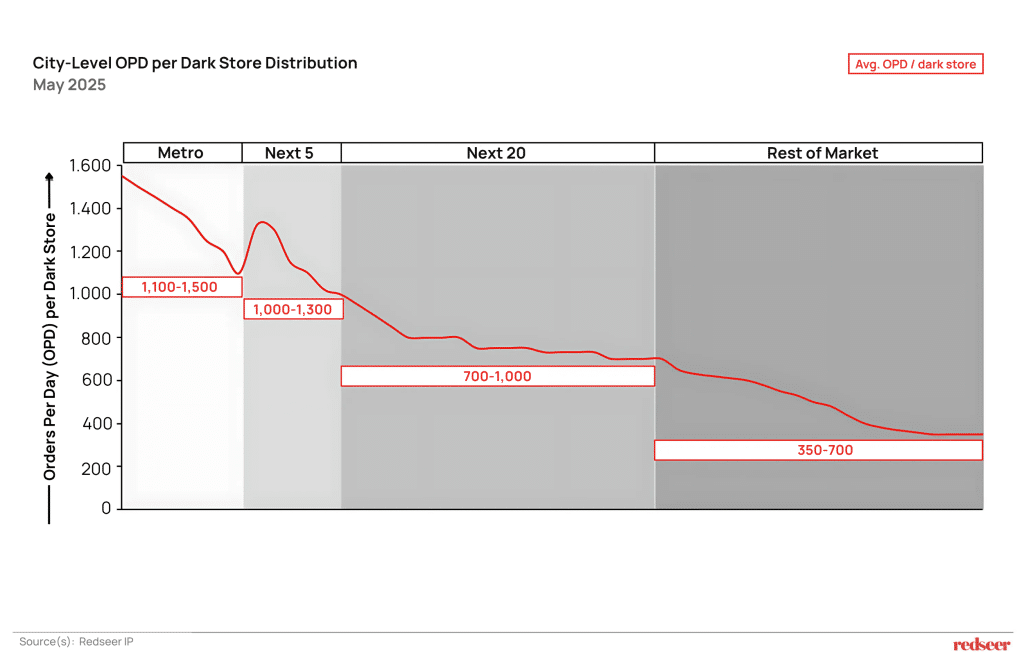

Initial understanding of quick commerce performance in the smaller cities indicates that the model isn’t being adopted in the same way as it is in metros or the next few cities. Orders per day per dark store drop sharply below 1,000 beyond the top 10-15 cities and below 700 in the next 20 cities.

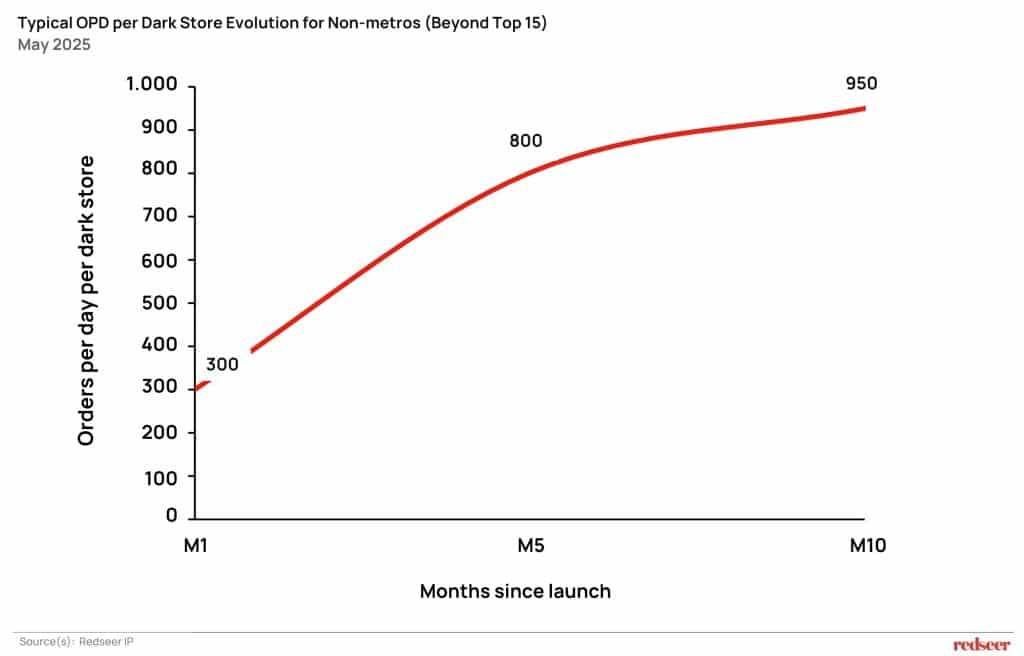

Further, the scale-up curve of a typical non-metro city (beyond the top 15) suggests that these cities tend to plateau out before the 1,000 OPD mark, reflective of weak demand.

Multiple factors are at play here. Firstly, these cities have a higher representation of nascent users, who have poor digital maturity and trust, impacting the frequent usage of quick commerce. Secondly, the population density drops sharply in a few of these cities, impacting the sheer demand volumes. Thirdly, the tastes & preferences are extremely localised in these cities, and possibly quick commerce selection isn’t representative of it yet. Lastly, these cites have long-standing relationships with local mom & pop store owners, who also facilitate home deliveries on credit informally.

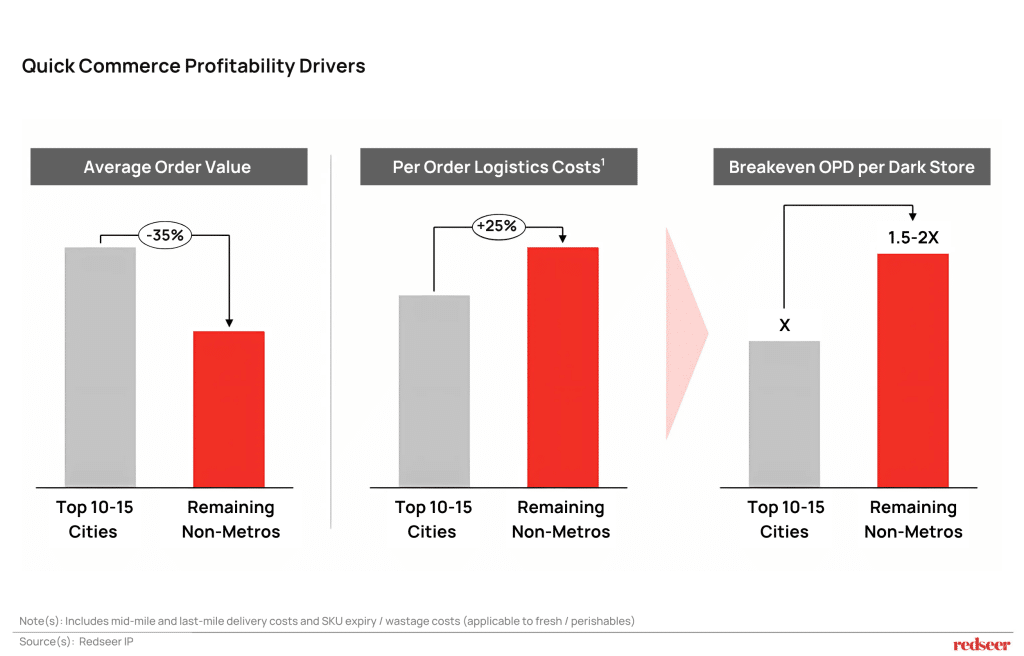

Further, creating a profitable play in the smaller cities is a steep ask for quick commerce players. While the lack of demand maturity leads to lower average order values, the low demand city results in a larger delivery radius and higher delivery payouts. The combined effect is that the breakeven dark store throughput in the smaller cities increases by 1.5-2x vs metros, making it highly challenging.

What’s the Path Ahead?

We recommend a 3-point approach for quick commerce players to tackle this situation:

- Reconsider if 100+ cities is the right footprint at the current stage for quick commerce. There may be merit in rolling back a few of these cities and solving for the remaining ones in a deeper way.

- While the challenges are significant, our initial analysis also identified a few bright spots. Student hubs such as Prayag Raj & Varanasi, and upscale cities such as Chandigarh, reflect a strong, quick commerce demand. It is worthwhile to perform a prioritisation exercise across the city universe to arrive at a data-backed shortlist of the focus cities.

- Once the priority cities are identified, it is important to go deeper into each of them and refine the product assortment, pricing, and marketing efforts in line with the demand & supply dynamics.

Final Thoughts:

Quick commerce has transformed the way India shops—but the next phase of growth requires a more surgical approach. The non-metro opportunity is massive, but demands a reimagined strategy grounded in local insights, stronger economics, and prioritised execution.

At Redseer, we work closely with leading platforms, solving their challenges with our proprietary data, toolkits, and consulting to help you unlock profitable growth in India and beyond. From converting high-intent non-users into loyal online grocery buyers, to helping India’s top ride-hailing player double its 2W taxi scale through a ground-up operating model—we solve what matters most.

Want to discuss your scale strategy? Speak to our Retail and Digital Commerce Expert, Kushal Bhatnagar.

At Redseer, We Solve for the New Growth Equation – From D2C scale-ups to digital marketplaces, we unlock strategic clarity in fast-moving landscapes.

Access our Annual 3MQ Report: Macro, Models and Market Quotient 2025, a detailed report that answers key questions from investors and founders: Where is growth headed? How can players and investors prepare for it? – Gain deep and our expert perspectives.