Executive Summary:

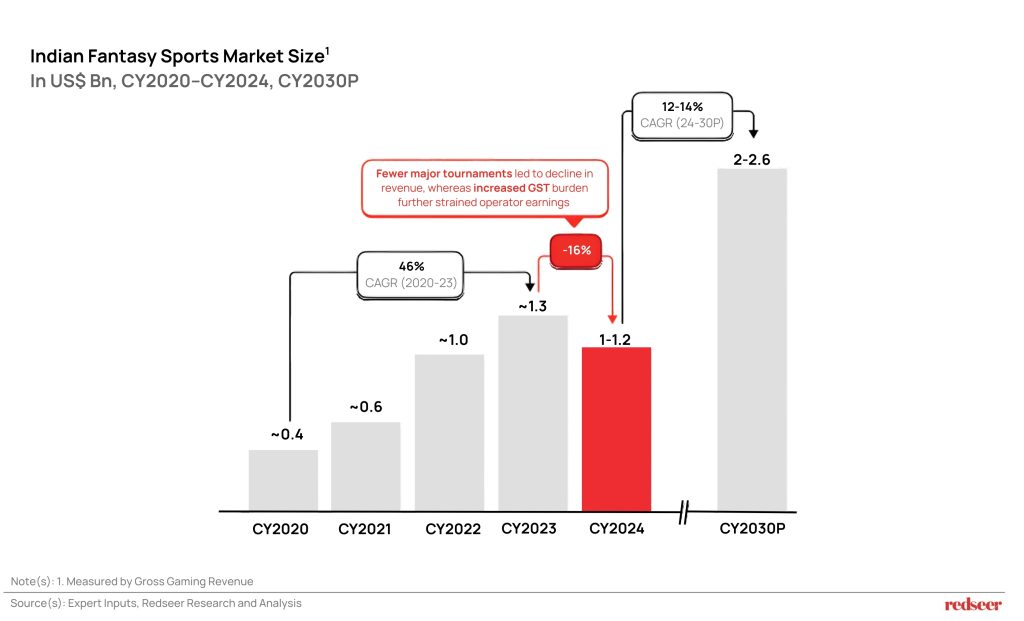

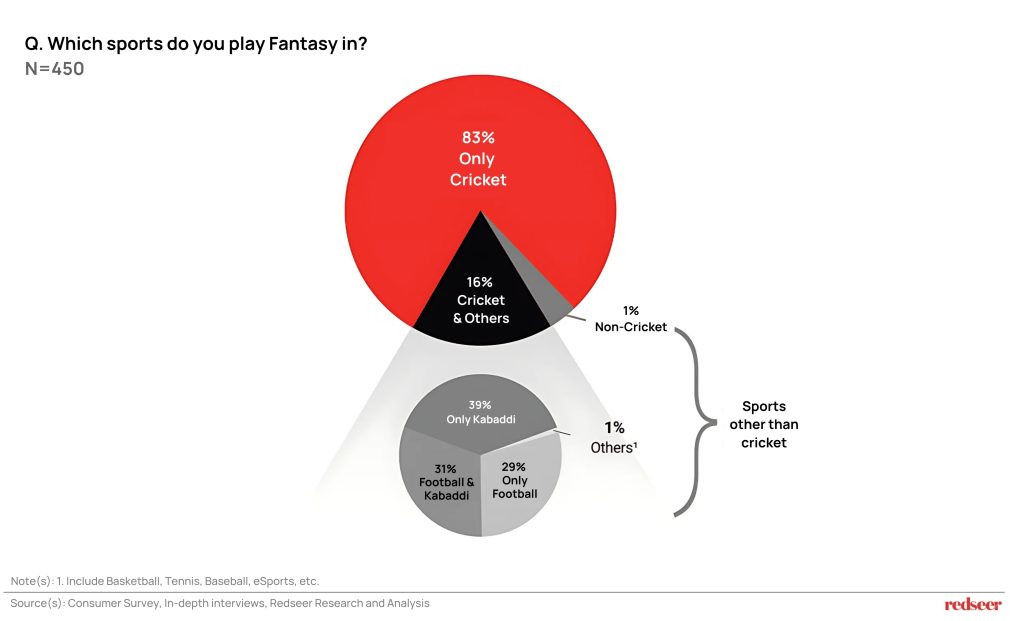

After a subdued 2024, impacted by fewer marquee tournaments and the GST overhaul, India’s fantasy sports industry stands at an inflection point. Valued at approximately $1-1.2 Bn in 2024, this market is projected to grow at a CAGR of 12-14% to reach $2-2.6 Bn by 2030. Though Cricket remains the dominant driver, contributing 85-90% of revenues, with the Indian Premier League (IPL) as the annual super-cycle that fuels user acquisition and monetization. The next big sport that has emerged as the clear secondary sport is ‘Kabaddi’, crossing the 200 Mn viewer mark, and Football, though being a global sport and despite a strong fan base, continues to underperform in this arena. The opportunity now lies in moving beyond seasonal spikes and contest entry fee dependence to building retention-led, diversified revenue models.

A Market on the Move

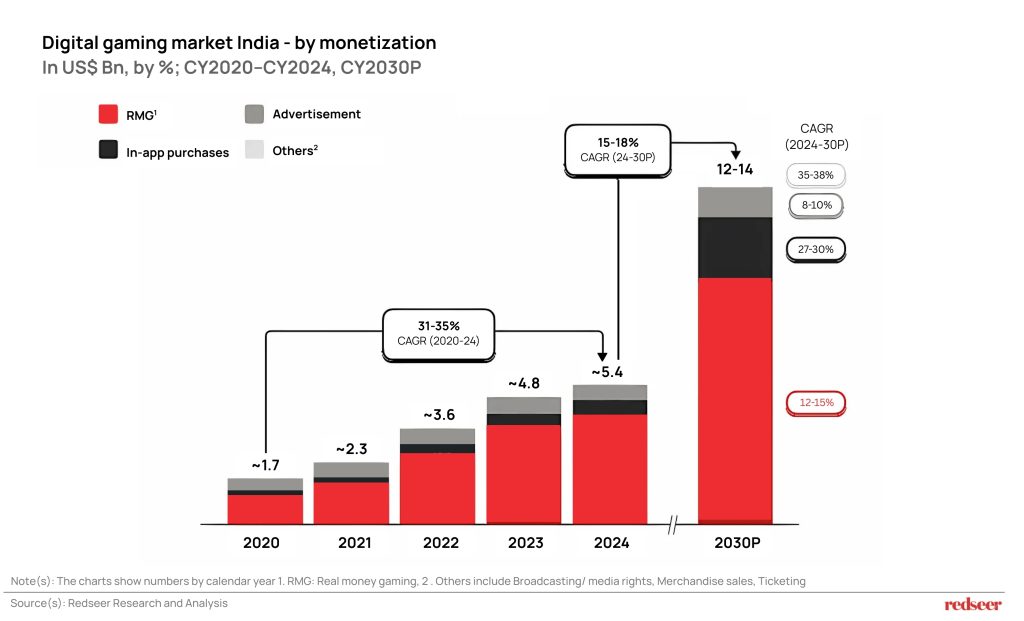

India’s digital gaming market is set to more than double by 2030. Real money gaming (RMG) accounts for over 70% of this market, making it the primary monetization lever in gaming.

Fantasy sports stands out with the highest annual transacting user base among all RMG formats. With cricket contributing 85-90% of revenues, the cricketing tournament IPL’s massive reach in 2024 underscored its pivotal role as a funnel for new users. Kabaddi’s growing viewership marks a stellar opportunity to reduce dependence on cricket.

Cricket is the de facto driver

99% of Fantasy Sports gamers play fantasy cricket: Cricket is like a culture in India, driven by deep emotional connection and familiarity with the sport and its players. This acts as a natural entry point, fuelling fantasy adoption. Key tournaments like IPL, World Cups, or other sporting events featuring Indian teams or players drive greater viewership and interest in the sport.

~16% of Fantasy sport gamers play more than 1 sport: Kabaddi, with a strong viewer base and Football, with global fandom, make up for the remaining fantasy sports played in India. Strong growth is expected in these sports over the coming years.

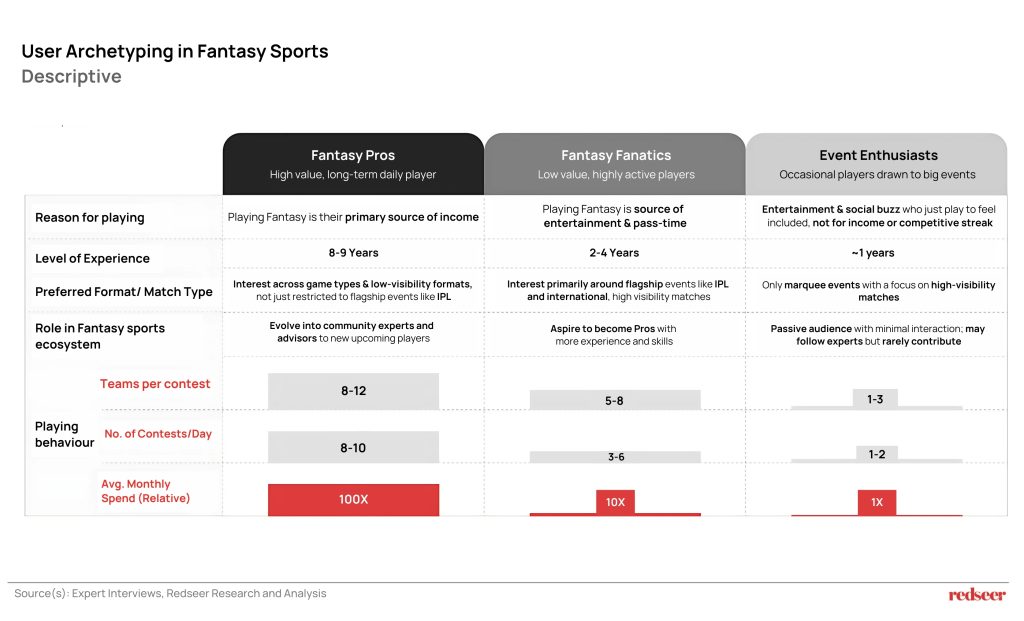

Few at the top drive revenues

Fantasy Pros (high-value long-term gamers) sit at the core of the ecosystem, driving growth and stability. Though only 2-5% of the user base, they contribute 70-80% of GGR (Gross Gaming Revenue), anchor engagement during off-peak seasons, and serve as influencers who onboard and educate newer users. Platforms retain them via exclusive perks, tools, and recognition, such as affiliate incentives, etc.

Scaling remains a challenge

- Heavy dependence on contest entry fees (~95% of revenue) and low time spent per user limits monetization beyond the core product; daily engagement and ARPU remain the lowest among RMG formats

- High CAC, multi-homing, and shallow loyalty increase user churn, while seasonal IPL-driven revenues amplify volatility and create scale challenges across non-cricket formats.

- Changing regulatory environment presents headwinds, squeezes margins. GST-led cost inflation and inconsistent state-level laws have forced platforms to revise wallet structures and triggered early-stage player exits; legal fragmentation continues to restrict nationwide access

Macro

India is on the path to becoming a gaming powerhouse with rapid industry growth in L4Y, but monetization remains behind global benchmarks. Indian Digital Gaming market sits at ~$5 Bn in CY2024 and is projected to mature and grow at 15-18% CAGR to reach $12-14 Bn by CY2030.

Key growth drivers:

- Higher Penetration in tier 2/ tier 3: Easy access to the internet is increasing gaming awareness, driving demand for high-end games supported by affordable gaming smartphones. Platforms are continuously innovating and enhancing offerings to meet escalating user expectations and sustain engagement.

- Growing community of mature gamers: A growing community of gamers is driving user maturity, making gaming the preferred form of entertainment. As gamers play longer, they are willing to pay more for better, high-quality games and in-game purchases to enhance their gaming experience.

- Rise in Social gaming led community game play: Shift of casual games to a pay-to-play (RMG) model is fuelling RMG growth. Increased session times and the rise in social gaming-led community gameplay are increasing monetization potential per player.

What’s next for Fantasy sports:

- Double down on other sports with niche communities and fan base: Basketball, Hockey, eSports, Formula 1, and Tennis are picking up with a surge in fan following and niche audience segments. These will provide an alternative avenue of growth and sustainability.

- Leverage a nuanced view of the customer to arrest user funnel leakage: Retention remains the most potent lever for long-term profitability. The first 72 hours of a new user’s journey – onboarding, team creation, low-entry contests, and early wins set the tone for engagement. Power features for Pros, such as multi-team management and private leagues, ensure sustained participation.

- Diversify monetization levers to expand revenue: Effectively leveraging diverse monetization channels is critical for growth and sustaining in the future.

- Adapt to GST changes and build regulatory resilience: Increased government recognition and proactive platform initiatives to prevent revenue leakage are driving future growth

Want to understand how you can make the most of it? Reach out to our experts to know more.

We are soon going to release a detailed report that will include deep insights and strategic advice for platforms and investors. If you’d like to be among the first to access this upcoming report, fill in your details, and we’ll send the full report straight to your inbox on launch day.