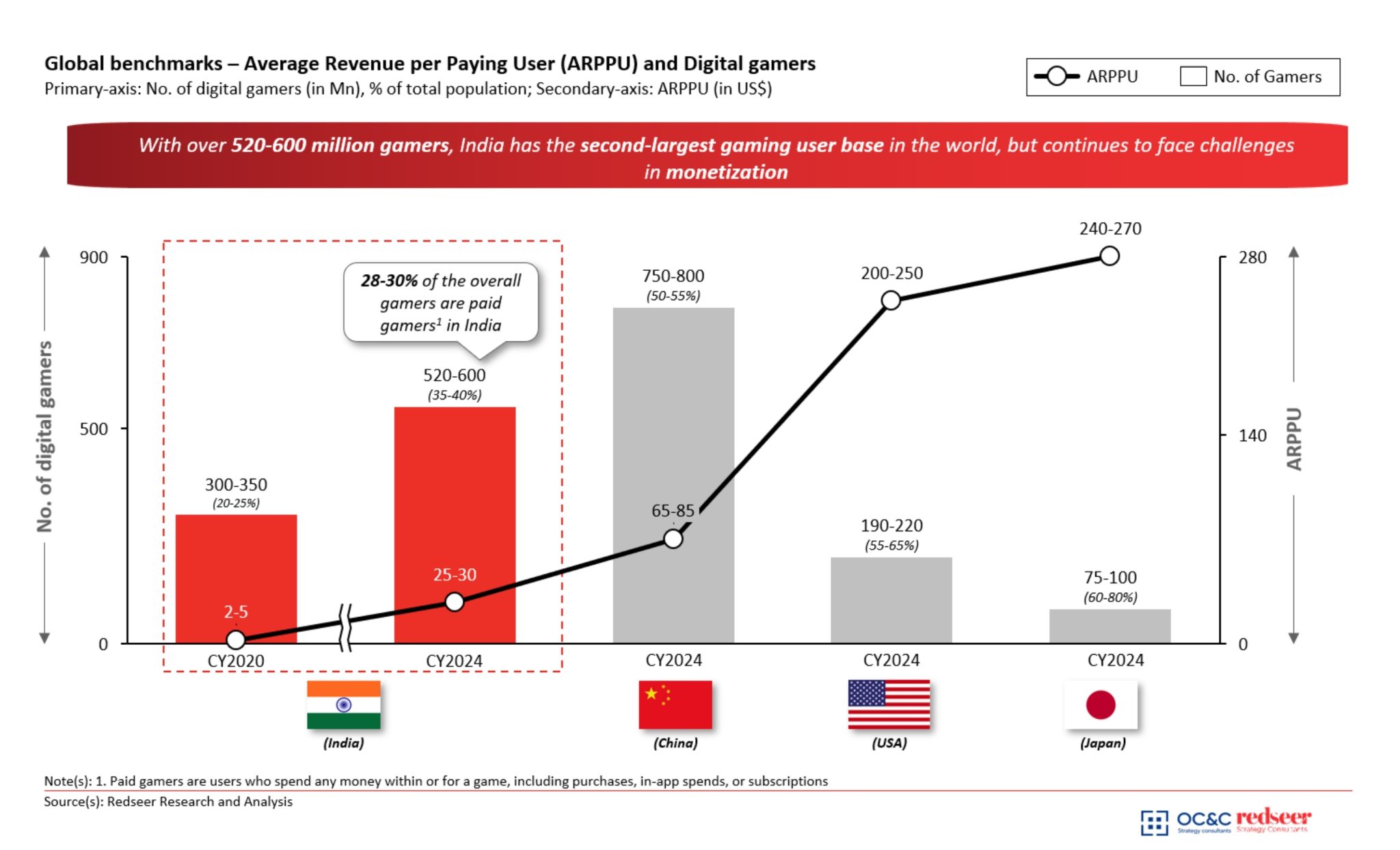

At 500+ Mn digital gamers annually in CY2024, India is emerging as a gaming powerhouse globally. Rapid growth in smartphone adoption, affordable high-speed data, and increasingly changing gameplay behaviour (basic hyper-casual to casual, mid-core to core games) are driving growth in user engagement, number of paid users, and willingness to pay. This is clearly reflected in the average revenue per paying user (ARPPU), which has significantly grown from US$2-5 in 2020 to $25-30 in 2024.

Monetization in gaming – then and now!

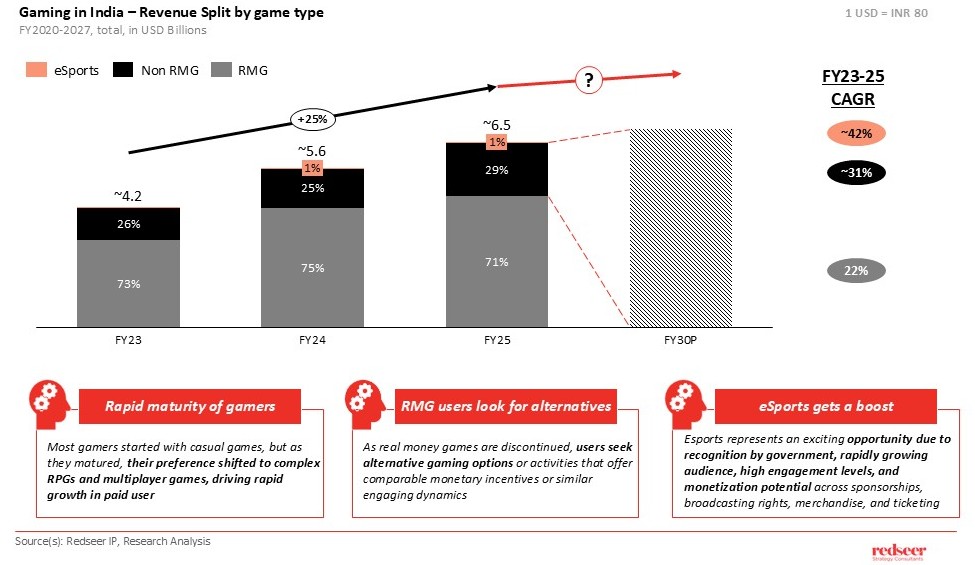

Gaming operators in India monetize users through a variety of avenues, namely in-app advertisement, in-app purchases, rake/ commission on real money gameplay, subscription, etc., contributing to the digital gaming market size of $6.1 Bn in FY25. Until last week, this market was projected to grow at a CAGR of 15-18% for the next 5 years.

However, with the passing of the “Promotion and Regulation of Online Gaming 2025” bill into law on 22 August 2025, the landscape of gaming in India is more uncertain than ever. Online Money Gaming or Real Money Gaming (RMG), defined as a game format that involves playing games with money with the expectation of winning monetary stakes, is now banned in India. Any advertisement or financial transaction via a bank for engaging in such games is also prohibited. At the same time, the new law promotes the growth of eSports and casual gaming, wherein it recognises eSports as a legitimate competitive sport.

The Immediate Impact

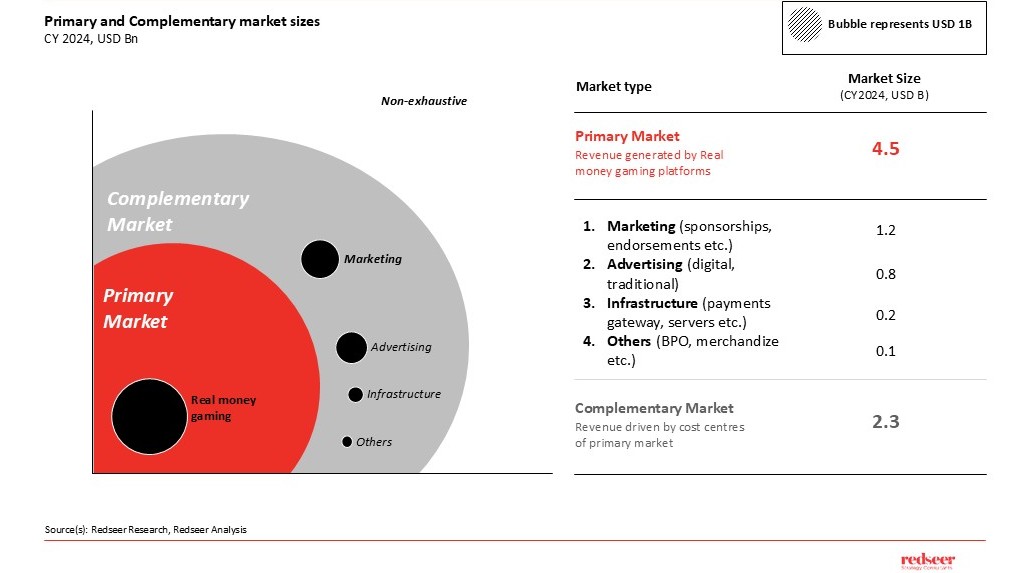

The real money gaming market in India, with 80-100M annual users in 2024, was expected to grow at 12-15% over the next 5 years. The ban under the new law has caused it to come to a standstill while platforms explore judicial route/ options. This has also landed a major blow to the complementary dependent sectors such as marketing (sponsorships, endorsements, etc.), advertising (traditional and digital,) and tech infrastructure (cloud services, payments gateway, servers, etc.).

With the current inflection points, three themes will define the structure and growth of India’s gaming in the short to mid-term:

- Casual gaming and eSports are poised to emerge as India’s next engines of investment and growth in digital gaming and global growth

- Investment in casual gaming is expected to grow on the back of market shifts and regulatory changes

- Rising paid user base and ARPU in non-RMG strengthen the case for building globally competitive titles from India

- RMG players, under pressure to diversify, are beginning to channel investments into these formats, like casual (free-to-play) formats

- With a massive gamer base and surging demand, the timing is right for India to create its own mid-core/core success stories

- eSports, ~$40 Mn market in FY2025, represents India’s next big youth media growth story, projected at 30–35% CAGR.

- Rising mid-core/core gamer base (200M+) and govt. Recognition is fueling mass participation (players, influencers, and viewership)

- Gamers engage for excitement, community, and improving gameplay

- Brands are ramping up spending to reach 20–35-year-olds, and publishers are investing to popularize titles

- With strong tailwinds and policy support, the eSports market is projected to grow 30–35% CAGR over the next 5 years

- To unlock full potential, India must close gaps in game quality, consumer activation, and ecosystem development

- Despite the strong popularity of casual/mid-core formats, global titles dominate; India lacks locally developed, high-quality games that can compete globally

- eSports growth remains concentrated among a niche user segment; broad-based adoption requires investment in customer activation and local IP

- Scaling eSports and non-RMG gaming will require infrastructure, talent, and publisher investment to create a sustainable national fandom, along with innovative monetization models

- Investment in casual gaming is expected to grow on the back of market shifts and regulatory changes

- Gaming adjacencies in entertainment, retail, hospitality, etc., are emerging as a resilient path forward for existing RMG players looking for a pivot. Beyond gaming, players can deepen their presence in adjacent spaces, including both:

- B2C opportunities such as OTT, sports ticketing, hospitality, merchandise, NFTs, etc.

- B2B opportunities such as sports and gaming analytics consulting, white-label game development, or corporate gamification projects

- International expansion as the next frontier: global markets remain an attractive play. While selecting the markets to expand over the near term, gaming companies in India would need to consider:

- Market attractiveness

- Regulatory acceptance

- Competitive structure.

That said, one of the ways in which companies can differentiate themselves at a global stage is by popularising Indian-origin games and sports through marketing and free-to-attend events, while also laying the groundwork for future RMG launches.

As all participants rethink their business models and take up the 1 to 10 journey again, innovation and speed of execution would determine the leaders of this transformed market.

At Redseer, we combine deep IP with on-ground expertise across gaming and media to help operators and investors navigate these shifts and identify the next frontiers for growth. We would be glad to discuss this further. Please visit our website or reach out to Mukesh Kumar ([email protected])