UAE continues to redefine the global tourism landscape. Tourism has positively impacted the overall GDP, especially in key sectors such as hospitality and retail. There is also an immense opportunity pool for retailers in the region, generated by catering to international visitors. Our associate partner, Akshay, was recently quoted on the UAE’s tourism sector, which is predicted to see a massive surge, driving a $100 billion contribution to the economy. He discussed this in Arabian Business, where we also touched on the growing impact of tourism on the UAE’s economic landscape.

In this edition, we’ll explore the growth of tourism in UAE, its economic impact, and the exciting opportunities it presents for various sectors. What to expect in this article:

- Resilience of UAE’s tourism industry

- Significance of tourism to the country’s GDP

- Breakdown of tourist spending patterns & growth projections

Read on for more insights into the future impact of UAE tourism.

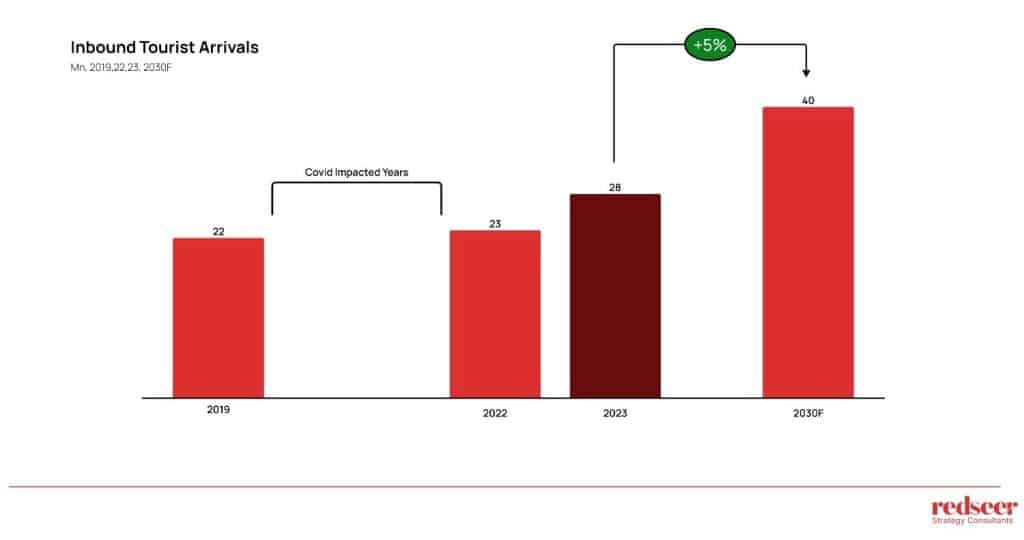

1. Tourist Inflow Surpassed Pre-Pandemic Levels in 2023…

UAE’s tourism sector has largely been resilient, surpassing pre-pandemic levels in 2023. With an ambitious target of welcoming 40 million tourists by 2030, the country is poised for exponential growth in its visitor numbers.

This trajectory is fueled by several key factors. UAE’s calendar is brimming with international events, conferences, and exhibitions that draw business travelers and tourists alike. Notable events include GITEX (Gulf Information Technology Exhibition), the Dubai Airshow, and the Abu Dhabi International Petroleum Exhibition and Conference (ADIPEC), which attract thousands of visitors annually.

Furthermore, UAE’s progressive visa reforms and relaxed entry requirements have opened doors to visitors from various countries. These policy changes, coupled with aggressive marketing campaigns and promotional efforts by both public and private sectors, have positioned UAE as a top global destination.

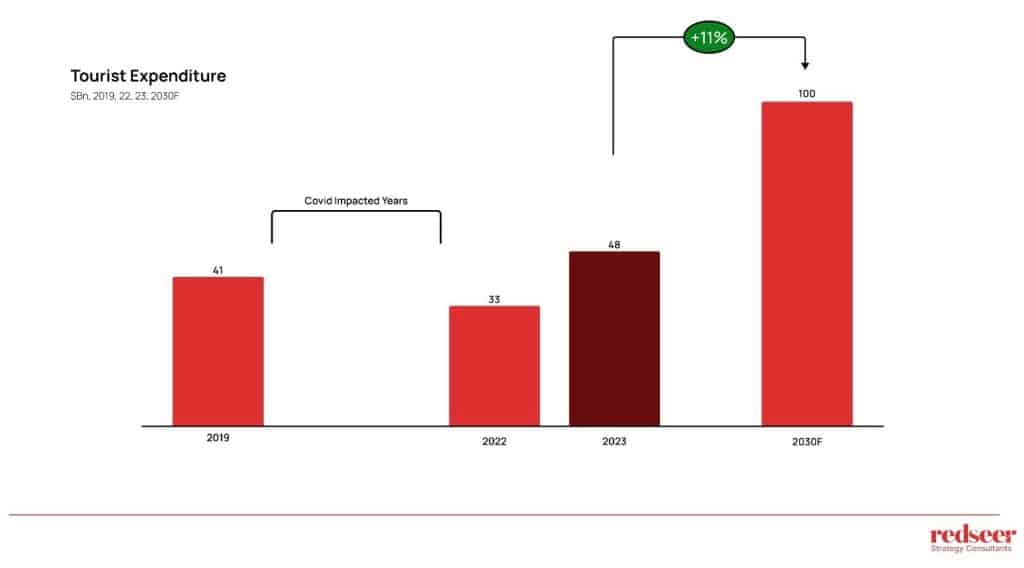

2. …contributing a massive $48 Bn to the economy – to reach ~$100 Bn by 2030

The economic impact of tourism in the UAE is significant. In 2023, the sector contributed a $48 Bn economy. Looking ahead, this figure is projected to reach $100 Bn by 2030, with tourist spending expected to increase by 11% annually from 2023 to 2030.

This growth aligns perfectly with the UAE Tourism Strategy 2031, an ambitious plan to cement the country’s position as a leading global tourist destination. The strategy aims to elevate the tourism sector’s contribution to the GDP to approximately $123 Bn and attract an additional $27 Bn in tourism investments.

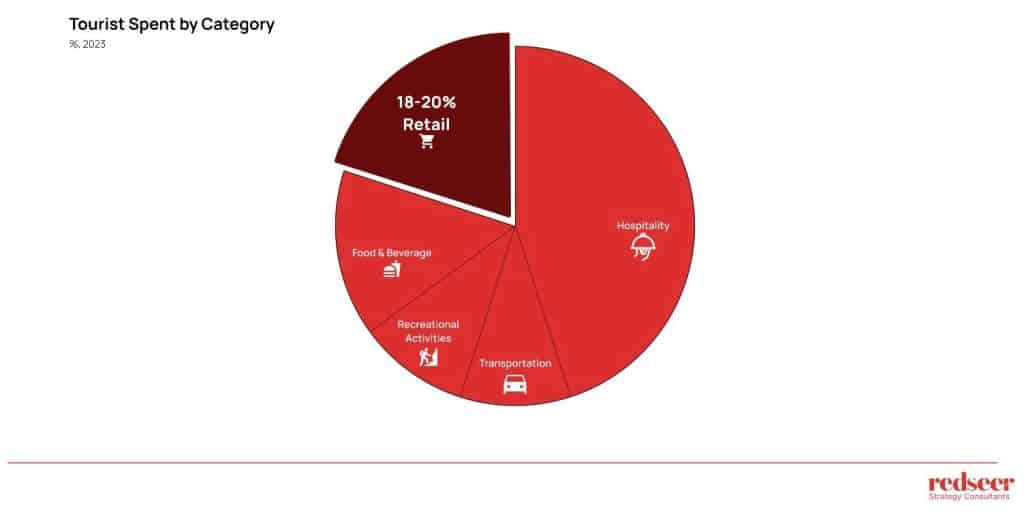

3. While hospitality is the top spend area, retail accounts for a sizable 18-20% of the tourist spend…

When it comes to tourist expenditure in the UAE, hospitality takes the lion’s share, accounting for 45% of the total spending. This dominance reflects the country’s strategic focus on luxury accommodations.

Looking ahead, the UAE’s ambitious construction plans for luxury properties are set to further elevate its hospitality offerings. Projects like the upcoming Marsa Al Arab and Zaya Nurai Island in Abu Dhabi demonstrate the country’s commitment to expanding its luxury accomodation segment.

Also, retail spending claims a substantial 18-20% of tourist wallets. This significant portion is largely driven by a strong preference for luxury brands among visitors.

Lastly, The food and beverage sector also plays a crucial role in the tourist experience. International visitors can find options that suit their preferences across various locations and price points throughout the country.

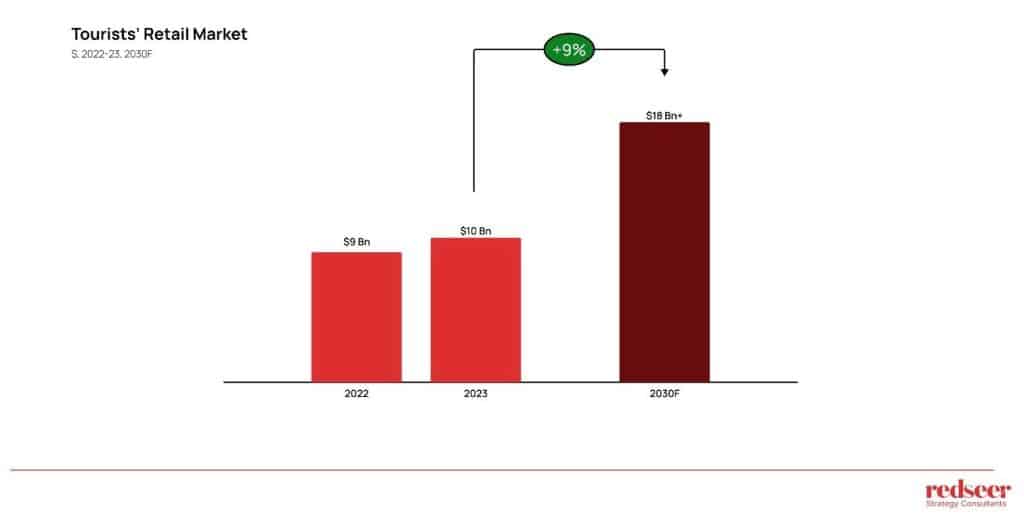

4. …Leading to a $18Bn+ tourism retail opportunity by 2030

The retail sector in the UAE is set to experience significant growth, driven by tourism. From a current market size of $10 Bn in 2023, tourism’s contribution to the retail market is expected to reach $18 Bn by 2030.

This projection underscores the immense potential for retailers in the UAE, particularly those catering to international visitors. The country’s tax-free shopping experience remains a significant draw for tourists, encouraging higher spending on retail goods.

As we look to the future, it’s clear that tourism will continue to be a major driver of economic growth in the UAE, presenting exciting opportunities across various sectors, particularly in retail.

Stay tuned for more updates on this dynamic and evolving landscape.