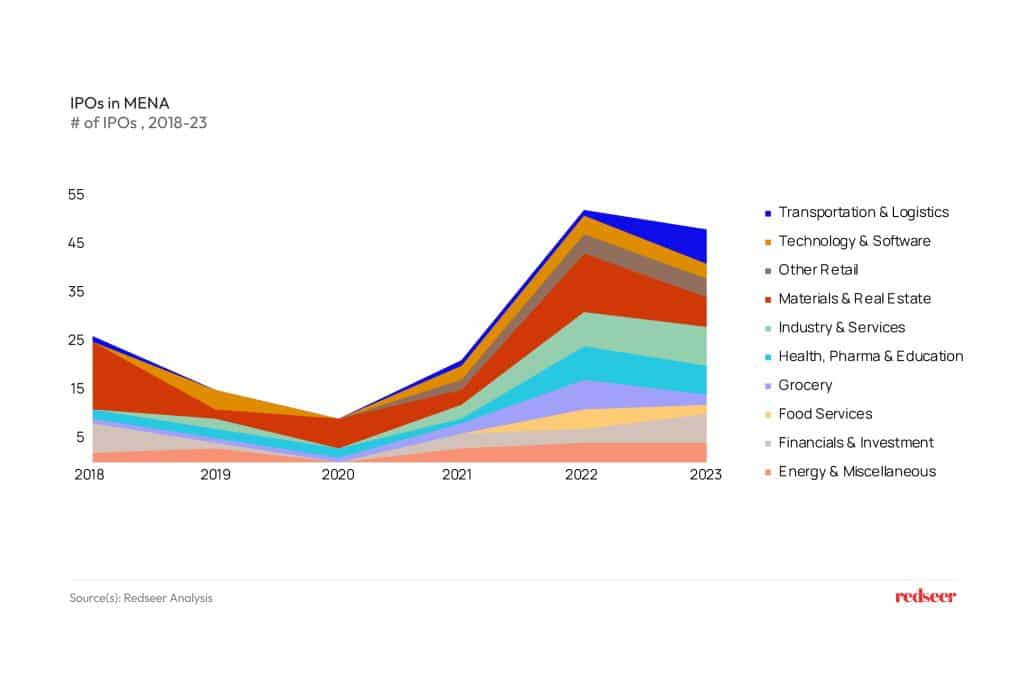

There was a time when Initial Public Offerings (IPOs) in the Middle East and North Africa (MENA) region were a rarity. From only a handful of IPOs taking place annually a few years ago, we currently see around 50 IPOs in the region on an annual basis looking at the data from the previous 2 years. While the momentum is set to continue, the landscape is expected to see some structural shifts this year onwards.

Read on to find out 3 shifts that we expect to play out in MENA’s booming IPO market:

1. Sector mix diversification

The year 2022 marked a significant turning point for Initial Public Offerings (IPOs) in the MENA region. After gaining some momentum before the pandemic, the IPO market saw a relative lull during 2020 and 2021. However, amidst a challenging macroeconomic environment, 2022 witnessed a remarkable resurgence with over 50 IPOs in the region.

Historically, IPOs in MENA have been dominated by legacy sectors such as energy, industrials, materials, and real estate. Yet, 2022 signaled a shift with notable listings in transportation and logistics as well as financial services. This diversification hints at the broader trend expected to unfold in the coming years, with a more varied sector mix anticipated.

Notably, 2024 Q1 witnessed the listing of Modern Mills Company in the Grocery sector on Tadawul, signaling the beginning of this trend. Spinneys recently listed on DFM as well and we have Lulu Group in the pipeline

2. Private B2C and B2B resurgence

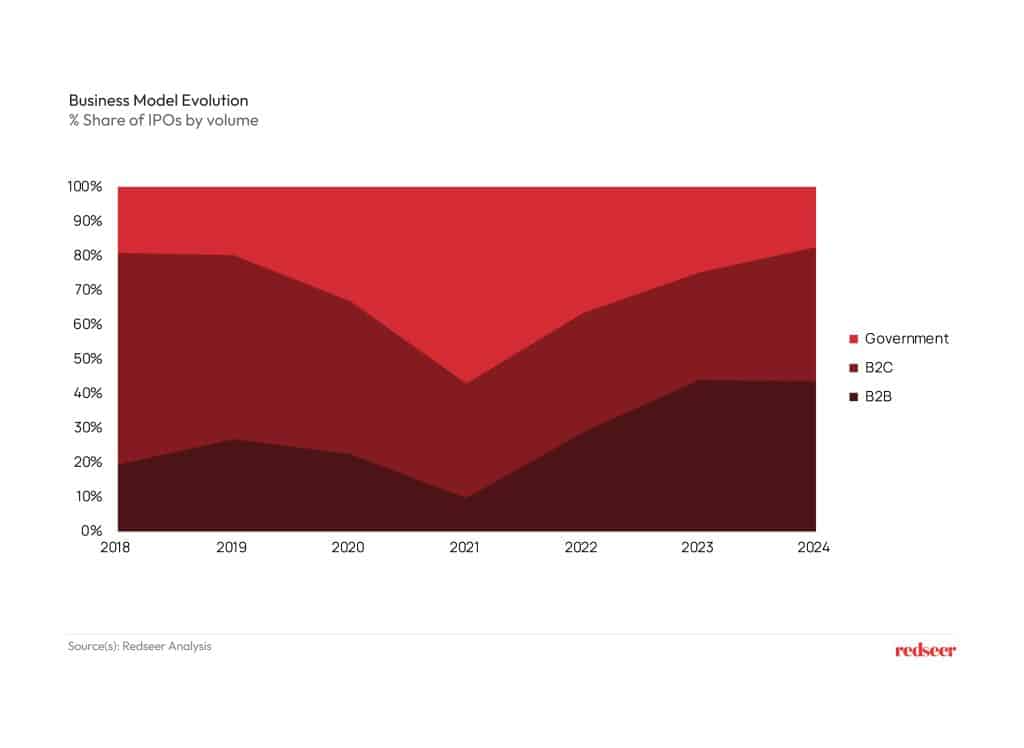

A few years ago, the MENA IPO market was primarily driven by large-scale government-led deals, which played a crucial role in raising awareness and establishing the market. As the market matured, there was a notable surge in consumer-facing IPOs, driven by the rapid growth of B2C startups.

The pandemic led to macroeconomic uncertainty, causing a slowdown in startup IPOs. However, government privatizations kept the market active during this period. In 2022-23, B2C companies made a strong comeback with notable IPOs such as Jahez International, Al Nahdi Medical, Alamar Foods, and Americana Restaurants.

Looking ahead, B2C companies are expected to continue playing a significant role as digital-first businesses reach maturity. Additionally, the B2B sector is poised for growth as investors seek tech-driven solutions to value chain challenges.

3. Digital-First Companies to Rise

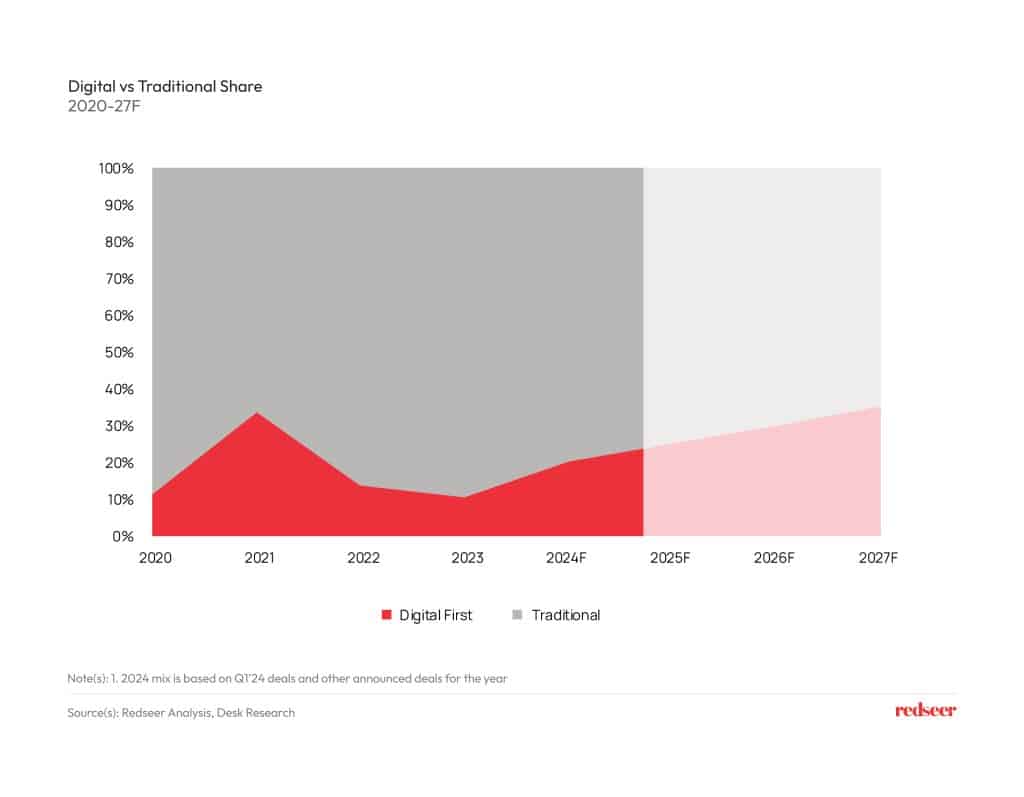

Another significant shift expected over the next three years is the prominence of digital-first companies in the IPO mix. In 2021, post-pandemic, we saw a surge in digital companies, but this momentum slowed in 2022-23 due to macroeconomic concerns and a focus on profitability within the startup ecosystem. However, 2024 has already seen an uptick in digital-first startups, evident from recent listings and announced IPOs.

Our IPO readiness index indicates that by 2027, over 35% of IPOs will be from digital-first companies. This trend reflects a growing confidence in the viability and profitability of digital enterprises, signaling a transformative period for the MENA IPO market.

These trends illustrate a dynamic and evolving IPO landscape in the MENA region, with a future marked by greater sectoral diversity and technological innovation. By embracing these changes, businesses, investors, and policymakers can capitalize on the opportunities presented by the MENA IPO market, which is truly coming of age now.

We hope you found this insight useful. Please feel free to reach out to us at [email protected] if you have any questions or would like to discuss our IPO Readiness Index.