FY23 alone saw more casual gamers graduating to core gaming, signalling a major structural shift in India’s gaming ecosystem. As more and more Monthly Average Users (MAUs) willingly participate in the requisite payments to level up, the time is ripe to explore ways in which this growing cohort can be best engaged and monetized.

In the last two years, significant strides were made in Indian eSporting with television entities like Star Sports broadcasting the Battlegrounds Mobile India (BGMI) Masters Series in 2022. Let us unravel what this development could mean for the future of gaming in India.

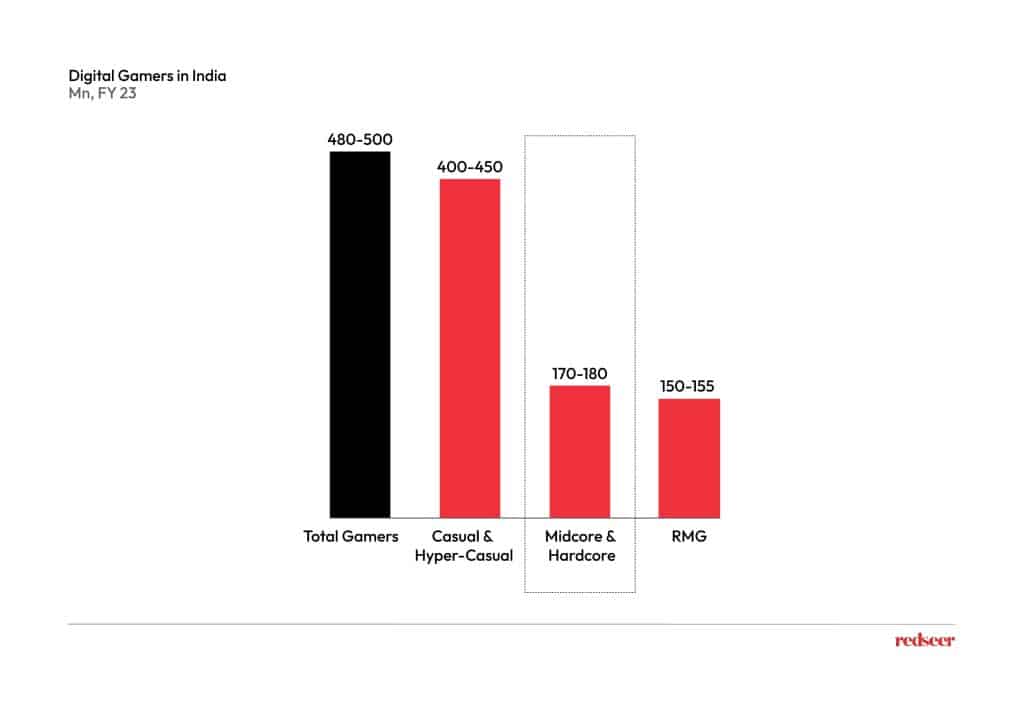

The Core Gaming community grows to 170-180 mn in FY23 alone as more casual gamers level up

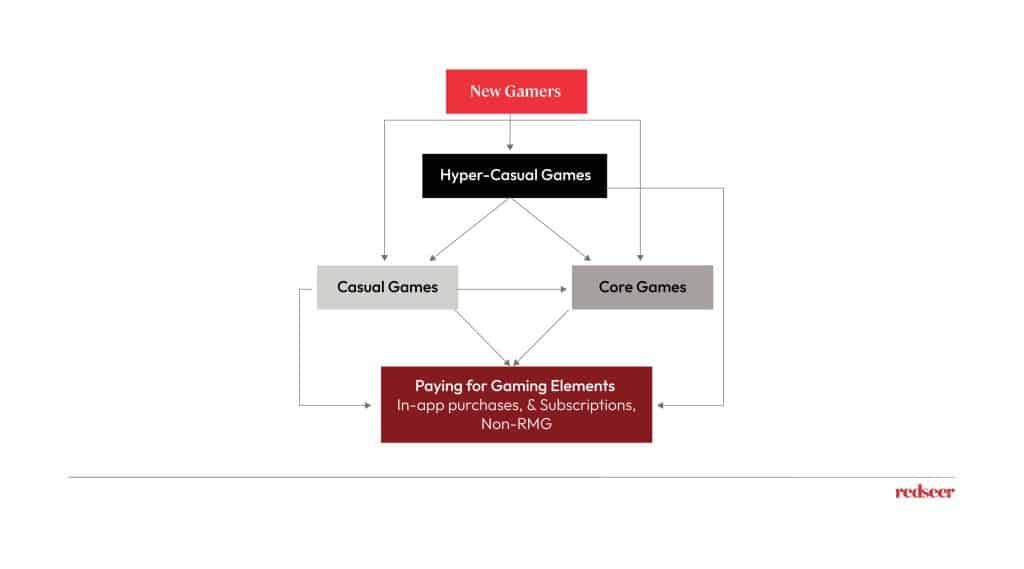

The conventional newcomer starts out with free hyper-casual gaming and progresses towards casual gaming. Some of them eventually mature into core gaming with in-gaming payments opening access to newer levels and elements, in addition to improving the overall experience. In the case of the adult and elder cohort, free alternatives to Real Money Gaming (RMG) serve as the first point of contact. India is currently looking at a 170-180 Mn strong community of core gamers in FY23 alone.

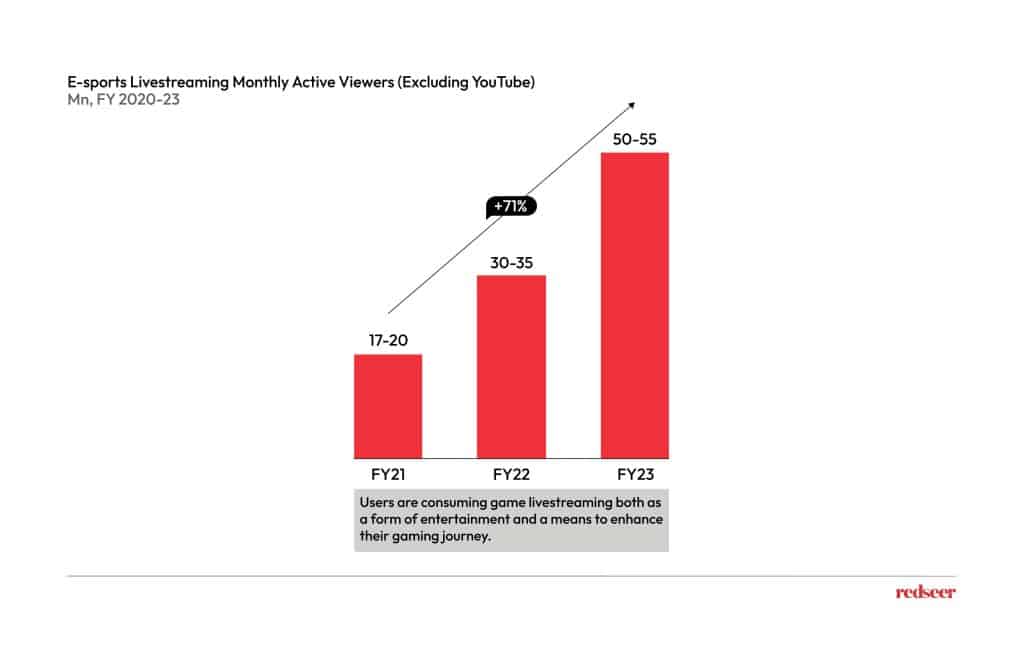

Active Livestreaming Attendance leaps by 71% between FY21 and FY23, signaling opportunities for monetization

Gamers’ Willingness to Pay (WTP) for in-game experiences has also led to a rise in active livestreaming attendance. Livestreaming provides gamers with the opportunity to both better their skills and be entertained by the best in the business. As a result, pureplay gaming platforms (Loco, Rooter etc) as well as other platforms including YouTube and OTTs attracted an average livestreaming audience size of 25-30mn and 30+ Mn respectively in FY23. It is to be noted that formats across advertising, subscriptions and merchandising were utilized for monetization purposes.

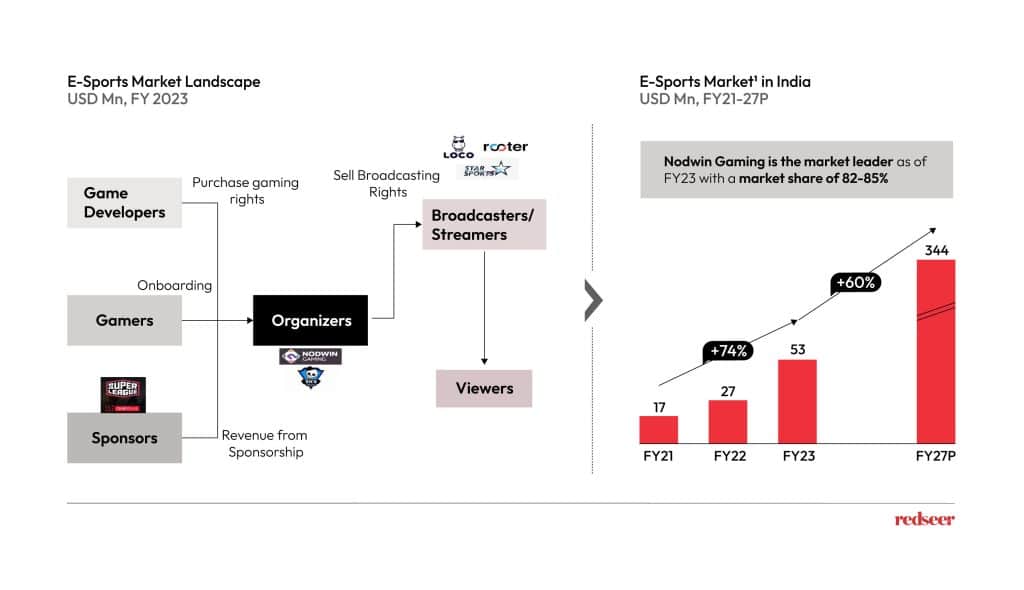

A homegrown eSporting ecosystem takes shape, bumping up Nodwin Gaming’s market share to 82-85% in FY23

The gradual rise of eSporting across tournaments and networking events in India is garnering attention from international gaming entities. Nodwin Gaming emerged as the market leader in FY23 with their market share growing to 82-85%. They also played hosts to the one-of-its-kind Battlegrounds Mobile India (BGMI) Masters Series tournament 2022 which was livestreamed by Star Sports.

Limited investor awareness, a nascent MAU monetization system and social taboos inhibit ecosystem growth

Three significant hurdles stand in the way of this growth trajectory – a) limited awareness of the potential of gaming and eSporting among the Indian investor pool, b) limited monetization opportunities despite the mushrooming MAU cohort, c) a prevalent social taboo that prevents gaming from being considered as a serious career path.

Creative solutions aimed at increasing awareness about the sector’s growth potential among important stakeholder cohorts will be critical to shaping its future.