Last November, a farmer’s unfortunate story captured headlines and created a buzz on social media. A rural man who had travelled 415 kilometers to Bengaluru was forced to sell two quintals of onions for a profit of INR 8.36 after a sudden price crash. The agriculture sector in India is characterized by inefficiencies at every stage of the supply chain. Solving farmer pain points and addressing value chain gaps can open up vast opportunities for the AgriTech players. From improving the quality of inputs to farmer advisory and selling, AgriTech companies can add significant value to India’s agriculture output. Here we elaborate on why the farm sector is lagging and can digitization in rural India sets the stage for this AgriTech revolution.

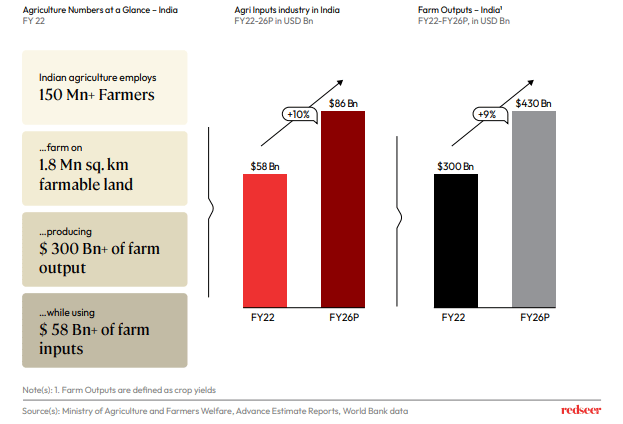

1. Agriculture is a massive sector in India, with output projections of 430 Bn by FY26

India has a massive agricultural sector with an estimated 10% growth year-on-year, both in terms of input and output. A majority population living in rural areas depend on agriculture directly and indirectly. Agriculture offers employment to more than 150 Mn farmers.

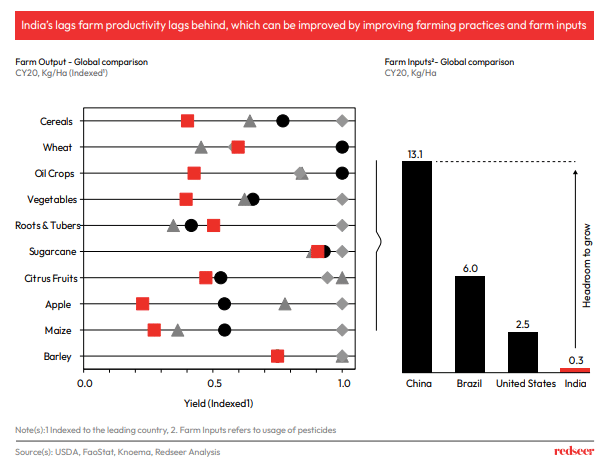

2. Despite the scale, Indian agriculture lags behind its peers’ on-farm productivity

Although India has the largest arable land in the world, with a total area of over 1.8 Mn sq. km, it still lags behind its peers, such as China, Brazil, and the USA, in agricultural output. The low productivity is due to factors such as minimal usage of farming inputs and poor understanding of the input usage.

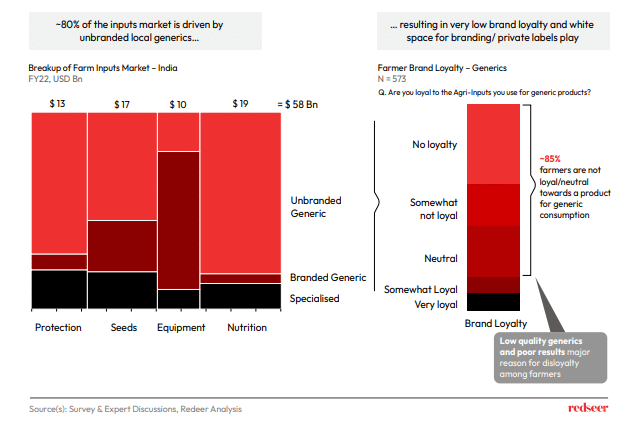

3. Over 80% of the agricultural input market is dominated by unbranded generics

Contributing further to low productivity are unbranded input products that are unreliable and yield poor results. As a consequence, over 85% of farmers do not feel a sense of loyalty to brands or products available in the market. On the flipside, this white space opens up major opportunities for brand building and private labels in the sector.

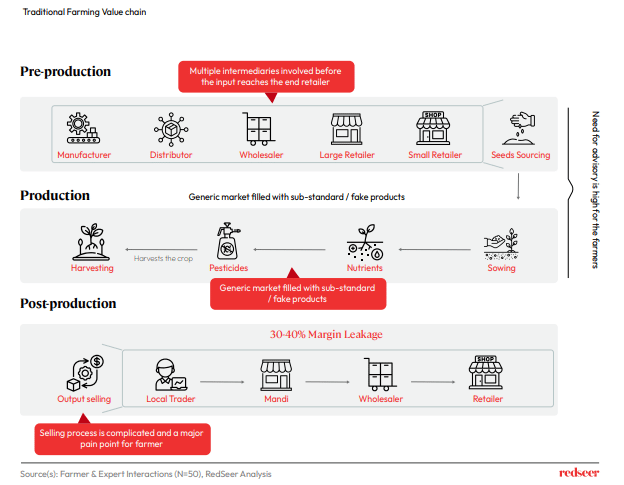

4. Multiple intermediaries in the value chain cause margin leakages

Inefficiencies are further exacerbated by the intermediaries at every step of the farming value chain. By the time the agriculture input reaches the farmer, it would have gone through four intermediaries at the minimum. Selling agricultural produce, which is a major pain point for farmers, is the next stage, where the presence of intermediaries leads to further margin leakage.

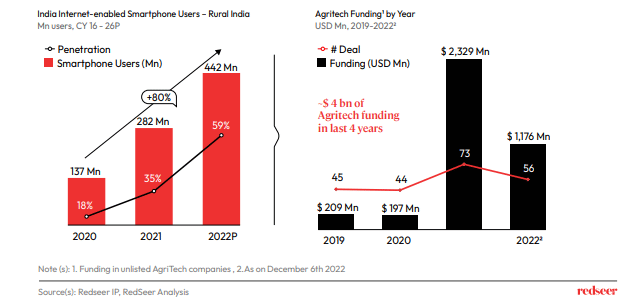

5. Increasing digitization in rural India can set the stage for much needed AgriTech disruption

Over the last few years, the number of Smartphone users in rural India has skyrocketed from 137 Mn in 2020 to 442 Mn in 2022. The penetration of high-speed internet has enabled farmers access to high-quality tech, products and information that can significantly improve their farming methods.

Our analysis shows that AgriTech is primed to take advantage of the increased need for technology in agriculture in India. Over the last four years, the funding for AgriTech has grown substantially, with the single biggest spike occurring in 2021.