What was the most unexpected yet positive event in Southeast Asia in 2023?

It’s a no-brainer for those keeping an eye on this region. A lesser-known firm from a typically overlooked industry in Indonesia – an Agritech company1 – hit unicorn status and was gearing to fund its growth. Remember, this happened while most companies were cutting back and reducing costs.

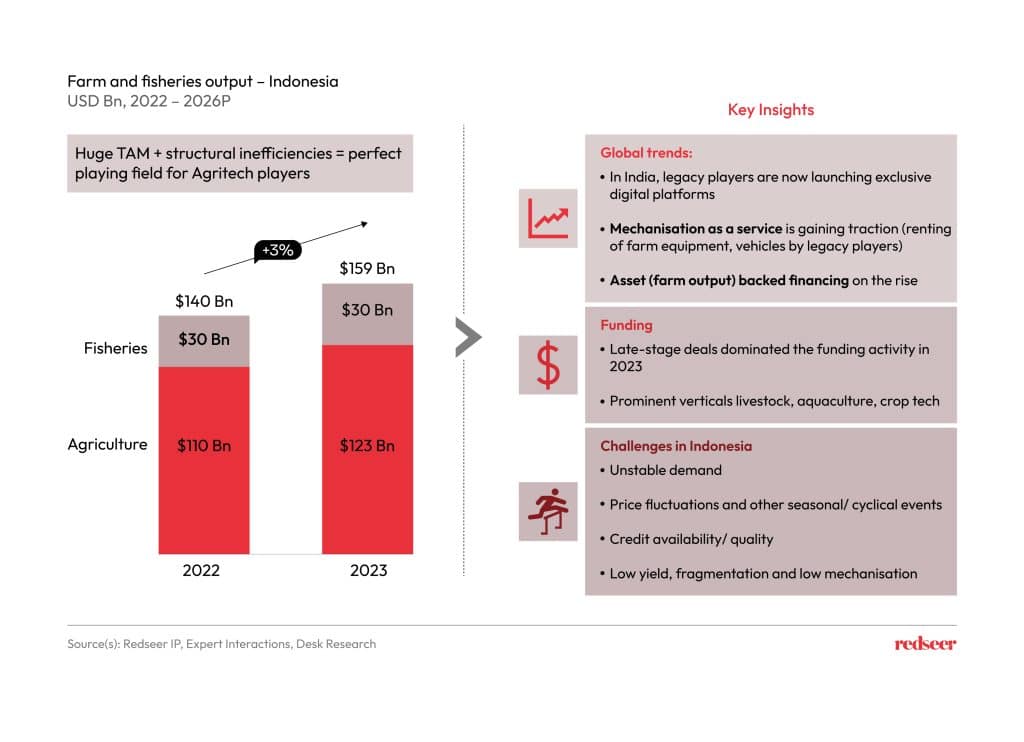

Despite the buzz around this event, we believe Indonesia’s Agritech sector still has some surprises up its sleeve2. Agriculture, a massive $140 billion industry, accounts for 15% of the country’s GDP and employs 29% of its population. Yet, it’s held back by outdated supply chains and financing models. That’s where Agritech can step in to make a real impact.

Of course, there are challenges one needs to factor. In the following sections, we talk about those and what it could take to build the next wave of successful AgriTech’s in the country.

Footnotes:

- For the curious kind, it was E-fishery, https://bitly.ws/39nvf

01.Indonesia AgriTech remains a sector of choice; strong funding, innovative business models and geographical expansion are the dominant traits being observed

The $140 Bn + agriculture and fisheries market in Indonesia offers immense opportunities for tech players to step in and innovate. Their tech solutions can solve some of the most basic but critical challenges faced by farmers. The funding activity and the regional/ continental expansion are a testimony of the impactful role the agritech startups have played. A great positive for the broader startup ecosystem.

While on one side there have been challenges faced by various AgriTech startups across domains ranging from farm to fork B2C, marketplaces, and financing; and on the other there are players that have catapulted themselves to success leveraging their learnings and creating a robust business offering.

So, what differentiates the laggards from the leaders? Well, continue scrolling below to know the right ingredients for a successful AgriTech business!

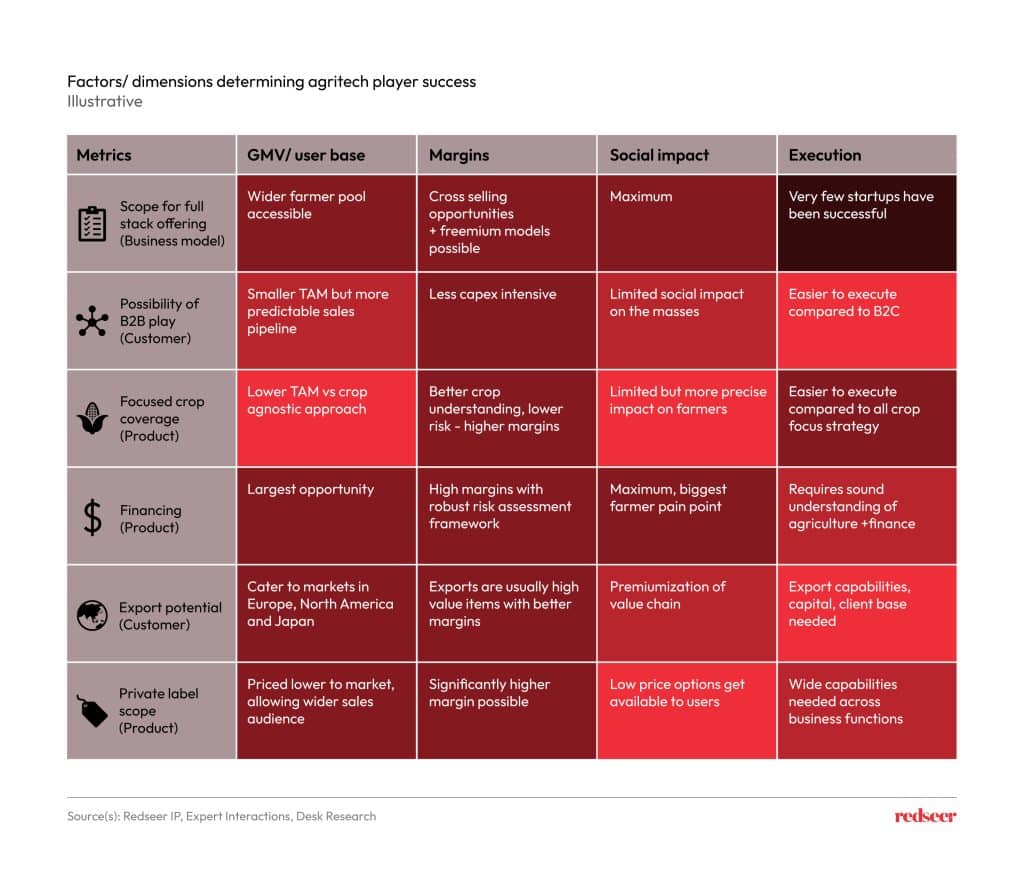

02.The following critical dimensions can be looked at to determine potential success for AgriTech players in Indonesia

To begin with, let’s look at the factors and dimensions that are at play in AgriTech along with the typical approach adopted by the successful player:

- Aim for full stack offerings as a long-term goal with financing being a part of it.

- Focus on select crops and develop capabilities within that sphere before pivoting to other crops.

- B2B (supplying output products to Horeca, export houses, and processing centers) is more profitable compared to the simple B2C farm-to-fork model.

- Export and private label are also more margin additive and good to have in the product portfolio.

03.How can players create a sustainable full stack offering and create a successful and robust AgriTech solution

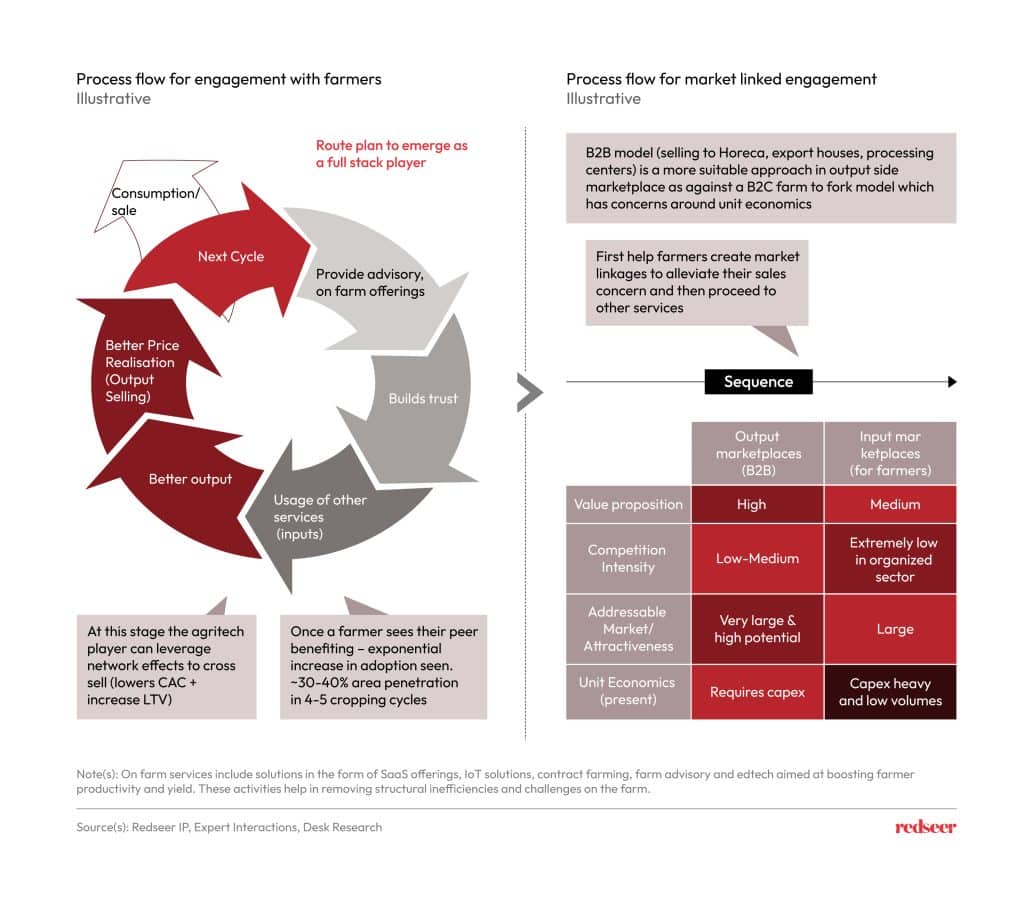

As shown in the chart on the left side, on-farm services can become the starting point for any agritech player as it enables the farmers to unlock greater value from their product offerings and increase productivity. This helps an agritech build a connection with the farmers. Within farm services, knowledge solutions can be a starting point to educate farmers followed by others on the farm services. Once there is a higher yield and better realizations, agritech players get an opportunity to cross-sell other offerings to farmers.

Full-stack players have a better shot at creating a sustainable business with a stable top line and healthy margin. To achieve the same agritech startups need to work both with farmers and on market-linked engagements to provide a holistic end-to-end business offering.

No wonder eFishery stands out within the AquaTech space compared to peers!

04.Players can choose to identify white spaces at crop level and work around these low hanging opportunities before pivoting across many crops

By selectively operating in specific crops, players can carve a niche for themselves. Ideal crop types would demonstrate some or all the following characteristics:

- Face issues around low yield, seasonality, extreme price fluctuations, low farm mechanization

- Simple on-farm activities by farmers can drastically increase the value of the crop.

- Do not have strong government support thus less competitive

- Large domestic/ export TAM

04.While a risk adjusted financing solution can be created by AgriTech players by following a comprehensive 3 step model

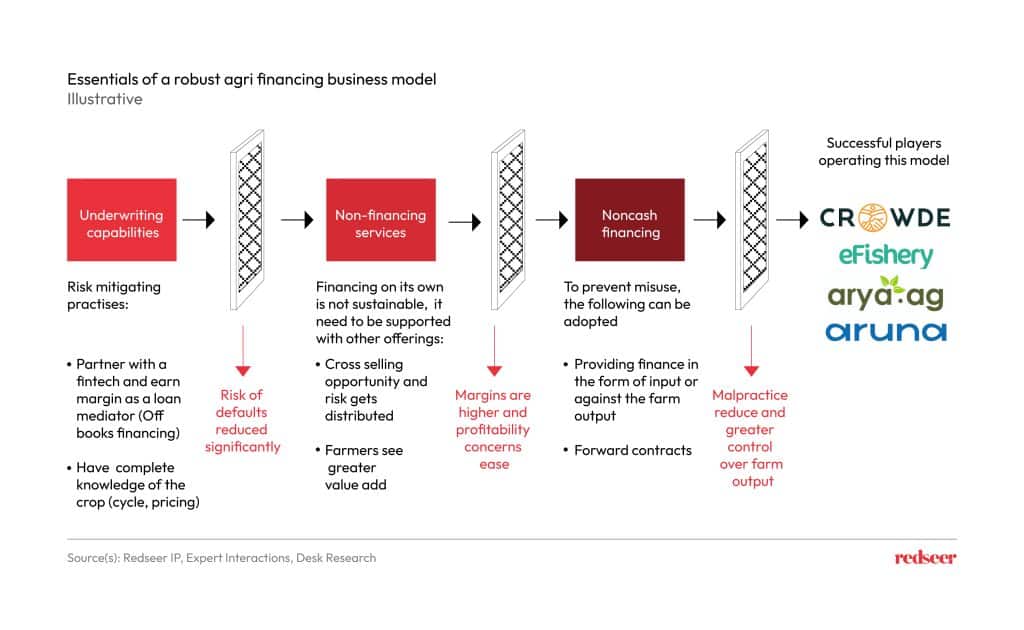

Lending is the largest opportunity within Agritech. Some of the agritech players failed earlier as they could not price the risk appropriately or lackedan understanding of the agriculture business model (cycles, farm processes) They simply approached it as a fintech offering. Some key success levers for agri financing are:

- Presence across the value chain

- Control over output to ensure ease of recoverability

- Offer financing in a noncash way format