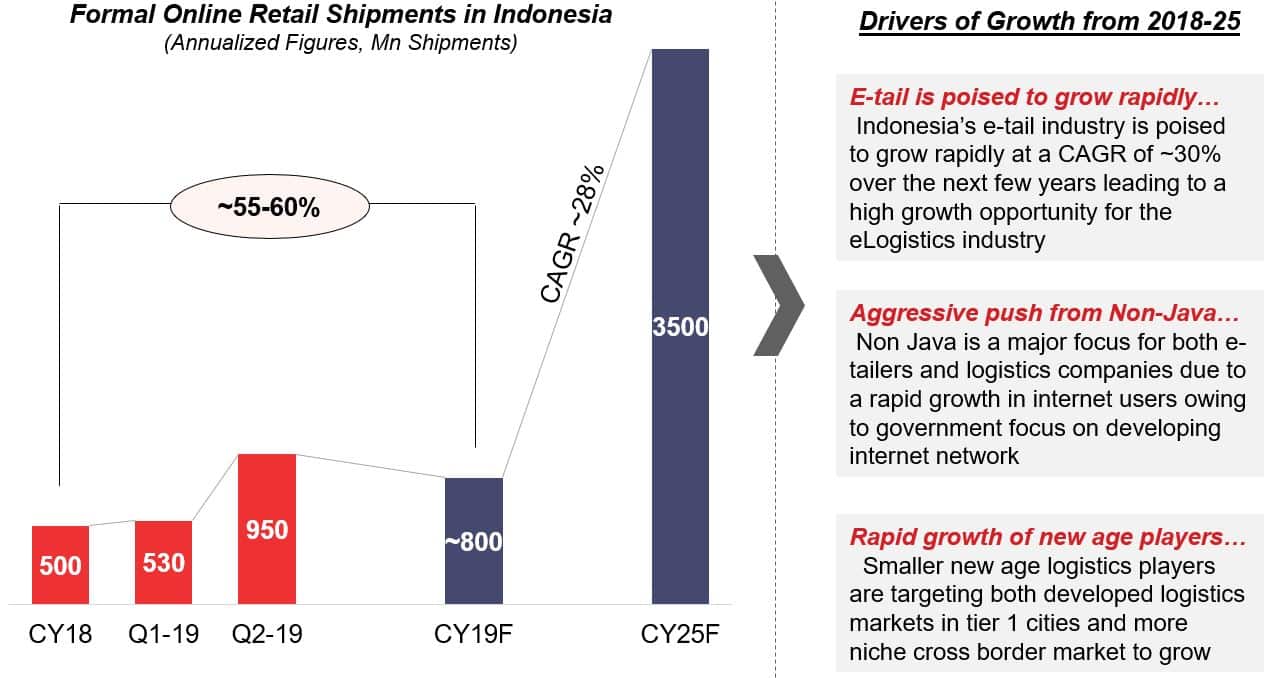

eLogistics in Indonesia expected to be ~800mn shipments (formal e-tailing sector) in 2019

Published on: Oct 2019

- Driven by the growth of formal e-tail (55% y-o-y in 2019), logistics likely to expand rapidly as well

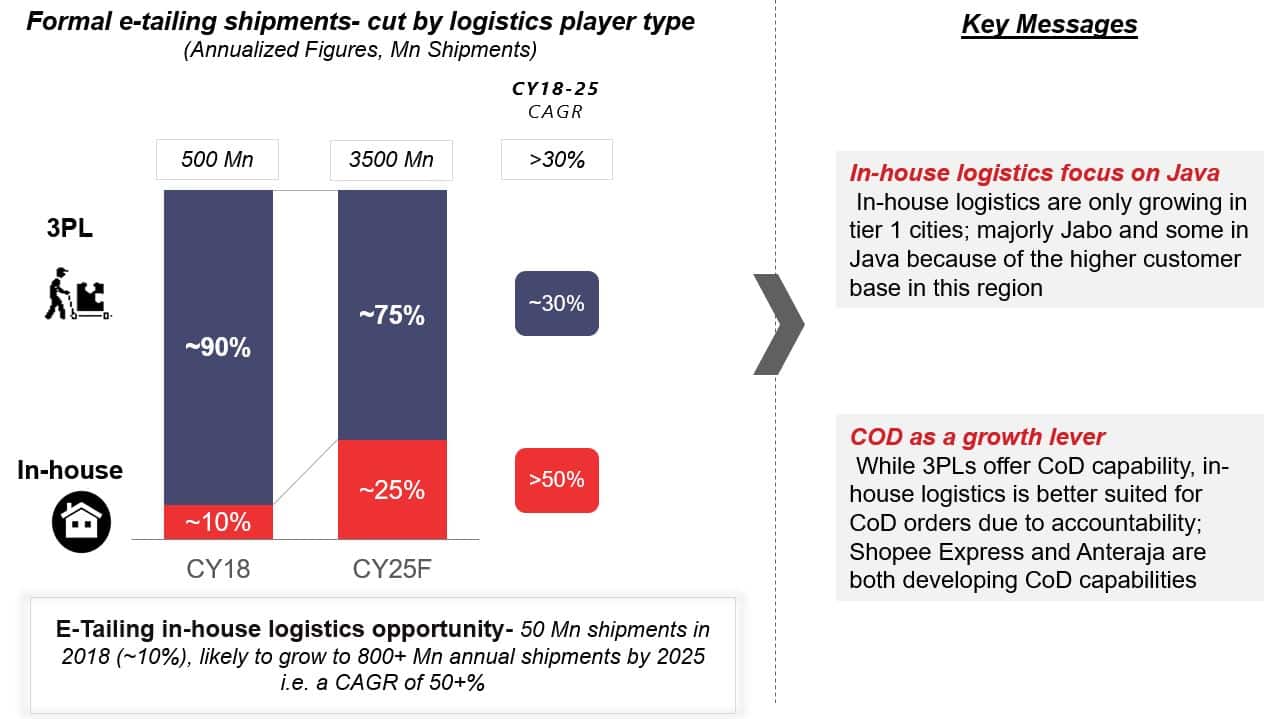

In-house logistics will grow but a massive opportunity for 3PLs still present

- Scaling up in-house logistics including affiliate players (e.g. Anteraja, Shopee Express) is an increasing focus of players to enable superior experience especially in Jabo area and increase repeat purchases

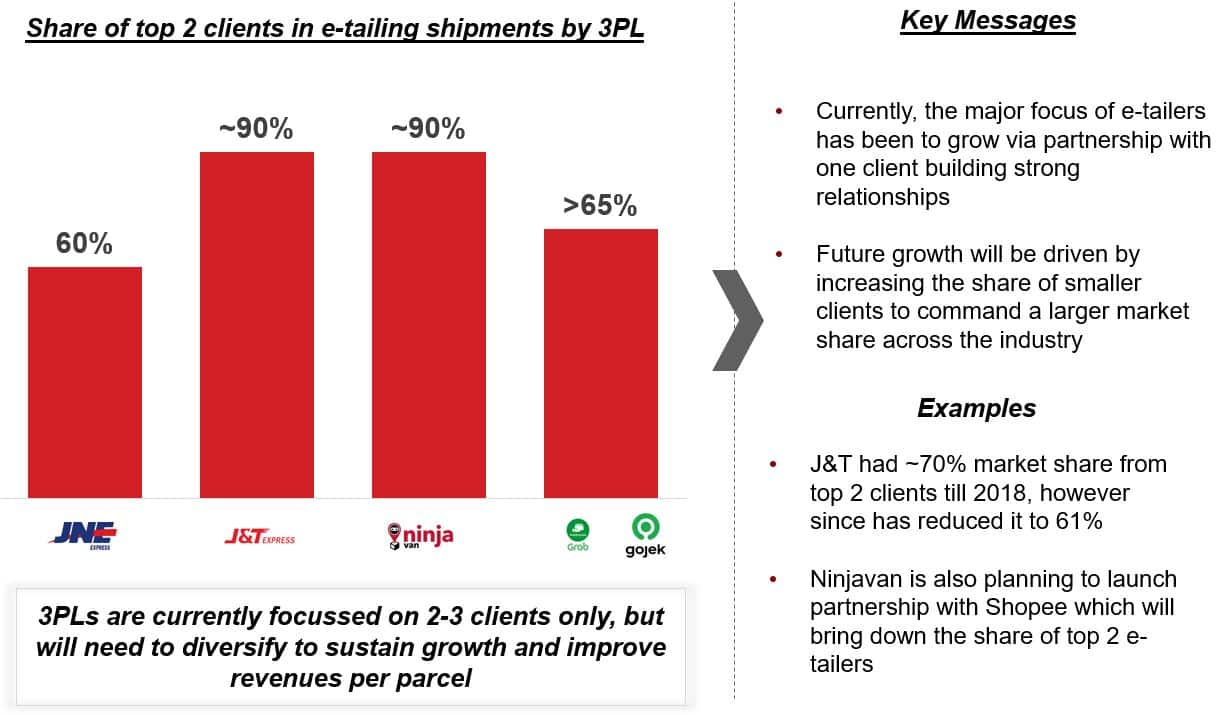

Formal e-tailing business of 3PLs is currently concentrated in the top 2 clients

- 3PLs have grown rapidly by strongly partnering with e-tailers on multiple fronts including on logistics rebates e.g. J&T with Shopee

- While this has enabled rapid scaling, it has also led to high dependency

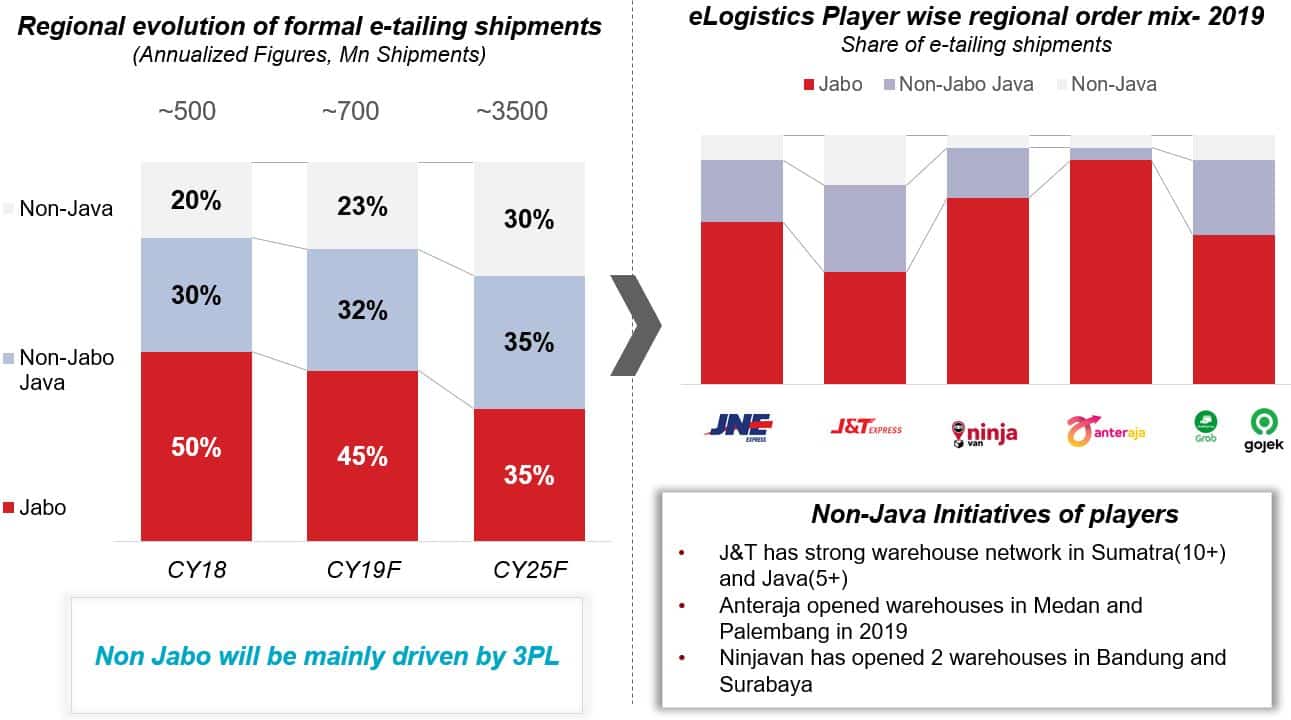

Current eLogistics= Jabo heavy, but non-Java demand and infra poised to expand especially for 3PLs

- Growing e-tailing demand in non-java to drive growth for 3PLs as well

- However, most 3PLs are currently Jabo heavy, even though they are starting infra creation in other islands

Both larger and smaller 3PLs targeting upcoming growth opportunities via partnerships and in-house offerings

- 3PLs targeting growth opportunities like COD, cross-border, non-Java deliveries via different approaches