Digital Advertising: Demystifying Evolving Needs of Advertisers in India

Advertising today is seamlessly integrated into our daily lives across multiple channels and platforms, marking a significant evolution from the dominance of TV and radio. The widespread adoption of smartphones and the expanding internet reach have transformed how brands engage with audiences, making digital advertising more personalised and targeted than ever.

Want to get strategic guidance?

With over 800 million internet users in India, the advertising market is undergoing a shift. Increased engagement on platforms like Social media, eCommerce, and OTT platforms are altering the way brands interact with their customers. Advanced data analytics now allow advertisers to understand consumer preferences and behaviours, delivering ads that resonate personally.

In this article, our experts at Redseer explore the advertising market, evolving brand needs and future prospects. Discover valuable insights about this dynamic industry and drive your business forward.

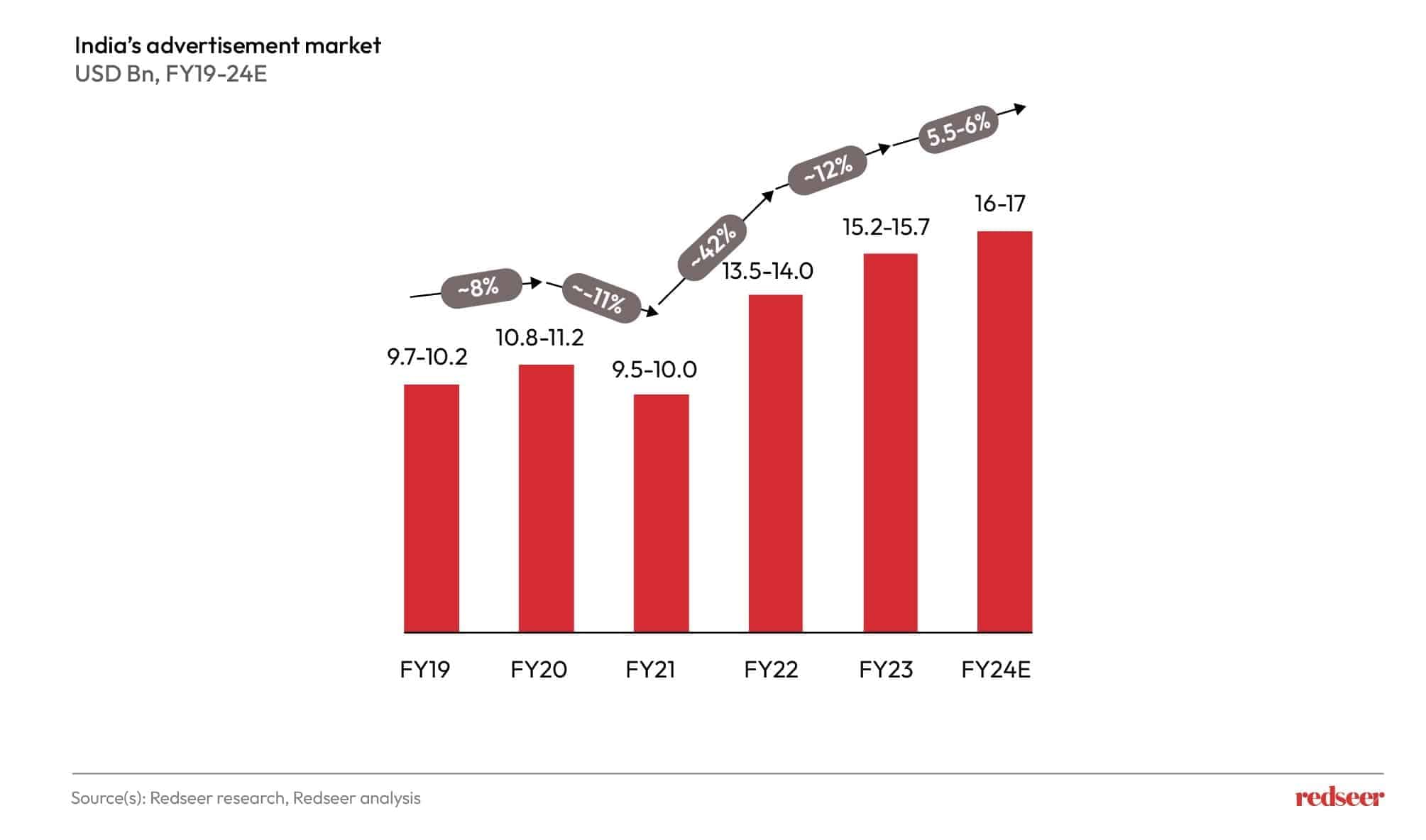

Advertising spending in FY 2024 saw muted growth; expected to recover and grow sustainably till FY 2028

India’s advertising landscape underwent significant transformation, especially during and after the COVID-19 pandemic. With increased online activity, the demand for digital advertising surged. By FY24, advertising spending in India is expected to reach USD 16-17 billion. Although FY24 experienced a muted growth rate due to economic uncertainties and market adjustments, the long-term outlook still remains promising, with an anticipated annual growth rate of 9-10% till FY28.

Several factors drive this sector���s growth:

- Shifting Digital Consumption: As consumers spend more time on digital platforms, brands tend to allocate higher budgets for digital advertising.

- Rising Competition: The rise of new digital-first brands in the mid-to-premium segment has intensified competition, while traditional players across sectors are ramping up their ad spending and presence, to capture more consumer attention.

- Diverse Regional Audience: With rising disposable incomes across various demographics, there is an increased need for personalized marketing strategies to cater to these diverse audiences.

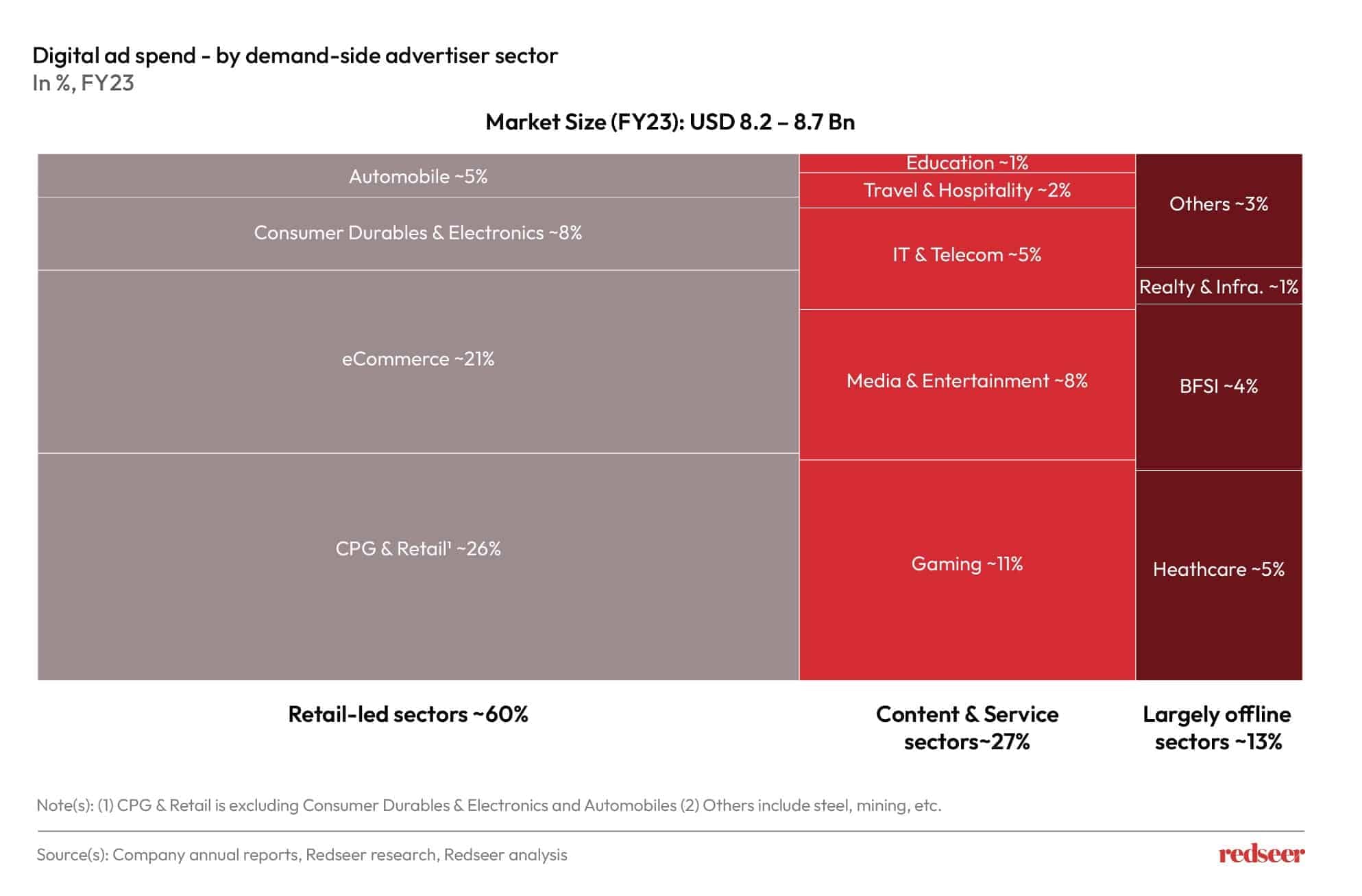

Digital ad spend, pegged at USD 8.8-9.3Bn in FY24, was dominated by retail-led sectors, followed by content & services with high online presence

With a significant user base of internet users in India, digital advertising is poised to become a dominant force with internet users likely to surpass television viewership over the next two years, as highlighted in our last article.

Retail-led advertisers dominate digital advertising spend, favoring channels with higher engagement and conversion rates, making digital advertising as crucial as traditional advertising avenues like TV

Different sectors use digital advertising in unique ways to meet their specific needs:

- Retail-Led Sectors: In FY23, retail-related businesses, including eCommerce, CPG, and consumer durables, drove about 60% of the digital advertising market. With a heavy focus on boosting engagement and conversions, these sectors are expected to further increase their digital ad allocations.

- Content and Service Sectors: These sectors use ads to boost engagement, drive website traffic, encourage app downloads, and promote services, focusing more on audience interaction than immediate purchases.

- Largely Offline Sectors: Traditional businesses like real estate, infrastructure, BFSI, and healthcare adopt digital advertising to increase visibility, generate leads, and stay competitive in a digital-first world.

By tailoring their digital advertising strategies, each sector maximizes campaign effectiveness based on their brand goals. The flexibility offered by digital advertising, to reach different users based on the brand requirements is the key to unlocking advertising efficiencies.

In FY24, the eCommerce sector continued to witness a good growth rate in ad spend, even as many other sectors, such as CPG & Retail, experienced muted growth rates. Conversely, sectors like Education and Gaming are currently facing a reduction in ad spending due to macroeconomic and regulatory challenges. The automobile industry enjoyed increased ad spend driven by new vehicle launches, and the travel and hospitality sector expanded its ad budget post-pandemic.

Several factors are at play when brands formulate their advertising strategy and their digital ad platform mix

As the digital landscape evolves, new and established brands are rethinking strategies to keep pace with changing consumer behaviours and technological advancements. Digital advertising has become a core component of business growth. The balance between traditional and digital marketing spends is very important as it helps the brand to remain relevant. Factors influencing this balance include:

- Target audience: Brands are becoming increasingly focused on targeting the right people, ensuring their advertising efforts reach the intended audience.

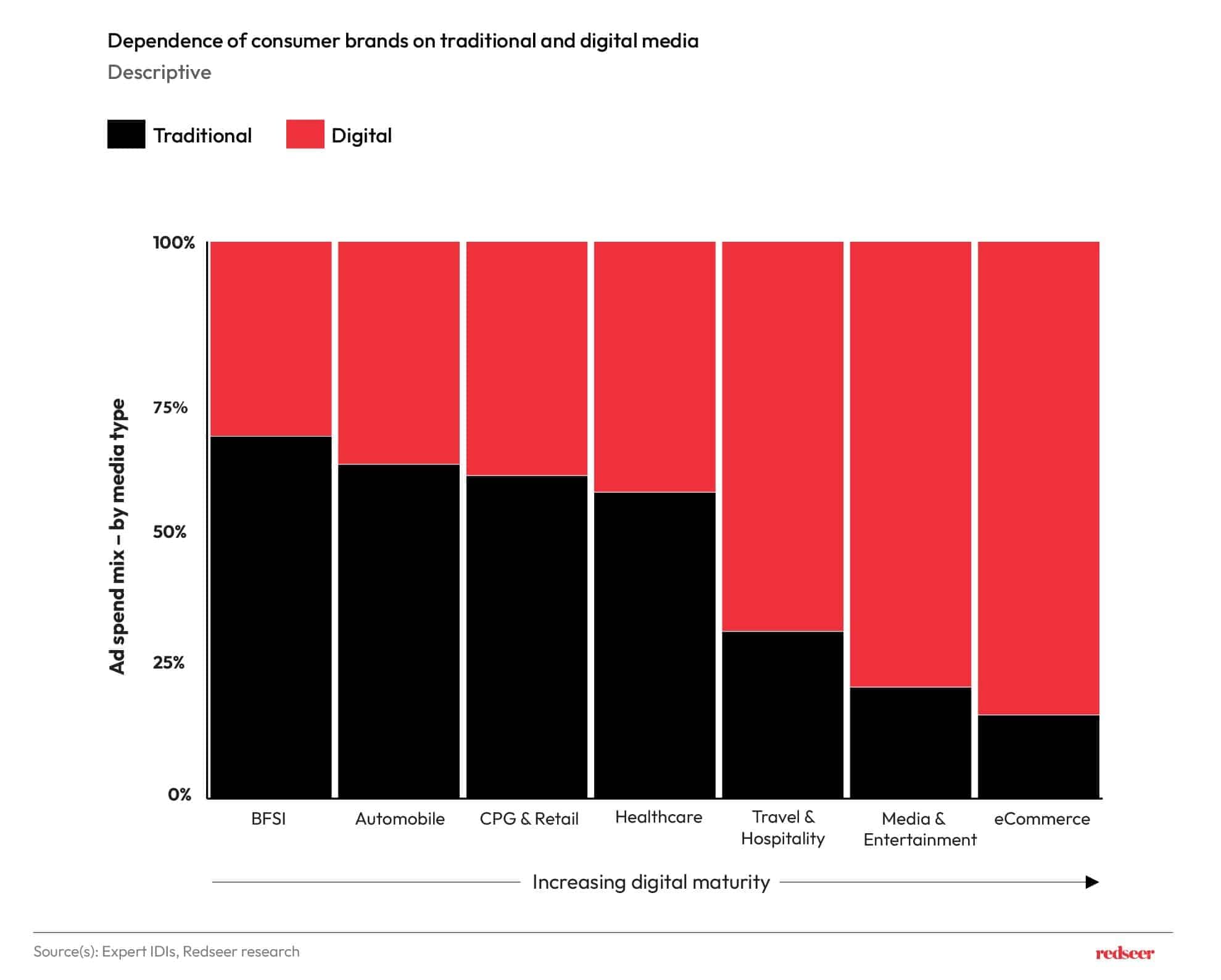

- Digital Maturity of customers: Different industries are at varying stages of digital adoption, with some being early adopters and others still in the process of integrating digital strategies into their marketing efforts.

- Scale of Business: Smaller businesses find digital advertising particularly beneficial due to its cost-effective and measurable nature, allowing them to optimize their marketing spend and achieve significant results even with limited budgets.

- Legacy vs Digital-First Brands: Legacy brands are gradually shifting more of their budget to digital to stay competitive, while digital-first brands have always been digitally focused.

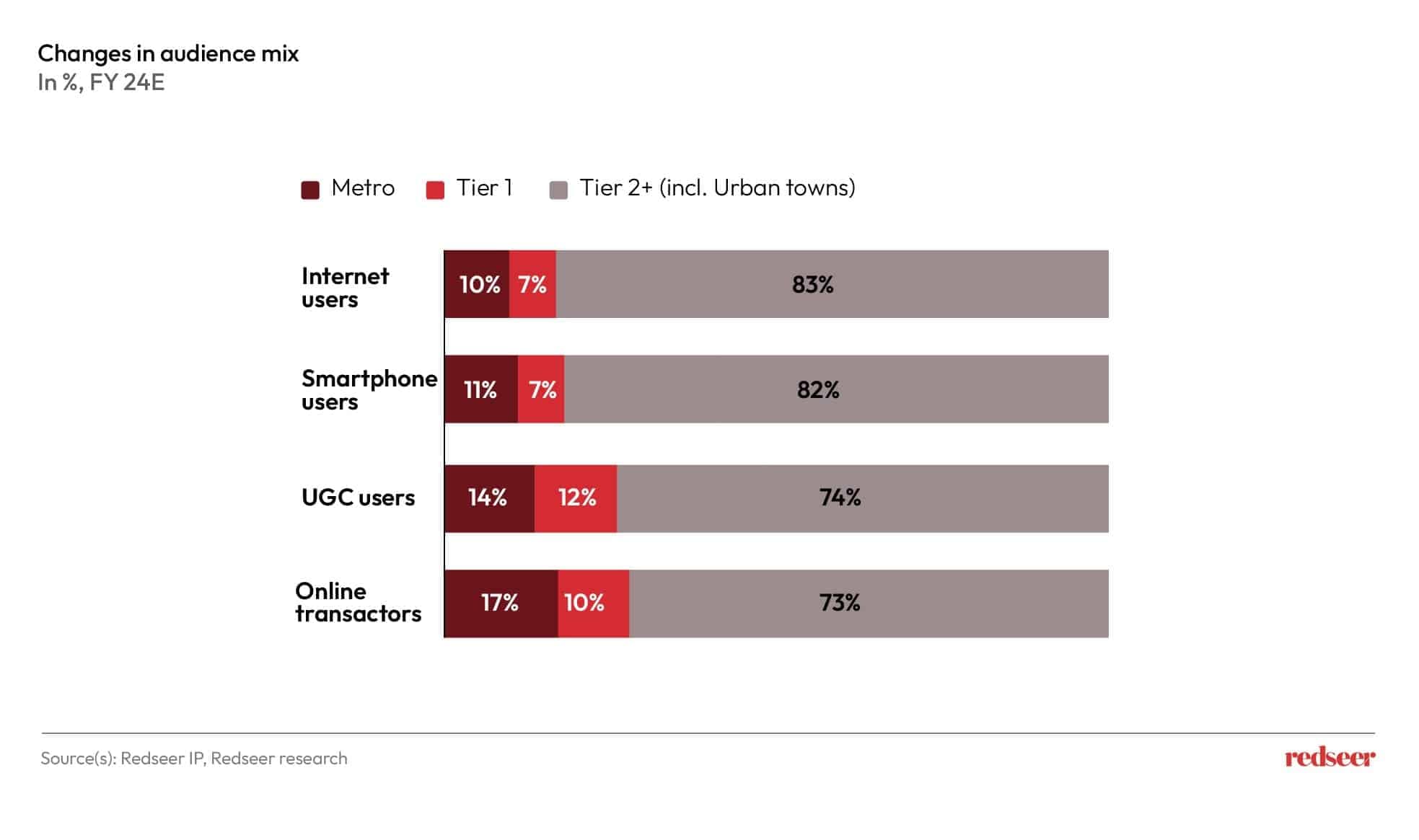

1. Growing consumer spending and audience mix towards Tier-2+ cities is prompting brands to increase ad spending in these regions

With more people in smaller cities getting online, brands are reallocating budgets to target these new internet users, increasing ads on regional platforms or in local languages to capitalize on emerging markets.

So, what does this mean for brands?

1. Increasing spending on regional platforms: Catering to local tastes and languages, regional platforms attract advertisers aiming for niche audiences.

2. Shifting focus of brands towards Tier-2+: Brands are increasingly focusing on reach and conversion from the growing Tier-2+ digital population.

3. Increased Ad Spend on eCommerce: Brands invest heavily in eCommerce ads to attract new customers.

2. Multiple consumer sectors seeing digital disruption with foray of multiple new-age, digital-first brands, all thriving on the back of digital media

Traditional-heavy industries like BFSI (Banking, Financial Services, and Insurance), automobiles, and Healthcare lean heavily on traditional advertising and are gradually increasing the allocations for digital ad platforms. On the other hand, digitally mature industries like travel, hospitality, media, entertainment, and eCommerce lead with innovative digital strategies.

The prominence of digital channels in the consumer journey defines their ad allocations. In sectors like automobiles, the digital consumer journey is limited to discovery and product comparisons. In contrast, the typical journey from discovery to conversion for a digital-first brand happens online. The push to capture customers online is higher for the latter.

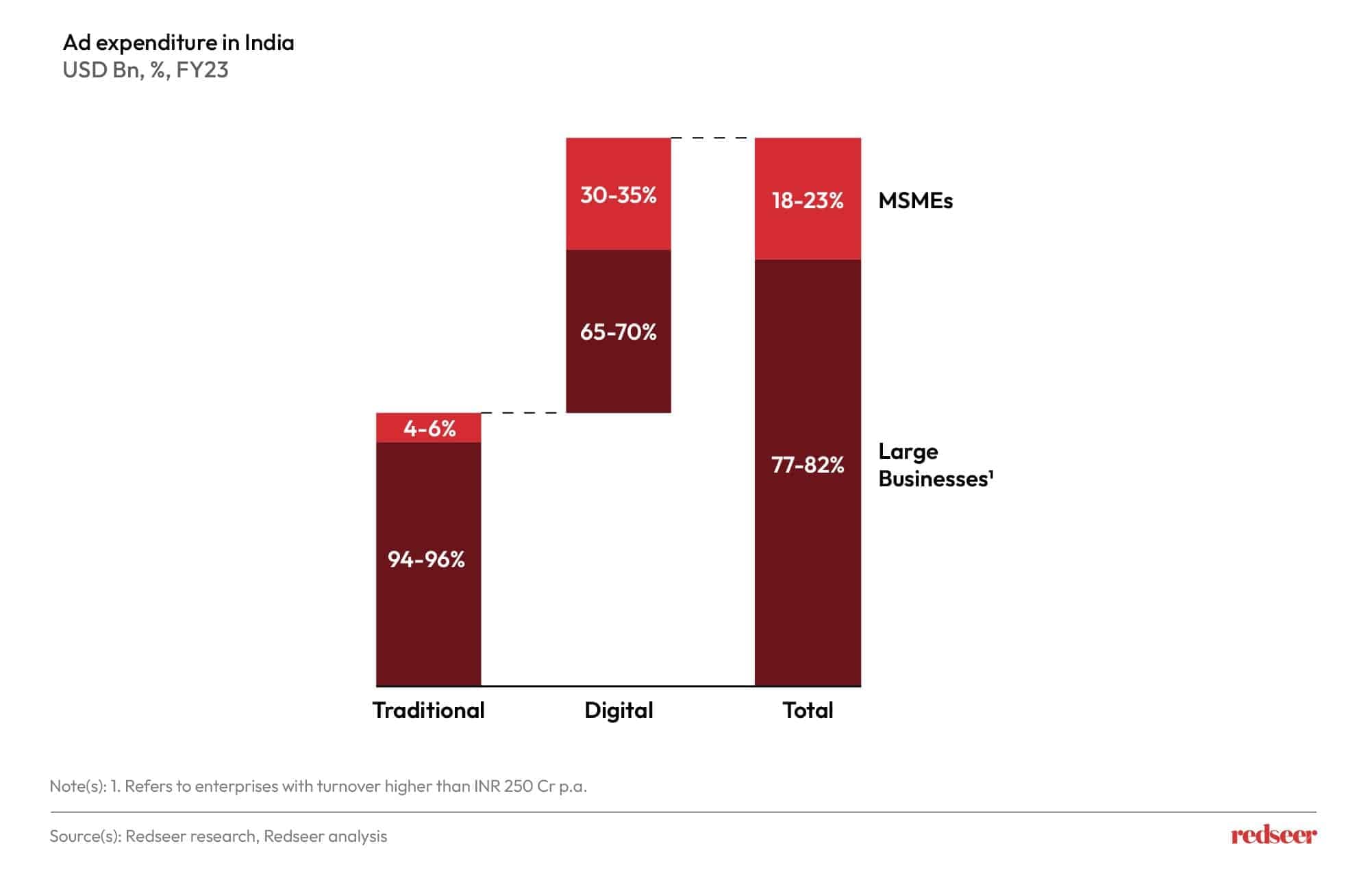

3. The growing digital savviness of MSMEs is allowing them to capitalise on digital advertising, alongside the plethora of self-serve tools available

India’s MSMEs (Micro, Small, and Medium Enterprises) make up over one-third of the total digital advertising spend. They leverage digital technologies and tools like self-service platforms for precise audience targeting and optimized spending, distinguishing them from larger businesses. In FY23, MSMEs invested more in digital advertising compared to traditional methods, distinguishing them from larger businesses.

MSMEs typically operate with tighter budgets, making the value of digital advertising on conversion much higher for them. They can optimize their ad spend for maximum impact without setting up physical stores or spending heavily on traditional advertising, utilizing advanced tools for personalized, impactful campaigns.

In contrast, large businesses, with their more substantial budgets, aim for high conversion rates on a broader scale, leveraging their ability to reach extensive audiences.

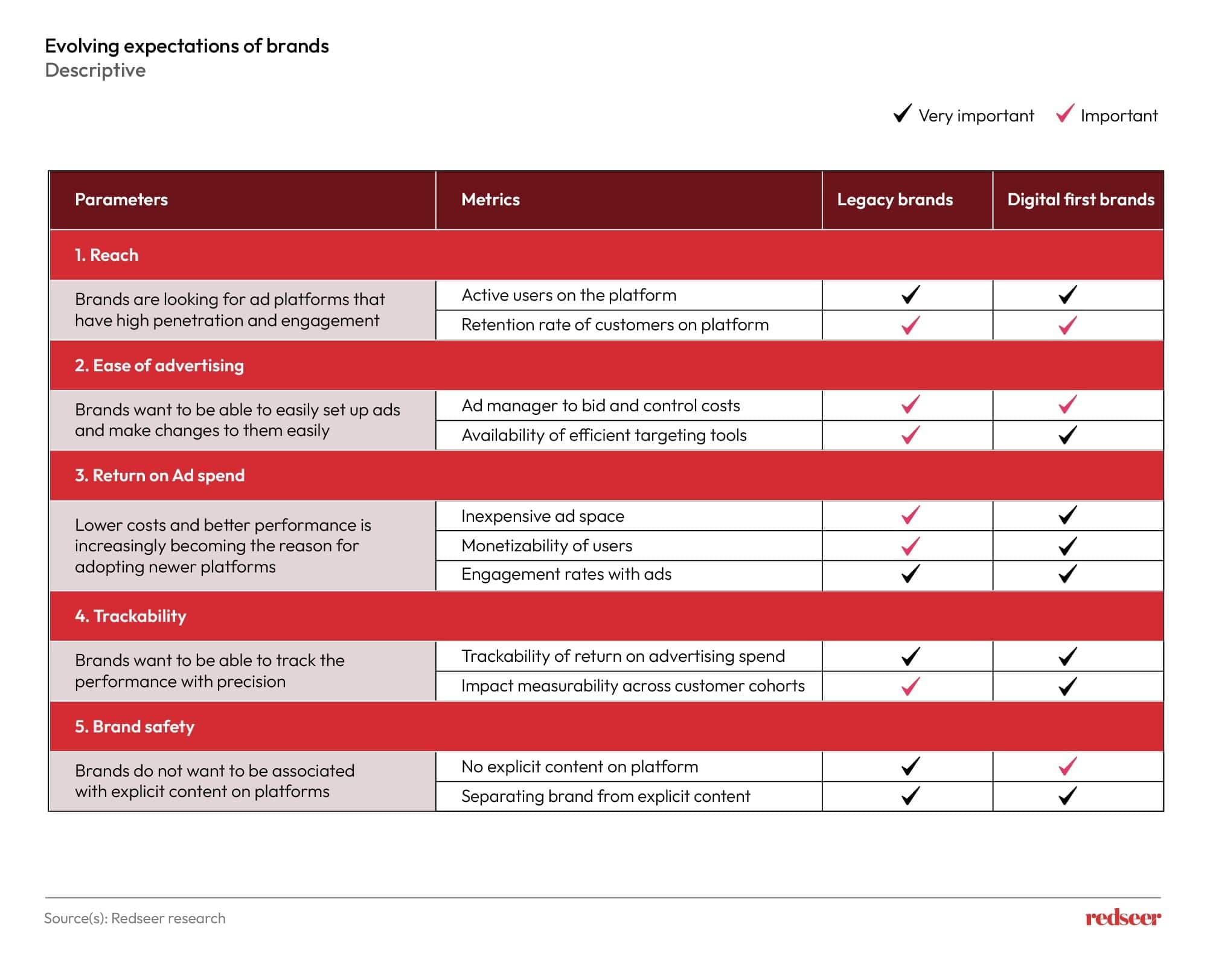

4. As brands mature in their journey, their expectations from ad platforms continue to evolve and become complex

Legacy brands, which have been around for decades, are shifting from traditional media methods like TV and print ads to more modern, digital approaches to reach more audiences. This digital transformation isn’t just about following trends—it’s about growing in a market that increasingly favours digital engagement. While digital-first brands focus mainly on online advertising for high returns on ad spend (RoAS) at minimal costs, legacy brands try to maximise reach at scale for lower cost.

Evolving Brand Expectations (in their branding and performance advertising) need refined ad product offering

As brands mature, their expectations from advertising platforms become more complex. They are increasingly in need of advanced solutions that offer niche audience targeting, ease of campaign execution, cost-efficiency, and ad performance tracking. In line with the changing expectations, advertising platforms are gearing towards innovating and refining their ad products and providing sophisticated tools and streamlined processes to brands.

High-intent audience conversions are achieved through eCommerce and hyperlocal app advertising, while social media and content platforms enable contextual advertising that enhances brand recall and conversions.

Way forward

What makes digital advertising stand out is its flexibility to optimise and customise an advertising campaign — from allowing brands to reach niche audiences to get desired outcomes from a performance campaign (leads, app instals, signups, transactions etc.). With consumer spending recovering current fiscal and henceforth, and sectors such as eCommerce, Consumer Durables & Electronics, and Travel & Hospitality driving growth, it would boost digital ad spend.

In the next 2-3 years, India’s digital advertising will be defined by innovation in influencer marketing, programmatic advertising, and GenAI-driven strategies in the way brands reach and engage with their audiences. So, whether you’re looking to refine your current strategy or dive into new digital opportunities, there’s never been a better time to explore and innovate.

Curious to explore the world of digital advertising and see how your business can make the most of it? Reach out to our expert, Mukesh Kumar, for insights and guidance into this advertising revolution.

Don’t miss out—subscribe to our newsletter for the latest trends and updates in digital advertising!

Written by

Mukesh Kumar

Associate Partner

Mukesh is a go-getter with an analytical approach who enjoys solving challenging business issues. He has worked extensively in the retail, TMT, public policy, and private equity sectors and specialises in research and growth initiatives.

Talk to me

Quick Commerce Finds Its New Normal with Scale, Mix, and Momentum

India Fashion: Why Growth Is Concentrating at the Bottom of the ASP Curve

SEA’s USD 123 Bn Remittance Market: Fragmented Landscape, Focused Winners