MENA’s Digital Advertising Landscape is continuing to evolve in step with consumer behaviour shifts. In previous editions, we have explored the opportunities that in-app advertising and MENA’s digital advertising landscape hold.

In this edition, we explore the next stages of how changes in content consumption for MENA digital media users will present new opportunities for brands to connect with consumers. In particular, even with the disproportionate influence that social media holds on MENA’s consumer spending today, the sands are shifting yet again towards channels with richer context and information that will affect consumer purchase decisions intimately.

Digital Advertising

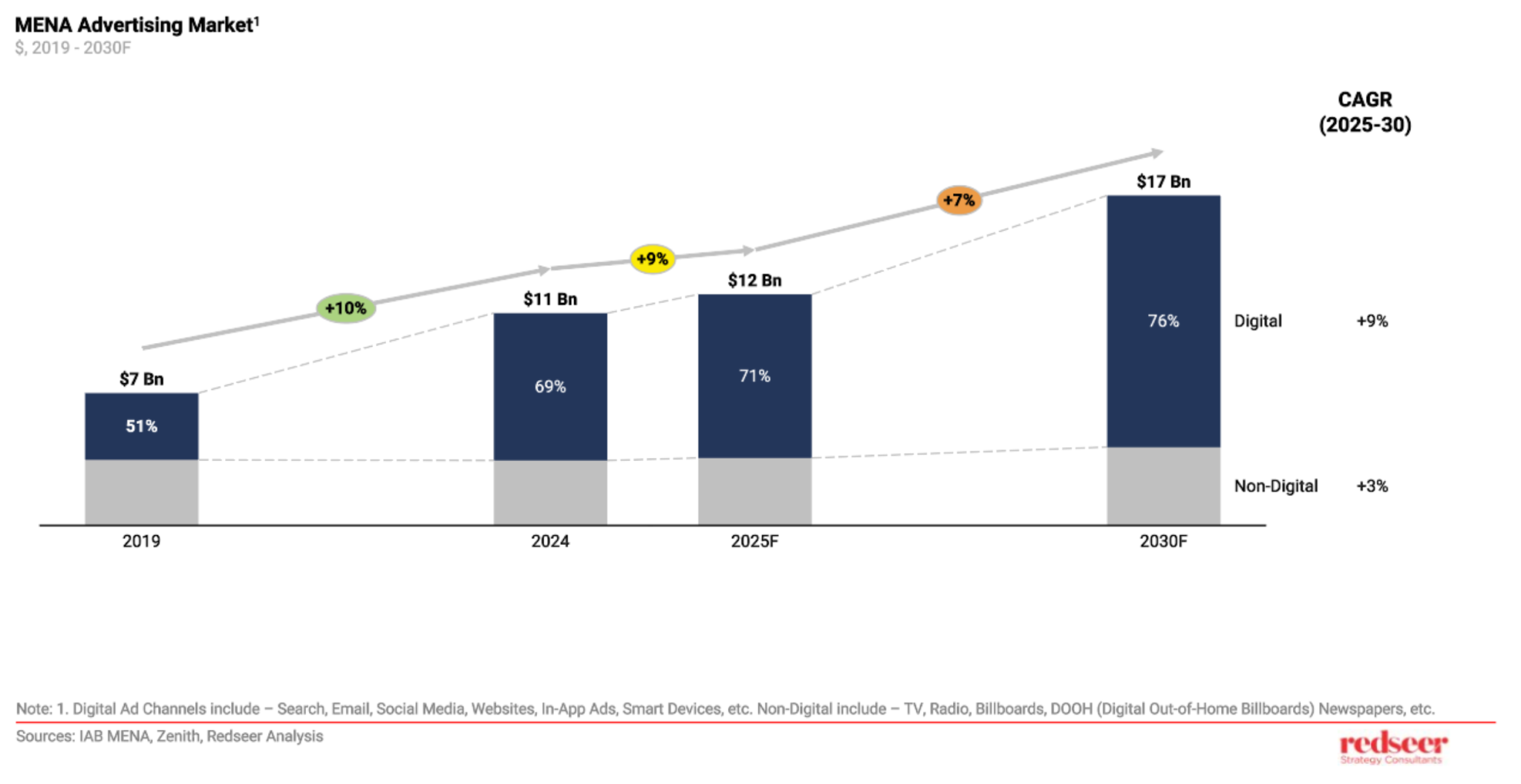

MENA is witnessing a remarkable transformation in its advertising landscape, with digital channels becoming increasingly dominant. The region’s advertising market is set to reach $17 billion by 2030, with digital advertising commanding an impressive three-quarters of total ad spend.

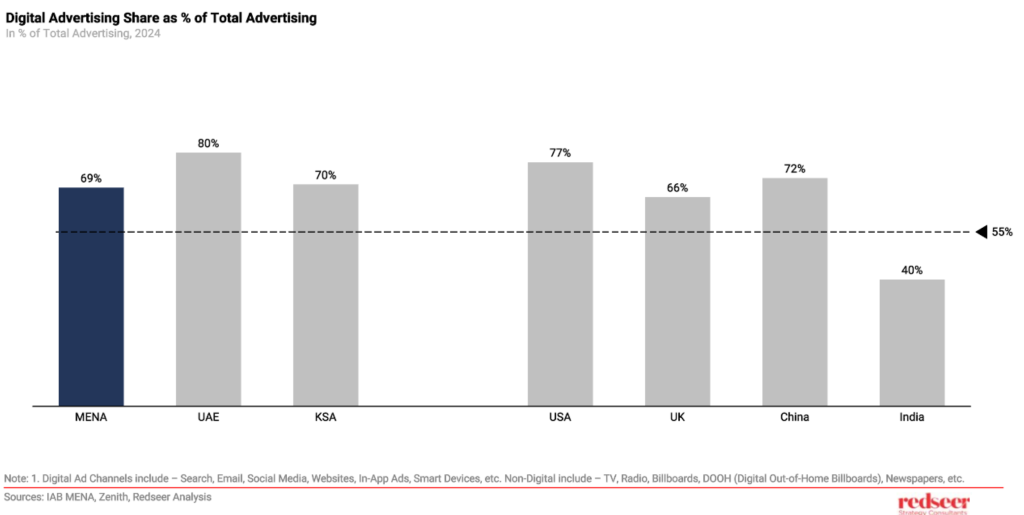

This digital shift isn’t merely about volume—it’s about sophistication. MENA’s digital advertising market has reached maturity levels comparable to global leaders, with the UAE leading the charge at 80% digital ad share. The regional average of 69% puts MENA in the same league as the United States (77%) and China (72%), significantly ahead of emerging markets like India.

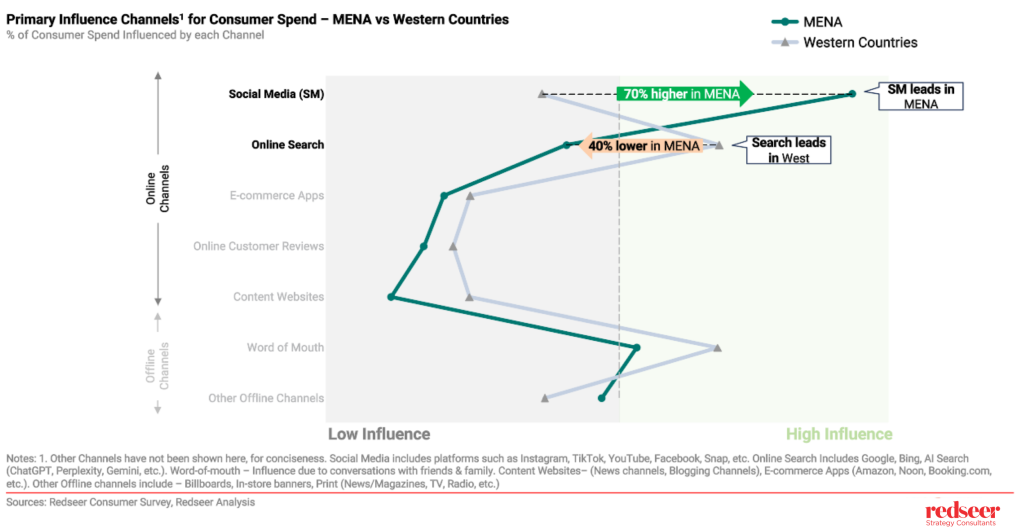

What sets MENA apart is its unique consumer behavior patterns. Unlike Western markets where search dominates, social media wields extraordinary influence in MENA, showing 70% higher impact on consumer decisions than in Western countries.

This regional preference for social discovery and recommendations has shaped the advertising landscape, with platforms like YouTube, TikTok, and Instagram emerging as market leaders, followed by Snapchat and Facebook in challenger positions.

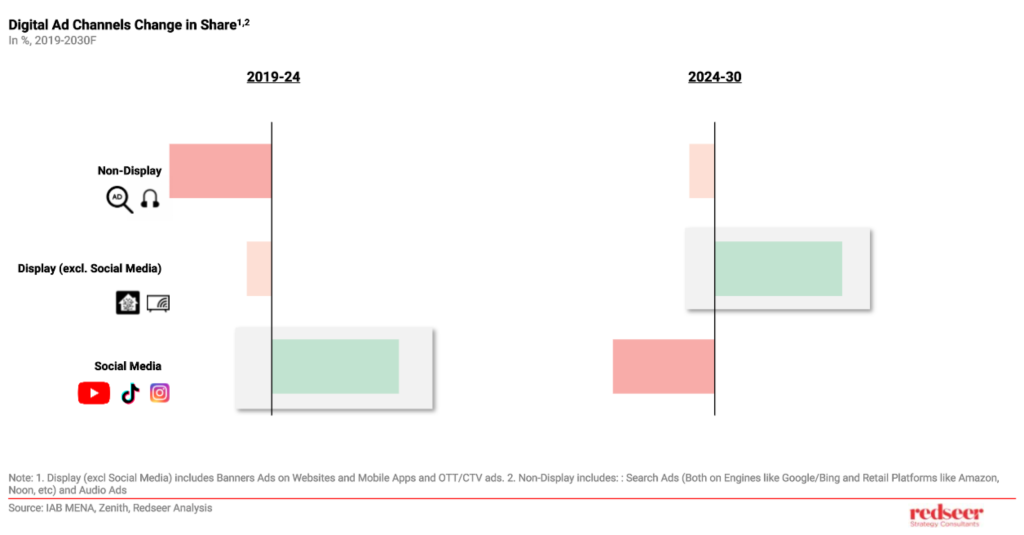

This regional preference for social discovery and recommendations has shaped the advertising landscape. Going forward, however, the advertising landscape is expected to shift towards other channels, driven by changes in the mix of publishers and change in content consumption patterns for MENA digital users

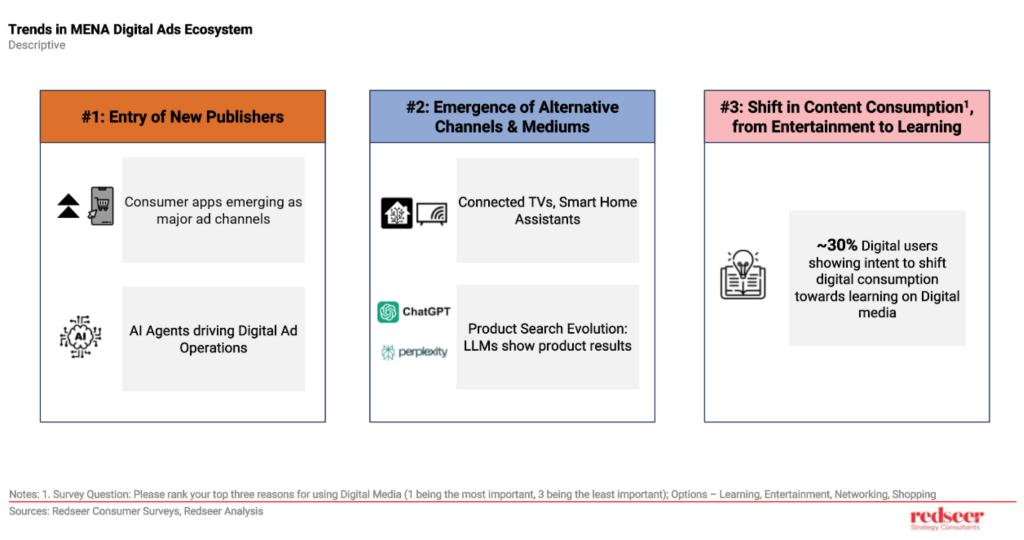

This shift is being fueled by three factors:

- Entry of New Publishers:

- Traditionally, digital advertising has stuck to open channels (Social media platforms, public websites). However, with the growing prominence of retail consumer apps in the region (eg, Noon, Careem, STARZPlay, etc.), these channels become a direct way to connect with consumers and advertise products & services.

- Publishers will now also incorporate the use of AI to create Agentic Workflows for automation of in-house digital advertising operations (eg, ideation, creation of ad copies, etc.)

- Emergence of Alternative Channels & Mediums:

- Connected TVs and Smart Home Assistants (eg, Alexa) offer rich context and highly personalized campaigns to consumers, thereby making them an indispensable channel of connect for brands targeting households.

- Evolution of product search: With LLM usage reaching all-time highs, these platforms are evolving fast to become a channel of influence on consumer spend. eg, Perplexity launched an integration with Amazon to show product listings in its search results, when users enquire about products on their searches.

- Shifting behaviour in content consumption: Digital Media users in MENA are fast changing their content consumption patterns. In a recent Redseer survey of digital media users in MENA, 30% of respondents showed clear intent to shift towards learning, instead of pure entertainment, when using these platforms.

MENA’s digital advertising landscape is therefore set to experience significant shifts as content consumption patterns evolve, chief among them being the changes in how social media channels will be viewed by users and the emergence of channels with richer context that interact deeply with consumers. Brands will have to adapt their advertising strategies to build organic connect with audiences.