India’s tryst with Digital Public Infrastructure began with the roll out of the Aadhar process – a commendable effort designed to provide a unique identity card for the 1.2 billion strong Indian population. Since the undertaking of the mammoth task, the digital identity spectrum has evolved to the JAM trinity or Jan Dhan, Aadhar and Mobile, setting the tone for the expansion of India’s Digital Public Infrastructure. Each of these components have contributed towards the facilitation of Direct Benefit Transfer (DBT) to 900 million beneficiaries, bringing more members of underserved communities into the ambit of Banking and Income Tax, streamlining eGovernance and have gone on to play a critical role in the nationwide vaccination drives during the pandemic. Today, over 97% of the Indian population possesses a digital ID, with nearly 50% owning smartphones, and approximately 40% having access to banking services.

Both the Aadhar card and Unified Payments (UPI) emerged as lifelines to both the general public and businesses during the lockdown period. UPI, which currently facilitates about 45% of the nation’s payments, has been majorly successful in tearing down geographical barriers. In fact, 70% of the user base hail from outside Tier-1 cities and over 80% of the new users are from Tier-2+ localities. A robust system of DPIs is now emerging with the creation of newer properties like DigiLocker 2.0, Account Aggregator (AA), Open Network for Digital Commerce (ONDC), Ayushman Bharat Health Account (ABHA), Digital Infrastructure for Knowledge Sharing (Diksha) among others.

70% of retail merchants observe an increase in sales due to UPI adoption, and 90% of payments are to be UPI-led by 2027

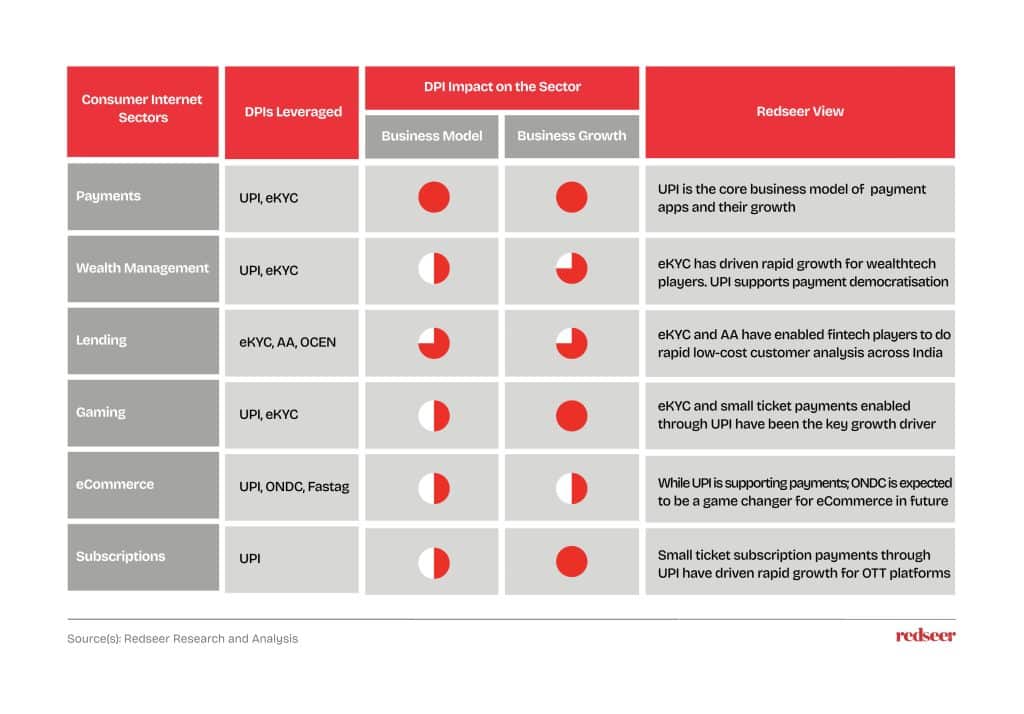

The affordability of India’s internet data combined with its formidable subscriber base of 800 million users (of which 350 million are transacting users) drive up the demand for UPI. Redseer’s research observes that a) convenience in terms of user interface and interoperability, b) security protocols and c) merchant acceptance are three factors that have contributed to the increase in UPI adoption. Geographies outside the top 40 cities in India are expected to fuel the next wave of UPI growth in India. UPI has also catalysed growth within the Fintech space with leading market players branching out into sectors like credit, commerce, wealth management and insurance.

UPI spurs change in Discount Broker client base with 85% falling within the 20-30 age bracket, Tier-2 cities lead the way in lending

The advent of eKYC has enabled wealth management firms to reach out to a wider client base across the nation and introduced simplified, paperless procedures to replace the 40-page forms of yore. This has also brought down the time taken to open demat accounts from 3-7 days to less than a day. Innovations like the Account Aggregator network which are synonymous with easy, user-approved financial data-sharing are gaining popularity among wealthtech firms and the lending ecosystem.

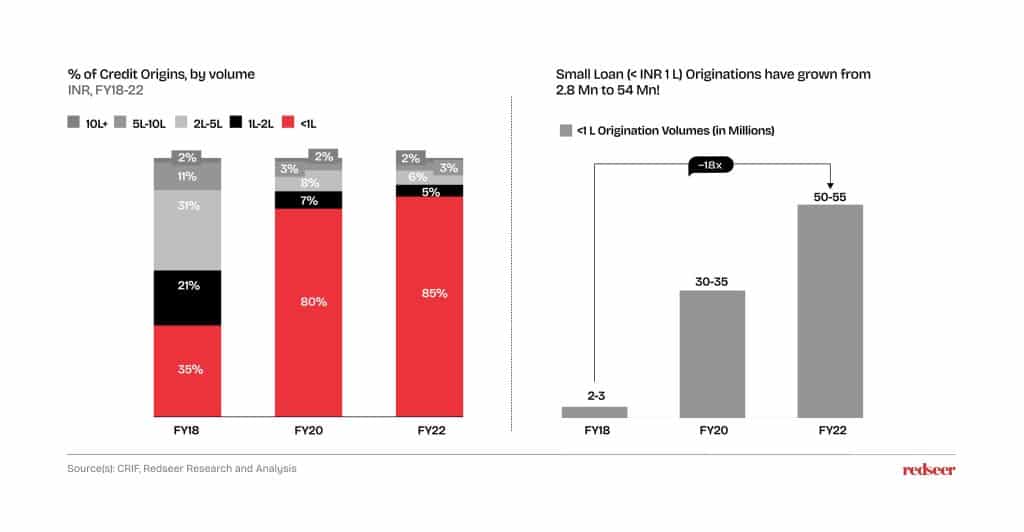

The speeding up of loan processing through the use of eKYC and Account Aggregators have enabled lenders to reach out to demographics located beyond Tier-1 cities in India. Fintech firms are in the process of exploring partnerships with NBFCs and Buy Now Pay Later (BNPL) services are seen to close the nation’s credit gap.

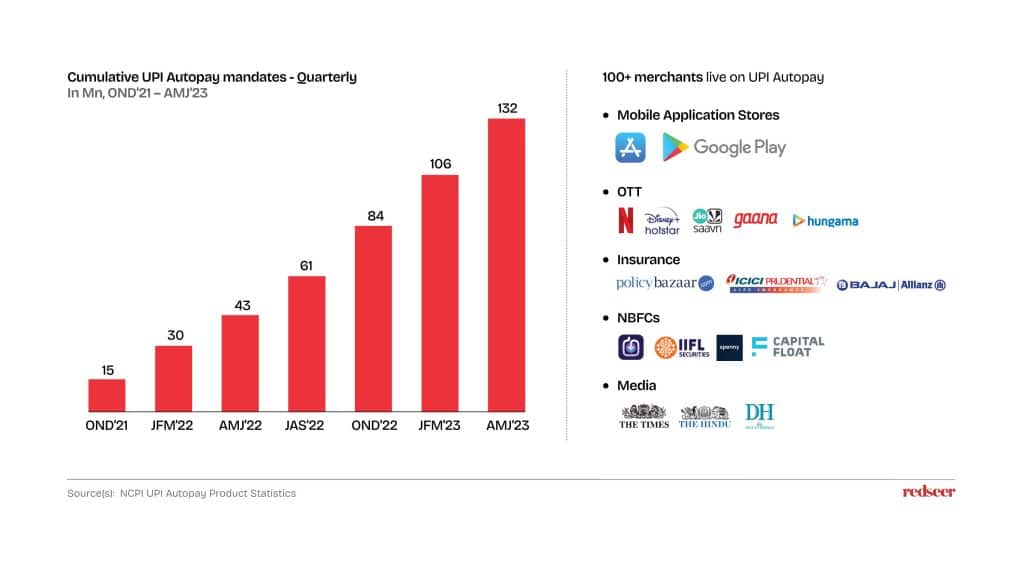

Monetization on Games sees a 20-25% uptick in new paying users, and UPI Autopay boosts payment collection for subscriptions

UPI and eKYC have brought 100 million users and USD 27 billion in transaction value to the online gaming industry. They have effectively facilitated transactions in the Real-money Gaming ecosystem and contributed to over 70% of the overall gaming transactions. UPI Autopay, a platform launched in 2021 has revolutionized the collection of subscriptions payments for categories including OTT, insurance, financial services, telecom and media among others. Currently, the platform hosts over 100 active merchants and facilitates monthly subscriptions of up to Rs 5000.

Mobility, Foodtech and Gaming drive 55% of eCommerce spending and ONDC sees interest from Paytm, PhonePe and Ola

DPIs have played a critical role in the journey of the e-Commerce sector towards achieving a Gross Merchandise Value (GMV) of approximately USD 80 billion in 2022. A significant share of eCommerce transactions now occurs through UPI owing to zero Merchant Discount Rates (MDR) on UPI payments. Mobility accounts for ~65% of the eCommerce payments with Foodtech following closely at ~50% and eTailing at ~35%

Platforms like Open Network for Digital Commerce (ONDC) could generate a Gross Merchandise Value (GMV) ranging from USD 250-300 billion by 2030. It is particularly beneficial to players in the MSME space as its open architecture and affordability are conducive to their digital requirements.

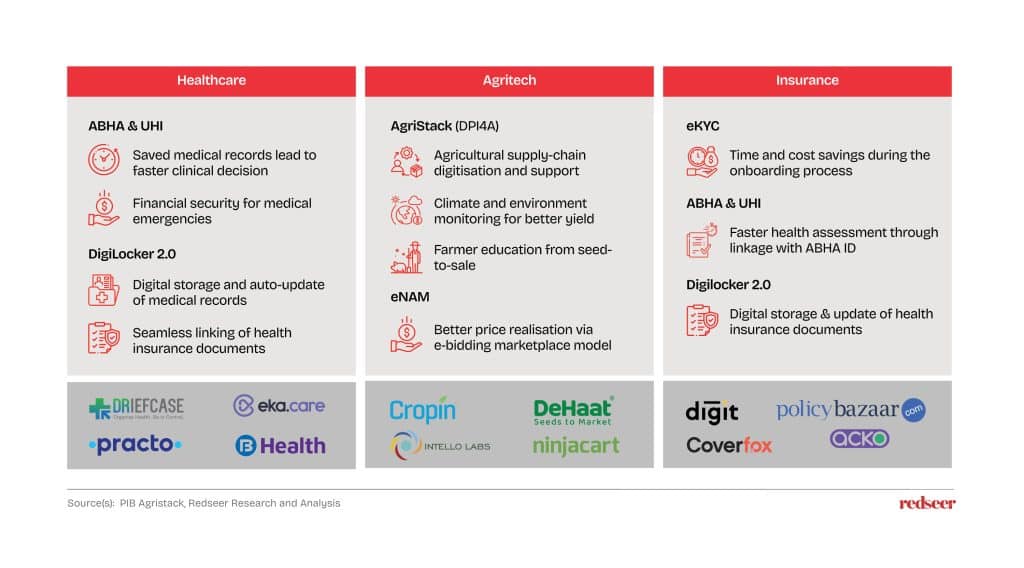

Healthcare, Agritech and Insurtech to lead the way in the next wave of DPI transformation

Startups are expected to leverage open protocols to develop new business models and achieve accelerated growth using DPI. The Healthcare, Agritech and InsureTech domains are expected to lead the way forward in the evolution of DPI. The secure centralization of data across multiple parameters will strengthen decision-making across medical consultation and diagnostics, farming process and market identification, and increase insurance penetration.

The Indian Internet Economy is expected to grow to US$ 1 trillion by 2030. A significant expansion of the merchant and consumer base for existing verticals, and further innovation and democratization of DPIs are key to catalysing startup growth.