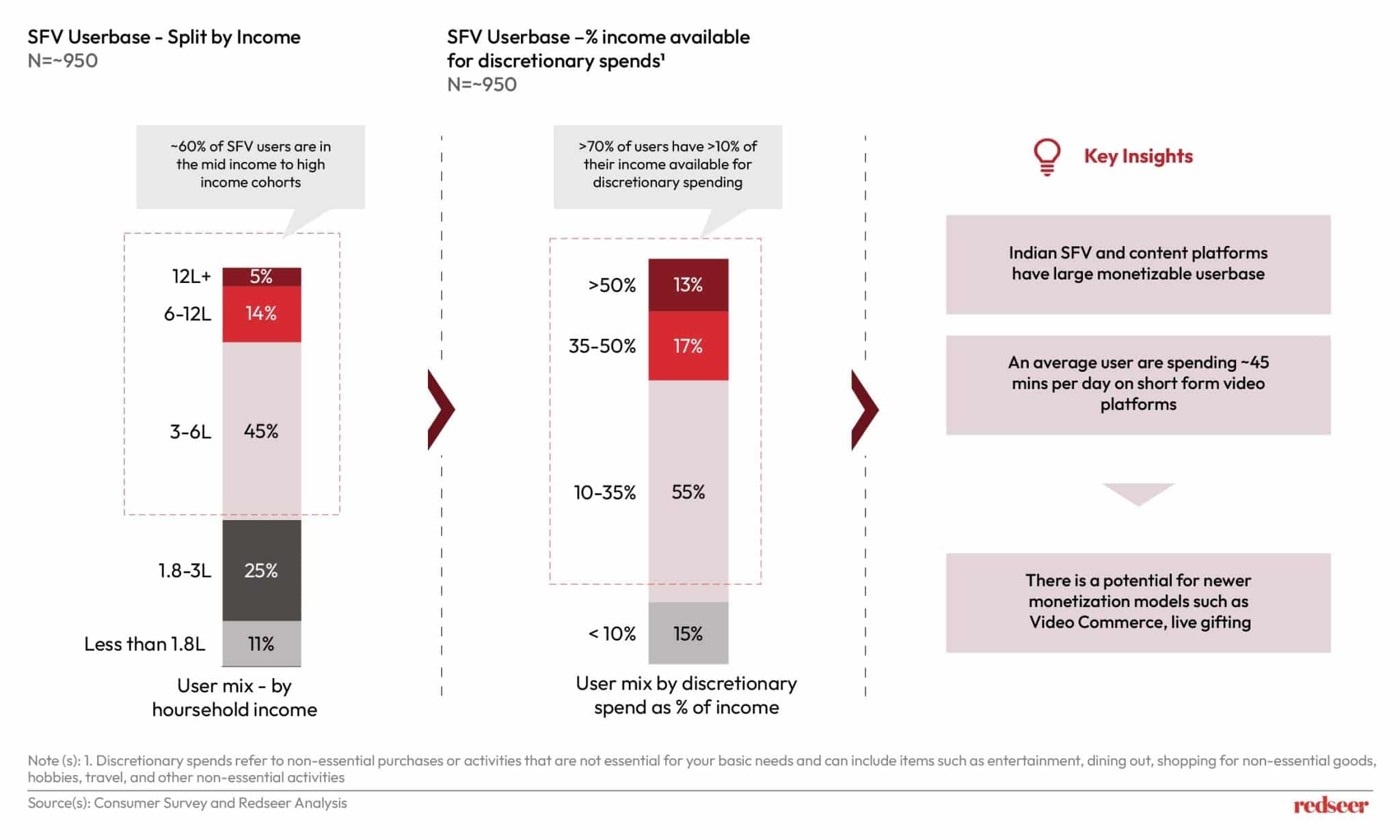

Indian Short Form Video (SFV) platforms are no longer just sources of entertainment—they are transforming into influential contributors within the country’s digital landscape. With Indian users now spending an average of 30 minutes per day on these platforms, and more than 60% of users coming from middle- to high-income households, SFVs are part of our daily lives. This deepening engagement positions SFVs to play a significant role as they mature and diversify their revenue models.

The shift began in the wake of the TikTok ban, when platforms like Josh, Moj, and Chingari quickly stepped in to fill the gap, attracting millions of users with culturally relevant, regional language content. Leveraging the accessibility of affordable smartphones, these platforms have experienced a surge in active users, particularly from Tier-2 and smaller cities, creating a thriving, uniquely Indian content ecosystem.

Redseer has been at the forefront of tracking SFV’s rise in India since 2022, with previous reports like India’s SFV Platforms: Insights and Analysis examining the platforms’ content monetization strategies and their growing role in digital advertising. With Redseer’s extensive expertise in India’s emerging digital sectors, we are well-equipped as a trusted authority to help companies harness the monetization opportunities within SFVs. Our insights into this rapidly evolving market can guide businesses to unlock new growth avenues and create impactful strategies as SFV platforms continue to reshape India’s digital economy.

Diverse User Archetypes with High Monetization Potential

Indian SFV users span across varied demographics with different engagement and spending capacities. Research identifies four major archetypes—Value Seekers, Digital Innovators, Household Stewards, and Career Mavens—each interacting uniquely with SFV content. The Value Seekers and Digital Innovators stand out, accounting for more than half of the user base and engaging with content for over 30 minutes daily. This is crucial because over 50% of these users are from middle to high-income households and are monetizable, meaning they possess sufficient disposable income for discretionary spending on items like virtual gifts, influencer-driven purchases, and subscription services.

Furthermore, SFV users display a high overlap with e-commerce and OTT platforms, highlighting a robust appetite for digital transactions. For instance, 80% of SFV core user groups are regular e-commerce shoppers, while others are beginning to explore paid gaming and premium OTT subscriptions. The spending capacity and cross-platform engagement of these user groups mark them as prime candidates for targeted advertising and innovative revenue models.

Content as the Growth Catalyst: Original, Relevant, and Engaging

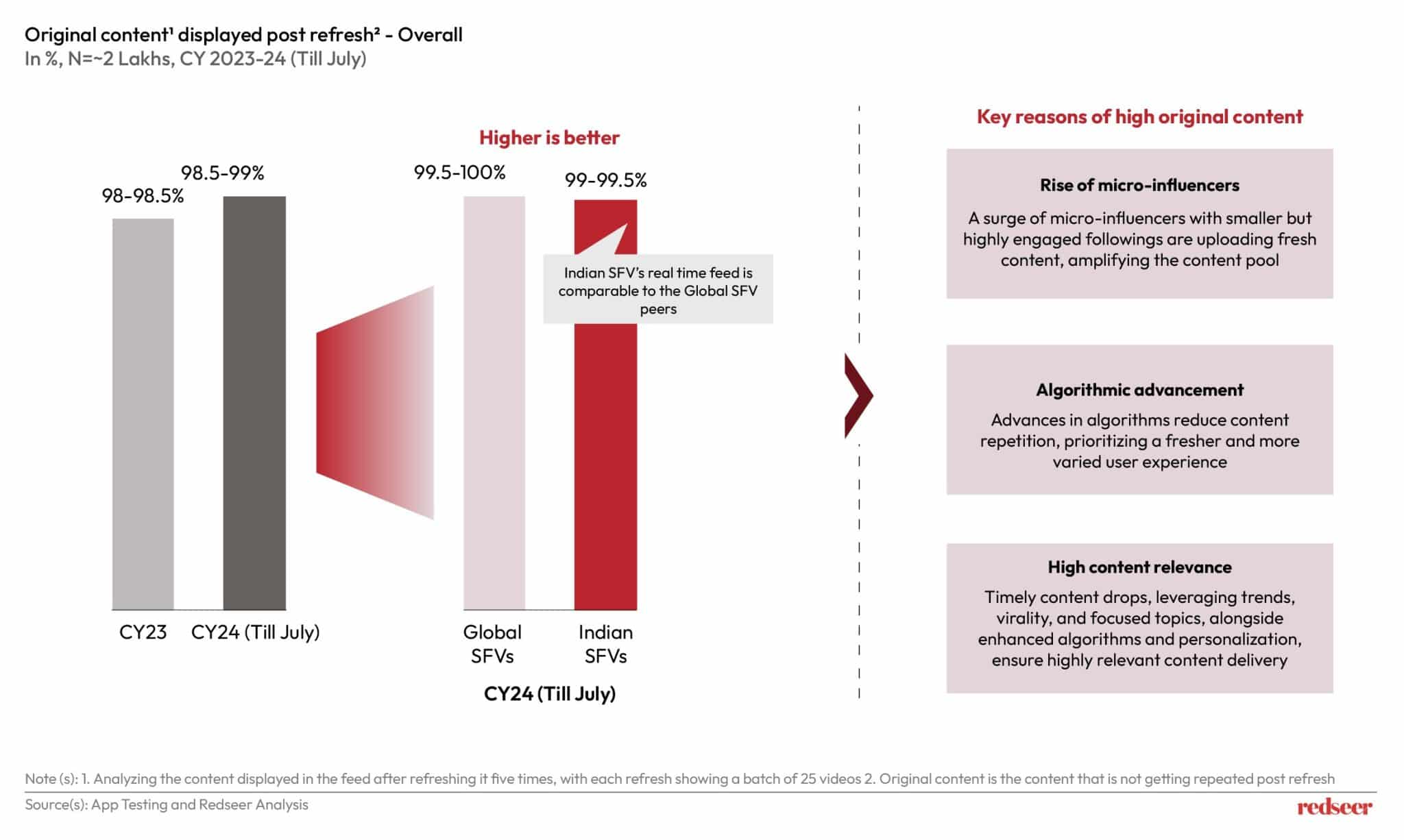

Indian SFV platforms’ growth is rooted in their ability to deliver content that resonates with local audiences. With over 99% of SFV content deemed original and minimal inflammatory content (less than 0.6%), Indian SFVs ensure that users encounter fresh, engaging material. In contrast to global counterparts, Indian SFVs are marked by high content relevance across popular genres like music, motivation, and fitness, where 70-80% of content aligns closely with user preferences.

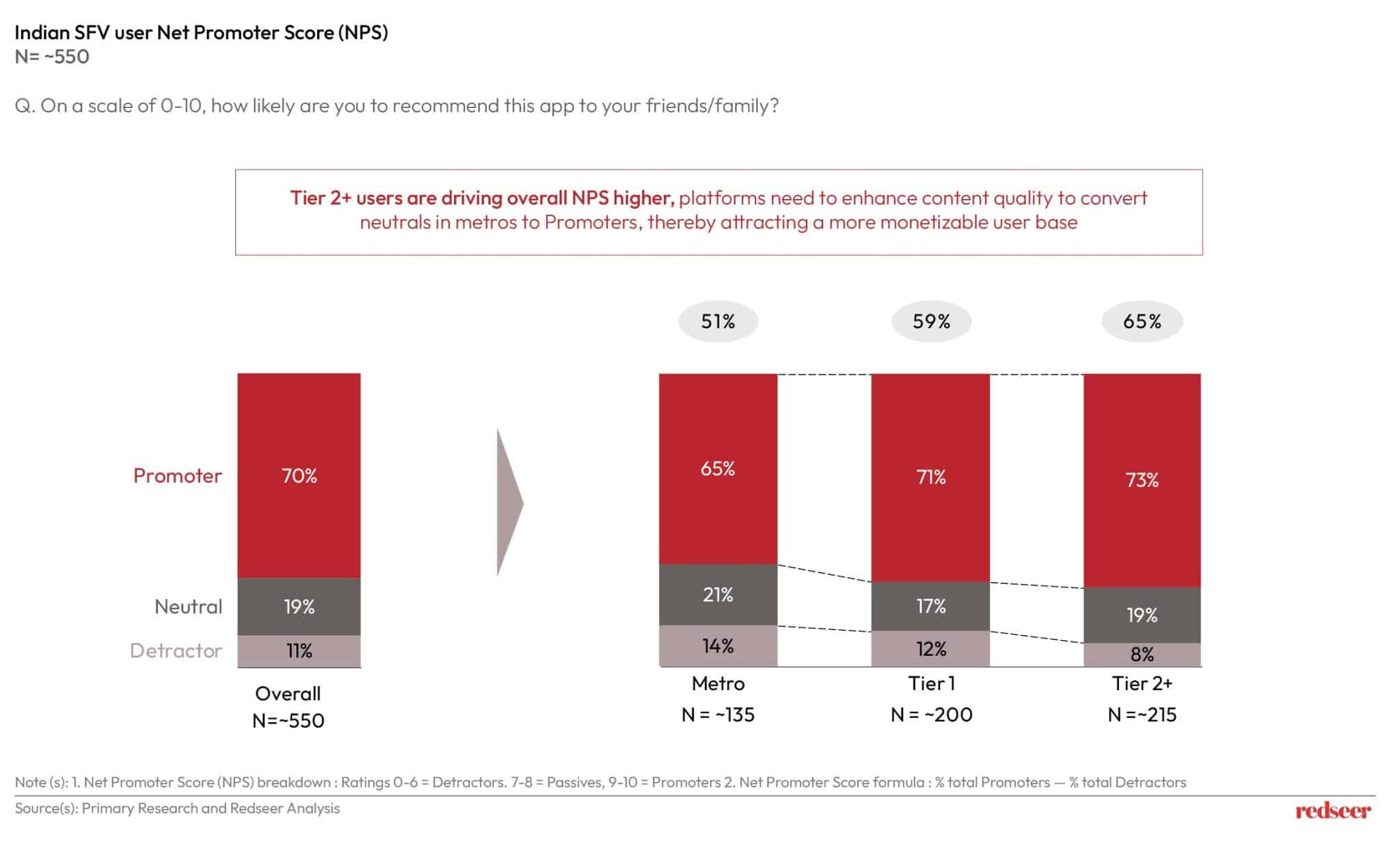

These platforms are also fine-tuning their recommendation algorithms to better serve users’ diverse interests. Advanced AI-driven personalization is making SFVs a powerhouse of relatable content, helping platforms maintain a high net positive customer sentiment, especially among users from Tier-2 cities, where Net Promoter Scores (NPS) exceed 60%. This emphasis on hyper-local, high-quality content is cementing SFVs as an integral part of India’s digital consumption landscape, forming the foundation for sustainable monetization.

Monetization Models: The Four Pillars of Revenue

India’s SFV platforms are now transitioning from audience-building to revenue generation, leveraging four primary monetization streams: advertising, influencer marketing, virtual tipping, and video commerce. Each model presents a unique avenue for revenue generation, enabling platforms to engage brands, empower influencers, and involve users in new ways.

Advertising:

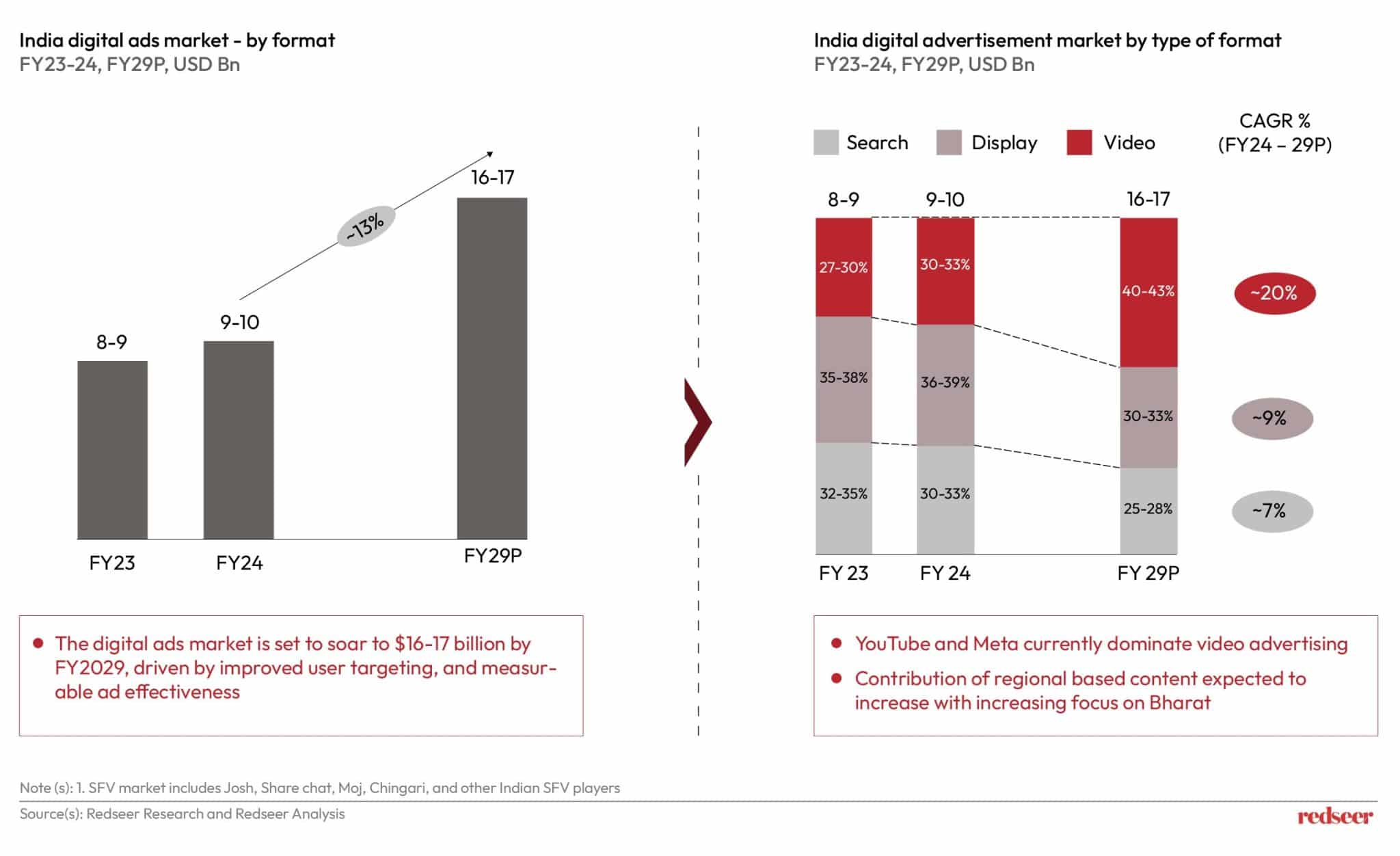

India’s digital advertising market is poised to double in the next five years, with video advertising emerging as the fastest-growing ad format. The market is projected to soar to $16-17 billion by FY2029, fueled by increasing usage of digital media in marketing campaigns, improved user targeting, and measurable ad effectiveness. Currently, platforms like YouTube and Meta dominate video advertising, but the contribution of regional content platforms is expected to increase as the focus shifts to Bharat—Tier-2 and smaller towns.

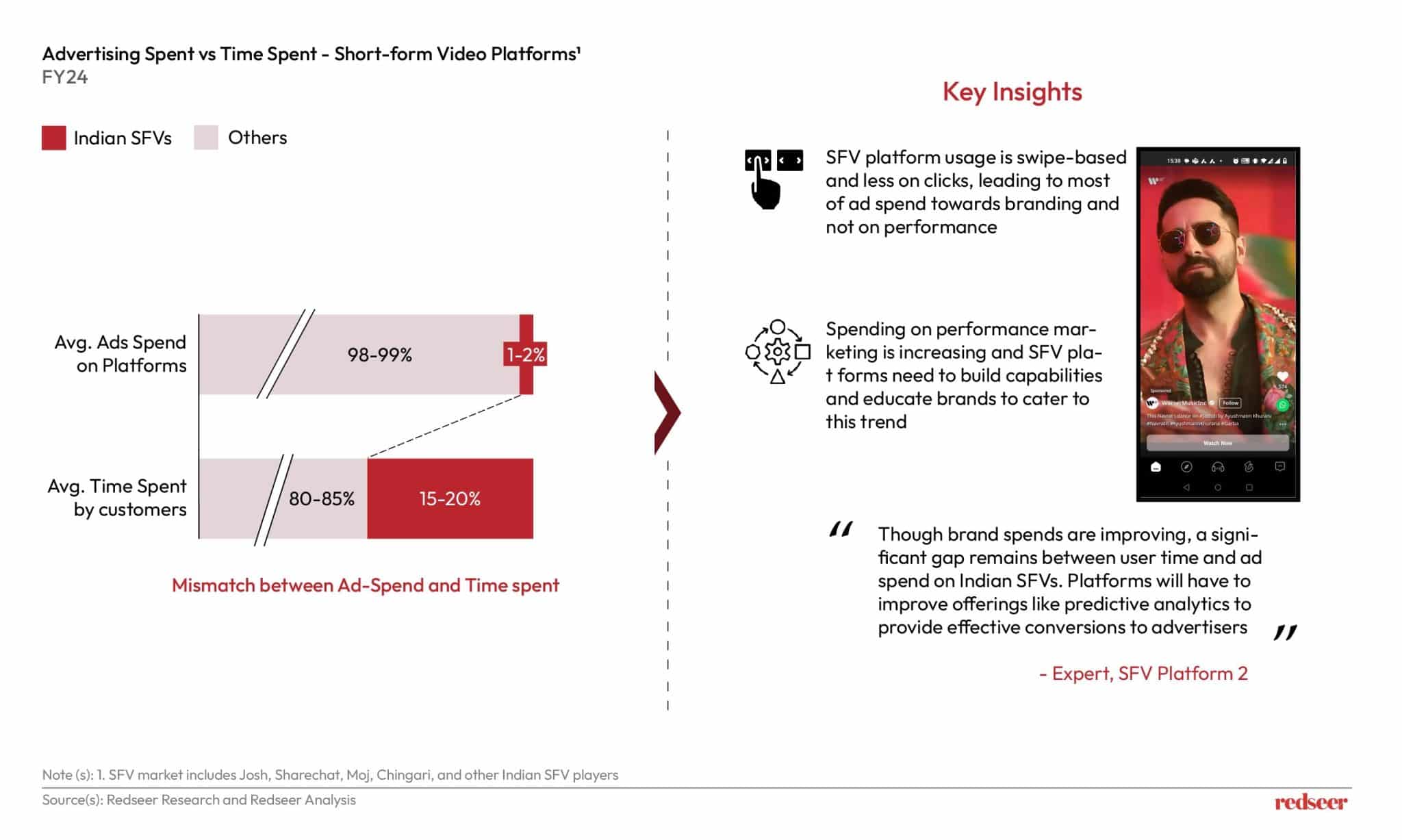

Despite India SFVs capturing substantial user attention, ad spending on these platforms remains relatively low, currently representing just 1-2% of overall digital ad spend in India, even though SFV platforms account for 15-20% of total digital screen time. This discrepancy highlights the untapped advertising potential in this space. India SFV platforms are primarily swipe-based, with users engaging less through clicks, which has historically led to using it for branding campaigns over performance campaigns

Spending on performance marketing is increasing, and SFV platforms need to build the necessary infrastructure and educate brands to cater to this trend. By doing so, they can better align with the evolving advertising landscape and attract a greater share of performance-driven ad spend, particularly targeting Tier-2+ users.

Influencer Marketing:

Influencer marketing in India is projected to become five-fold by FY29, potentially reaching $3-4 billion. SFV platforms offer brands an efficient way to access influencers and connect with their captive follower base, who trust influencers for their authenticity. As influencers become architects of contemporary lifestyles—shaping purchasing decisions, brand perceptions, and consumer attitudes—their role in driving brand trust and awareness has never been more crucial.

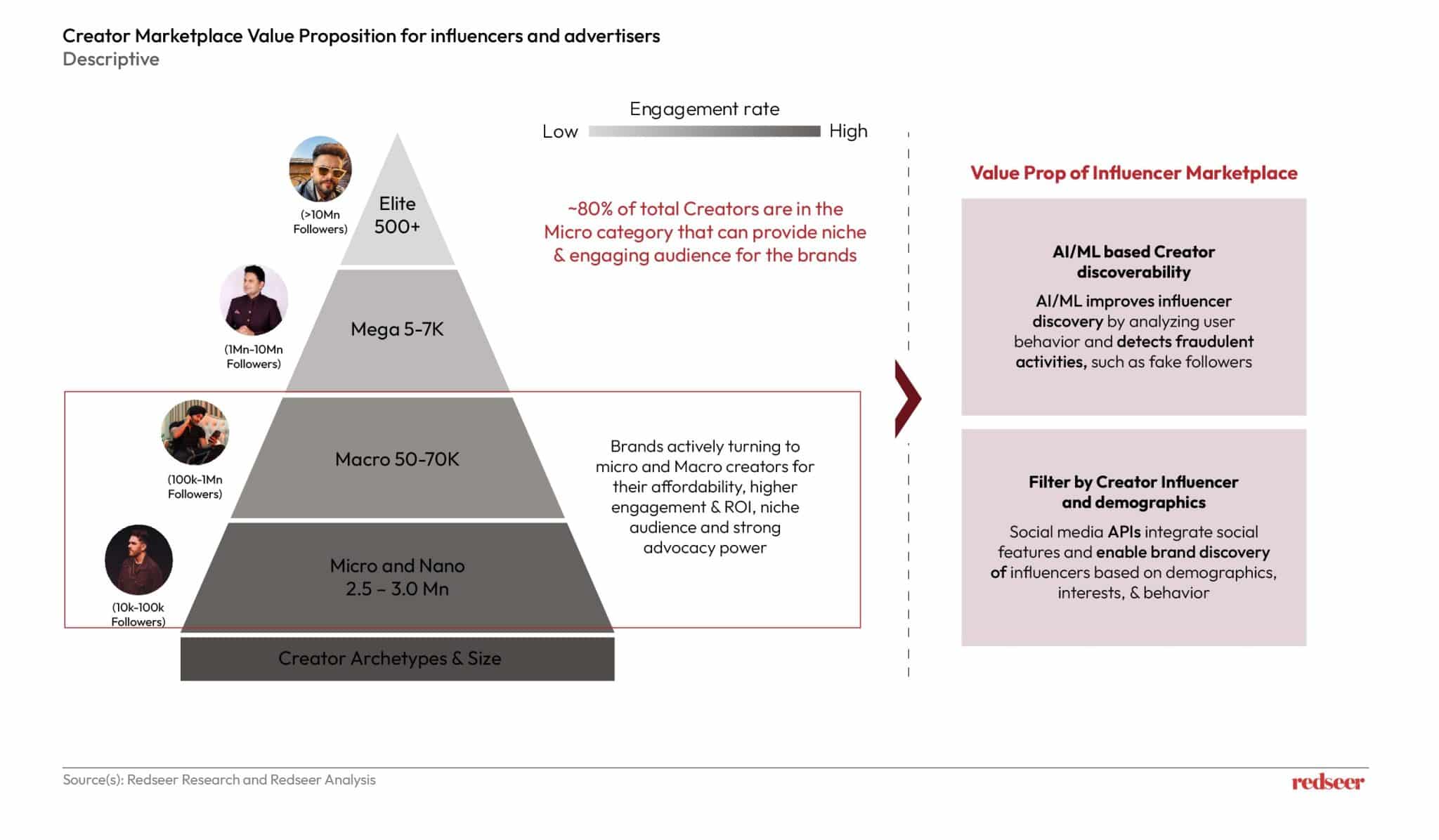

Micro and nano influencers, who make up around 80% of creators, are particularly impactful due to their highly engaged, niche audiences. These influencers are cost-effective, deliver higher engagement rates, and provide strong ROI, making them highly sought after by brands. Creator marketplaces, powered by AI/ML, are enhancing discoverability and offering brands the ability to filter creators by demographics and engagement metrics. These platforms are helping brands find trustworthy collaborations and providing transparent pricing, which is critical for optimizing campaigns.

As engagement on SFVs continues and influencer popularity grows, brands are increasingly turning to influencer-led campaigns to reach audiences. The ability to directly connect with existing and potential customers is making influencer marketing an integral part of digital advertising strategies. Influencers are not just generating income; they are also helping brands foster meaningful connections with their audience, with Indian SFV creators reaching 1 million followers in half the time of their global counterparts, proving the rapid rise of this market.

Virtual Tipping and Gifting:

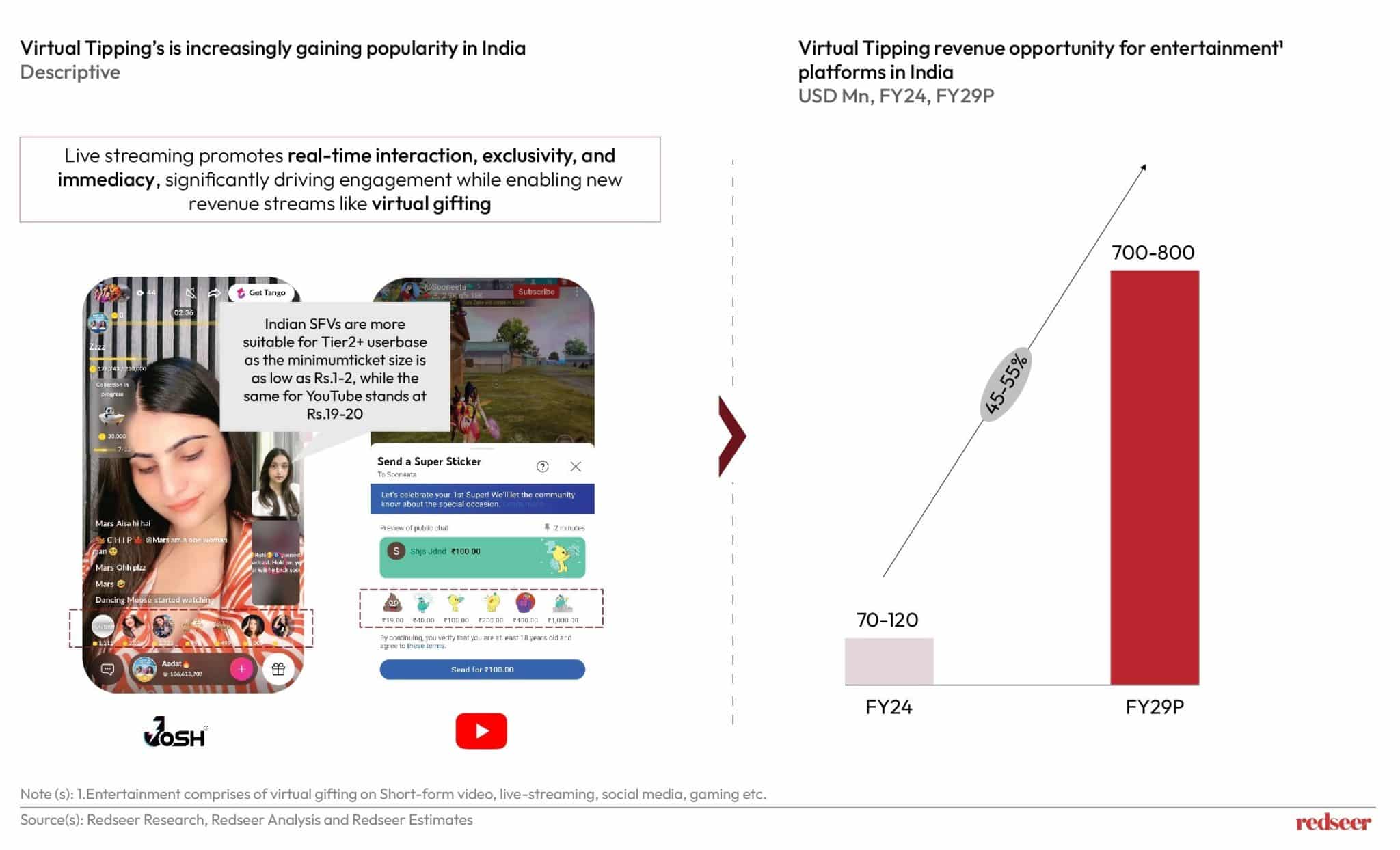

Virtual tipping is rapidly emerging as a significant revenue stream for Indian SFVs, expected to reach $700-800 million by FY29. This growth is driven by a strong sense of personal connection between influencers and their audiences, as well as the increasing quality of content. Live streaming, which promotes real-time interaction, exclusivity, and immediacy, has played a central role in this trend, significantly driving engagement and enabling new monetization opportunities, such as virtual gifting. Approximately 4% of users on SFV platforms tip their favorite influencers, with the average user spending INR ~100 on tips each month, highlighting the growing appetite for direct creator support.

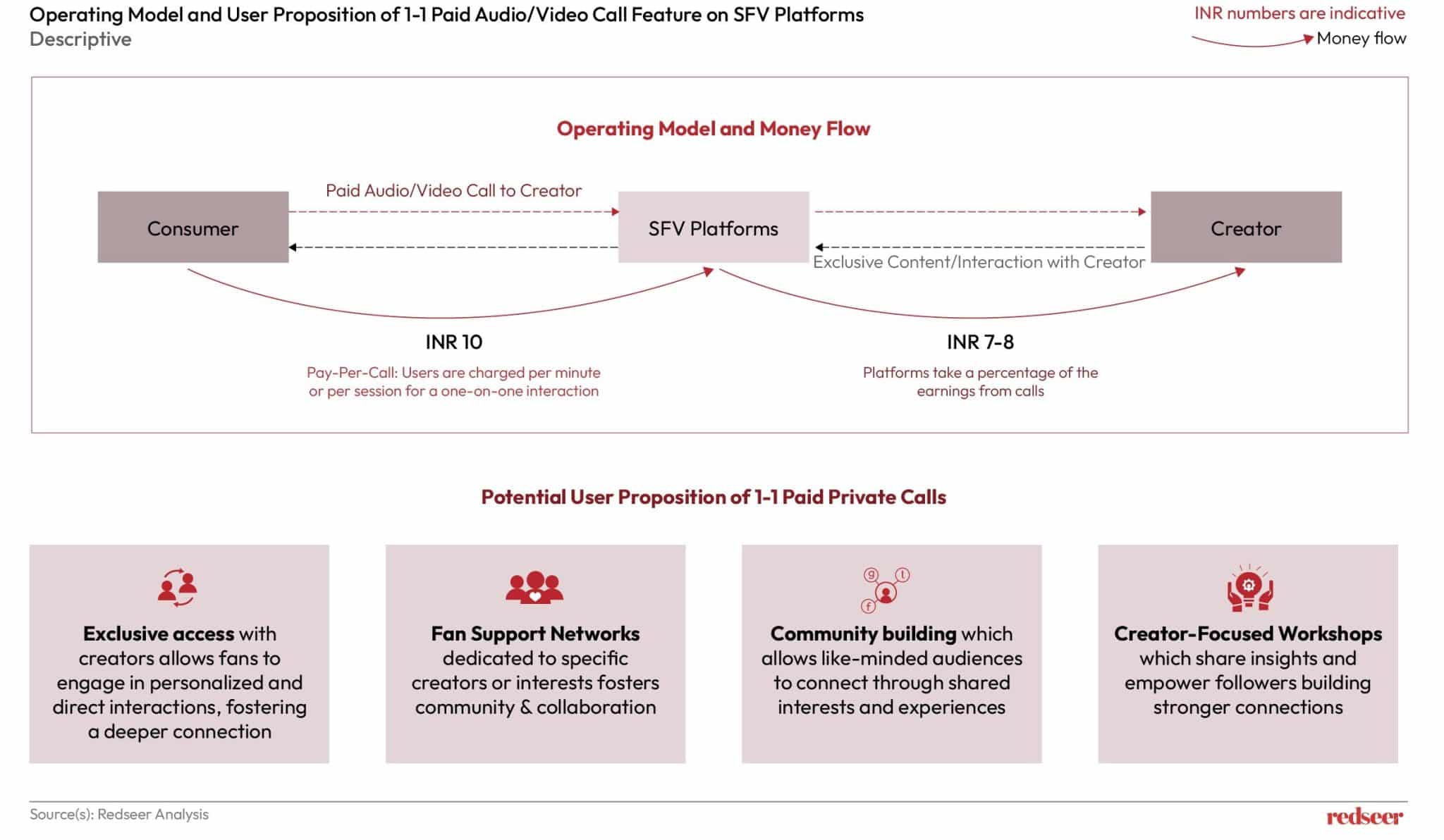

Virtual tipping allows users to directly support creators, fostering a sense of community and loyalty, while simultaneously creating a new revenue model for influencers. This feature is especially popular in Tier-2+ markets, where tipping is both affordable and meaningful for users who are more likely to engage with influencers on a personal level. SFV platforms are also experimenting with paid interactive sessions, including 1:1 calls and exclusive fan interactions, which provide additional monetization opportunities. These features allow influencers to engage with their audiences in a more intimate way, offering unique experiences like influencer-focused workshops, one-on-one calls, and fan support networks.

Looking at global trends, virtual tipping in China has evolved into a $30 billion industry, with virtual gifting contributing up to 30% of SFV platform revenue. India’s SFV platforms, while still in the early stages, are set to follow suit, with the potential for virtual tipping and gifting to become a key driver of both creator earnings and platform revenue, particularly as platforms continue to innovate with new ways for fans to interact and support their favorite influencers.

Video Commerce:

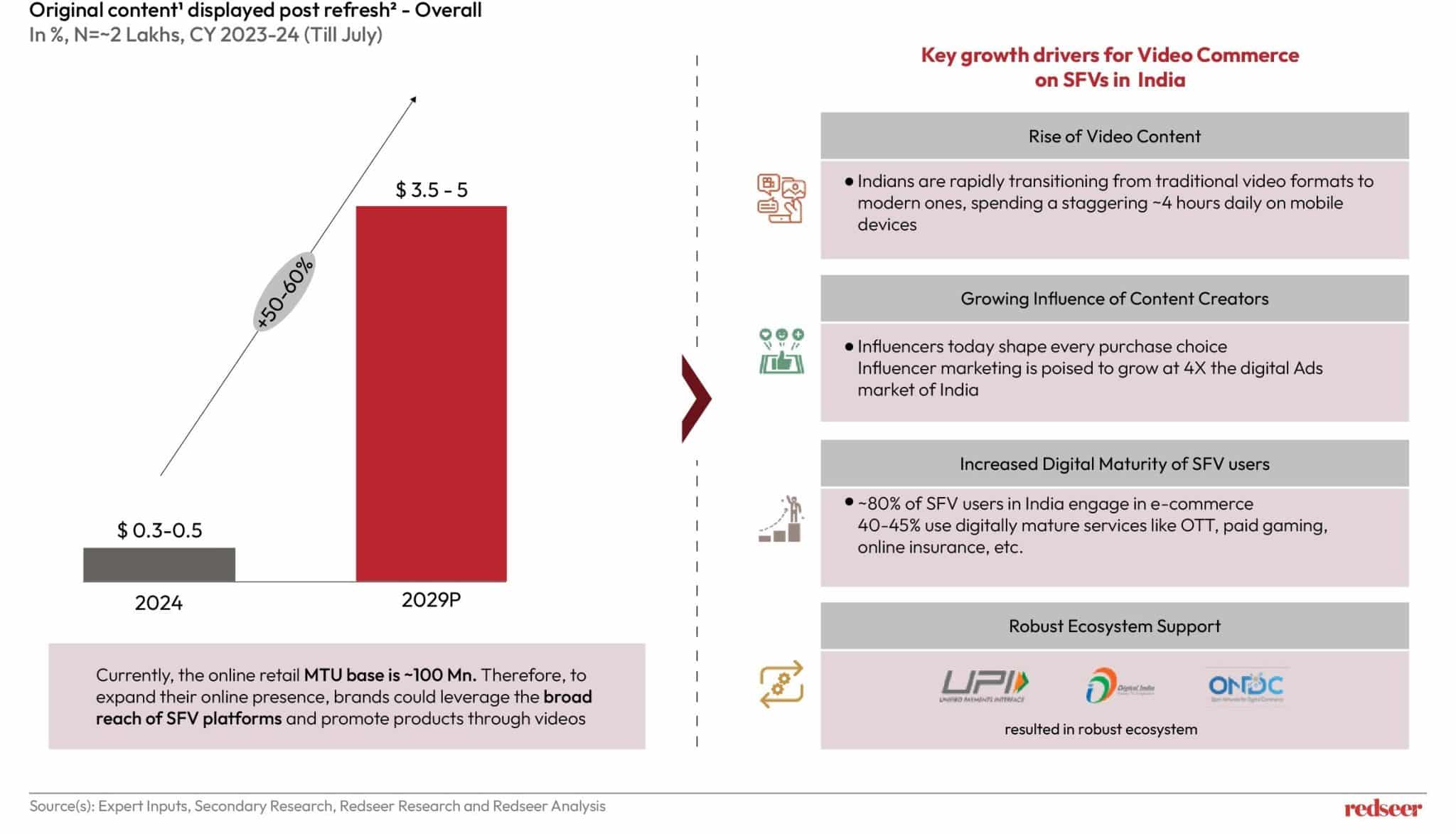

Video commerce in India is still in its nascent stages, but the sector holds tremendous growth potential. Expected to grow fivefold, reaching $5 billion by FY29, video commerce is primed to become a significant driver of e-commerce. In India, video commerce is currently estimated at $0.3-0.5 billion GMV in 2024, but as digital adoption deepens and consumer behavior evolves, it is set to grow rapidly, with estimates projecting a market size of $3.5-5 billion by 2029.

The key drivers for this growth include the increasing popularity of video content, the rising influence of content creators, and the growing digital maturity of SFV users. Additionally, there is robust ecosystem support, from e-commerce integrations to improved payment gateways, that will enable SFV platforms to enhance the video commerce experience. eCommerce and SFV platforms in India are already hosting product demos, live shopping events, and interactive purchasing experiences, allowing users to make purchases seamlessly within the platform.

Future Prospects: A Blueprint for Growth

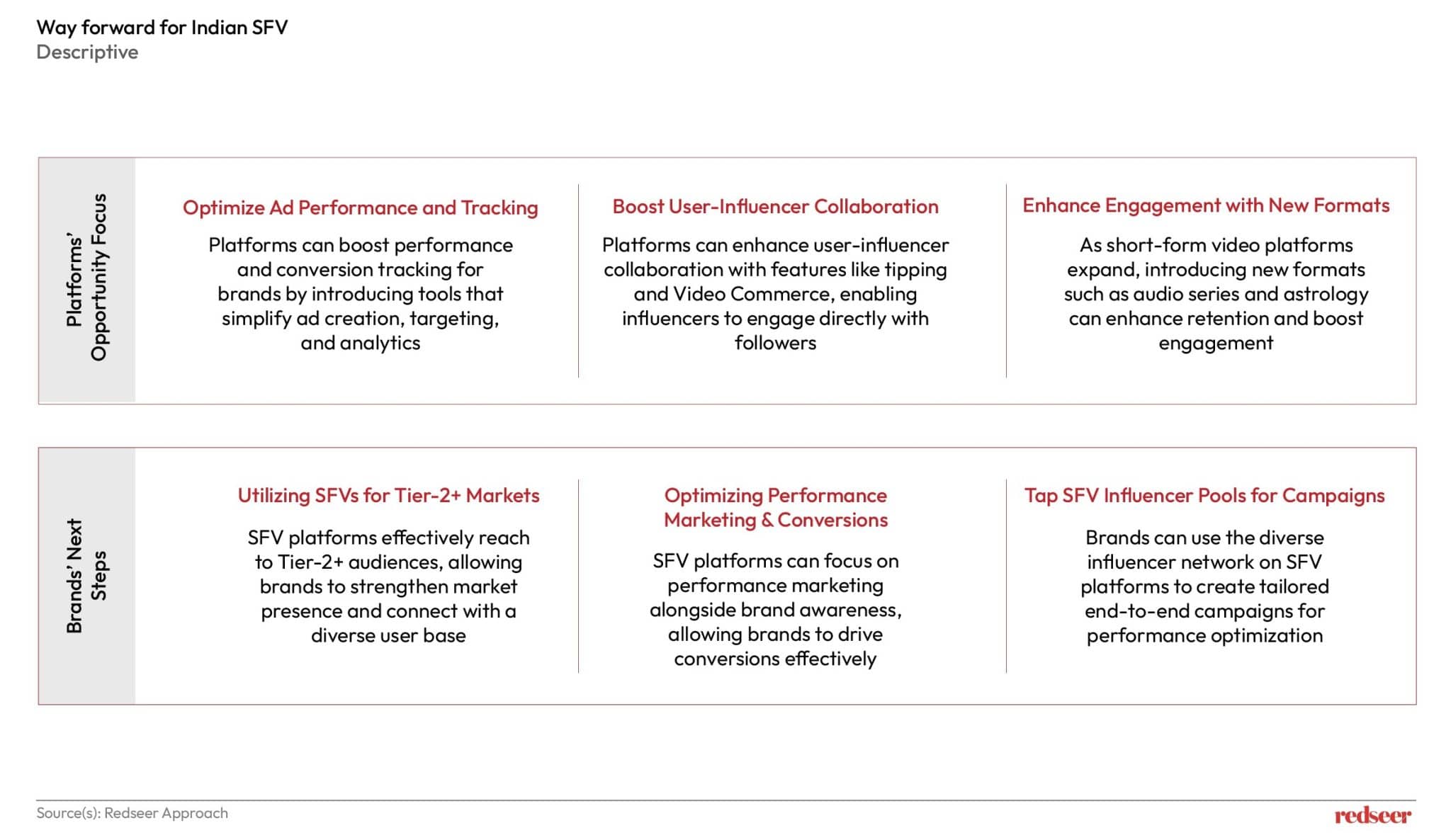

Indian SFV platforms are at a pivotal point in their growth trajectory. The path forward lies in a balanced approach that focuses on increasing user engagement and, strengthening their monetization capabilities. These platforms have a threefold opportunity to drive future growth, which should be strategically prioritized.

- Platforms should optimize ad performance and tracking tools, ensuring they can effectively measure and improve ad ROI. By focusing on building performance marketing capabilities, SFVs can attract a wider range of advertisers, particularly those targeting Tier-2+ markets, where user engagement is growing exponentially. Improving content targeting and investing in advanced analytics tools will further enable SFVs to deliver highly relevant ads, resulting in better conversion rates.

- India SFV platforms can enhance user-influencer collaborations by offering new formats for engagement. Beyond virtual tipping and gifting, platforms can introduce exclusive interactions such as paid private calls, workshops, or co-branded content. These innovative formats will provide users with more meaningful connections to their favorite influencers, while simultaneously creating new revenue streams for influencers. Moreover, as SFVs continue to refine their content algorithms and enhance discoverability features, they will empower influencers to reach larger audiences, build stronger communities, and establish more sustainable revenue models.

- The opportunity to tap into Tier-2+ markets remains a key growth lever for SFVs. These regions are home to a large, untapped user base with growing digital engagement. By optimizing performance marketing efforts and creating targeted campaigns that speak to the unique needs of Bharat, SFVs can drive significant brand engagement and conversions.

Additionally, SFVs can leverage the influencer ecosystem to further promote brands, engage users, and build lasting relationships across diverse demographics. By focusing on these strategic areas—optimizing ad performance, boosting user-influencer collaboration, and enhancing engagement in underserved markets—Indian SFVs can solidify their position as digital powerhouses and unlock new avenues for growth.

Pioneering India’s Digital Economy

As Indian SFVs mature, they are reshaping the digital ecosystem by unlocking new revenue channels and offering unique value propositions to brands, influencers, and users alike. Filling the gap left by TikTok, SFVs are charting a transformative path with local relevance and global monetization models. With strong growth in Tier-2+ markets and adapting to changing user behaviors, Indian SFVs are set to lead the next wave of digital growth. In the next newsletter, we’ll explore how regional content is fueling this growth

At Redseer Strategy Consultants, we are at the forefront of analyzing the emerging trends within the Indian SFV sector. Our deep expertise in the digital landscape, coupled with our data-driven insights, allows us to guide businesses as they navigate this rapidly evolving space. We help brands identify growth opportunities, optimize their engagement strategies, and capitalize on the potential of SFVs to maximize their digital impact.

Unlock the potential of India’s SFV market. Reach out to our team for tailored insights to explore the future opportunities and growth strategies in India’s digital economy.