In the first part of our series, we explored the rising prominence of local cuisines within Indonesia’s Food Services sector. Now, in Part-2, we delve into the growth prospects for both online and offline channels, and how both new entrants and established players can capitalize on these trends.

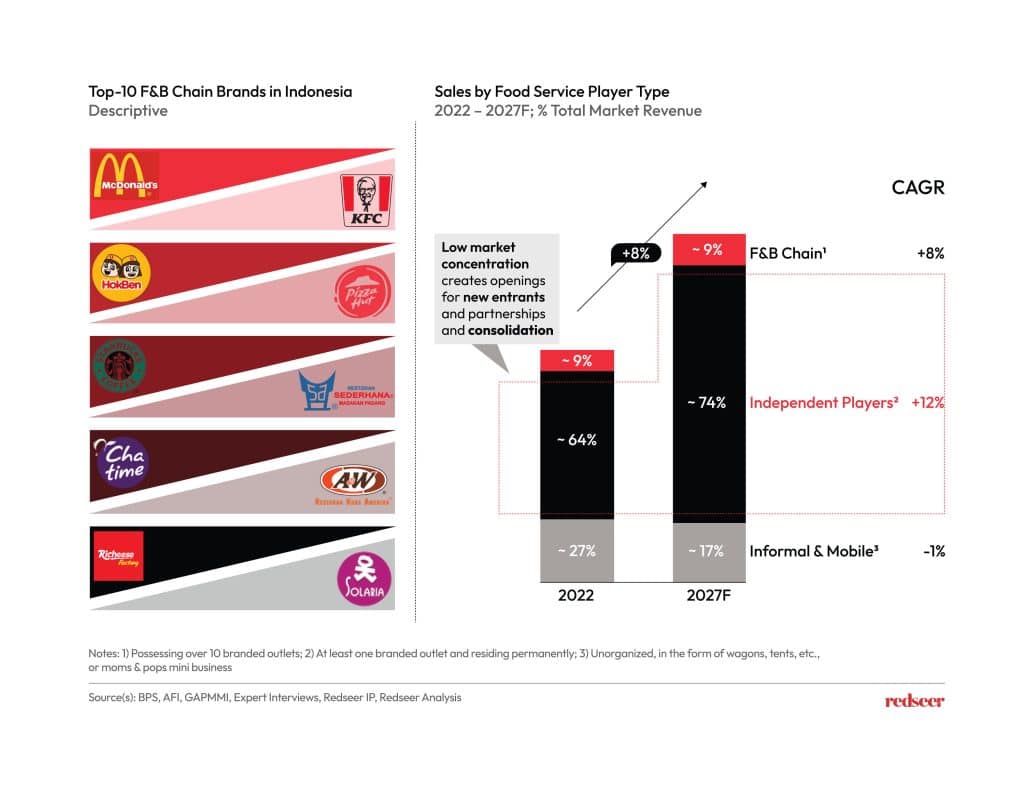

01. Despite being considered as the champions in locating prospective areas, Chain players control only a small part of the highly fragmented market

Prominent Quick Service Restaurant (QSR) chains have become highly visible in major urban areas (tier-1 locations), yet they hold a relatively small market share of about 9%. The majority is still controlled by unorganized, independent outlets. While chain operators are poised for expansion, independent vendors are expected to increase their market share, thanks to their focus on local cuisines, mass-market appeal, and agility in adapting to local market shifts.

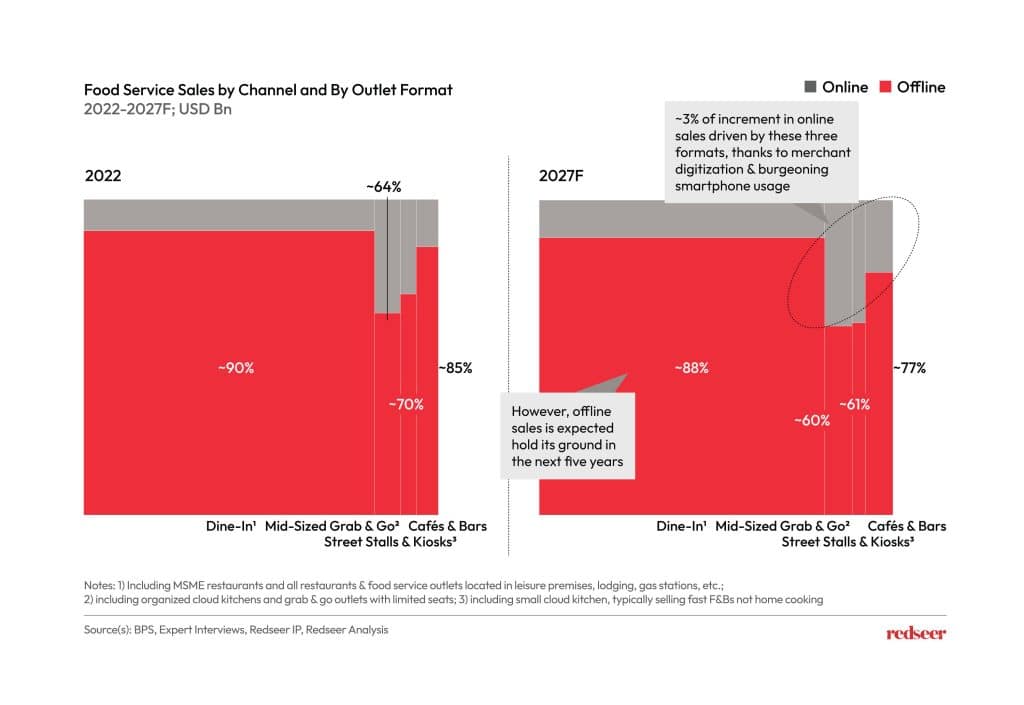

02.Dine-in formats, which consistently hold ~80% of the total F&B sales, are expected to dominate offline sales

The next five years will see offline channels continue to lead in the Food Services sector. Traditional dine-in formats are projected to remain the most popular. However, mid-sized Grab & Go outlets, street stalls, kiosks, and cafes are likely to experience a surge in online activity, prioritizing convenience and quick service over traditional dining experiences.

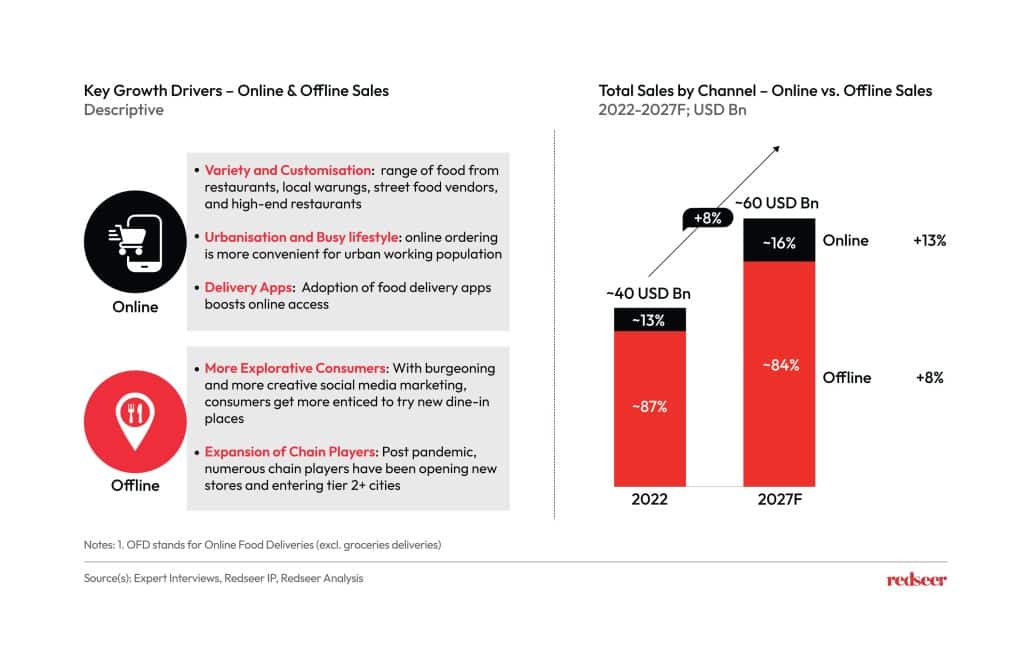

03. Online Food Services growth will be driven by rising digitisation, increasing variety and customisation of food, and availability of delivery apps

Offline channels hold a unique appeal, especially for consumers seeking new food experiences in major cities. The expansion of chain outlets into smaller cities (tier-2 locations) is anticipated to further fuel offline growth. However, Online platforms are set to grow rapidly, driven by a wider variety of food options and the ability to offer customized orders. The proliferation of food delivery apps is also meeting the increasing demand for convenience in food purchasing.

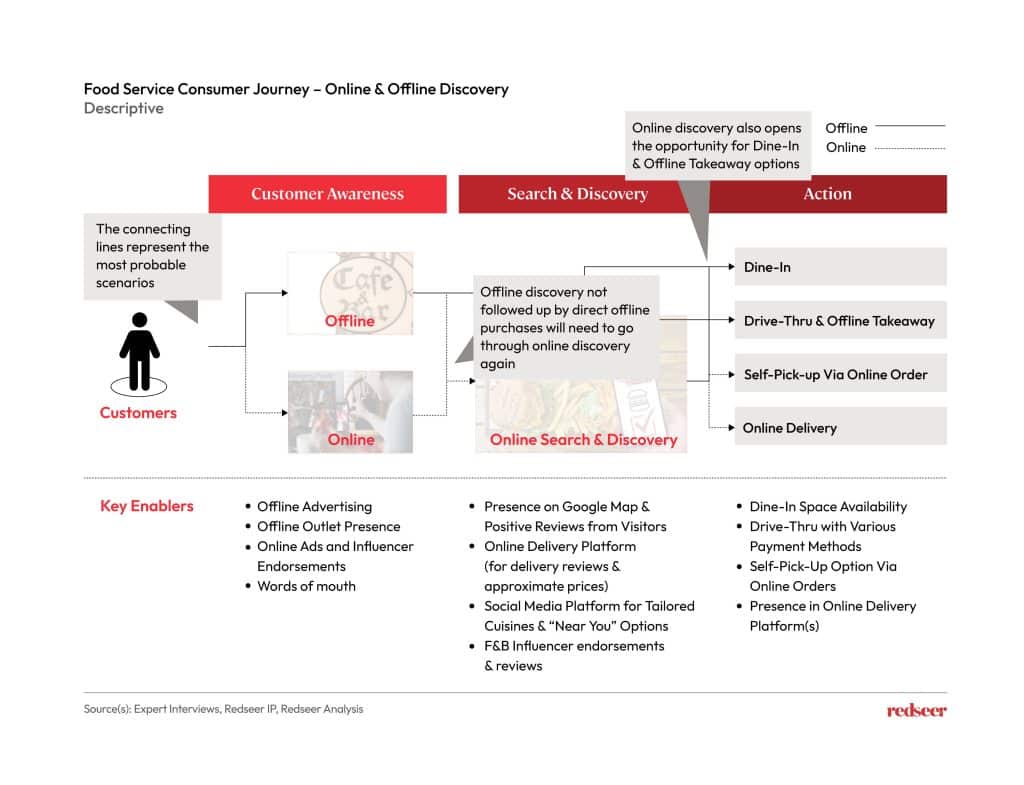

04. While bulk of food purchases happen offline, online presence is a critical part of discovery, and helps to close the F&B purchase journey

Today’s consumers often navigate between online and offline channels when buying food. An online presence is crucial for helping customers search, discover, and select their meals. Therefore, food service providers need to maintain strong online and offline touchpoints to support the entire customer journey from search to purchase.

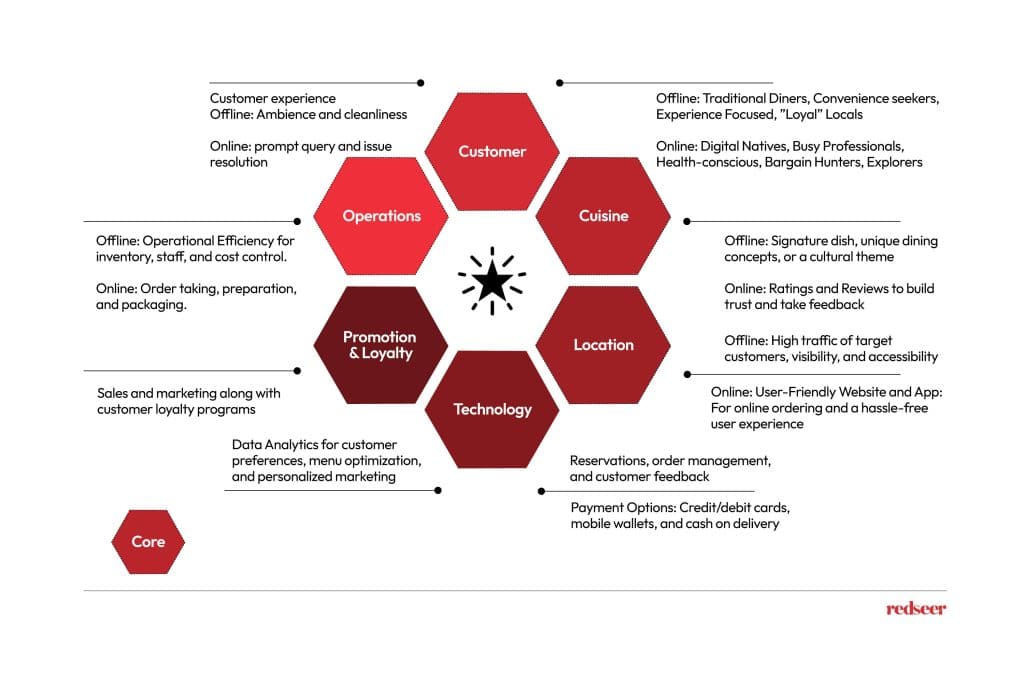

05. Successful food services businesses address the core – cuisine, location, and customer experience – as well as non-core attributes

To thrive in the Indonesian food service market, businesses should focus on offering in-demand cuisines through both online and offline channels while ensuring a positive customer experience. Effective promotions and loyalty programs are key to acquiring new customers and encouraging repeat business. Additionally, leveraging technology can significantly enhance customer convenience and satisfaction.