Ready to Drink Evolution: How Q-Commerce is Redefining Refreshment in Ready to Drink Beverage Market

It’s a sweltering summer afternoon, and you’re at home, craving something to quench your thirst. With just a few taps on your phone, you browse through your favourite quick commerce app. In minutes, a delivery arrives at your doorstep, offering an array of choices—from refreshing iced teas to invigorating cold coffees and wholesome fruit juices. The convenience and instant gratification provided by quick commerce platforms are driving a significant shift in the ready-to-drink (RTD) beverages market, catering to the demand for on-the-go refreshments and impulsive purchases.

Build new product innovation and market strategy.

India’s large, youthful population, coupled with its tropical climate, significantly fuels the demand for RTD beverages. With a median age of around 28 years, a substantial segment of the population prefers convenient, on-the-go consumption. This demographic’s inclination towards innovative beverage trends is amplified by India’s hot and humid weather, which heightens the need for refreshing and hydrating drinks.

The online RTD segment has witnessed substantial growth over the last year and is expected to continue expanding. This growth is, however, driven by an increase in the adoption of non-carbonated beverage choices along with rising Quick commerce. You too are a part of this growing trend if you opt for juices, value-added dairy drinks, cold coffees, and iced teas. So, what’s in store for the future of the RTD sector? Our experts at Redseer have delved deep and uncovered the drivers behind this growth and the key trends shaping its future.

The RTD Beverage Market’s Remarkable Surge

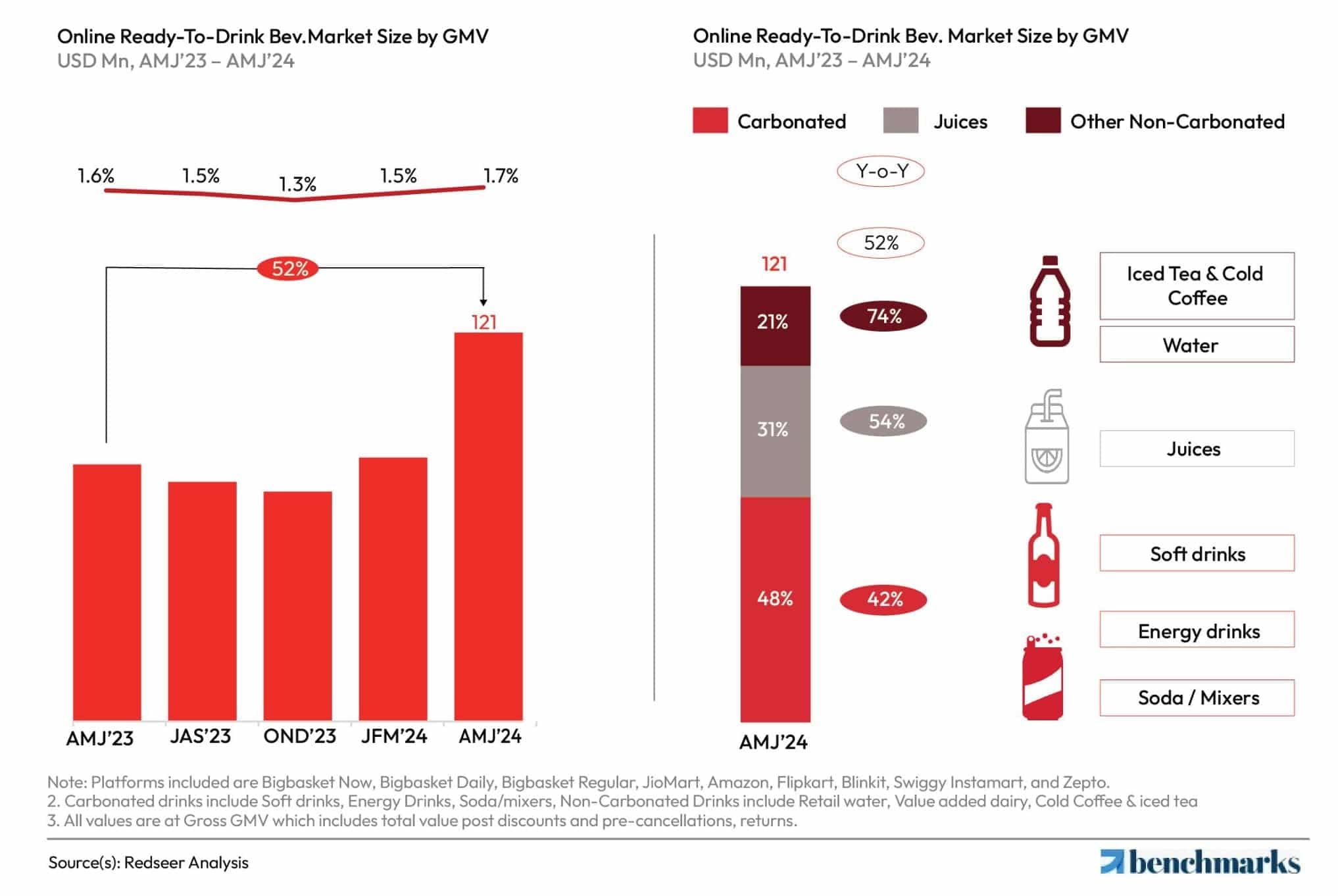

The Online Ready-to-drink (RTD) beverages market in India has experienced significant growth, particularly evident in the 52% year-on-year (YoY) increase during AMJ 2024, reaching 121 USD Million. . This surge is attributed to the rapid expansion of quick commerce platforms, which have facilitated easier consumer access to beverages.

Changing Consumer Preferences

Now, let us look at the evolving preferences of the consumers. The penetration of non-carbonated drinks has significantly increased over the past year. As per our study, from April-May-June (AMJ) 2023 to AMJ 2024, there has been a slight change in consumer behaviour. The penetration of non-carbonated beverages such as fruit juices, value-added dairy drinks (yoghurt-based), iced teas, and cold coffees has increased.

Non-carbonated drinks take centre stage

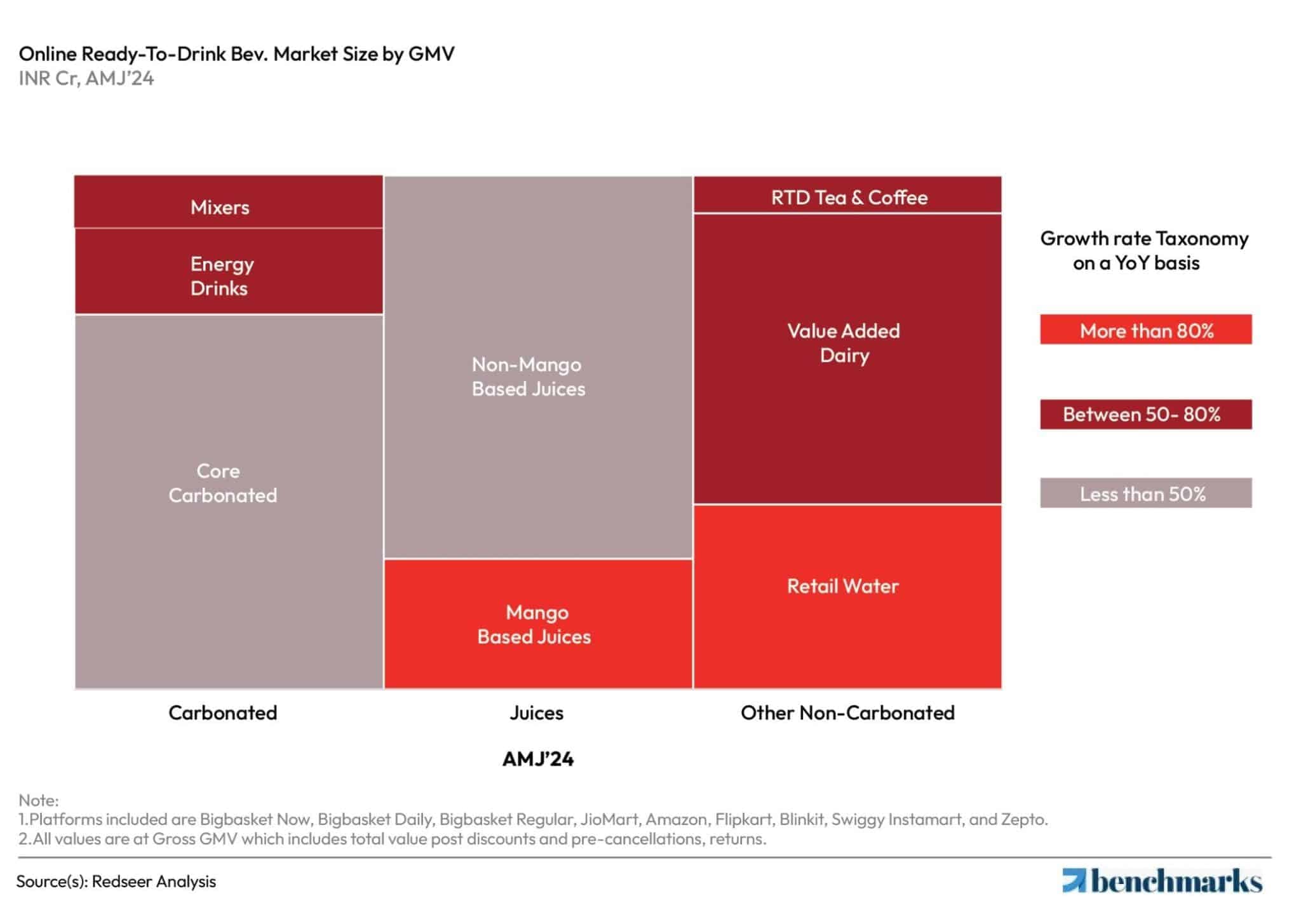

Over the past year, retail water and mango-based Juices have surged by more than 80%, making them the fastest-growing categories. In contrast, core carbonated drinks and non-mango juices have experienced growth rates of less than 50%. This shift underscores a growing consumer preference for newer alternatives.

Role of Quick Commerce and Slotted Platforms

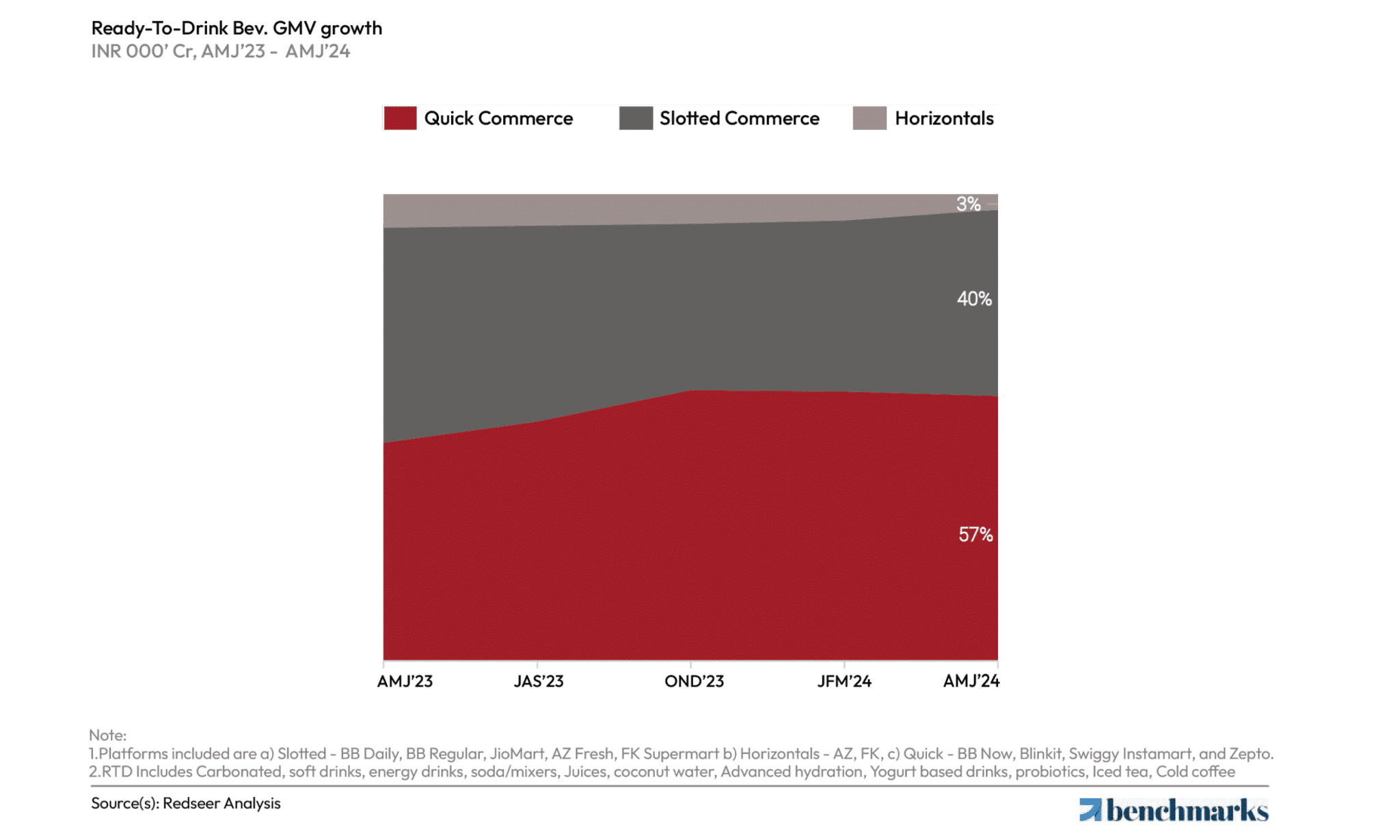

Quick commerce is not just a convenience; it is reshaping how FMCG products, particularly RTD beverages, are distributed and consumed. The demand for RTD beverages is being significantly fueled by the rise of Quick Commerce platforms, increasing its contribution to approximately 57% of the online RTD gross merchandise value (GMV), while slotted commerce holds 40% of the market. These platforms offer an increasing user base and wide availability of SKUs (stock-keeping units) across various pack sizes, providing consumers with the option to try new-age direct-to-consumer (D2C) brands. This model also benefits brands, allowing them to launch new flavours and test the market effectively.

Meanwhile, slotted platforms are leading in the sales of mango-based juices. Quick commerce platforms, however, enjoy a higher price per litre compared to slotted platforms in core carbonated drinks due to the high demand for small pack size SKUs and larger average order values (AOV) driven by virtual combos.

India’s RTD Evolution

As consumers are increasingly prioritising healthier choices, the sector is set for continued expansion, driven by innovation and the growing influence of e-commerce and quick commerce platforms. This shift not only reflects changing consumer preferences but also opens up exciting opportunities for both established and new brands in the beverage industry.

Curious about how you can tap into these trends? Connect with our industry expert Ujjwal Chaudhry and subscribe to our newsletter today for more insights on other markets as well. Get the latest trends and analyses delivered straight to your inbox!

Written by

Ujjwal Chaudhry

Partner

Ujjwal has expertise in multiple sectors including e-commerce, healthcare and fintech. He has helped large corporates enter into new products and categories.

Talk to me