As the Indian technology ecosystem braces for an unprecedented era of growth, a recent report by Redseer titled “India’s Evolving Tech Fundraising Market,” a collaboration between HSBC and Redseer sheds light on the significant transformations underway. The headline-grabbing projection is that the total market cap of listed new-age stocks in India is poised to skyrocket to $1 trillion by 2033. This ambitious forecast signals a seismic shift in the value and perception of the Indian internet economy.

The IPO Revolution

The Indian tech landscape, historically overshadowed by global giants, is now carving out its niche in the global market. According to the report, the publicly listed new-age companies, encompassing internet retail, fintech, SaaS, and other sectors, are set to escalate their market cap tenfold over the next decade. This monumental growth signifies more than mere numbers; it’s a testament to the maturing Indian internet economy and its burgeoning global relevance.

The report draws a parallel between the U.S. and Indian tech markets. While U.S. tech firms like FAANG+M have already cemented their dominance with over $10 trillion in value, the Indian tech landscape is still in its formative stages. Currently, Indian tech startups, with leading names like Zomato, Nykaa, and Paytm, represent a mere 1% of the total market cap. This contrast highlights the immense growth potential of the Indian tech sector.

Growth that is unstoppable and an indication of investor’s confidence

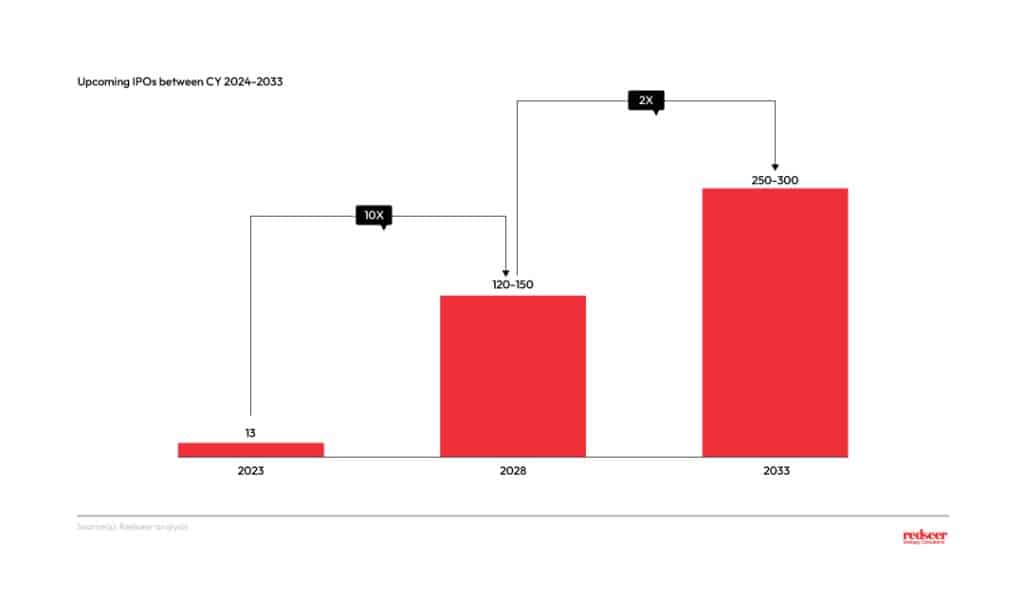

Looking ahead, the report predicts over 250 new-age listings between 2024 and 2033, a sign of growing confidence in the tech sector. These listings are expected to be dominated by consumption-driven goods, fintech, and SaaS. The surge reflects a broader shift in market dynamics and investor confidence in Indian tech startups.

Success and Setbacks in IPO Journeys: Only 1 in 3 IPO listings succeed in first attempt

A significant trend towards profitability has boosted investor sentiment towards IPOs. The report notes that cumulative losses in the industry have reduced considerably, indicating a healthier foundation for future listings. However, it also points out the challenges in achieving and maintaining profitability, a crucial factor for the success of IPOs.

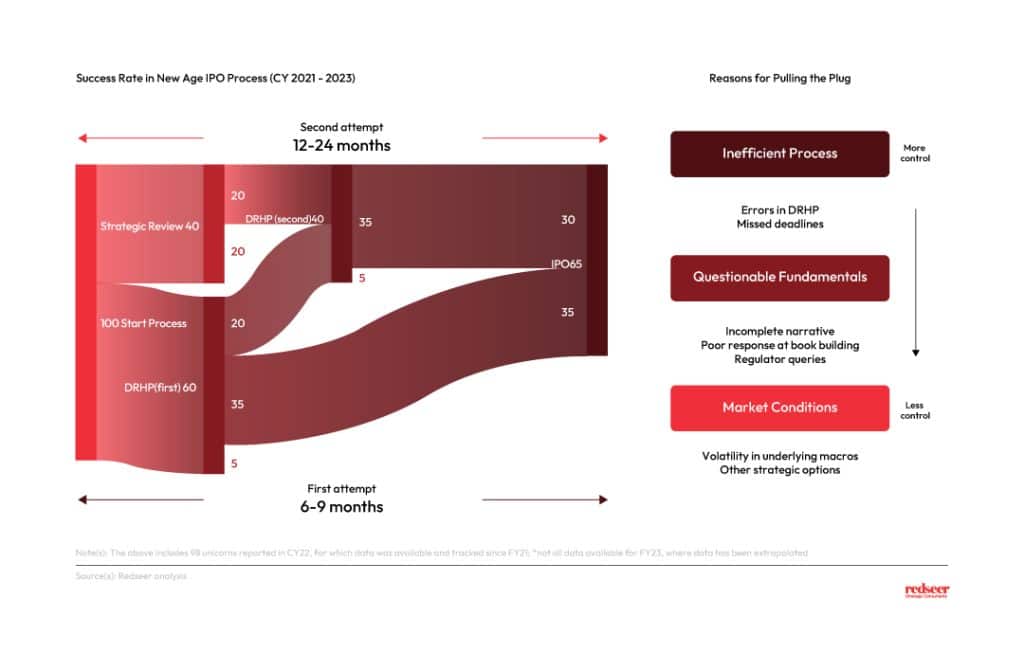

The path to a successful IPO is fraught with challenges. The report finds that only one in three new-age listing initiatives succeed on the first attempt. Factors contributing to failures include inefficient processes, questionable fundamentals, and volatile market conditions. This finding underscores the need for robust strategies and meticulous planning in the IPO process.

The Critical Role of Strategic Advisors in making the IPO journey more accessible for founders & investors

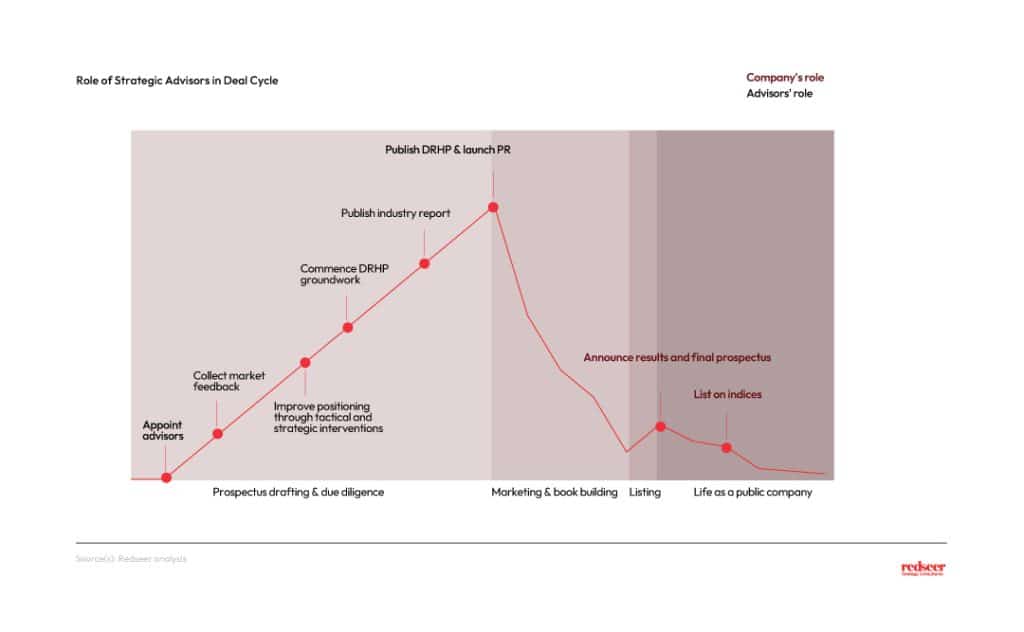

Strategic advisors play a pivotal role in navigating the complex IPO landscape. They aid companies by building credibility, assisting in due diligence, and managing market feedback. Their expertise is particularly crucial for companies still striving for profitability and those in data-deficient sectors.

The Indian tech ecosystem stands at a transformative crossroads. With a projected market cap of $1 trillion by 2033 and a flurry of anticipated IPOs, the sector is gearing up for a period of significant growth. However, this journey will require overcoming substantial challenges and adapting to an ever-evolving market landscape.