India’s Got Retail: A Tale of Fragmented Supply & Consolidating Distribution

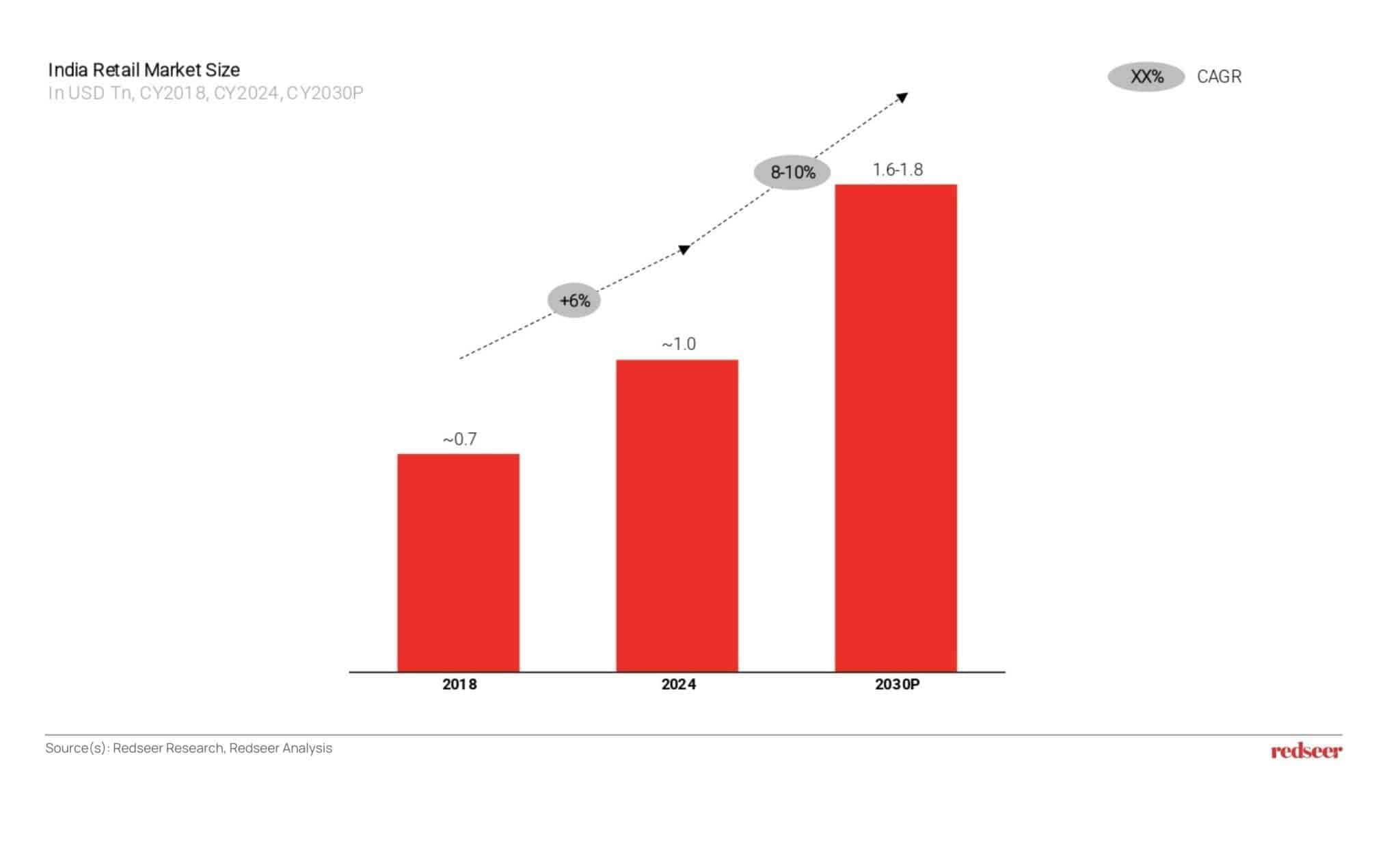

India’s retail ecosystem, expected to surpass USD 1.6 Tn consumption by 2030, is undergoing a transformative shift. Both supply & distribution are changing rapidly to better serve the diverse & evolving consumer needs. With the growing adoption of technology across the value chain and the advancements in infrastructure & logistics, the interplay of supply and distribution in India retail has never been more exciting.

Fragmented Supply: A Defining Characteristic of Indian Retail

Want to evaluate new investment and M&A opportunities?

Supply in India retail is extremely fragmented. Fragmented segments, such as unbranded products, regional brands, and D2C brands, together account for more than 75% of the retail market. Despite the ongoing brandification, this fragmentation is here to stay, and even by 2030, more than 70% of the market is expected to remain fragmented, with unbranded products contributing more than 55% of India’s retail

The factors driving this fragmentation include:

- Diverse Regional Preferences: India’s culture, language, and tastes change every few kilometers, across the major consumption categories (such as food and fashion), making it difficult for brands to scale pan-India, while accounting for the complex regional & local needs.

- High Price Sensitivity: With per capita income of India still 0.5x of Indonesia, 0.2x of China, and 0.03x of the US, the majority of India’s population has limited disposable income, leading to prevalence of small ticket size transactions, and high price elasticity. This limits the profit margins for brands (making it difficult to offset fixed expenses), and puts them under competitive pricing pressures from regional & unbranded products.

- Complex Supply Chains: The presence of multiple unorganized intermediaries at both sourcing and distribution levels leads to inefficiencies in logistics and inventory management, making it difficult for brands to expand seamlessly across the country.

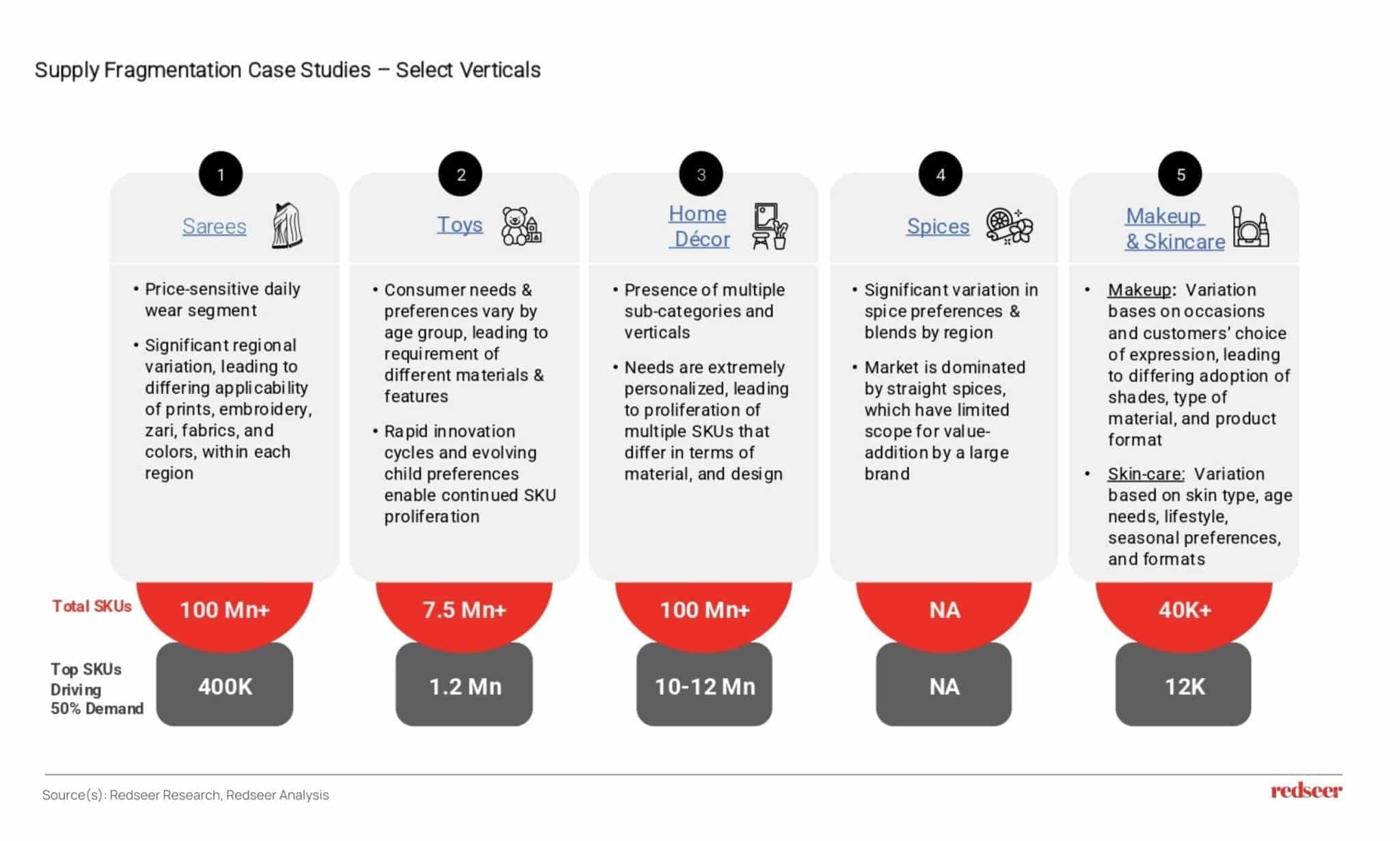

Extensive SKU Range Underscores the Supply Fragmentation

As a result of the considerable regional differential, the need for customization & personalization, and variation in the requirements of different consumer cohorts, India’s retail market has seen a proliferation of a huge number of SKUs. Illustrated below is the degree of fragmentation in a few select verticals. For example, in the case of home decor, the top 10-12 million SKUs drive ~50% demand. This figure is 1.2 million in case of toys, and 400k in case of sarees.

Organized Retail (Offline + Online) – Challenging the ‘Status Quo’

The high degree of supply fragmentation has led to the creation & sustenance of general trade in India, accounting for ~80% of India’s retail. This is contrary to the highly branded markets like the US, where ~80% of the supply is large brands, and organized retail caters to ~80% of consumption.

However, GT has certain limitations leading to a sub-par experience for the end-consumer. Firstly, it is served by a highly inefficient value-chain, leading to higher prices, frequent stockouts, quality inconsistency, and pricing opaqueness/fluctuations. Further, it operates very informally, leading to sub-optimal product assortment, poor service quality, and frequent consumer drop-offs.

Organized retail—both offline and online—is addressing these inefficiencies and rapidly gaining market share. By 2030, it is expected to exceed $600 billion, capturing more than 35% of the total retail market. This growth is being driven by the aggregation of the value pool by eliminating intermediaries, enabling retailers to deliver better value to consumers, and the use of advanced tech and infra, facilitating the provision of better assortment and convenience to consumers.

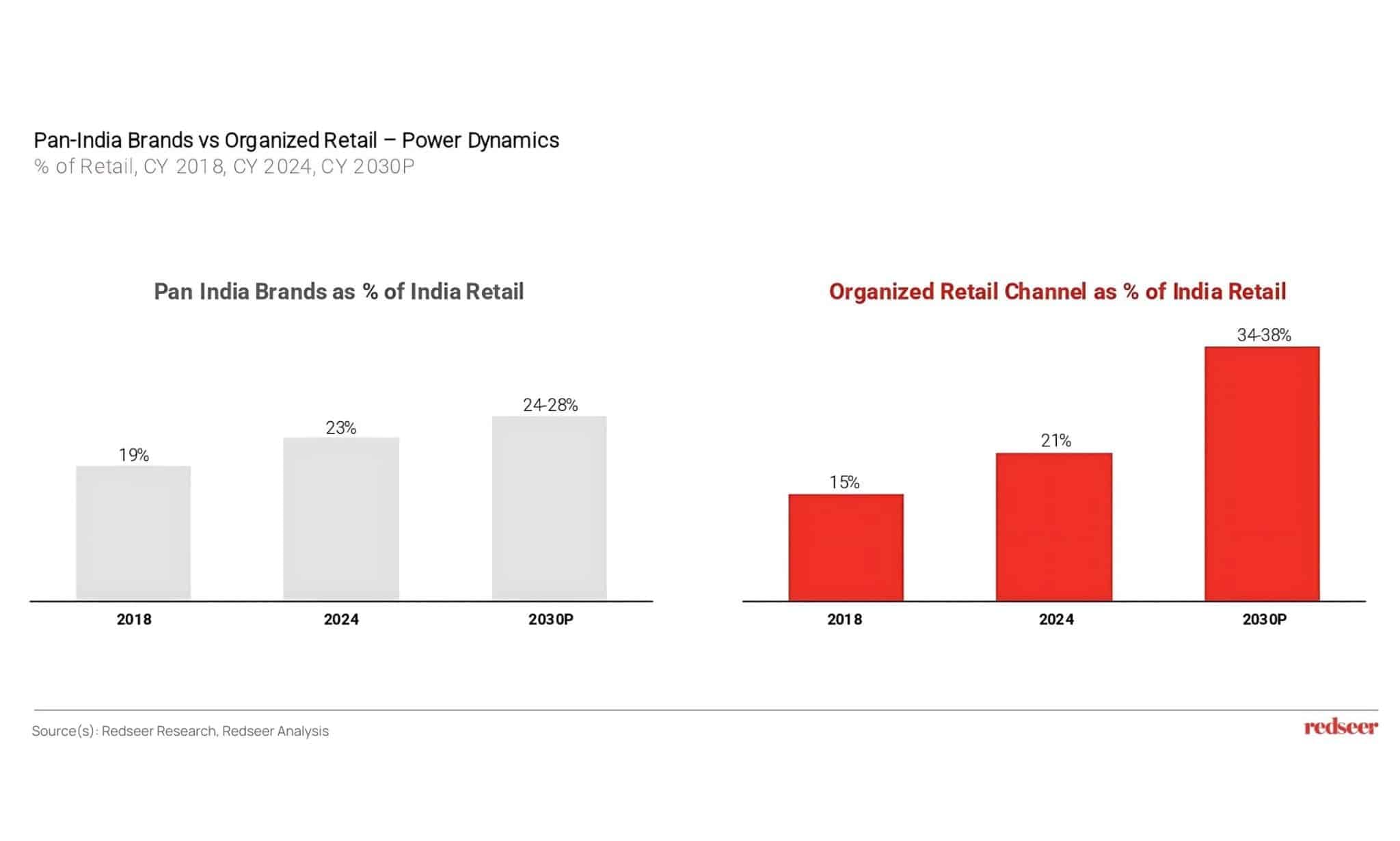

Shifting Power Dynamics in Favour of Organized Channel Partners

The projected rise of organized retail is expected to enable the segment to become larger than pan-India brands. This will lead to increased dependency of pan-India brands on organized retailers, and dilution of distribution as a long-standing moat for pan-India brands.

On the other hand, organized retailers are expected to increasingly target the fragmented portion of supply through:

- Innovative supply creation by (unbranded supply aggregation, backward integration, private labels, etc.), supported by the rise of brands focused on organized formats (D2C)

- Agility in adapting to shifting consumer preferences

- Logistics innovations enabling wider reach and profitable low-ticket servicing

Future Outlook: Multiple Organized Retail Models Will Scale and Sustain

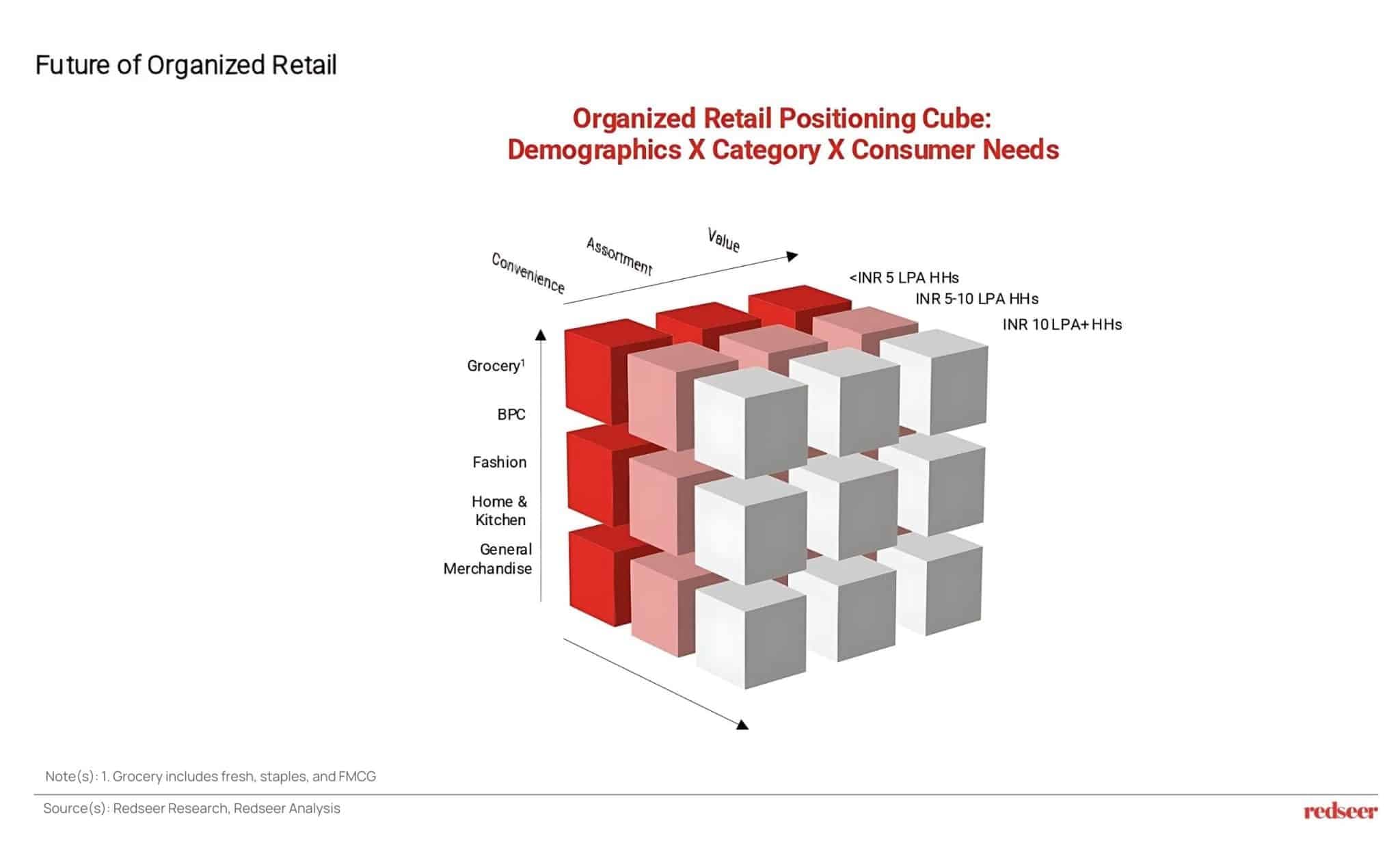

Consumer preferences are extremely varied in the Indian retail market and can largely be bucketed into 3 segments:

- Assortment: Provision of the latest & unique variants, variety across colours, tastes, sizes, and features, and availability of well-known brands

- Value: Provision of affordable products enabling faster access to products

- Convenience: Enabling faster access to products

These preferences vary significantly across consumer demographics, and also across the different use-cases for the same demographic segment. For example, low-income consumers look for affordability across the different product categories. However, in addition to affordability, they also look for convenience in case of FMCG products, latest & unique variants in case of BPC & fashion, and national brand availability in case of mobile phones.

This creates a strong need for multiple organized models to evolve alongside the trinity of convenience, assortment, and value, with the optimal category blends, enabling organized retail to win alongside the widespread GT-led distribution. With the right strategies in place, businesses can harness the potential of India’s $1.6 trillion opportunity and position themselves for long-term success. Get in touch with Redseer Strategy Consultants to explore how we can help you navigate this dynamic

Written by

Kushal Bhatnagar

Associate Partner

Kushal has worked with funds as well as corporates across the eHealth, Hyperlocal, eGrocery, Fintech and beauty & personal care verticals. He gained immense experience in global healthcare consulting and has been able to bring that knowledge to build the digital healthcare practice here.

Talk to me